Kansas Sample Letter for Corrections to Credit Report

Description

How to fill out Sample Letter For Corrections To Credit Report?

Have you found yourself in a situation where you frequently need documents for either professional or personal purposes.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of template options, including the Kansas Sample Letter for Corrections to Credit Report, which can be filled out to comply with federal and state regulations.

Once you find the correct form, click Buy now.

Choose the payment plan you desire, complete the required information to create your account, and pay for the order using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Kansas Sample Letter for Corrections to Credit Report at any time if necessary. Just click on the form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and prevent errors. The service offers well-crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and begin simplifying your life.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Kansas Sample Letter for Corrections to Credit Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and confirm it is for the appropriate city/region.

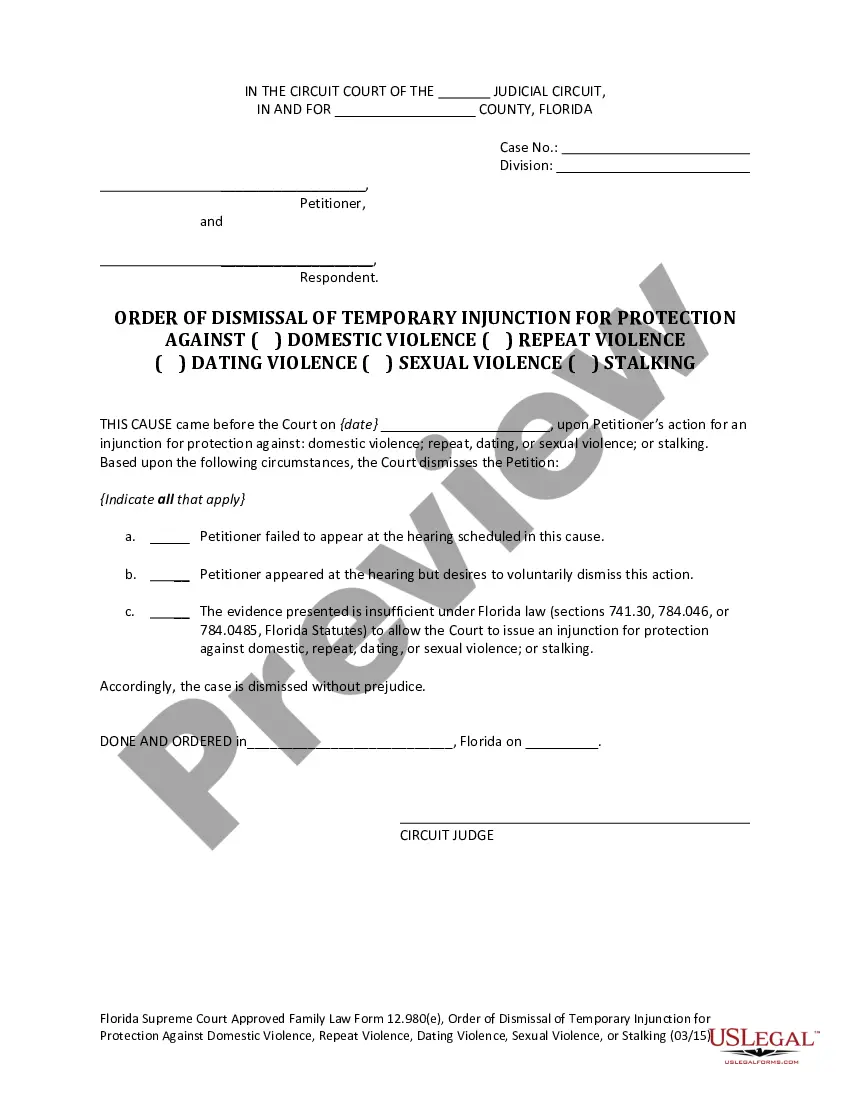

- Utilize the Review button to inspect the form.

- Check the summary to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search box to locate the form that caters to your needs.

Form popularity

FAQ

When writing a credit report dispute letter, begin with your personal information and the date. Then, clearly outline the items you dispute along with a concise explanation of why they are incorrect. Utilizing the 'Kansas Sample Letter for Corrections to Credit Report' can streamline this process, making it easier for you to format your letter correctly. Remember to include any supporting documents to strengthen your case and increase your chances of a successful dispute.

Creating a credit report dispute letter involves gathering important information first, such as your credit report and any documentation that supports your claim. Start by clearly stating the inaccuracies and providing the necessary details for each item you dispute. To make your letter more effective, you can use the 'Kansas Sample Letter for Corrections to Credit Report' as a guideline. This sample letter will help ensure you include all critical elements in your dispute letter.

A 623 letter is a formal request sent to credit reporting agencies that addresses inaccuracies in your credit report. This letter cites Section 623 of the Fair Credit Reporting Act, which gives you the right to dispute misleading information. To enhance your chances of success, consider using the 'Kansas Sample Letter for Corrections to Credit Report' as your template. This resource simplifies the process and ensures that your request is clear and effective.

To make corrections to your credit report, begin by reviewing your report thoroughly to identify inaccuracies. You should then write a formal dispute letter to the credit reporting agency, detailing the incorrect information and including supporting documents. A Kansas Sample Letter for Corrections to Credit Report is a useful resource that can guide you in crafting a compelling dispute letter. Accurate credit reports are crucial for your financial health, so addressing errors promptly is essential.

To remove collections from your credit report, you can draft a letter to the creditor requesting validation of the debt. If the creditor cannot prove the legitimacy of the debt, you may succeed in having it removed. Utilizing a Kansas Sample Letter for Corrections to Credit Report can provide a structured approach and language that clearly conveys your request. This method can be effective in ensuring that incorrect collections do not negatively affect your credit score.

The 623 credit law refers to Section 623 of the Fair Credit Reporting Act, which outlines the obligations of furnishers of information to credit reporting agencies. Essentially, it allows you to dispute inaccurate information on your credit report directly with your creditors. If you believe the information is incorrect, using a Kansas Sample Letter for Corrections to Credit Report can help streamline your dispute process. Understanding this law empowers you to take control of your credit information.

To write a letter step by step, start with a clear purpose for your letter. Draft an outline that includes an introduction, body, and conclusion. It helps to use templates like the Kansas Sample Letter for Corrections to Credit Report for guidance. Finally, format your letter neatly, review it for accuracy, and make any necessary edits before sending.

The process of a letter of credit involves several parties: the buyer, seller, and the bank. The buyer requests a letter of credit from their bank, which then verifies details and guarantees payment to the seller, provided they meet the necessary conditions. A well-drafted letter, similar to a Kansas Sample Letter for Corrections to Credit Report, can guide you in structuring your requests effectively.

When disputing something on your credit report, start by clearly stating your identity and the specific inaccuracies found in your report. Provide any necessary supporting documents, like statements or payment records, to strengthen your case. Conclude with a request for correction and consider using the Kansas Sample Letter for Corrections to Credit Report to structure your letter appropriately.

A 623 letter refers to a request for verification sent to creditors under Section 623 of the Fair Credit Reporting Act. It formally asks the creditor to provide details regarding the information they reported to credit bureaus. To effectively communicate your request, utilizing a Kansas Sample Letter for Corrections to Credit Report can enhance your letter's clarity and impact.