Kansas Checklist — Sale of a Business The sale of a business in Kansas involves several steps and requirements that both the buyer and the seller must adhere to. To ensure a smooth and successful transaction, it is essential to follow a comprehensive Kansas Checklist — Sale of a Business. This checklist serves as a guide to cover all the necessary considerations before, during, and after the sale process. Here is a detailed description of the various elements typically included in a Kansas Checklist — Sale of a Business: 1. Business Valuation: Before listing your business for sale, it is crucial to accurately determine its value. Hire a professional business appraiser or use reputable valuation methods to assess the fair market value of your business. 2. Confidentiality Agreements: Protect the sensitive information of your business by requesting potential buyers to sign confidentiality agreements before sharing any proprietary or financial data. 3. Financial Documents: Gather and organize all financial records, including tax returns, profit and loss statements, balance sheets, cash flow statements, and any other relevant documentation. These documents will be crucial in negotiations and due diligence. 4. Legal Documentation: Consult an attorney experienced in business sales to review and draft necessary legal documents such as a Letter of Intent, Purchase Agreement, and Bill of Sale. These documents outline the terms and conditions of the sale, including purchase price, payment terms, and any warranties or representations. 5. Due Diligence: Allow interested buyers to conduct thorough due diligence on your business. They will examine financial records, contracts, leases, licenses, permits, and any potential liabilities. Be prepared to provide all requested information promptly. 6. Regulatory Compliance: Ensure that your business complies with all applicable federal, state, and local regulations. This includes licenses, permits, zoning restrictions, health and safety requirements, and environmental regulations. 7. Employee and Contractual Obligations: Review any employment agreements, non-compete agreements, vendor contracts, and lease agreements. Determine how the sale will affect these contracts and obligations, and inform the buyer accordingly. 8. Tax Considerations: Understand the tax implications of selling your business. Consult with a tax professional to determine any potential capital gains tax liabilities and explore strategies to minimize taxes. 9. Transition Planning: Discuss with the buyer the transition period and develop a plan for transferring ownership smoothly. This may include training, client introductions, and ensuring the buyer has access to all necessary information and resources. 10. Closing the Sale: Once all negotiations, due diligence, and legal requirements are met, proceed to finalize the sale. Transfer ownership and assets according to the terms outlined in the Purchase Agreement, and make any necessary notifications to employees, customers, and vendors. Types of Kansas Checklist — Sale of a Business: 1. Asset Sale Checklist: Focuses on the sale of individual business assets rather than the sale of the entire business entity. 2. Stock Sale Checklist: Pertains to the sale of shares or ownership interests in a business entity, transferring control and ownership of the entire company. 3. Franchise Sale Checklist: Specifically tailored for the sale of a franchised business, which involves additional considerations such as franchisor approvals and transfer fees. 4. Small Business Sale Checklist: Designed for smaller businesses with fewer complexities and considerations, typically involving a single owner or family-owned business. By following a comprehensive Kansas Checklist — Sale of a Business, buyers and sellers can navigate the sale process efficiently while ensuring compliance with legal and regulatory requirements, leading to a successful business transaction.

Kansas Checklist - Sale of a Business

Description

How to fill out Kansas Checklist - Sale Of A Business?

