A receipt is an acknowledgment in writing that something of value, or cash, has been placed into the possession of an individual or organization. It is a written confirmation of payment.

Kansas Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

How to fill out Acknowledgment By A Nonprofit Church Corporation Of Receipt Of Gift?

Are you currently in a situation where you need documents for either professional or personal reason frequently.

There are numerous legal document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of template options, including the Kansas Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, designed to meet federal and state requirements.

Once you find the correct form, click on Get now.

Choose your preferred pricing plan, complete the necessary details to create your account, and place an order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Kansas Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift template.

- If you do not have an account and would like to start using US Legal Forms, follow these instructions.

- Locate the form you need and ensure it is for the correct city/county.

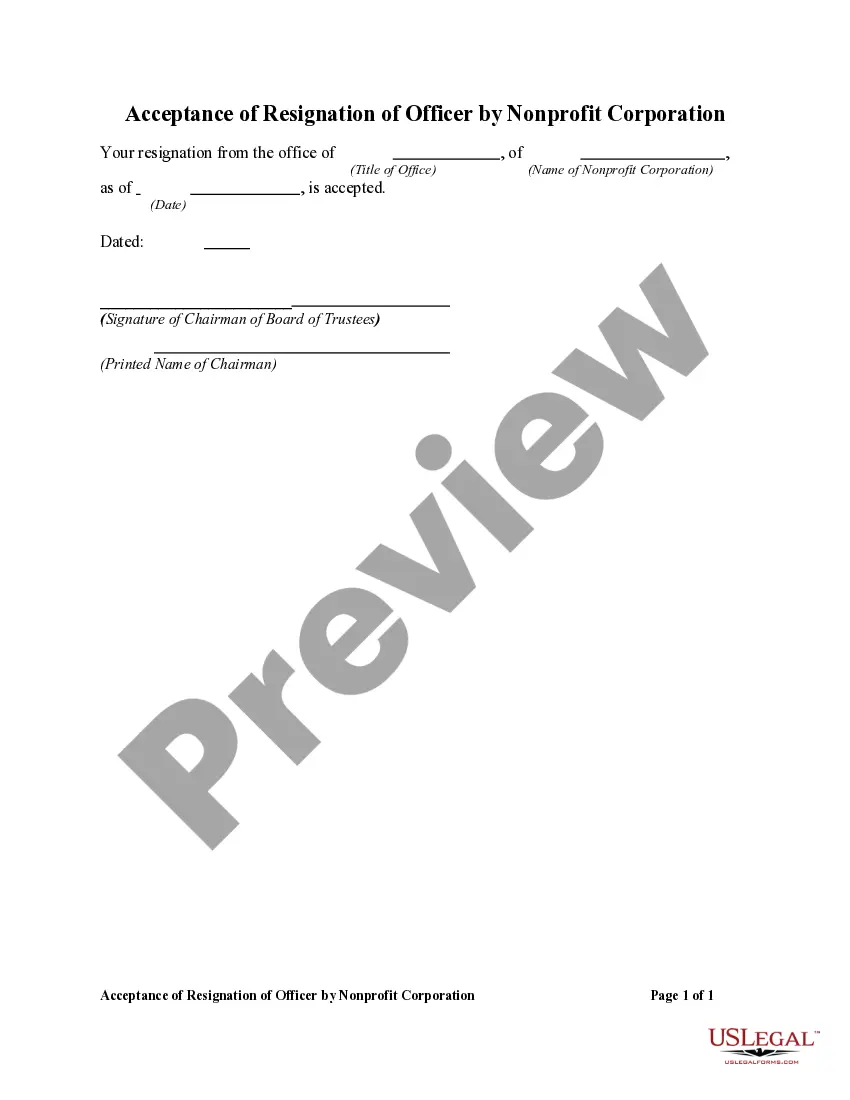

- Use the Review button to examine the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you’re looking for, use the Lookup field to find the form that fits your needs and requirements.

Form popularity

FAQ

A Contribution Statement is a listing of a contact's donations within a certain time-period (most commonly at year end). These statements would then be sent to the donor for tax purposes. You might also call this a tax receipt or a giving statement.

