Kansas Sample Letter for Mobile Home Insurance Policy

Description

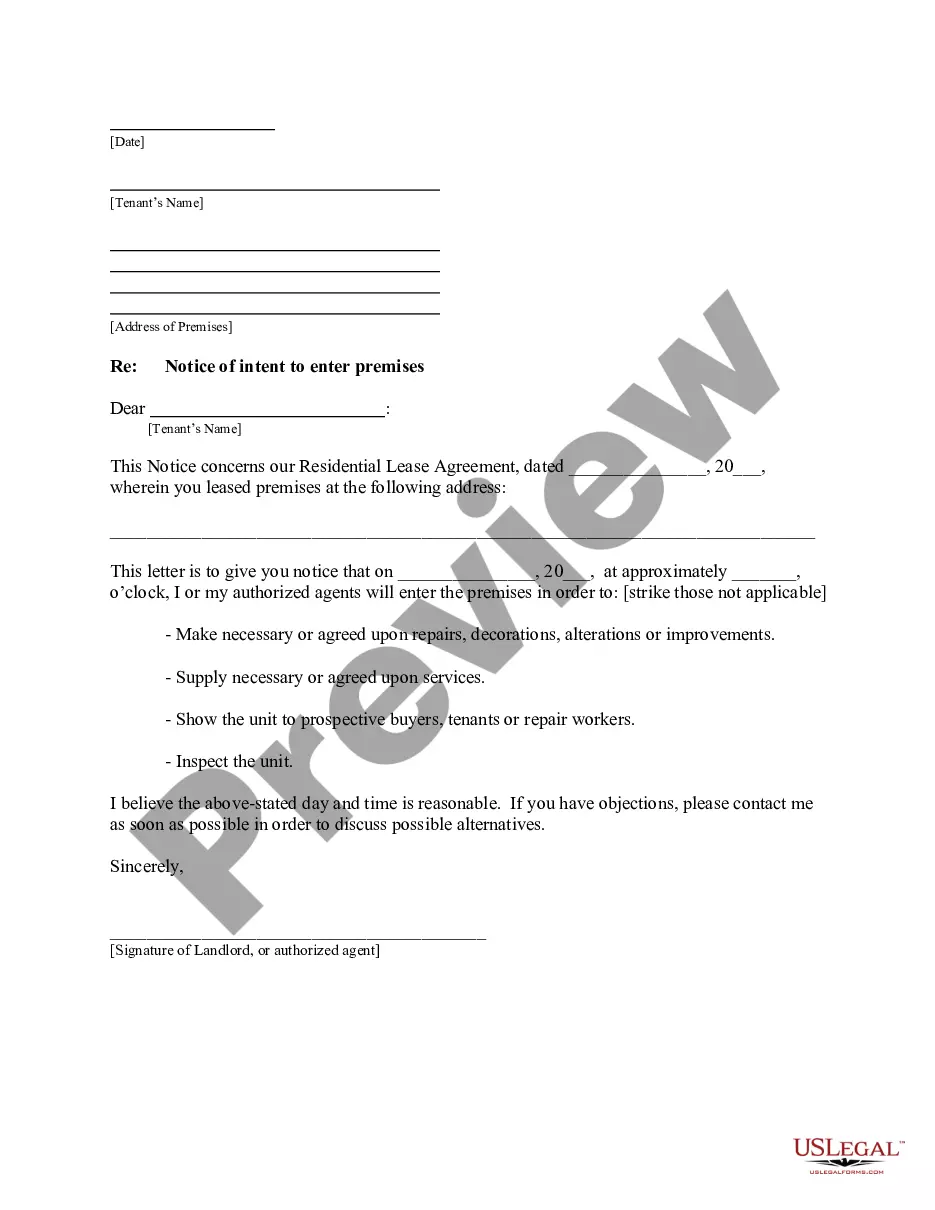

How to fill out Sample Letter For Mobile Home Insurance Policy?

US Legal Forms - one of several most significant libraries of lawful types in the USA - offers a variety of lawful file layouts you may download or print. Making use of the site, you will get 1000s of types for enterprise and specific functions, categorized by categories, claims, or key phrases.You can find the latest models of types much like the Kansas Sample Letter for Mobile Home Insurance Policy in seconds.

If you already have a subscription, log in and download Kansas Sample Letter for Mobile Home Insurance Policy through the US Legal Forms local library. The Acquire switch can look on every type you look at. You have accessibility to all earlier delivered electronically types from the My Forms tab of your respective accounts.

If you would like use US Legal Forms initially, allow me to share easy recommendations to get you started:

- Ensure you have picked the correct type for your city/county. Select the Preview switch to review the form`s information. Read the type information to actually have chosen the right type.

- In the event the type doesn`t satisfy your requirements, take advantage of the Research discipline near the top of the monitor to find the one which does.

- In case you are happy with the shape, confirm your selection by clicking on the Acquire now switch. Then, opt for the prices strategy you favor and give your qualifications to register on an accounts.

- Approach the transaction. Make use of Visa or Mastercard or PayPal accounts to finish the transaction.

- Find the file format and download the shape on the gadget.

- Make adjustments. Load, edit and print and signal the delivered electronically Kansas Sample Letter for Mobile Home Insurance Policy.

Every single format you included with your account lacks an expiration particular date which is your own eternally. So, if you would like download or print another copy, just check out the My Forms segment and then click about the type you will need.

Gain access to the Kansas Sample Letter for Mobile Home Insurance Policy with US Legal Forms, probably the most comprehensive local library of lawful file layouts. Use 1000s of professional and express-certain layouts that meet your small business or specific demands and requirements.

Form popularity

FAQ

I the undersigned ________ of Shri/Smt. __________________________________ here by inform you about the death of my_______________. I request you to settle the death claim under his policy no. _________________________________ at the earliest in my favour being the nominee of the above no.

Dear [Recipient's Name], I am writing to request compensation for [state the reason for compensation], which occurred on [date]. The incident resulted in [state how you were affected] and I have incurred [state the amount of money you spent, if applicable] due to the inconvenience.

Dear [INSURANCE COMPANY], Please send me a complete and certified copy of my homeowner's insurance policy, including all declarations, endorsements, riders and/or changes to the policy, which would affect coverage at the time of the above-noted loss.

In order to write a successful insurance claim letter, start with an introduction who you are, why you are writing, contact information and the details on your property. This will help the insurance adjuster understand the most important details and how to get in touch with you when there are questions.

While writing the claim letter ensure that it should be successful in producing the intended result. All data should be clearly mentioned such as policy number, date and the policy amount. Finally the claim amount should be mentioned. The letter should be written in a polite way.

Proof of insurance is documentation from your insurer proving you have an active insurance policy that meets state requirements.

In order to write a successful insurance claim letter, start with an introduction who you are, why you are writing, contact information and the details on your property. This will help the insurance adjuster understand the most important details and how to get in touch with you when there are questions.