As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

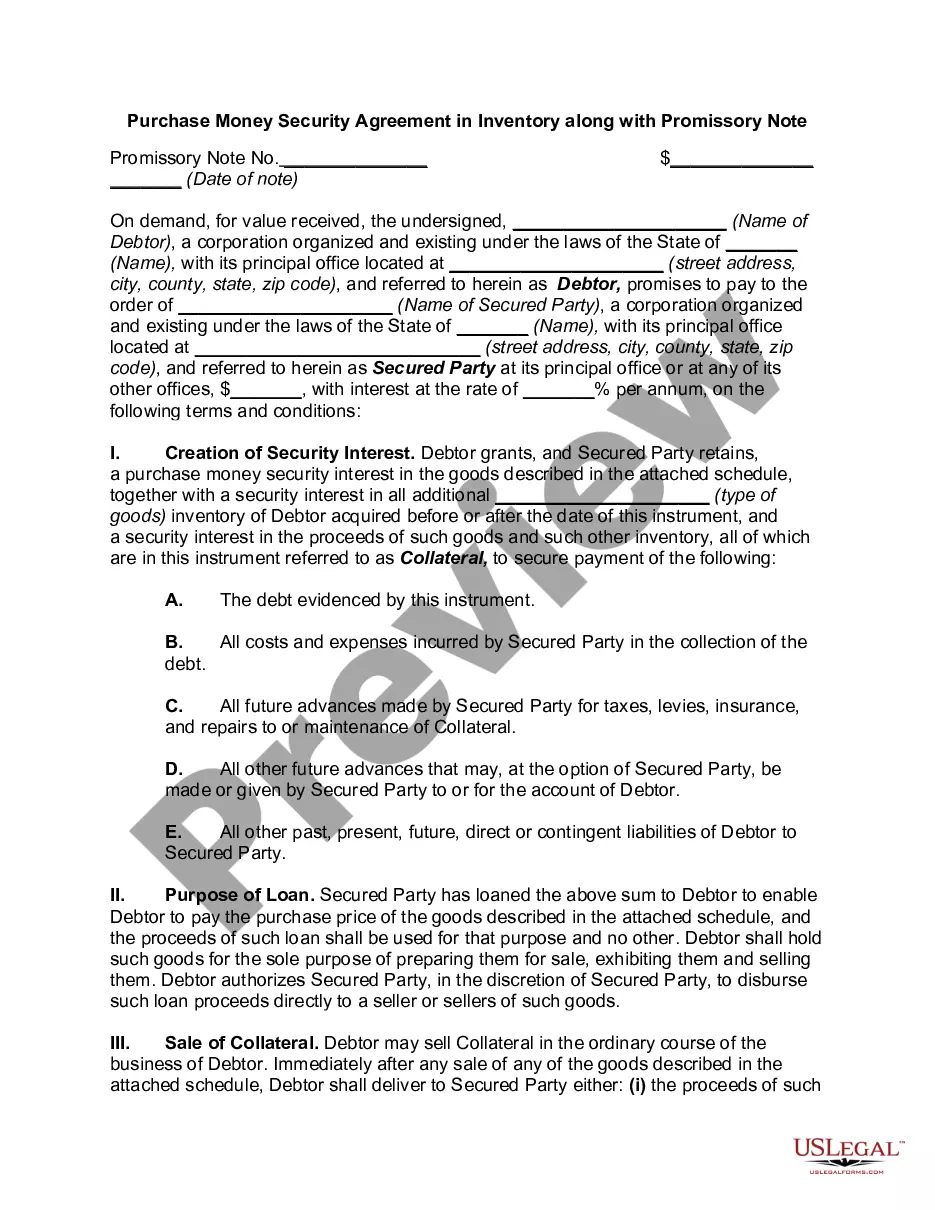

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Kansas Application and Loan Agreement for a Business Loan with Warranties by Borrower is a legal document designed specifically for businesses in Kansas that are seeking financial assistance through a loan. This comprehensive agreement outlines the terms and conditions that both the borrower and lender must adhere to throughout the loan process, ensuring the protection of both parties' rights and obligations. Key Keywords: Kansas, application, loan agreement, business loan, warranties, borrower This application and agreement template aims to streamline the loan application process by providing a structured format for businesses to present their financial information and loan requirements to potential lenders. It includes sections that capture crucial details such as the borrower's business name, legal structure, contact information, and purpose of the loan. Additionally, the agreement lists the various warranties that the borrower must provide to the lender, which may include the accuracy and completeness of financial statements, compliance with laws and regulations, absence of litigation, and the borrower's authority to enter into the agreement. Different types of Kansas Application and Loan Agreement for a Business Loan with Warranties by Borrower may exist based on the specific terms agreed upon by the parties involved. For instance, there could be a distinction between secured and unsecured loans, each requiring its own set of warranties and collateral arrangements. Furthermore, the agreement may differentiate between fixed interest rate loans and variable interest rate loans, with corresponding clauses outlining relevant repayment terms, grace periods, and late payment consequences. The Kansas Application and Loan Agreement for a Business Loan with Warranties by Borrower serves as a legally binding document, ensuring transparency and fairness between the lender and borrower. By including warranties, it establishes a level of trust and accountability, reducing the lender's risk while providing the borrower with access to the necessary funds to support their business goals. Prior to signing this agreement, both parties should thoroughly review the terms, may seek legal advice if necessary, and fully understand their rights and obligations within the loan agreement. Overall, this Kansas Application and Loan Agreement for a Business Loan with Warranties by Borrower is an essential tool for businesses in Kansas looking to secure financial assistance through a loan. It safeguards the interests of both the borrower and lender, facilitating a seamless and mutually beneficial loan process.