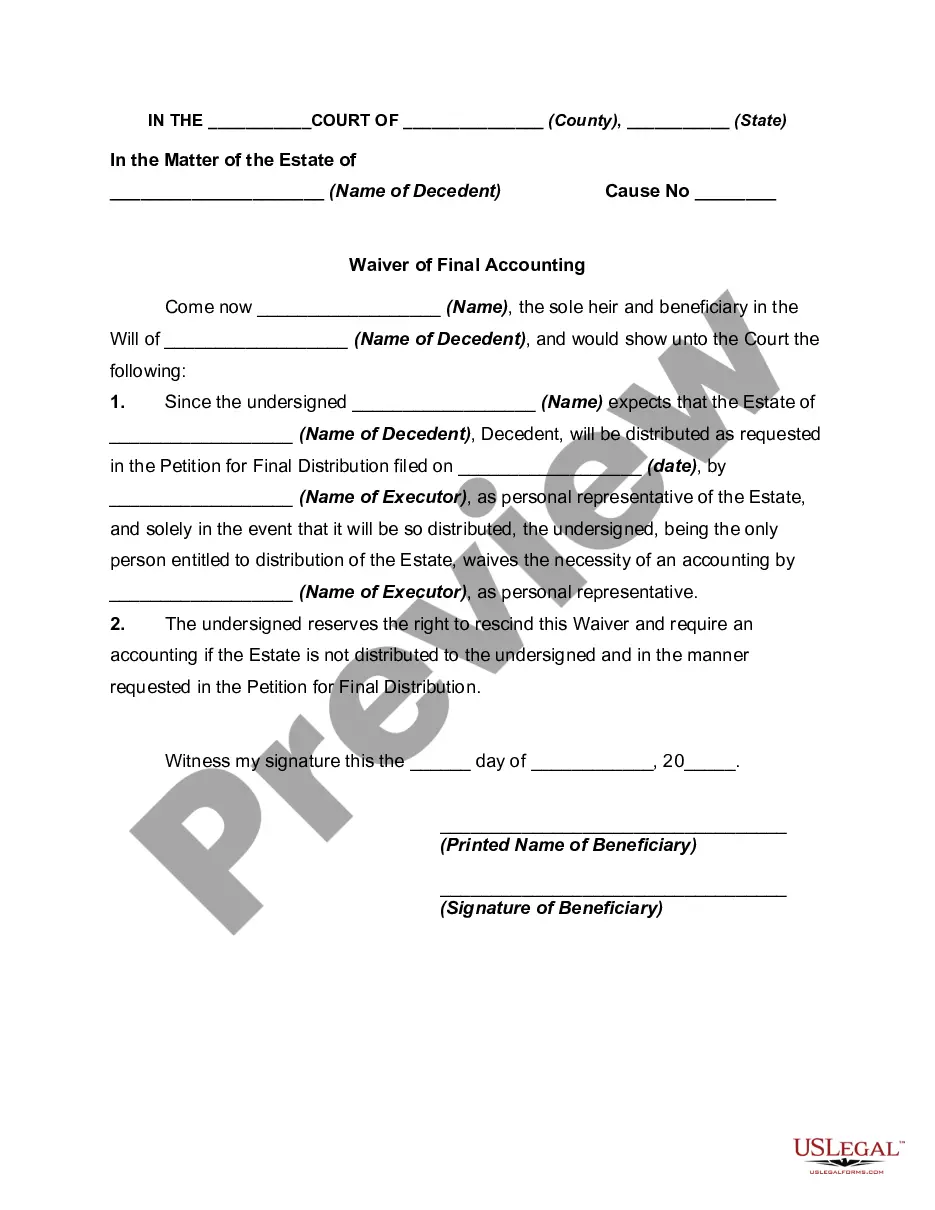

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

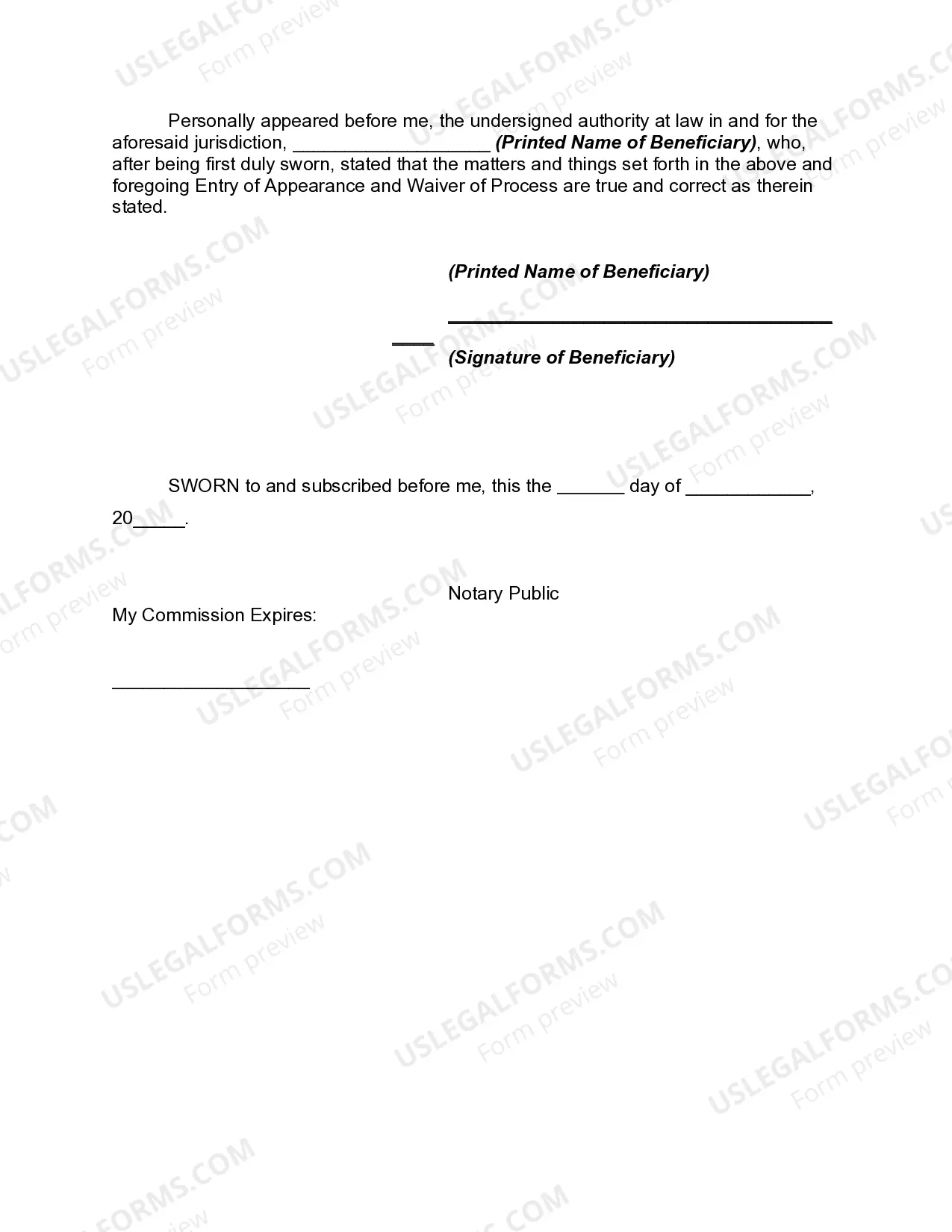

Kansas Waiver of Final Accounting by Sole Beneficiary is a legal document that relieves the executor of an estate from preparing a final accounting report for the beneficiary. This waiver allows the beneficiary to acknowledge that they have received their share of the estate without requiring the executor to go through the lengthy process of accounting for every financial transaction and asset distribution. In Kansas, there are two main types of waivers of final accounting by sole beneficiary: 1. Conditional Waiver: This type of waiver is granted when the sole beneficiary has received full disclosure of the estate's financial transactions and is fully aware of their entitlements. The beneficiary agrees to waive their right to a formal final accounting as long as certain conditions are met. These conditions could include full payment of their share, providing copies of relevant financial documents, and receiving a written statement confirming the completion of their entitlements. 2. Unconditional Waiver: An unconditional waiver of final accounting is granted when the beneficiary has complete trust in the executor and willingly relinquishes their right to receive a formal accounting report. In this case, the beneficiary is confident that they have received their rightful share of the estate without requiring additional documentation or verification. This type of waiver is often based on a strong relationship of trust between the beneficiary and the executor. The Kansas Waiver of Final Accounting by Sole Beneficiary is a valuable tool that simplifies the estate settlement process. It saves time, reduces administrative burdens, and eliminates unnecessary costs associated with preparing a formal accounting report. However, it is important for both the beneficiary and the executor to fully understand the implications of waiving the final accounting requirement and ensure that all legal requirements are met. It is advisable to consult an attorney specializing in estate law to draft the waiver document accurately and ensure compliance with Kansas state laws.