Kansas Loan Agreement between Stockholder and Corporation is a legal document that outlines the terms and conditions under which a corporation borrows funds from one of its stockholders. This agreement ensures transparency and legal protection for both parties involved in the loan transaction. The Kansas Loan Agreement includes important details such as the names of the corporation and stockholder, the loan amount, interest rates, repayment terms, and any collateral or guarantees offered by the corporation. It clearly defines the obligations and responsibilities of each party, providing a framework for the loan's execution and repayment. There are several types of Kansas Loan Agreements between Stockholder and Corporation that can be tailored to specific situations. These types include: 1. Promissory Note: This is a basic type of loan agreement where the corporation promises to repay the borrowed funds to the stockholder within a specified period. The promissory note includes the loan amount, interest rate, repayment schedule, and any penalties for late payments. 2. Secured Loan Agreement: In this type of loan agreement, the corporation offers collateral as security to the stockholder in case of default. The collateral can be in the form of assets or property owned by the corporation. This provides an added level of security and assurance for the stockholder. 3. Convertible Loan Agreement: This agreement allows the stockholder to convert the loan into equity or stock ownership in the corporation at a later date. This type of loan facilitates the potential for the stockholder to become a shareholder in the company. 4. Demand Loan Agreement: This loan agreement allows the stockholder to demand repayment of the loan at any time, without requiring a specific repayment schedule. This type of agreement provides flexibility for both parties and allows the stockholder to have immediate access to their funds when needed. It is important for both the corporation and stockholder to consult legal professionals and thoroughly understand the terms and conditions of the Kansas Loan Agreement before entering into the agreement. This ensures compliance with state laws and mitigates any potential disputes or uncertainties in the future.

Kansas Loan Agreement between Stockholder and Corporation

Description

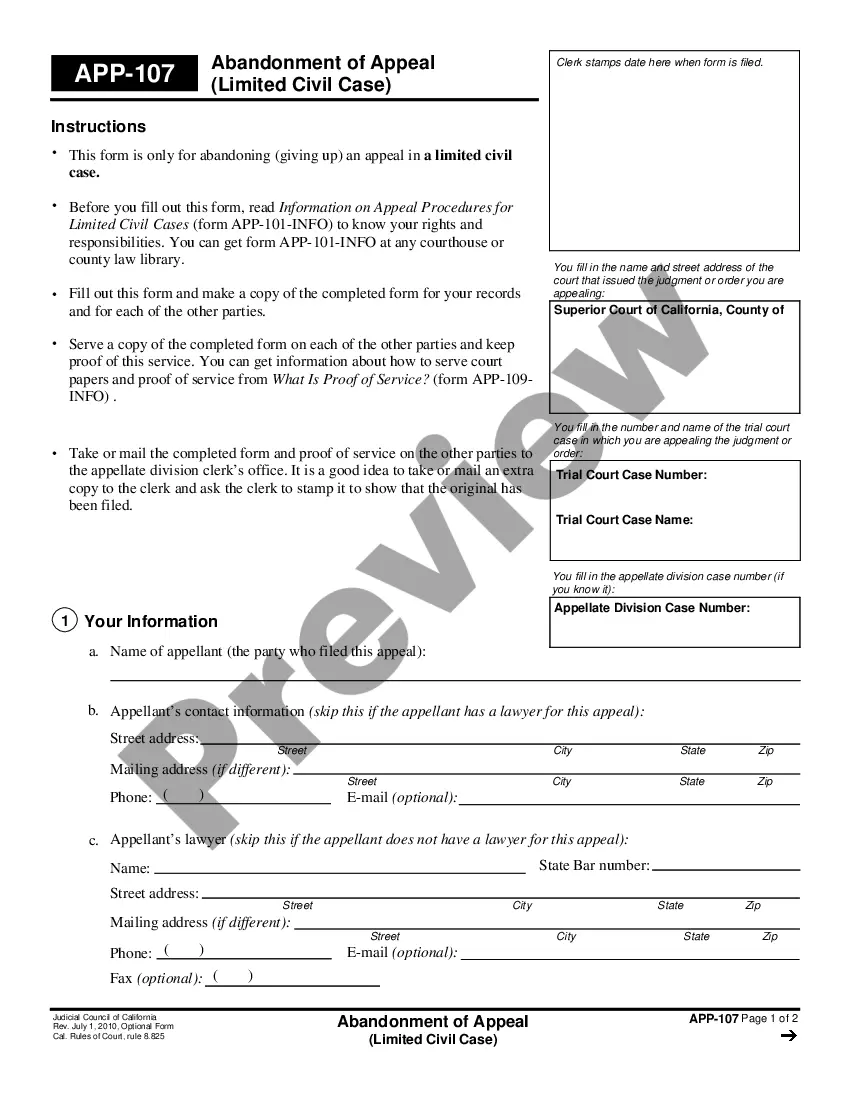

How to fill out Kansas Loan Agreement Between Stockholder And Corporation?