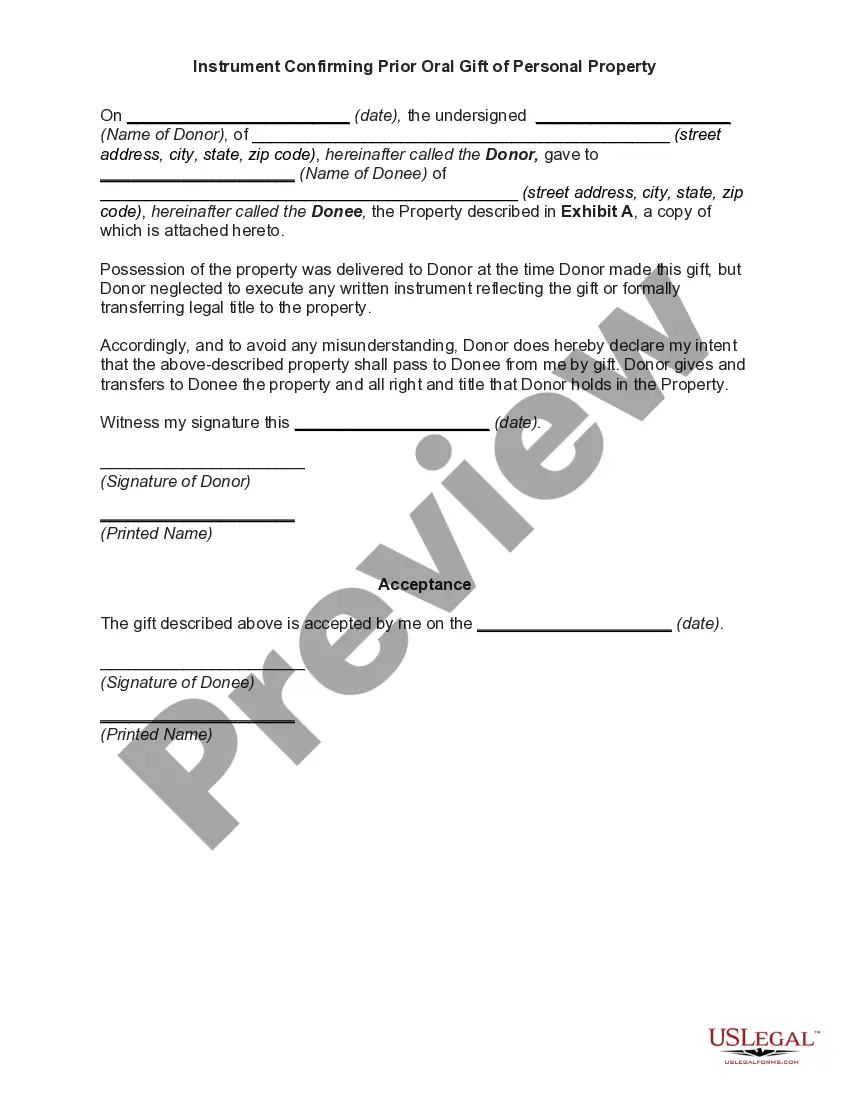

A donor or donation acknowledgment letter, or charitable contribution acknowledgment letter, is a letter nonprofits send to thanking their donors for their gift. As we'll discuss below, it's also an opportunity for you to provide the official documentation required by the IRS to donors who have given a gift over $250.

6 IRS Requirements for Every Donor Receipt to Ensure a Charitable DeductionName of the Charity and Name of the Donor.Date of the Contribution.Detailed Description of the Property Donated.Amount of the Contribution.A Statement Regarding Whether or not Any Goods or Services were Provided in Exchange for the Contribution.More items...?

In order to maintain non-profit status, your church does not need to fill out a contribution statement at the end of the year. It is not a legal requirement, and there are no penalties for skipping this process. However, in lieu of community and tax deductions, you would be ill-advised not to.

Here is what should generally be included in a nonprofit donation receipt:The donor's full name.The nonprofit organization's name.Unique Donation ID.Date of the donation.The amount of gifts received.Signatures from signing authorities.

A way to do this is by acknowledging the gift. The nonprofit may desire to state something like: Thank you for your contribution of insert detailed description of goods/services donated that your charitable organization received on dates.

