Kansas Sample Letter to Seller regarding Sale of Business Assets - Outline Purchase Transaction

Description

How to fill out Sample Letter To Seller Regarding Sale Of Business Assets - Outline Purchase Transaction?

If you wish to full, download, or print out legitimate papers themes, use US Legal Forms, the greatest assortment of legitimate forms, that can be found online. Make use of the site`s easy and convenient lookup to discover the papers you want. Various themes for organization and individual purposes are categorized by categories and suggests, or search phrases. Use US Legal Forms to discover the Kansas Sample Letter to Seller regarding Sale of Business Assets - Outline Purchase Transaction within a few click throughs.

In case you are presently a US Legal Forms consumer, log in in your bank account and then click the Down load button to get the Kansas Sample Letter to Seller regarding Sale of Business Assets - Outline Purchase Transaction. You may also access forms you formerly delivered electronically in the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the form for that appropriate city/region.

- Step 2. Utilize the Review solution to examine the form`s content. Don`t forget about to see the outline.

- Step 3. In case you are unsatisfied using the develop, utilize the Search discipline near the top of the display to discover other types of the legitimate develop design.

- Step 4. Upon having found the form you want, click the Purchase now button. Opt for the prices plan you prefer and add your qualifications to sign up for the bank account.

- Step 5. Procedure the deal. You can use your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Select the format of the legitimate develop and download it in your device.

- Step 7. Comprehensive, edit and print out or signal the Kansas Sample Letter to Seller regarding Sale of Business Assets - Outline Purchase Transaction.

Each legitimate papers design you acquire is yours permanently. You may have acces to every develop you delivered electronically inside your acccount. Click the My Forms portion and pick a develop to print out or download again.

Be competitive and download, and print out the Kansas Sample Letter to Seller regarding Sale of Business Assets - Outline Purchase Transaction with US Legal Forms. There are millions of professional and condition-particular forms you can utilize to your organization or individual requirements.

Form popularity

FAQ

At its most basic, a purchase agreement should include the following: Name and contact information for buyer and seller. The address of the property being sold. The price to be paid for the property. The date of transfer. Disclosures. Contingencies. Signatures.

The asset purchase agreement is typically drafted by the buyer and seller of the assets. However, in some cases, it may be handled by an attorney.