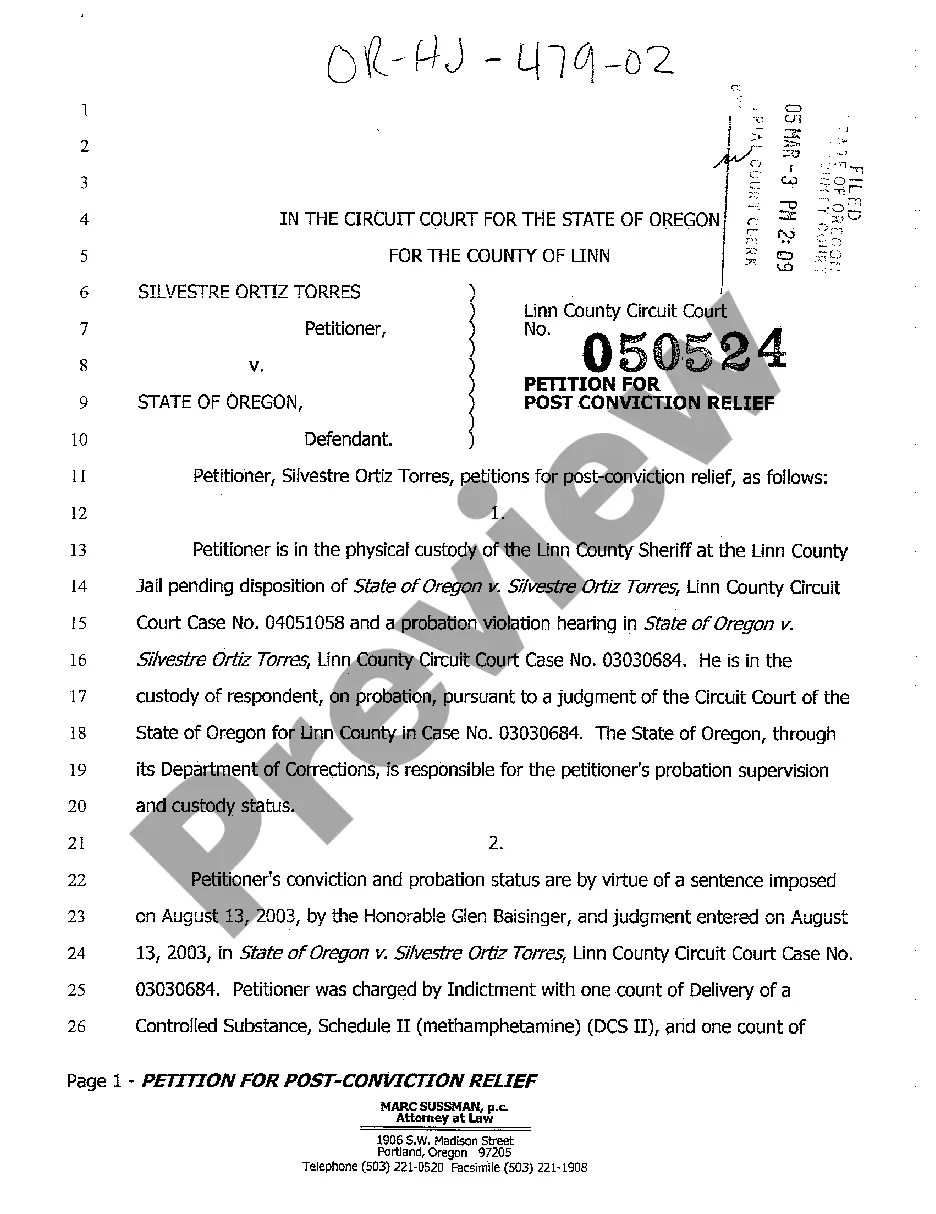

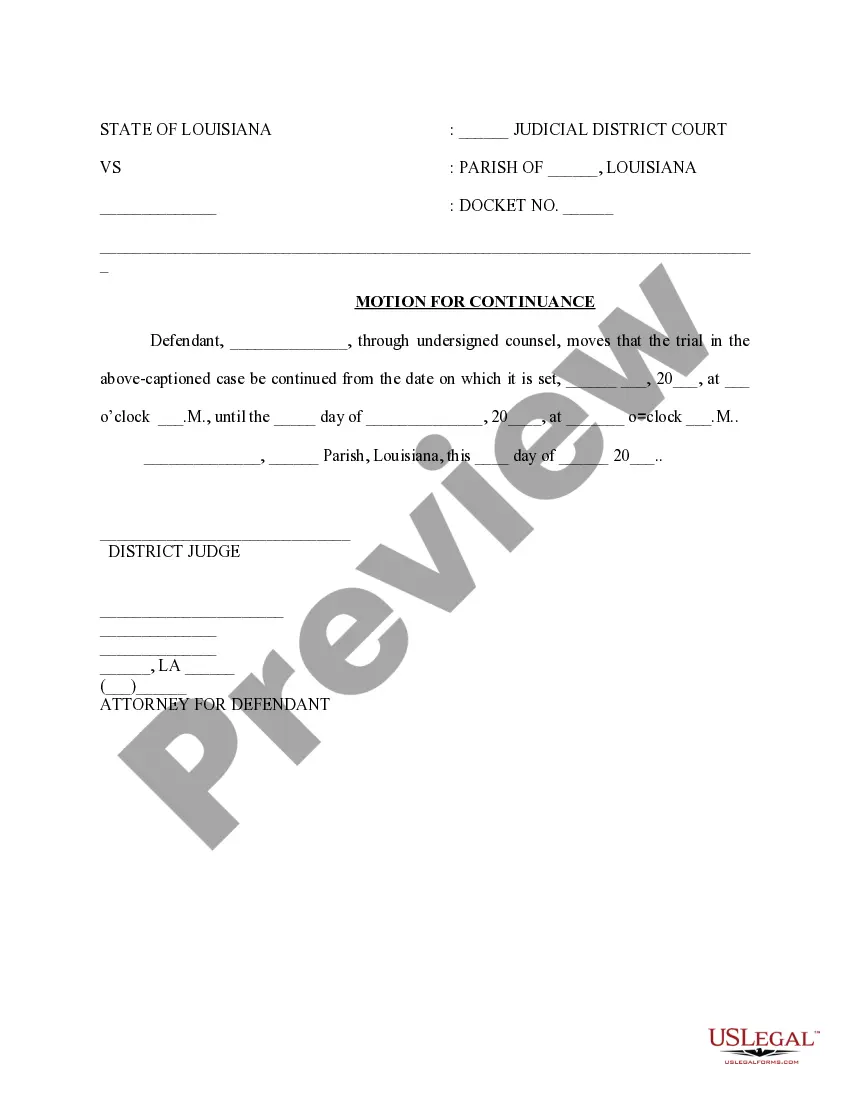

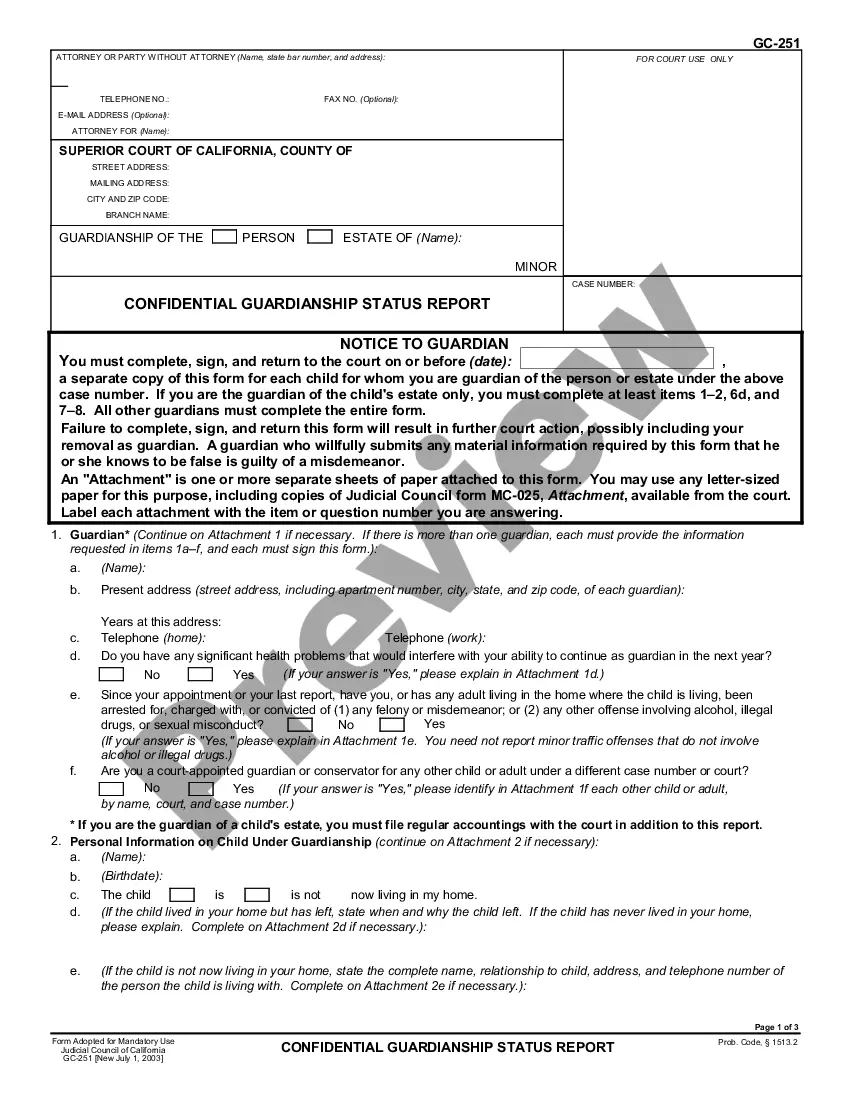

If you wish to comprehensive, download, or printing lawful file layouts, use US Legal Forms, the biggest collection of lawful kinds, which can be found on the web. Use the site`s basic and handy research to find the paperwork you require. Various layouts for business and personal purposes are categorized by categories and suggests, or key phrases. Use US Legal Forms to find the Kansas Checklist - Sale of a Business in a number of clicks.

When you are already a US Legal Forms customer, log in to the accounts and then click the Obtain option to have the Kansas Checklist - Sale of a Business. You can even gain access to kinds you earlier downloaded inside the My Forms tab of your accounts.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for that correct town/land.

- Step 2. Use the Preview solution to examine the form`s content material. Don`t forget to learn the information.

- Step 3. When you are not happy together with the kind, make use of the Look for industry on top of the display screen to locate other types in the lawful kind design.

- Step 4. When you have discovered the shape you require, go through the Buy now option. Choose the prices strategy you choose and add your references to register for an accounts.

