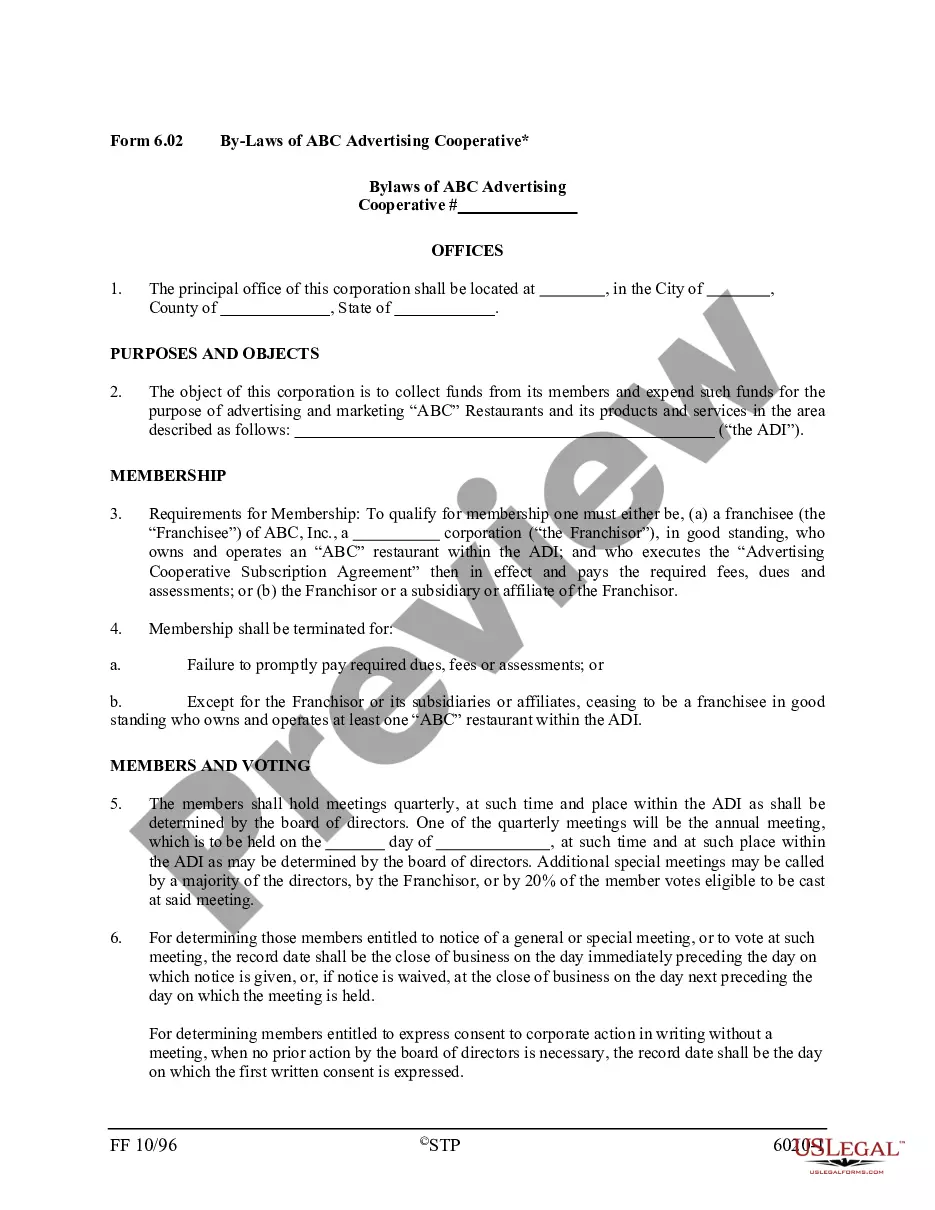

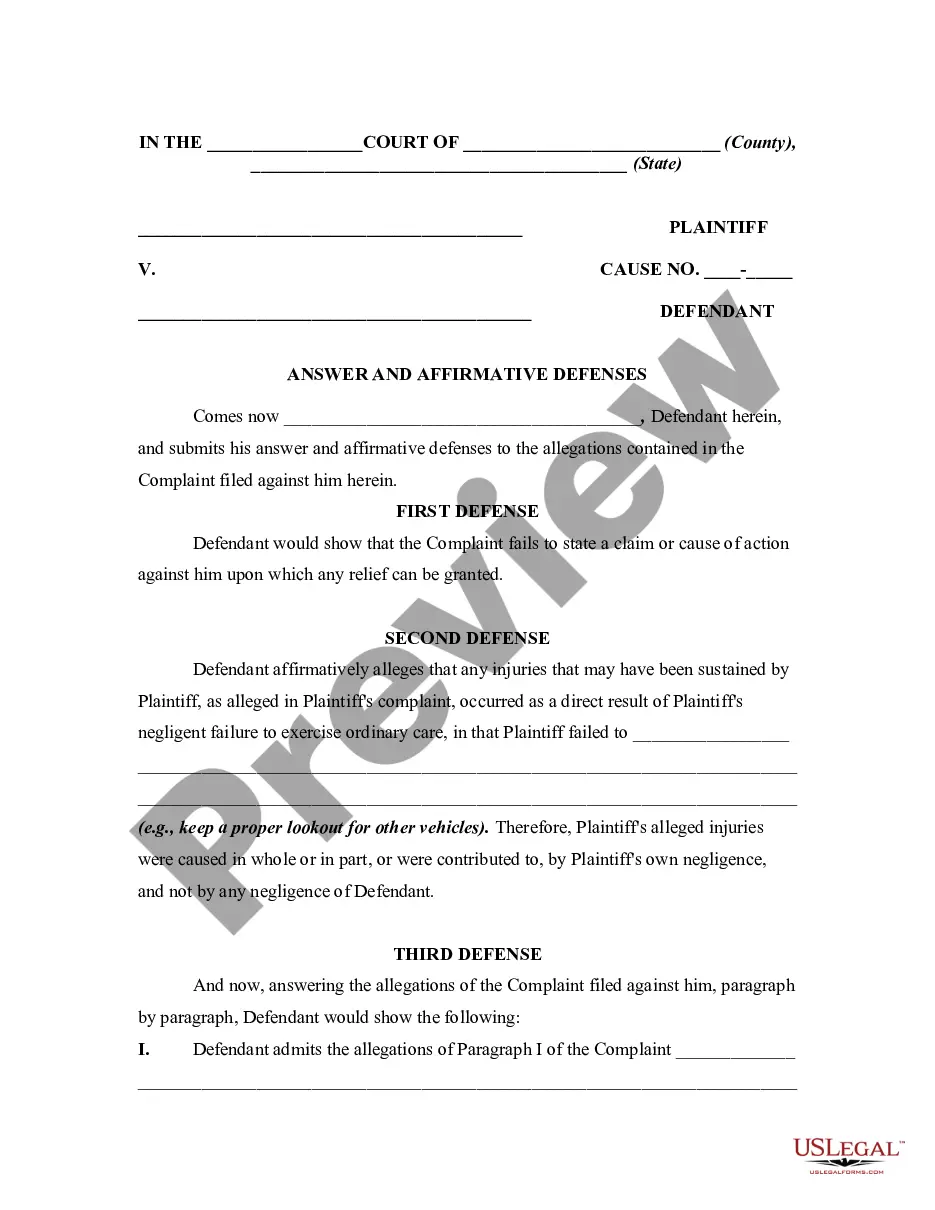

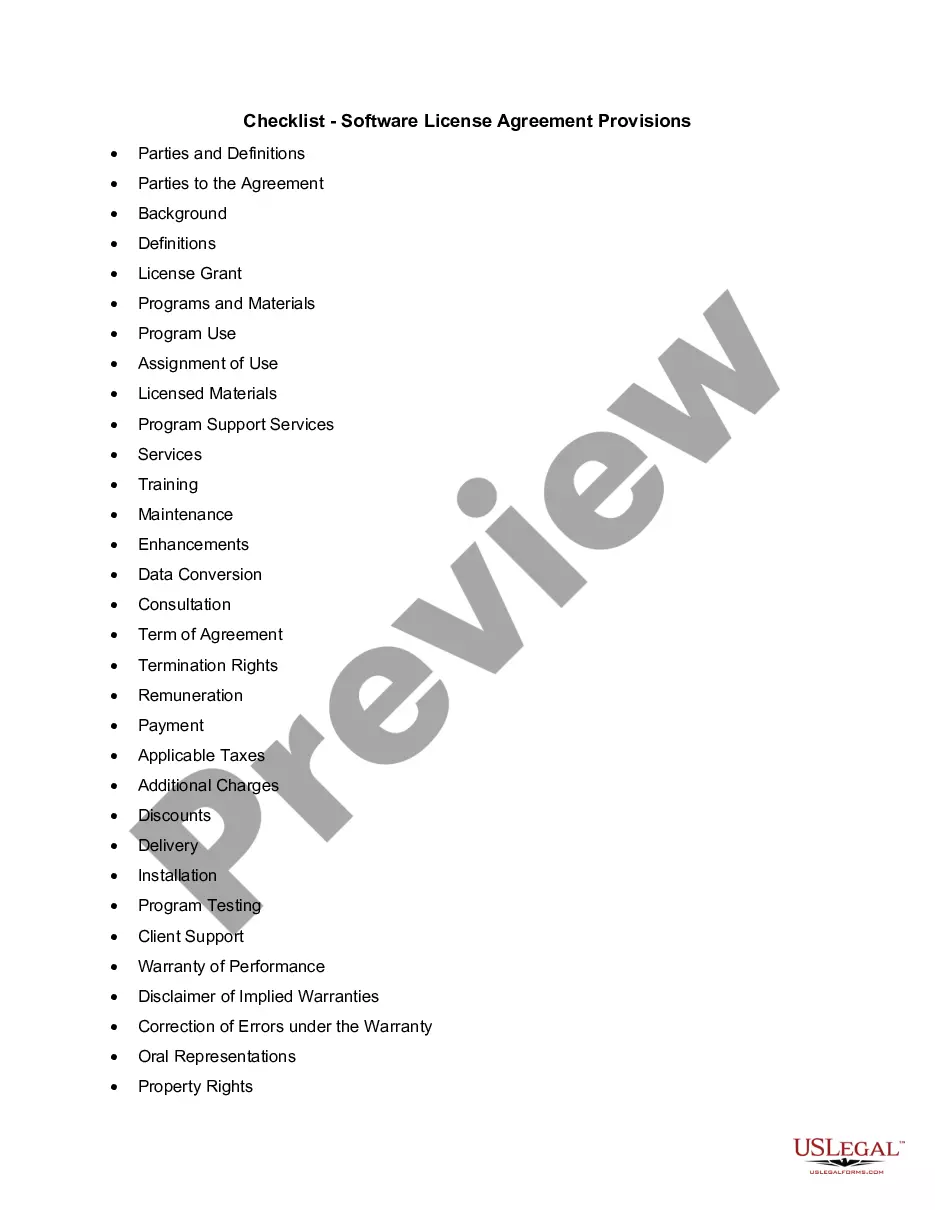

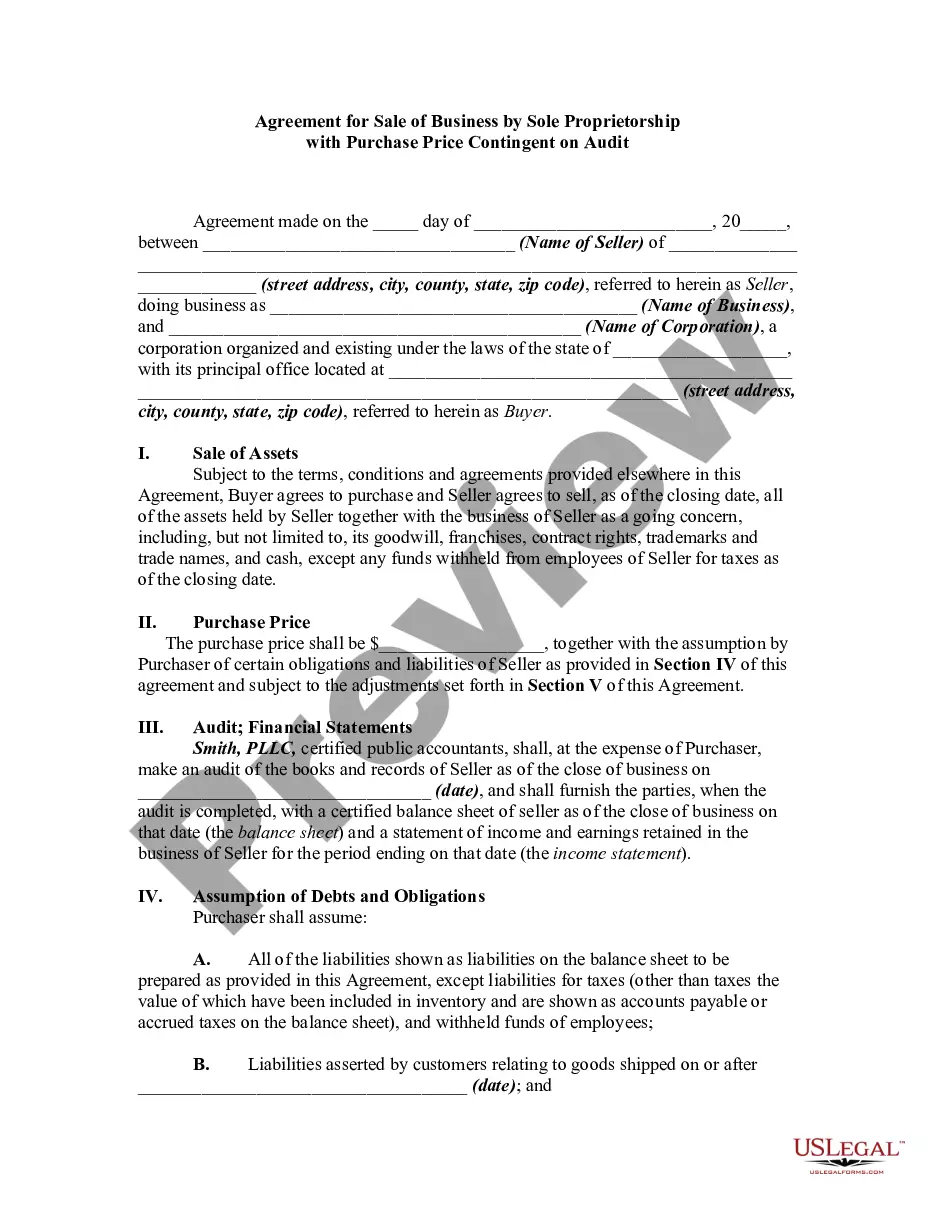

The bylaws of a corporation are the internal rules and guidelines for the day-to-day operation of a corporation, such as when and where the corporation will hold directors' and shareholders' meetings and what the shareholders' and directors' voting requirements are. Typically, the bylaws are adopted by the corporation's directors at their first board meeting. They may specify the rights and duties of the officers, shareholders and directors, and may deal, for example, with how the company may enter into contracts, transfer shares, hold meetings, pay dividends and make amendments to corporate documents. They generally will identify a fiscal year for the corporation.

Kansas Bi-Laws of a Non-Profit Church Corporation

Description

How to fill out Bi-Laws Of A Non-Profit Church Corporation?