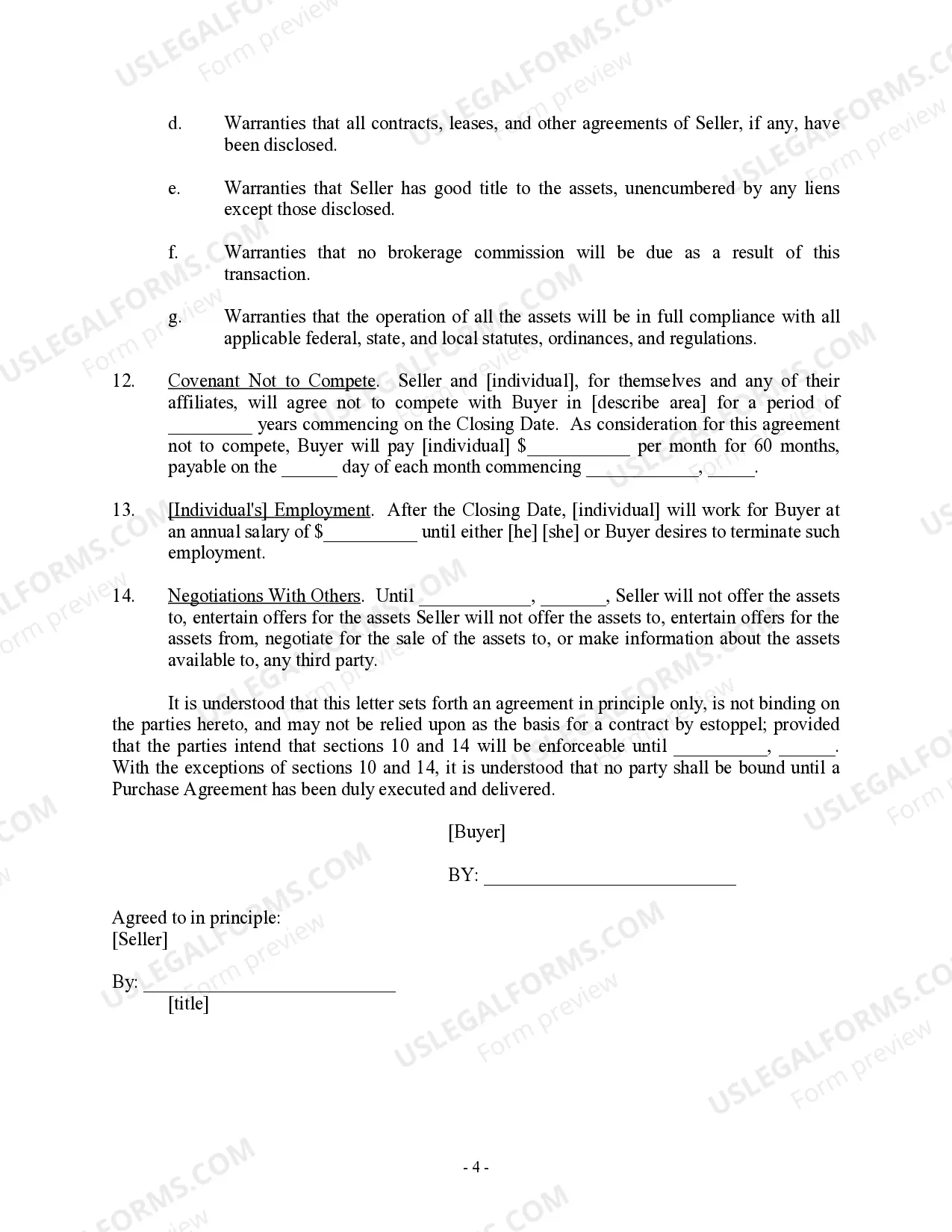

What to include in letters of intent to purchase. Name and contact information of the buyer. Name and contact information of the seller. Detailed description of the items or property being sold. Any relevant disclaimers or liabilities. The total purchase price. Method of payment and other payment terms, including dates.