If you have to full, acquire, or printing lawful papers layouts, use US Legal Forms, the most important selection of lawful types, which can be found on the Internet. Make use of the site`s simple and easy hassle-free lookup to find the documents you need. Different layouts for organization and person purposes are sorted by classes and states, or keywords and phrases. Use US Legal Forms to find the Kansas Loan Agreement between Stockholder and Corporation in just a couple of mouse clicks.

Should you be already a US Legal Forms customer, log in in your accounts and then click the Acquire button to find the Kansas Loan Agreement between Stockholder and Corporation. You can also accessibility types you in the past delivered electronically from the My Forms tab of the accounts.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape for your correct area/nation.

- Step 2. Take advantage of the Review choice to check out the form`s information. Do not overlook to learn the outline.

- Step 3. Should you be not happy together with the develop, utilize the Lookup industry near the top of the display to locate other types from the lawful develop template.

- Step 4. Once you have identified the shape you need, go through the Get now button. Opt for the pricing strategy you like and include your qualifications to sign up to have an accounts.

- Step 5. Procedure the purchase. You should use your charge card or PayPal accounts to perform the purchase.

- Step 6. Choose the formatting from the lawful develop and acquire it on your own product.

- Step 7. Complete, revise and printing or sign the Kansas Loan Agreement between Stockholder and Corporation.

Every single lawful papers template you purchase is the one you have forever. You may have acces to every develop you delivered electronically with your acccount. Go through the My Forms section and select a develop to printing or acquire yet again.

Contend and acquire, and printing the Kansas Loan Agreement between Stockholder and Corporation with US Legal Forms. There are many specialist and status-specific types you can use for your organization or person needs.

Form popularity

FAQ

Lending corporate cash to shareholders can be an effective way to give the shareholders use of the funds without the double-tax consequences of dividends. However, an advance or loan to a shareholder must be a bona fide loan to avoid a constructive dividend.

How to record shareholder loans (payable and receivable):Set up a new account in the chart of accounts called shareholder loan.If the funds have come in to the bank account from the shareholder it can simply be allocated as a deposit or a transfer to the shareholder account (no journal entry necessary).More items...?08-May-2020

Shareholders may take a loan from the corporation and are not required to report it as personal income on their personal tax return for that fiscal tax year. A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed.

What should be in a personal loan contract?Names and addresses of the lender and the borrower.Information about the loan cosigner, if applicable.Amount borrowed.Date the loan was provided.Expected repayment date.Interest rate, if applicable.Annual percentage rate (APR), if applicable.More items...?

10 Essential Loan Agreement ProvisionsIdentity of the Parties. The names of the lender and borrower need to be stated.Date of the Agreement.Interest Rate.Repayment Terms.Default provisions.Signatures.Choice of Law.Severability.

A loan to a shareholder must be returned to the corporation by the end of the next fiscal year to ensure that the amount will not be taxed. For the loan not to be considered income, according to the CRA, interest must be charged by the corporation at a prescribed rate to any shareholder loan amount.

Shareholder loan is a debt-like form of financing provided by shareholders. Usually, it is the most junior debt in the company's debt portfolio. On the other hand, if this loan belongs to shareholders it could be treated as equity. Maturity of shareholder loans is long with low or deferred interest payments.

You can borrow from the corporation. A promissory note should be prepared showing the loan amount, interest rate and a specific repayment date. A formal note is evidence of an arms-length transaction between the corporation and the borrower.

How do I create a Shareholder Loan Agreement?Determine how the corporation will make payments.State the term length.Specify the loan amount.Determine the payment details.Provide both parties' information.Address miscellaneous matters.Sign the document.

A Shareholder Loan Agreement, sometimes called a stockholder loan agreement, is an enforceable agreement between a shareholder and a corporation that details the terms of a loan (like the repayment schedule and interest rates) when a corporation borrows money from or owes money to a shareholder.