Kansas Assignment Creditor's Claim Against Estate is a legal procedure related to settling the debts of a deceased person's estate in Kansas. When a person passes away, their estate goes through a probate process to distribute their assets and pay off any outstanding debts. In the case where a creditor is owed money by the deceased, they can file a creditor's claim against the estate to seek payment. Keywords: Kansas, Assignment Creditor's Claim Against Estate, legal procedure, settling debts, deceased person's estate, probate process, distribute assets, outstanding debts, creditor, file a claim, seek payment. There are two types of Assignment Creditor's Claim against Estate recognized in Kansas: 1. General Creditor's Claim: This type of claim involves a creditor, such as a bank, credit card company, or individual, who is owed a debt by the deceased individual. It typically includes debts like outstanding loans, credit card balances, medical bills, and other unsecured debts. To proceed with a general creditor's claim, the creditor needs to file the claim with the probate court within a specific timeframe determined by Kansas probate laws. 2. Secured Creditor's Claim: This category of claim involves a creditor who holds a security interest or lien over specific property or assets of the deceased. Secured debts are usually associated with a mortgage, car loan, or any other loan where the creditor has a legal right to repossess the secured asset if the debt is not paid. To file a secured creditor's claim, the creditor needs to provide proper documentation supporting their security interest to the probate court. It's important to note that both types of creditor claims must be filed within the statutory time limit, which is typically six months from the date of the first publication of the notice to creditors. Failure to meet this deadline may result in the claim being barred. Once a creditor's claim is filed, the executor or personal representative of the estate will review the claim and determine its validity. They will assess if the claim is legitimate, accurate, and enforceable based on the available assets of the estate. If approved, the claim will be paid from the estate's assets in accordance with Kansas probate laws and the priority of the claims. In summary, a Kansas Assignment Creditor's Claim Against Estate is a legal process for creditors to seek payment of outstanding debts from the assets of a deceased person's estate. It encompasses both general and secured creditor's claims, which should be filed within the specified timeframe to be considered in the probate proceedings.

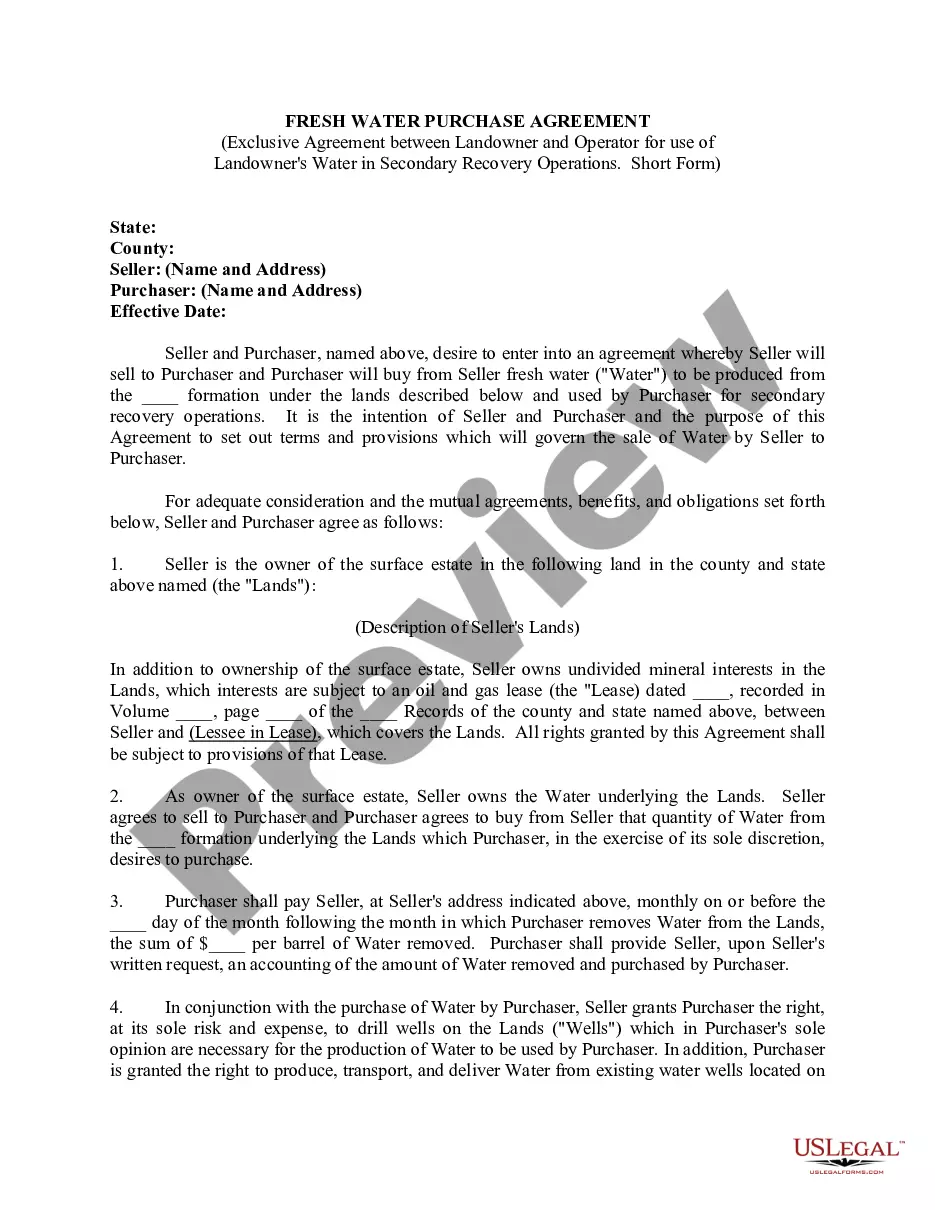

Kansas Assignment Creditor's Claim Against Estate

Description

How to fill out Kansas Assignment Creditor's Claim Against Estate?

Choosing the right legitimate document template can be a battle. Naturally, there are tons of layouts available online, but how can you find the legitimate develop you want? Make use of the US Legal Forms website. The service offers 1000s of layouts, like the Kansas Assignment Creditor's Claim Against Estate, which you can use for enterprise and private needs. All the kinds are inspected by specialists and meet up with federal and state requirements.

If you are already registered, log in to your account and click the Acquire button to have the Kansas Assignment Creditor's Claim Against Estate. Make use of account to search with the legitimate kinds you might have acquired formerly. Visit the My Forms tab of your account and get one more duplicate in the document you want.

If you are a brand new customer of US Legal Forms, allow me to share easy guidelines that you can follow:

- Very first, ensure you have chosen the appropriate develop for the town/area. You may look over the form using the Preview button and browse the form explanation to make sure this is basically the right one for you.

- In the event the develop is not going to meet up with your requirements, use the Seach discipline to discover the correct develop.

- Once you are certain the form would work, go through the Purchase now button to have the develop.

- Select the costs strategy you need and enter the needed information and facts. Create your account and buy your order with your PayPal account or credit card.

- Select the file structure and down load the legitimate document template to your system.

- Full, edit and printing and indication the received Kansas Assignment Creditor's Claim Against Estate.

US Legal Forms may be the greatest catalogue of legitimate kinds for which you will find different document layouts. Make use of the service to down load professionally-manufactured documents that follow condition requirements.