Kansas Self-Assessment Worksheet is a tool designed to help individuals assess their personal circumstances, financial well-being, and tax situation in order to accurately complete their Kansas state tax return. This worksheet provides a comprehensive checklist of information required for the tax-filing process. In Kansas, there are various types of self-assessment worksheets available, including: 1. Kansas Income Tax Worksheet: This worksheet assists individuals in calculating their Kansas taxable income by considering various income sources and deductions allowed under state tax laws. It helps determine the appropriate adjusted gross income (AGI) to report on the Kansas tax return. 2. Kansas Deductions Worksheet: This worksheet focuses on itemized deductions specific to Kansas, such as state and local taxes paid, mortgage interest, medical expenses, charitable contributions, and other eligible expenses. It helps taxpayers determine whether they should opt for standard deductions or itemized deductions, which could potentially reduce their Kansas tax liability. 3. Kansas Tax Credits Worksheet: This worksheet helps individuals identify and calculate any tax credits they may be eligible for in Kansas. These credits could include education-related credits, child and dependent care credits, energy-efficiency credits, and others. By utilizing this worksheet, individuals can maximize their tax savings and potentially lower their overall tax liability. 4. Kansas Self-Employment Worksheet: This worksheet is specifically designed for self-employed individuals or those earning income from freelance work or independent contracting. It assists in calculating self-employment tax, determining net profit or loss, and reporting income accurately on the Kansas tax return. Additionally, these worksheets often include sections for personal information, such as name, address, social security number, and filing status. They guide taxpayers through various income categories, including wages, interest, dividends, capital gains, and other sources of income. Furthermore, they provide spaces to record deductions, exemptions, and credits, ensuring accuracy and completeness of the tax return. By utilizing the Kansas Self-Assessment Worksheets, individuals can ensure that they have organized and accounted for all relevant financial information required for filing their Kansas state tax return accurately. These worksheets help individuals understand their tax situation, maximize deductions and credits, and ultimately avoid potential penalties or audits by the Kansas Department of Revenue.

Kansas Self-Assessment Worksheet

Description

How to fill out Kansas Self-Assessment Worksheet?

Choosing the right authorized papers web template can be a battle. Naturally, there are a variety of themes available on the Internet, but how do you discover the authorized develop you want? Take advantage of the US Legal Forms web site. The service delivers 1000s of themes, including the Kansas Self-Assessment Worksheet, that can be used for business and personal requires. All of the varieties are checked out by professionals and meet state and federal specifications.

If you are presently registered, log in to your account and then click the Down load key to obtain the Kansas Self-Assessment Worksheet. Use your account to search throughout the authorized varieties you might have acquired earlier. Go to the My Forms tab of your respective account and have yet another backup from the papers you want.

If you are a fresh end user of US Legal Forms, listed here are straightforward instructions that you should adhere to:

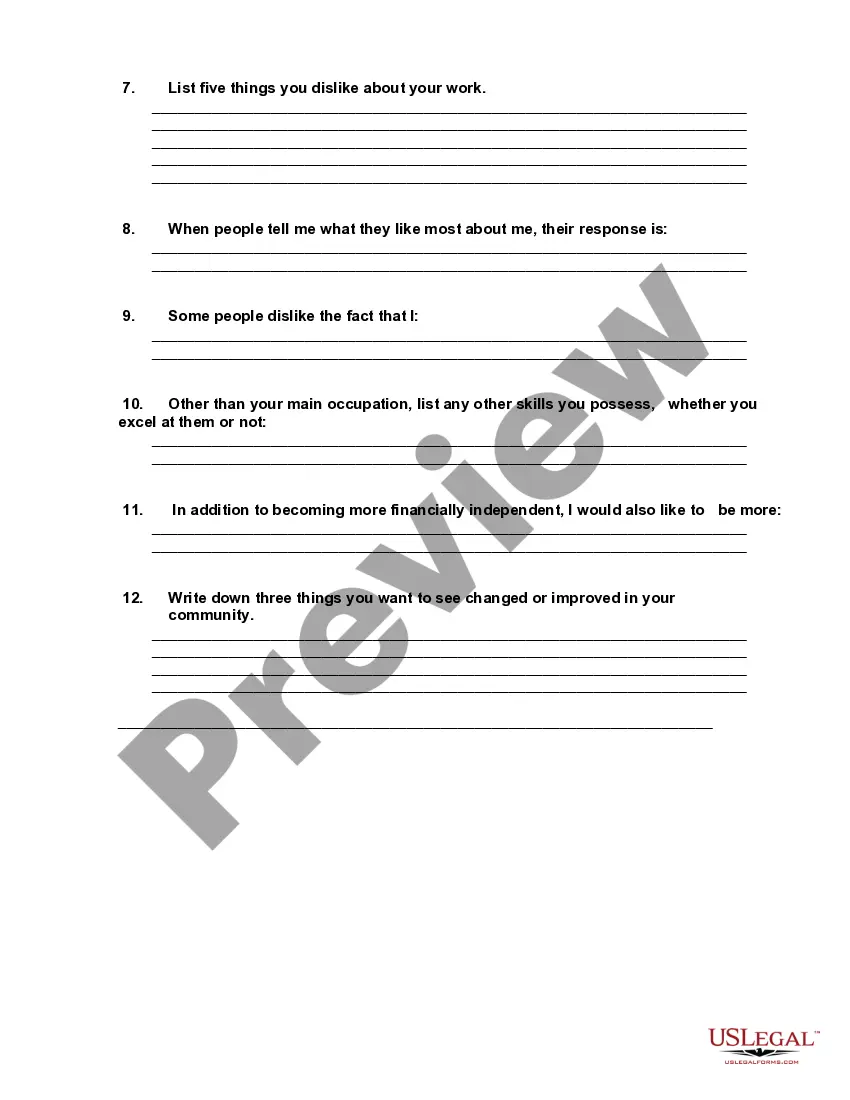

- Initial, make sure you have chosen the correct develop for the area/region. You are able to look through the shape utilizing the Preview key and study the shape description to ensure this is the right one for you.

- In the event the develop will not meet your expectations, utilize the Seach area to discover the proper develop.

- When you are certain the shape is suitable, click the Buy now key to obtain the develop.

- Pick the rates strategy you would like and enter the necessary info. Make your account and purchase the order with your PayPal account or credit card.

- Opt for the data file structure and acquire the authorized papers web template to your gadget.

- Total, change and print out and indicator the attained Kansas Self-Assessment Worksheet.

US Legal Forms will be the biggest catalogue of authorized varieties where you can discover a variety of papers themes. Take advantage of the company to acquire skillfully-produced paperwork that adhere to state specifications.