A buy-sell agreement is an agreement between the owners of the business for purchase of each others interest in the business. Such an agreement will spell out the terms governing sale of company stock to an outsider and thus protect control of the company. It can be triggered in the event of the owner's death, disability, retirement, withdrawal from the business or other events. Life insurance owned by the corporation is often used to provide the funds to purchase the shares of a closely held company if one of the owners dies.

The time to prevent disputes is before they occur. Experience proves that owners anxieties created in dealing with one another are inversely proportional to the effort they spend addressing business problems in the event that they should happen. Dealing with these contingencies before they manifest themselves is the secret to a harmonious business relationship with other owners, Use the checklist below to determine areas where you may need assistance.

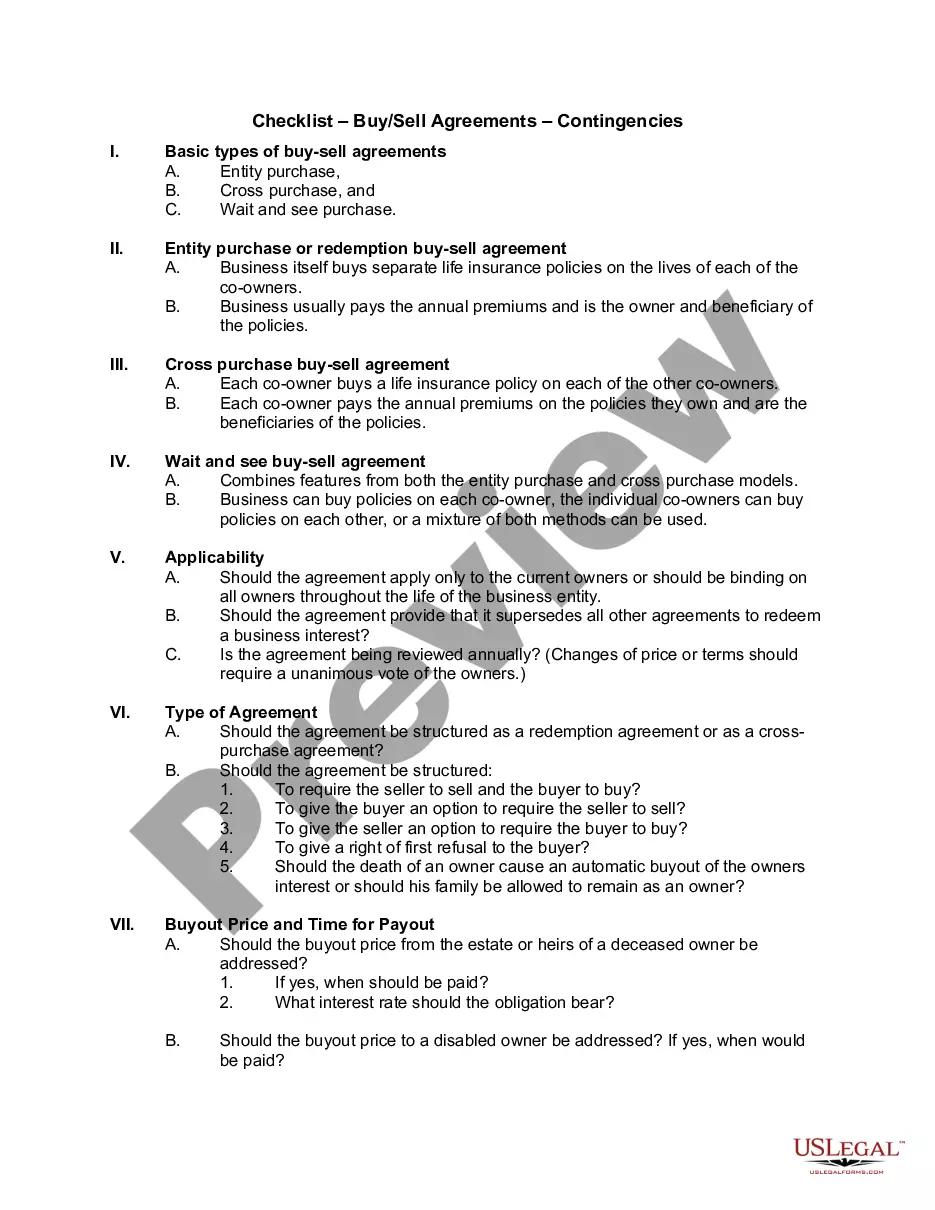

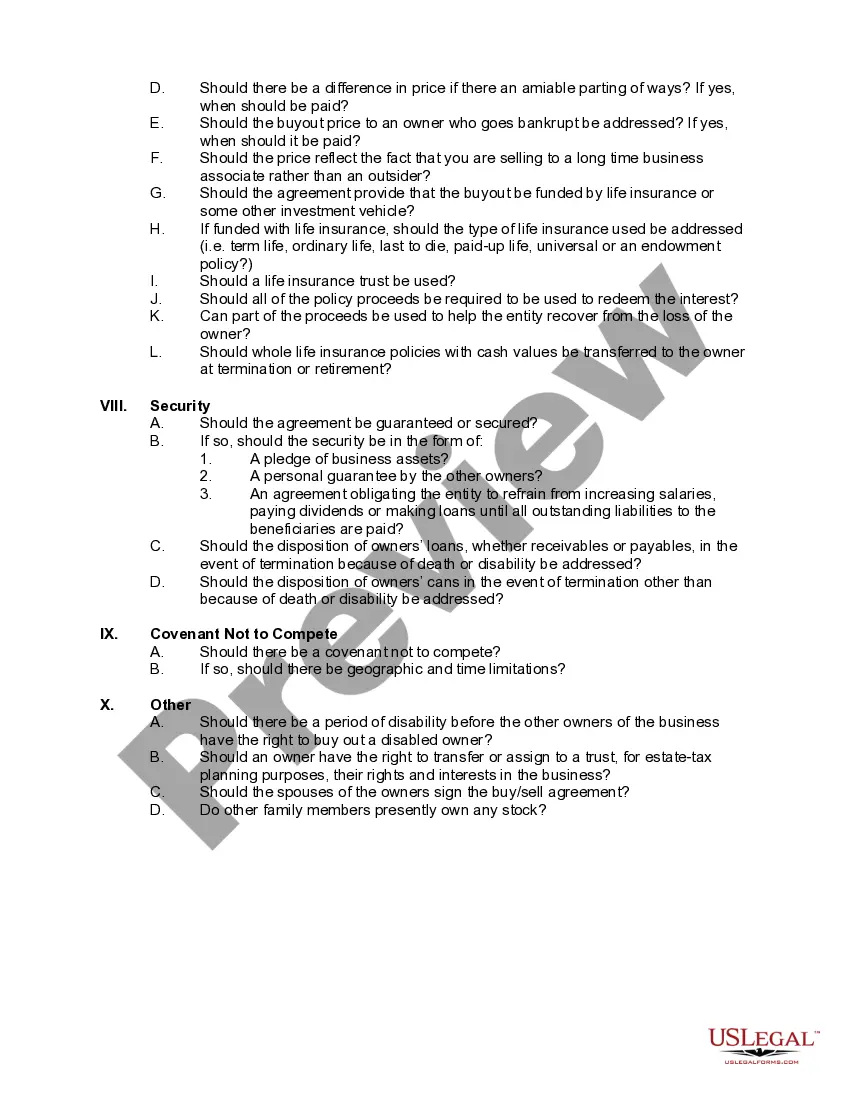

Kansas Checklist — Buy/Sell Agreement— - Contingencies: A Comprehensive Guide In Kansas, when engaging in a buy/sell agreement, it is crucial to ensure that all necessary contingencies are adequately addressed to protect both buyers and sellers. Here is a detailed description of the Kansas Checklist for Buy/Sell Agreements — Contingencies, including various types: 1. Financing Contingency: One common contingency in Kansas is the financing contingency, which allows the buyer to withdraw from the agreement if they fail to secure a suitable loan within a specified period. This protects buyers from being financially obligated in case they cannot secure financing. 2. Appraisal Contingency: An appraisal contingency ensures that the property's value meets or exceeds the agreed-upon purchase price. If the appraisal comes in lower, the buyer can renegotiate the price or terminate the contract, safeguarding their investment. 3. Inspection Contingency: The inspection contingency provides the buyer with the opportunity to conduct a thorough inspection of the property. If significant issues are discovered, the buyer may request repairs, credit, or even cancel the agreement based on the findings. This contingency ensures buyers are not stuck with a property that needs substantial and unexpected repairs. 4. Title Contingency: The title contingency serves to protect the buyer by ensuring that the property has a clear title, free from any legal encumbrances or claims. If any issues arise during the title search, the buyer can withdraw from the agreement or request the seller to resolve the title issues before proceeding. 