If you need to download, print, or obtain authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's simple and convenient search feature to locate the documents you need.

A wide range of templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you acquire is yours forever. You have access to every form you saved within your account. Go to the My documents section and choose a form to print or download again.

Be proactive and download, print, the Kansas Bi-Laws of a Non-Profit Church Corporation with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to find the Kansas Bi-Laws of a Non-Profit Church Corporation in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the Kansas Bi-Laws of a Non-Profit Church Corporation.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form appropriate for your city/state.

- Step 2. Use the Review option to examine the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Lookup field at the top of the screen to find other versions of the legal form template.

- Step 4. After you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Kansas Bi-Laws of a Non-Profit Church Corporation.

Form popularity

FAQ

The purpose of nonprofit organizations is generally to improve quality of life for others at a community, local, state, national, or even global level. These organizations are not dedicated to private or financial gain but to the advancement of public interest.

Nonprofit organizations can't legally operate without a designated board of directors that takes responsibility for ensuring legal compliance and accountability. A nonprofit board of directors is responsible for hiring capable staff, making big decisions and overseeing all operations.

Kansas does not require bylaws to be written or filed with the state. However, it's good practice, regardless of the state requirement. Bylaws help protect all involved.

Nonprofit religious organizations are places of worship, such as churches and mosques, as well as faith-based nonprofits that have missions based on religious values. In many ways, the process for forming a religious nonprofit is the same as creating other types of charities.

A 501(c)(3) eligible nonprofit board of directors in Kansas MUST: Have a minimum of three board members.

Nonprofits must have at least three board members when they form.

Depending on the corporate law of the state where the nonprofit was incorporated, one person can hold multiple officer positions.

State laws determine the minimum number of board directors, which is usually two or three. Depending on the state, there could be a board of one, but it might be difficult to attain 501(c)(3) status with just one board member. Nonprofit organizational budgets are sometimes a factor in the number of board members.

Religious organizations include nondenominational ministries, interdenominational and ecumenical organizations, and organizations whose main purpose is to study or advance religion. A nonprofit religious broadcasting station is one example of a religious organization in this sense.

How to Start a Nonprofit in KansasName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...