- Step 5. Approach the purchase. You should use your credit card or PayPal accounts to finish the purchase.

- Step 6. Choose the format in the lawful kind and download it on the system.

- Step 7. Comprehensive, modify and printing or indication the Kansas Checklist - Sale of a Business.

Each and every lawful file design you buy is the one you have forever. You have acces to every kind you downloaded inside your acccount. Go through the My Forms area and choose a kind to printing or download yet again.

Contend and download, and printing the Kansas Checklist - Sale of a Business with US Legal Forms. There are millions of skilled and state-particular kinds you may use for the business or personal needs.

Form popularity

FAQ

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

Kansas does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.

Kansas's corporation tax rate is a flat 4% of federal taxable income (with state-specific adjustments) plus a 3% surtax on taxable income above $50,000. The tax is payable to the state's Department of Revenue (DOR). Use the state's corporation income tax return (Form K-120) to pay the tax.

A Kansas LLC operating agreement is a legal document that may be utilized by companies of all sizes, to establish businesses, member relationships (multi-member entities), standard operating procedures, company policies, and many other aspects of a business.

An LLC is typically treated as a pass-through entity for federal income tax purposes. This means that the LLC itself doesn't pay taxes on business income. The members of the LLC pay taxes on their share of the LLC's profits. State or local governments might levy additional LLC taxes.

Kansas corporations are subject to Kansas's corporate income tax at the flat 4% rate, with an additional 3% surtax on income over $50,000.

No. State law does not require or permit the registration or filing of DBAs or fictitious names.

What to do when I sellComplete the Notice of Business Closure (CR-108)Return the completed form to Kansas Department of Revenue, 915 SW Harrison Street, Topeka, KS 66625-9000 or FAX to 785-291-3614.Include information on the date the business was sold.Include the name and address of the new owner.More items...

California LLCs are required to have an Operating Agreement. This agreement can be oral or written. If it's written, the agreementsand all amendments to itmust be kept with the company's records. Limited Liability Companies in New York must have a written Operating Agreement.

Kansas does not require LLCs to have operating agreements, but it is highly advisable to have one. An operating agreement will help protect your limited liability status, prevent financial and managerial misunderstandings, and ensure that you decide on the rules governing your business instead of state law by default.