5. Disclosure Contingency: In Kansas, sellers are required by law to disclose any known material defects, damages, or other issues with the property. The disclosure contingency allows the buyer to review these disclosures and ensure they are comfortable proceeding with the purchase. If the buyer finds undisclosed issues, they may request remedies or terminate the agreement. 6. Due Diligence Contingency: The due diligence contingency permits the buyer to conduct thorough research and investigations on the property, including zoning restrictions, environmental concerns, permits, and any other factors that could impact its value or use. If the buyer discovers factors that negatively affect their intended use, they can decide to terminate the agreement. 7. Time Contingency: This contingency specifies the time frame within which the sale must be completed. It allows the buyer or seller to terminate the agreement if the other party fails to fulfill their obligations within the agreed-upon time, ensuring both parties adhere to the agreed-upon timeline. 8. Mortgage Contingency: For buyers relying on obtaining a mortgage to complete the purchase, a mortgage contingency allows them to terminate the agreement if they are unable to secure financing within a specified period. This contingency safeguards buyers from potential financial hardships. 9. Home Sale Contingency: If a buyer needs to sell their current home to finance the purchase of a new property, a home sale contingency protects them. It allows the buyer to withdraw from the agreement if they fail to sell their home within the specified time, avoiding the risk of owning two properties simultaneously. In summary, the Kansas Checklist — Buy/Sell Agreement— - Contingencies covers various crucial contingencies, ensuring that both buyers and sellers can protect their interests during a real estate transaction. These contingencies include financing, appraisal, inspection, title, disclosure, due diligence, time, mortgage, and home sale contingencies. Adhering to these contingencies is vital for a successful and secure buy/sell agreement in Kansas.Kansas Checklist — Buy/Sell Agreement— - Contingencies: A Comprehensive Guide In Kansas, when engaging in a buy/sell agreement, it is crucial to ensure that all necessary contingencies are adequately addressed to protect both buyers and sellers. Here is a detailed description of the Kansas Checklist for Buy/Sell Agreements — Contingencies, including various types: 1. Financing Contingency: One common contingency in Kansas is the financing contingency, which allows the buyer to withdraw from the agreement if they fail to secure a suitable loan within a specified period. This protects buyers from being financially obligated in case they cannot secure financing. 2. Appraisal Contingency: An appraisal contingency ensures that the property's value meets or exceeds the agreed-upon purchase price. If the appraisal comes in lower, the buyer can renegotiate the price or terminate the contract, safeguarding their investment. 