Kansas Sample Letter for Automobile Quote

Description

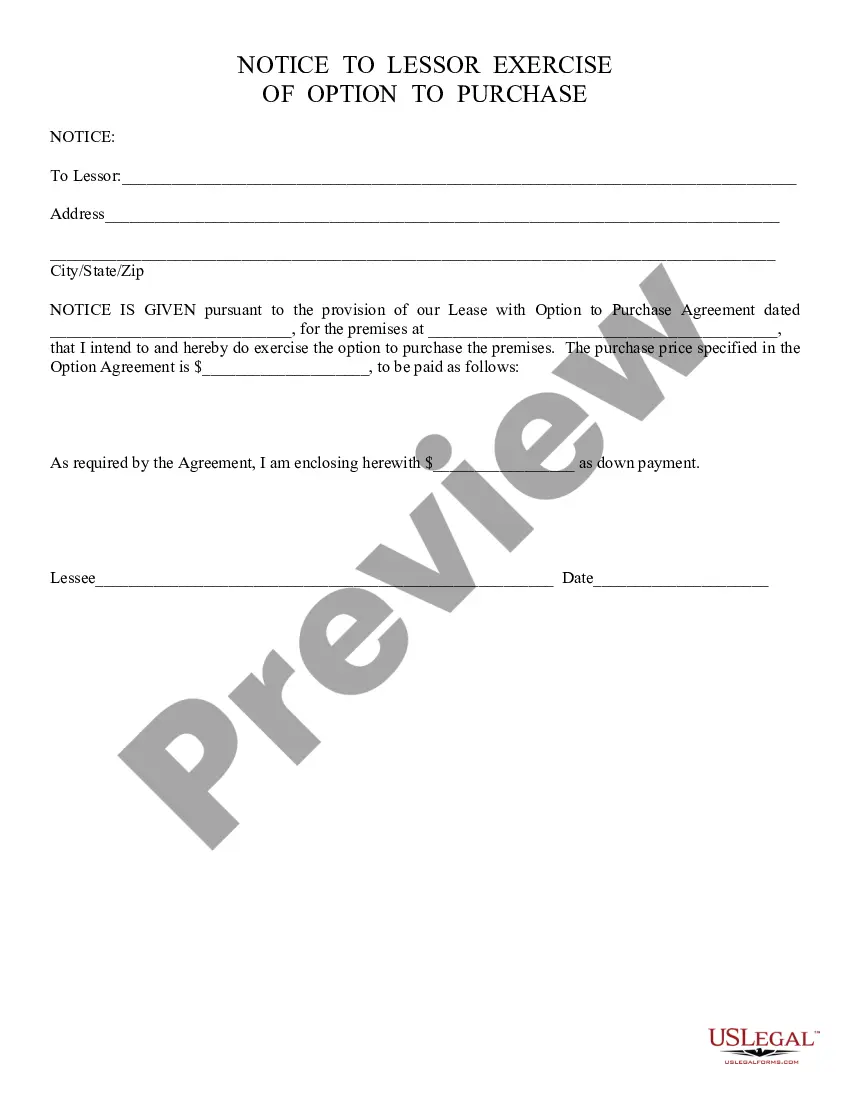

How to fill out Sample Letter For Automobile Quote?

Locating the appropriate authorized document template can be challenging. Of course, numerous templates are accessible online, but how will you locate the legal form you require? Utilize the US Legal Forms website.

The service offers thousands of templates, such as the Kansas Sample Letter for Automobile Quote, which can serve both business and personal purposes. All forms are examined by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to find the Kansas Sample Letter for Automobile Quote. Use your account to search for the legal forms you have purchased previously. Go to the My documents tab of your account and download another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the obtained Kansas Sample Letter for Automobile Quote. US Legal Forms is the premier repository of legal forms where you can find a variety of document templates. Leverage the service to download professionally crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you select the correct form for your area/region. You can view the form using the Review button and examine the form details to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search field to find the appropriate form.

- Once you are confident that the form is appropriate, click the Acquire now button to obtain the form.

- Select the pricing plan you want and enter the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

The average cost of car insurance in Kansas is $549 per year, or $46 per month, for a minimum liability policy.

Kansas Sales Tax on Car Purchases: Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles. There are also local taxes up to 1%, which will vary depending on region.

To summarize, do not forget to include the following:Your first and last name.Contact details.Date.Name of the insurance company.Name of the contact person, if available.The subject of the letter.The parts listed in the table above.Enclosed copies of supporting documentation.

Title and Tag Fee is $10.50. Modernization Fee is $4.00. Property Tax: For your property tax amount, use our Motor Vehicle Property Tax Estimator or call (316) 660-9000. This will start with a recording.

I hereby claim for its repair as admissible under your Insurance Policy. I shall be highly obliged. Sir, I am (Your name) and I am a client at your respectable insurance company for the past decade. You know the situation of traffic here in (Area and City name).

To calculate the sales tax on your vehicle, find the total sales tax fee for the city and/or county. The minimum is 6.5%. Multiply the vehicle price (after trade-ins and/or incentives) by the sales tax fee. For example, imagine you are purchasing a vehicle for $45,000 with the state sales tax of 6.5%.

7 Tips for Writing a Demand Letter To the Insurance CompanyStep 1 of 2. 50%Organize your expenses.Establish the facts.Share your perspective.Detail your road to recovery.Acknowledge and emphasize your pain and suffering.Request a reasonable settlement amount.Review your letter and send it!

You should always be honest, but you do not have to be forthcoming with any but the most basic information."The accident was my fault.""I don't have any injuries.""I am making an official statement.""I guess..." or, "I think..."Other People Involved.Accepting a Settlement."I don't have an attorney."

The address should be in all capital letters with no punctuation. Left-justify every line in the address block. Use two letter state abbreviations in caps (e.g., CA, NY, HI, MN). Use one space between city and state, two spaces between state and zip code.

You will pay property tax when you initially register a vehicle and each year when you renew your vehicle registration. Use the Kansas Department of Revenue Vehicle Property Tax Calculator to estimate vehicle property tax by make/model/year, VIN or RV weight/year, for a partial or full registration year.