Kansas Cash Receipts Control Log is a crucial tool used for tracking and monitoring financial transactions involving cash receipts in the state of Kansas. This log is designed to ensure proper control, accuracy, and transparency in the management of cash inflows. It is implemented to maintain financial accountability and prevent the mishandling or misappropriation of funds. The Kansas Cash Receipts Control Log serves as a comprehensive record-keeping system, capturing detailed information about cash receipts received by various state entities. It includes the date, description, source, and amount of each cash transaction, providing an organized and auditable trail of financial activities. By documenting every cash inflow, this log facilitates easy reconciliation and auditing processes. This control log is an essential document used across different sectors and departments within the Kansas state government. Its usage is not limited to a specific type of organization but extends to state agencies, public institutions, local governments, and educational establishments. However, the precise format and structure may slightly vary depending on the entity's specific requirements and accounting procedures. Furthermore, there may be different types or versions of the Kansas Cash Receipts Control Log that cater to the unique needs of various state entities. For instance, educational institutions like schools and universities may have specific control logs tailored to their internal accounting systems, while other organizations may use a standardized version provided by the state government. Overall, the Kansas Cash Receipts Control Log functions as an essential tool in maintaining financial integrity, facilitating accurate record-keeping, and ensuring compliance with financial regulations and policies. It plays a vital role in promoting transparency, trust, and financial accountability within the state.

Kansas Cash Receipts Control Log

Description

How to fill out Cash Receipts Control Log?

US Legal Forms - one of the largest repositories of legal templates in the United States - offers a wide range of legal document templates that you can access or create.

By using the website, you will find thousands of forms for both business and personal uses, organized by categories, states, or keywords. You can obtain the latest forms such as the Kansas Cash Receipts Control Log In just minutes.

If you hold a subscription, Log In to download the Kansas Cash Receipts Control Log from your US Legal Forms library. The Download button will be visible on each form you view. All previously acquired forms can be accessed through the My documents section of your account.

Edit. Fill out, modify, and print and sign the downloaded Kansas Cash Receipts Control Log.

Every template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- To use US Legal Forms for the first time, here are simple instructions to get you started.

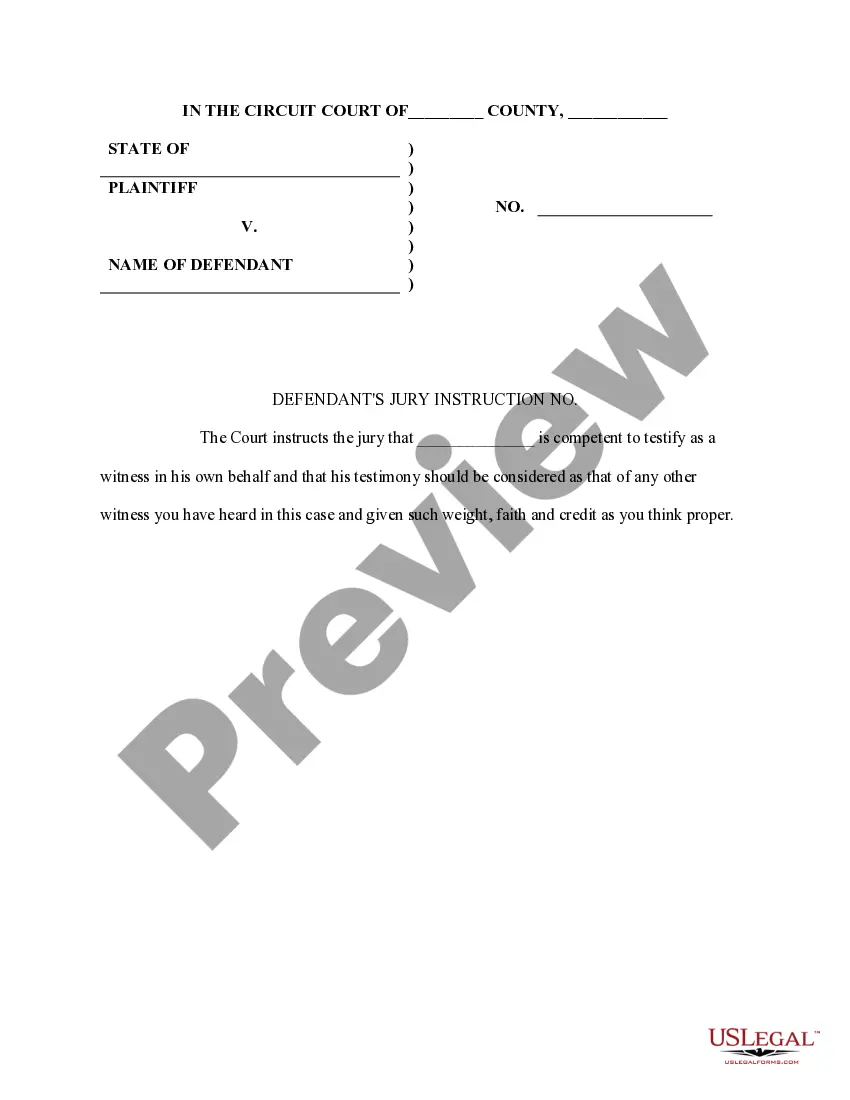

- Ensure you have chosen the correct form for your city/county. Click the Preview button to review the form's contents. Review the form summary to confirm you have selected the right form.

- If the form does not meet your needs, utilize the Search feature located at the top of the screen to find the one that does.

- Once you are satisfied with the form, finalize your choice by clicking on the Buy now button. Then, choose the payment plan you prefer and provide your details to create an account.

- Complete the transaction. Use Visa or Mastercard or your PayPal account to finalize the purchase.

- Select the format and download the form onto your device.

Form popularity

FAQ

Strong internal controls are necessary to prevent mishandling of funds and safeguard assets. They protect both the University and the employees handling the cash.

Best practices:Record cash receipts when received.Keep funds secured.Document transfers.Give receipts to each customer.Don't share passwords.Give each cashier a separate cash drawer.Supervisors verify cash deposits.Supervisors approve all voided refunded transactions.

Objective. The objective of cash receipt controls is to ensure that all monies (checks, currency, coin, and credit cards) are properly accounted for and timely deposited.

This includes cash sales, receipt of funds from a bank loan, payments from customer accounts, and the sale of assets.

Helpful ToolsNo.Date Enter the date that the petty cash receipt is prepared.Pay To Enter the name of the payee who received the petty cash disbursement.$ (Dollar Amount) Enter the total amount of the payment.Description Enter a brief, but specific explanation of what the funds were used for.More items...

Bank deposits and bank account reconciliations are examples of internal control and cash accounting. Retail companies with physical point-of-sale cash registers need to safeguard cash assets in the cash drawer.

You record cash receipts when your business receives cash from an external source, such as a customer, investor, or bank. And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet....What are cash receipts?Cash.Check.Purchases on store credit.

All receipts must include, but are not limited to, the following information: the date received, the dollar amount, a receipt number, name of the person paying for the transaction, description of the service or product, name of the department or area collecting the funds, and signature of the cash handler.

A cash receipt is a printed statement of the amount of cash received in a cash sale transaction. A copy of this receipt is given to the customer, while another copy is retained for accounting purposes. A cash receipt contains the following information: The date of the transaction.

To control cash transactions, organizations should adopt some of the following practices: Require background checks for employees, establish segregation of duties, safeguard all cash and assets in secure locations, and use a lockbox to accept cash payments from customers.

More info

ETF Options Roth Fundamental Analysis Technical Analysis.