3. Inspection Contingency: The inspection contingency provides the buyer with the opportunity to conduct a thorough inspection of the property. If significant issues are discovered, the buyer may request repairs, credit, or even cancel the agreement based on the findings. This contingency ensures buyers are not stuck with a property that needs substantial and unexpected repairs. 4. Title Contingency: The title contingency serves to protect the buyer by ensuring that the property has a clear title, free from any legal encumbrances or claims. If any issues arise during the title search, the buyer can withdraw from the agreement or request the seller to resolve the title issues before proceeding. 5. Disclosure Contingency: In Kansas, sellers are required by law to disclose any known material defects, damages, or other issues with the property. The disclosure contingency allows the buyer to review these disclosures and ensure they are comfortable proceeding with the purchase. If the buyer finds undisclosed issues, they may request remedies or terminate the agreement. 6. Due Diligence Contingency: The due diligence contingency permits the buyer to conduct thorough research and investigations on the property, including zoning restrictions, environmental concerns, permits, and any other factors that could impact its value or use. If the buyer discovers factors that negatively affect their intended use, they can decide to terminate the agreement. 7. Time Contingency: This contingency specifies the time frame within which the sale must be completed. It allows the buyer or seller to terminate the agreement if the other party fails to fulfill their obligations within the agreed-upon time, ensuring both parties adhere to the agreed-upon timeline. 8. Mortgage Contingency: For buyers relying on obtaining a mortgage to complete the purchase, a mortgage contingency allows them to terminate the agreement if they are unable to secure financing within a specified period. This contingency safeguards buyers from potential financial hardships. 9. Home Sale Contingency: If a buyer needs to sell their current home to finance the purchase of a new property, a home sale contingency protects them. It allows the buyer to withdraw from the agreement if they fail to sell their home within the specified time, avoiding the risk of owning two properties simultaneously. In summary, the Kansas Checklist — Buy/Sell Agreement— - Contingencies covers various crucial contingencies, ensuring that both buyers and sellers can protect their interests during a real estate transaction. These contingencies include financing, appraisal, inspection, title, disclosure, due diligence, time, mortgage, and home sale contingencies. Adhering to these contingencies is vital for a successful and secure buy/sell agreement in Kansas.