A Kansas Qualified Subchapter-S Trust for the Benefit of Child with Crummy Trust Agreement is a legal arrangement designed to provide financial benefits to a child while also taking advantage of tax-saving opportunities. This type of trust combines the benefits of a qualified subchapter-S corporation (S-corporation) with the flexibility and tax benefits of a Crummy trust. In Kansas, there are different variations of the Qualified Subchapter-S Trust for the Benefit of Child with Crummy Trust Agreement, each offering unique features and benefits. Some common types include: 1. Kansas Testamentary Qualified Subchapter-S Trust: This trust is established through the provisions of a last will and testament. It becomes effective upon the death of the granter and allows for the distribution of assets to the child beneficiary in a tax-efficient manner. 2. Kansas Revocable Qualified Subchapter-S Trust: With this type of trust, the granter retains the ability to modify or revoke the trust during their lifetime. It provides flexibility in managing the assets held within the trust, while still offering the benefits of a qualified subchapter-S corporation structure. 3. Kansas Irrevocable Qualified Subchapter-S Trust: Unlike the revocable trust, the granter cannot modify or revoke this type of trust. Once assets are transferred into the trust, they are no longer considered part of the granter's estate. This allows for potential estate tax savings and protects the assets from potential creditors. 4. Kansas Crummy Qualified Subchapter-S Trust: The Crummy provision allows the trust to qualify for annual gift tax exclusion purposes. It enables the granter to make annual gifts to the trust, which are then considered present interest gifts, therefore qualifying for the annual exclusion. This provision provides an additional tax advantage by reducing the overall taxable estate. By utilizing a Kansas Qualified Subchapter-S Trust for the Benefit of Child with Crummy Trust Agreement, individuals can protect and grow assets for their child's benefit while enjoying the tax advantages associated with S-corporations and the Crummy trust structure. It is essential to consult with a qualified estate planning attorney to determine the most suitable trust type and ensure compliance with Kansas state laws.

Kansas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

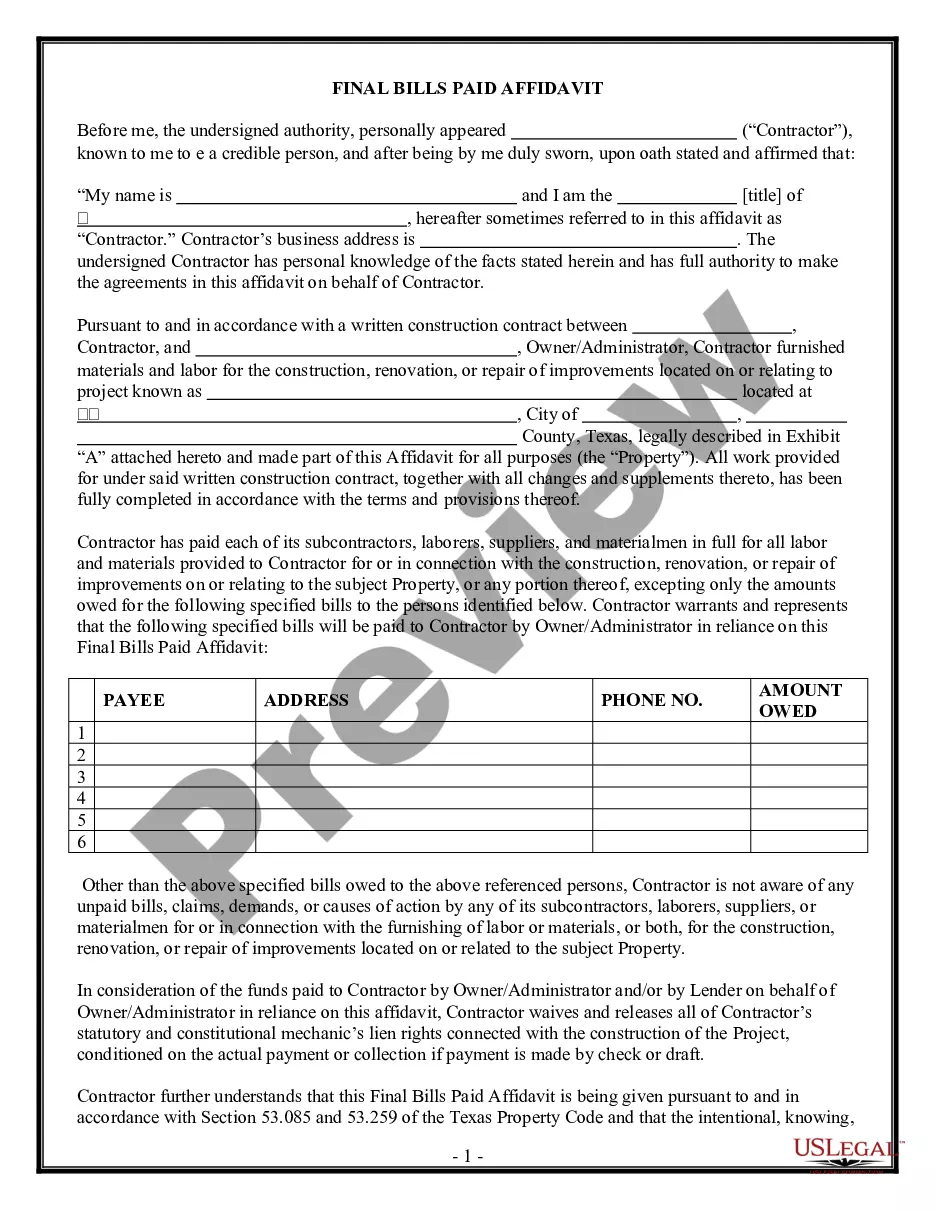

How to fill out Kansas Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

If you wish to full, acquire, or print legitimate document web templates, use US Legal Forms, the greatest variety of legitimate types, that can be found on the web. Take advantage of the site`s basic and convenient research to discover the documents you need. Various web templates for business and person reasons are categorized by groups and claims, or search phrases. Use US Legal Forms to discover the Kansas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement within a few mouse clicks.

In case you are already a US Legal Forms buyer, log in to the accounts and then click the Down load key to have the Kansas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement. You may also entry types you formerly downloaded in the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the form for that proper town/country.

- Step 2. Utilize the Preview solution to examine the form`s content material. Never forget about to learn the description.

- Step 3. In case you are unhappy with the type, utilize the Look for industry on top of the display screen to locate other variations of the legitimate type web template.

- Step 4. After you have identified the form you need, go through the Get now key. Choose the prices prepare you choose and include your references to register for the accounts.

- Step 5. Procedure the financial transaction. You should use your credit card or PayPal accounts to complete the financial transaction.

- Step 6. Choose the formatting of the legitimate type and acquire it in your product.

- Step 7. Total, revise and print or indication the Kansas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement.

Every single legitimate document web template you purchase is your own property for a long time. You possess acces to every single type you downloaded within your acccount. Click on the My Forms segment and select a type to print or acquire once again.

Remain competitive and acquire, and print the Kansas Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement with US Legal Forms. There are thousands of expert and express-certain types you can utilize for your personal business or person requires.