Kansas Notice of Returned Check

Description

How to fill out Notice Of Returned Check?

Are you in a situation where you require documents for either business or personal considerations nearly every day.

There is a plethora of legitimate document templates available online, but finding reliable ones can be challenging.

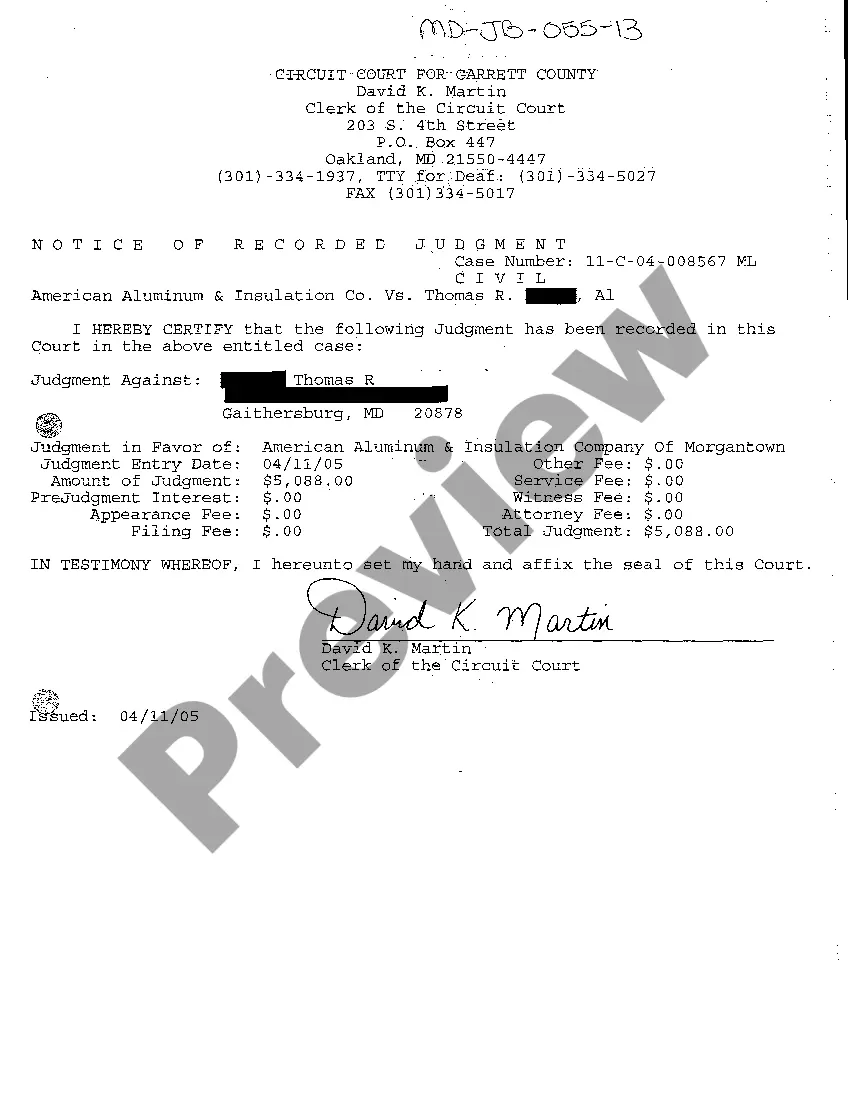

US Legal Forms provides an extensive range of template documents, such as the Kansas Notice of Returned Check, which can be tailored to comply with federal and state regulations.

Select your preferred payment plan, fill in the necessary information to create your account, and complete the transaction using your PayPal or Visa/Mastercard.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Subsequently, you may download the Kansas Notice of Returned Check template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and verify it is for the correct city/state.

- Utilize the Review option to examine the form.

- Read the details to ensure you have selected the right template.

- If the template does not meet your requirements, use the Search field to find a suitable form.

- When you identify the correct template, click Get Now.

Form popularity

FAQ

A check can be returned for several reasons, including insufficient funds, a closed account, or a mismatch in signatures. Understanding these reasons can help you address the situation effectively. By issuing a Kansas Notice of Returned Check, you can outline what went wrong and how to rectify it. This approach not only helps in resolving the issue but also enhances communication between you and the check issuer.

To collect a returned check, first communicate with the issuer to discuss the issue directly. If informal attempts fail, you can issue a Kansas Notice of Returned Check as a formal reminder of the bounced payment. This document may encourage the issuer to resolve the matter promptly, making collection easier and setting the stage for potential further actions if needed.

Receiving a returned check indicates that the issuing bank could not process the payment due to insufficient funds or account issues. You often face inconvenience, as you may have relied on those funds. It’s advisable to send a Kansas Notice of Returned Check to the check issuer, outlining the situation and making it clear that further action may be necessary to recover the owed amount.

When you receive a bounced check, it can create financial challenges. You might not receive the funds you expected, leading to potential payment issues. Additionally, you may need to consider issuing a Kansas Notice of Returned Check, which informs the issuer about the bounced payment. This step helps establish a formal record and allows you to pursue recovery options.

The statute for worthless checks in Kansas generally falls under K.S.A. 21-5824, which addresses issuing checks without sufficient funds. This law outlines the penalties and requirements for those who write checks that cannot be cashed due to lack of necessary funds. Familiarity with the statute can help individuals protect themselves from potential legal issues linked to the Kansas Notice of Returned Check. Consulting resources like U.S. Legal Forms can provide additional clarity and assistance.

Yes, writing a bad check can be classified as a felony in Kansas, especially when the amount exceeds $500. This designation emphasizes the seriousness of the offense and the legal liability that comes with it. By understanding your rights under the Kansas Notice of Returned Check, you can better handle any legal consequences that arise from such actions. Educating yourself on the law can empower you in challenging situations.

Writing a bad check for more than $500 in Kansas may lead to severe penalties, including felony charges. This situation can result in significant fines and potentially imprisonment. For those involved in such circumstances, recognizing how the Kansas Notice of Returned Check applies can help you take proactive steps. It is advisable to seek legal guidance to navigate the repercussions effectively.

Yes, you may face consequences if you accept a check that someone knows will bounce. Accepting a bad check could lead to legal issues, particularly if you attempt to deposit it knowing it lacks funds. Furthermore, the situation could escalate, leading to claims under the Kansas Notice of Returned Check law. Being informed can safeguard you against such complications.

In Kansas, a felony is a serious crime that typically results in imprisonment for more than a year. Examples include violent crimes, theft above a certain value, and certain drug offenses. Understanding the classification of felonies can help you navigate the legal system better. For issues such as a Kansas Notice of Returned Check, knowing the legal ramifications can aid in resolving disputes.

In Kansas, theft becomes a felony when the value of stolen property exceeds $1,500. Additionally, certain types of theft, such as stealing livestock or firearms, can also result in felony charges regardless of their value. Understanding the implications of a Kansas Notice of Returned Check is also crucial, as it can lead to significant legal trouble if not addressed. If you find yourself in a bind, consider seeking guidance from legal services available on platforms like US Legal Forms.