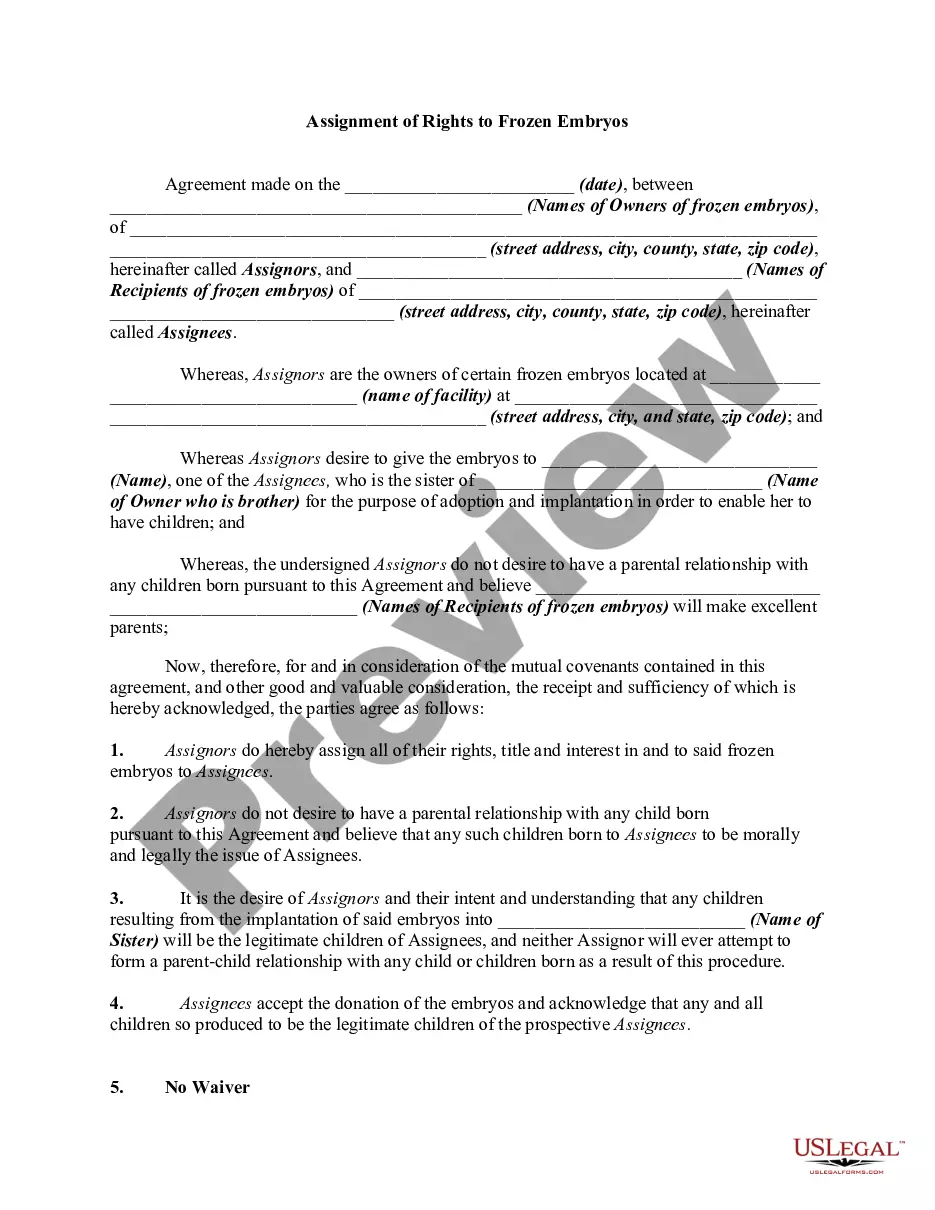

What Constitutes a Gift In-Kind? In-kind donations, usually a part of a nonprofit's overall funding plan, include contributions of goods or services. They are not donations of cash.

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

Here's what you should include in your own donation receipts:The donor's name.The organization's name, federal tax ID number, and a statement indicating that the organization is a registered 501(c)(3)Date of the donation.The amount of money or a description (but not the value) of the item(s) donated.More items...

A donation receipt is proof that a donor made a monetary or in-kind contribution to an organization. They are often letters or emails sent to a supporter after a donation has been made. Many nonprofits send receipts out by the end of the year the gift was given or in January of the following year.