Kansas Invoice Template for Independent Contractor is a useful document designed to facilitate payment processes between independent contractors and their clients or employers in the state of Kansas. This template encompasses all the necessary components required for an invoicing system, ensuring convenience and clarity for both parties involved. The Kansas Invoice Template for Independent Contractors includes various key features to streamline the billing process. It typically starts with a professional header that includes the contractor's name, business contact information (address, phone number, and email), and the invoice number and date. Next, the template includes sections for the client's details such as name, address, and contact information. This section ensures that the invoice is easily identifiable and delivered to the correct recipient. The Kansas Invoice Template also includes a detailed breakdown of the services or products provided by the independent contractor. Each itemized entry includes information such as the description of the service, the quantity, unit price, and the subtotal amount. This section helps the client understand the scope of work performed and facilitates accounting and record-keeping on both ends. Furthermore, the template includes sections for additional charges or fees, such as taxes or any applicable discounts. This transparent approach to billing ensures that both the contractor and the client are aware of any additional costs associated with the services rendered. The total amount due is calculated at the bottom of the invoice, summing up all the individual charges. The template also provides space for the contractor to include preferred payment methods, payment terms (e.g., due date), and any additional notes or terms related to the payment. In terms of Kansas-specific invoice templates for independent contractors, there are no major variations across industries or sectors. However, contractors may adapt the template according to their specific business needs or in accordance with any legal requirements. In conclusion, the Kansas Invoice Template for Independent Contractor provides an efficient and organized way to invoice clients, ensuring transparency and professionalism in the billing process. It simplifies financial transactions and helps contractors maintain accurate records, ultimately facilitating smoother business operations.

Kansas Invoice Template for Independent Contractor

Description

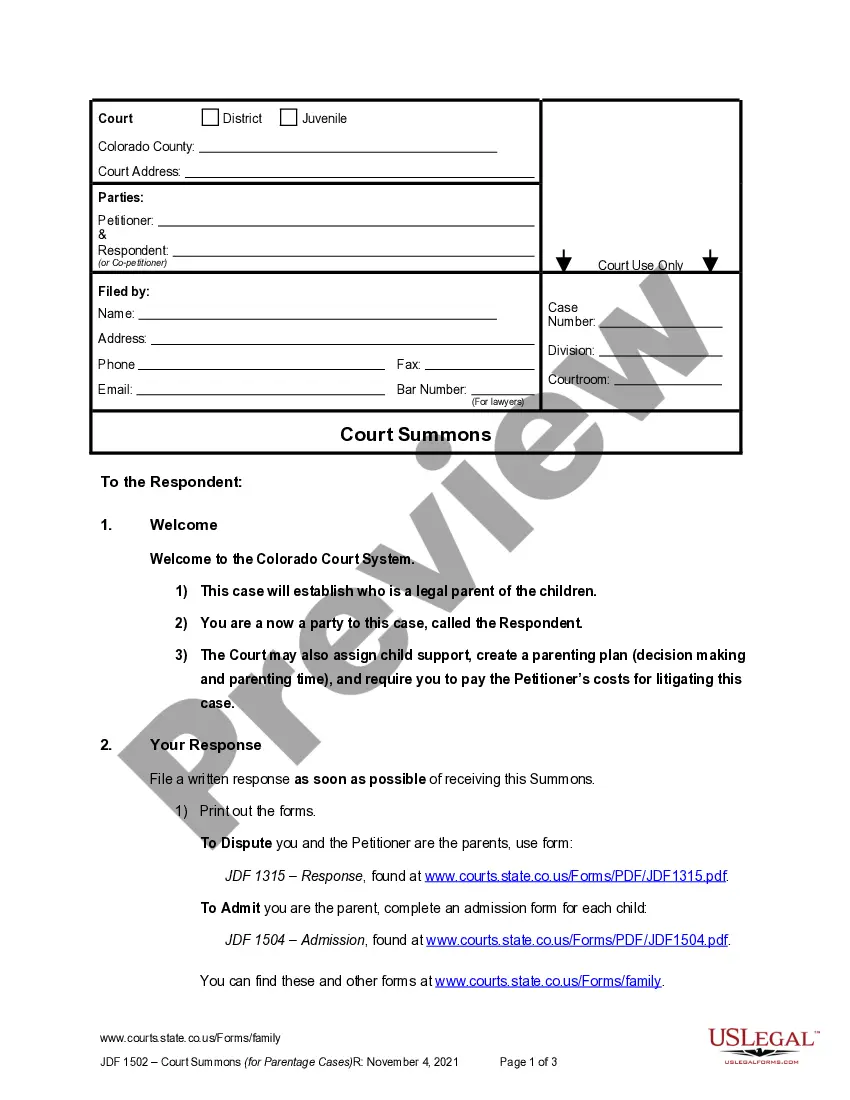

How to fill out Kansas Invoice Template For Independent Contractor?

If you want to full, acquire, or print legal document web templates, use US Legal Forms, the greatest variety of legal forms, that can be found on the Internet. Take advantage of the site`s simple and hassle-free search to discover the documents you will need. Different web templates for organization and person reasons are categorized by types and states, or key phrases. Use US Legal Forms to discover the Kansas Invoice Template for Independent Contractor in just a couple of mouse clicks.

Should you be previously a US Legal Forms buyer, log in to your accounts and click on the Download button to obtain the Kansas Invoice Template for Independent Contractor. Also you can accessibility forms you earlier downloaded from the My Forms tab of your own accounts.

If you use US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form to the appropriate city/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s information. Don`t forget to see the information.

- Step 3. Should you be unhappy with all the form, utilize the Look for industry near the top of the display to find other versions from the legal form design.

- Step 4. Upon having discovered the form you will need, click on the Purchase now button. Opt for the pricing strategy you favor and add your credentials to sign up on an accounts.

- Step 5. Approach the financial transaction. You can utilize your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Choose the structure from the legal form and acquire it in your product.

- Step 7. Total, revise and print or signal the Kansas Invoice Template for Independent Contractor.

Every legal document design you acquire is the one you have for a long time. You may have acces to each and every form you downloaded inside your acccount. Click on the My Forms area and decide on a form to print or acquire again.

Be competitive and acquire, and print the Kansas Invoice Template for Independent Contractor with US Legal Forms. There are thousands of expert and condition-distinct forms you can use for the organization or person requires.