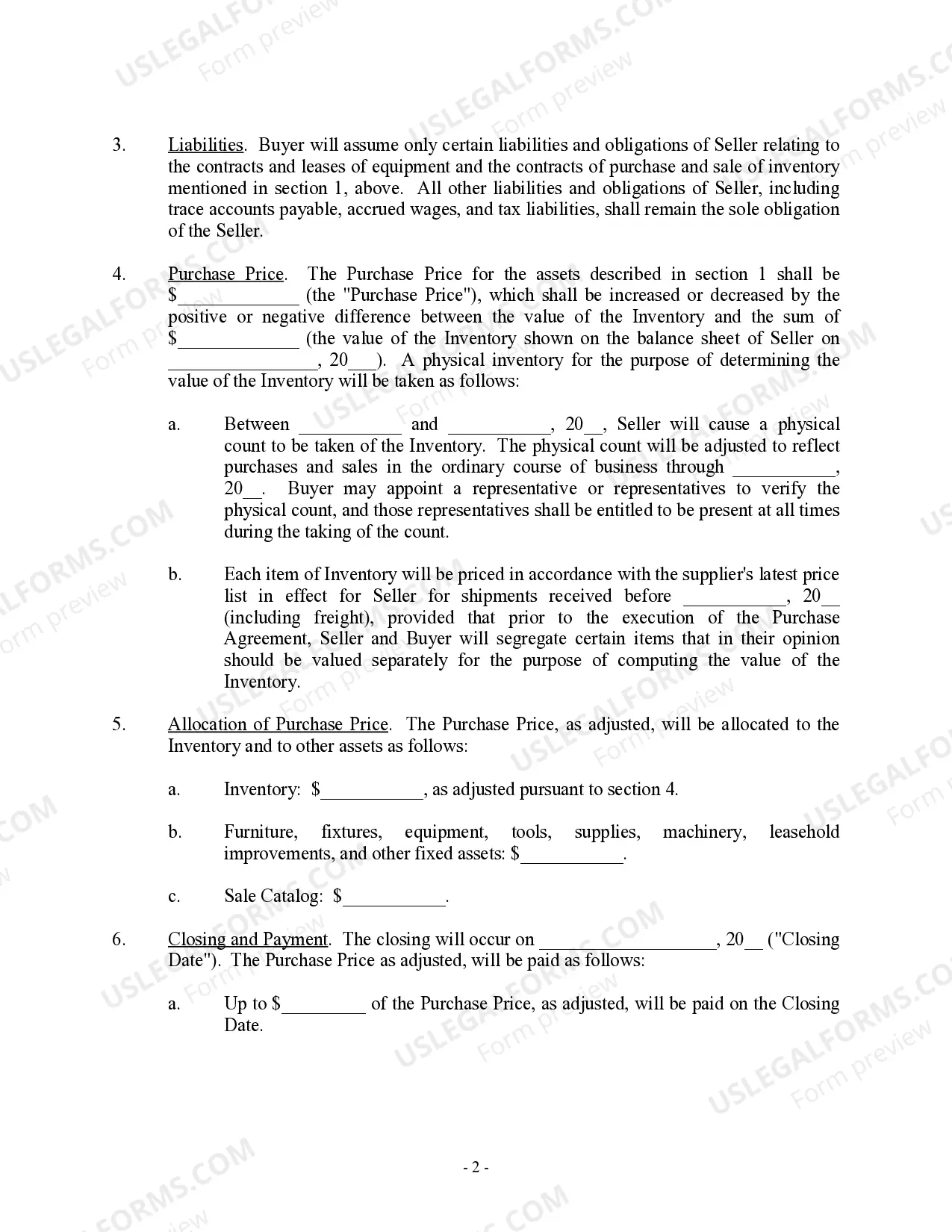

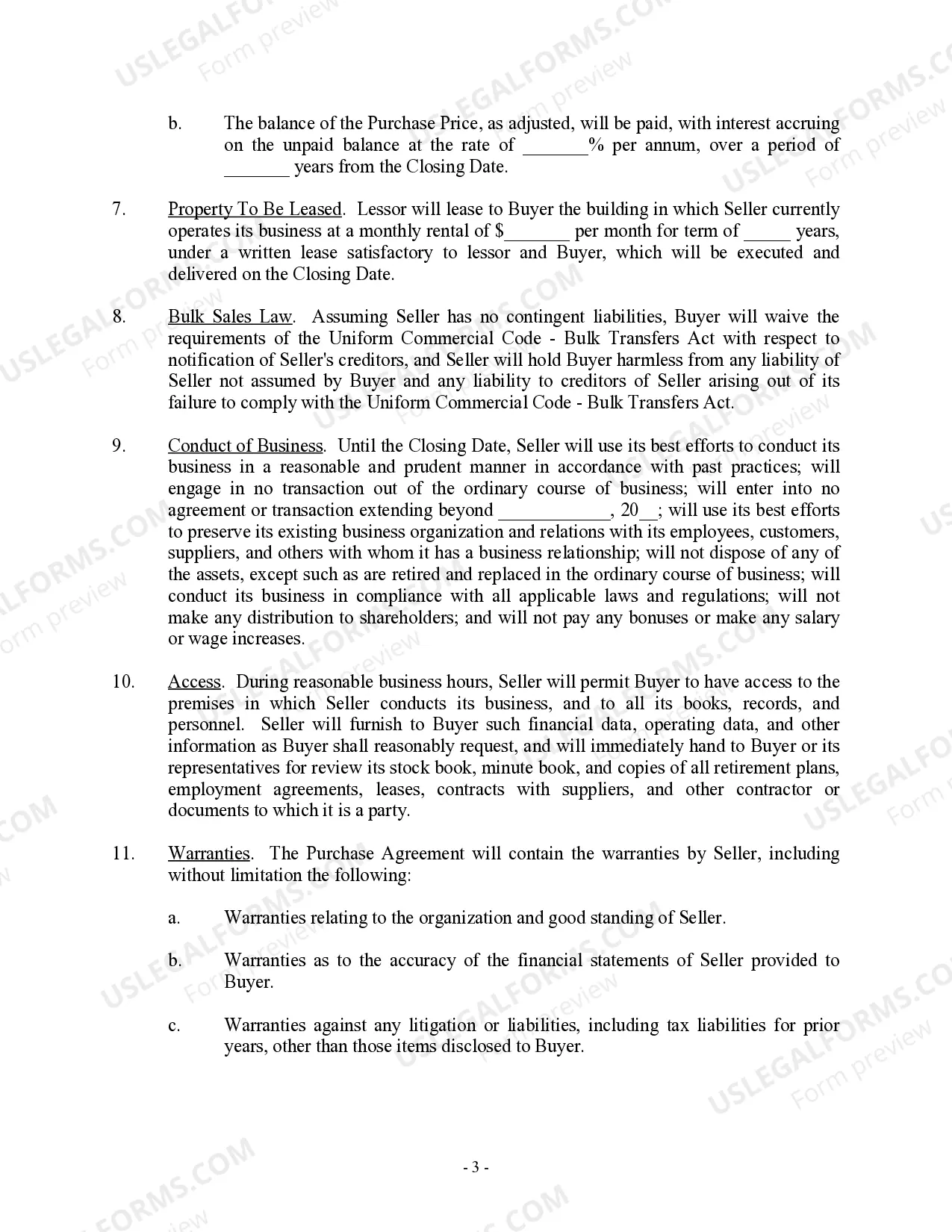

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

What is a letter of intent for business? A letter of intent is a non-legally binding document between two parties that intend to enter into a business transaction with each other. With this letter, the involved parties agree that they aim to formalize the transaction with a legally binding agreement.

Parts of an Asset Purchase Agreement Recitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing. ... Definitions. ... Purchase Price and Allocation. ... Closing Terms. ... Warranties. ... Covenants. ... Indemnification. ... Governance.

What Should be in the Equipment Purchase Agreement? The Name of the Buyer. ... The Name of the Seller. ... The Agreement. ... Delivery and Acceptance. ... Purchase Payments. ... Title to Equipment. ... Maintenance and Repair. ... Damage to the Equipment; Destroyed or Stolen Equipment.