Kansas Job Analysis

Description

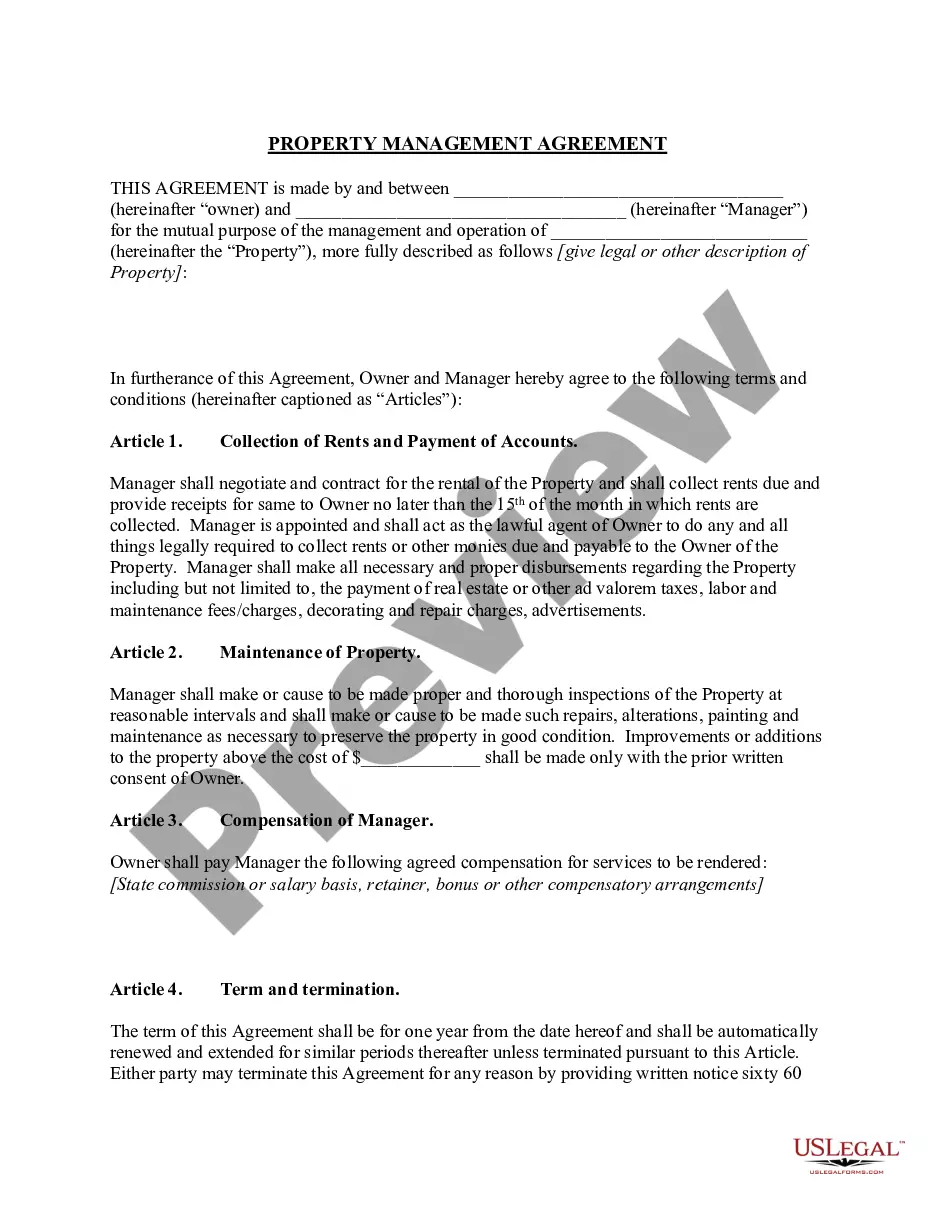

How to fill out Job Analysis?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a broad selection of legal template documents that you can download or print.

By using the website, you can discover a vast number of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Kansas Job Analysis in mere seconds.

If you have a monthly subscription, Log In to access the Kansas Job Analysis within the US Legal Forms library. The Download button will appear on every form you explore.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button.

Then, select your preferred payment method and provide your information to register for an account.

- You have access to all previously downloaded forms from the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Make sure to select the correct form for your city/state.

- Click on the Review button to evaluate the form's content.

- Check the form description to ensure you have chosen the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

Form popularity

FAQ

To fill out a job analysis form effectively, provide accurate and detailed information about the job's tasks, skills needed, and working conditions. Use your gathered insights from a Kansas Job Analysis to ensure that the form outlines the essential functions of the role. This leads to improved job clarity and aligns employee expectations.

In Kansas, reporting a new hire requires you to submit the employee's information to the Kansas Department of Labor. Typically, this includes the new hire's name, address, and Social Security number. By correctly documenting this in your Kansas Job Analysis, you streamline compliance with state regulations and make payroll processing easier.

Filling out a job description form involves writing clear and precise information about the role, including duties, skills, and knowledge required. Utilize data gathered from your Kansas Job Analysis when filling this out to ensure every aspect reflects the realities of the job. This can serve as a helpful reference for both recruitment and employee performance evaluations.

You can collect job analysis information through various methods, such as interviews with current employees, surveys, and direct observations. Gathering input from multiple sources enriches the data, ensuring a well-rounded perspective. In a Kansas Job Analysis, using diverse collection methods enhances the accuracy and reliability of the information assembled.

Filling a job analysis form requires you to accurately provide details about the job duties, required skills, and tools used. Ensure you are thorough and consistent while entering information, as this will reflect the role's demands in your Kansas Job Analysis. A clear and complete form supports better job clarity and more effective hiring processes.

Completing a job task analysis involves breaking down each task associated with the position into manageable steps. You can identify essential functions and determine the skills needed for each task. This process is a critical part of a Kansas Job Analysis, ensuring all job components are documented and understood for organizational efficiency.

To conduct a proper job analysis, start by gathering information about the position through observations and interviews with current employees. Focus on key responsibilities, skills required, and the tools used in the role. By aligning this data with the standards of a Kansas Job Analysis, you can create a comprehensive overview that benefits both management and employees.

A job analysis often involves assessing the roles and responsibilities of a specific position within an organization. For example, a Kansas Job Analysis for a marketing manager may detail tasks such as overseeing marketing campaigns, conducting market research, and analyzing consumer data. This process helps clarify expectations and provides insights for recruitment and performance assessments.

Yes, tax exempt certificates in Kansas can expire. The validity period often depends on the type of exemption and the specific regulations governing it. Regularly conducting a Kansas Job Analysis can help you stay updated on changes and ensure your certificate remains valid for your financial activities.

Tax clearance certificates in Kansas are typically provided by the Kansas Department of Revenue. These certificates confirm that you have settled all state tax liabilities. If you need assistance in procuring this document, platforms like USLegalForms can provide templates and support to streamline your application.