A Kansas Partnership Agreement Re Land is a legal document that governs the relationship between partners involved in a land-related venture or project in the state of Kansas. This agreement outlines the rights, responsibilities, and obligations of each partner to ensure the smooth operation and management of the partnership. Keywords: Kansas Partnership Agreement, Re Land, legal document, partners, relationship, rights, responsibilities, obligations, operation, management. There are different types of Kansas Partnership Agreement Re Land that cater to specific land-related ventures or projects. Here are a few notable examples: 1. Agricultural Partnership Agreement: This agreement is specifically designed for partners engaging in agricultural activities such as farming, ranching, or livestock production. It outlines the division of labor, sharing of expenses and profits, ownership of equipment and livestock, and any future land development plans. 2. Real Estate Partnership Agreement: This type of agreement is suitable for partners involved in real estate investments, development, or management. It addresses various aspects like the purchase, sale, leasing, or development of land and properties. It also covers profit sharing, decision-making processes, and dispute resolution procedures. 3. Conservation Partnership Agreement: This agreement focuses on partners involved in environmental conservation or land preservation initiatives. It usually includes details about the acquisition, management, and protection of land for conservation purposes. It may also outline the contributions, responsibilities, and financial arrangements for each partner. 4. Renewable Energy Partnership Agreement: This agreement is tailored for partners engaged in renewable energy projects, such as wind farms or solar power plants. It encompasses aspects like land lease or purchase, sharing of costs, distribution of energy production, and the division of profits or tax incentives associated with renewable energy. 5. Industrial Partnership Agreement: This type of agreement is applicable to partners engaged in industrial developments, such as manufacturing, mining, or logistics projects. It covers land acquisition, zoning regulations, environmental compliance, liability distribution, and profit-sharing arrangements. 6. Development Partnership Agreement: This agreement is used for partners involved in land development projects, including residential, commercial, or mixed-use developments. It outlines the responsibilities of each partner, project financing, construction, marketing strategies, and profit-sharing mechanisms. Regardless of the specific type, a Kansas Partnership Agreement Re Land plays a crucial role in ensuring that all partners have a clear understanding of their rights, obligations, and objectives. It helps to build a strong foundation for cooperation, transparency, and effective management of land-related ventures.

Kansas Partnership Agreement Re Land

Description

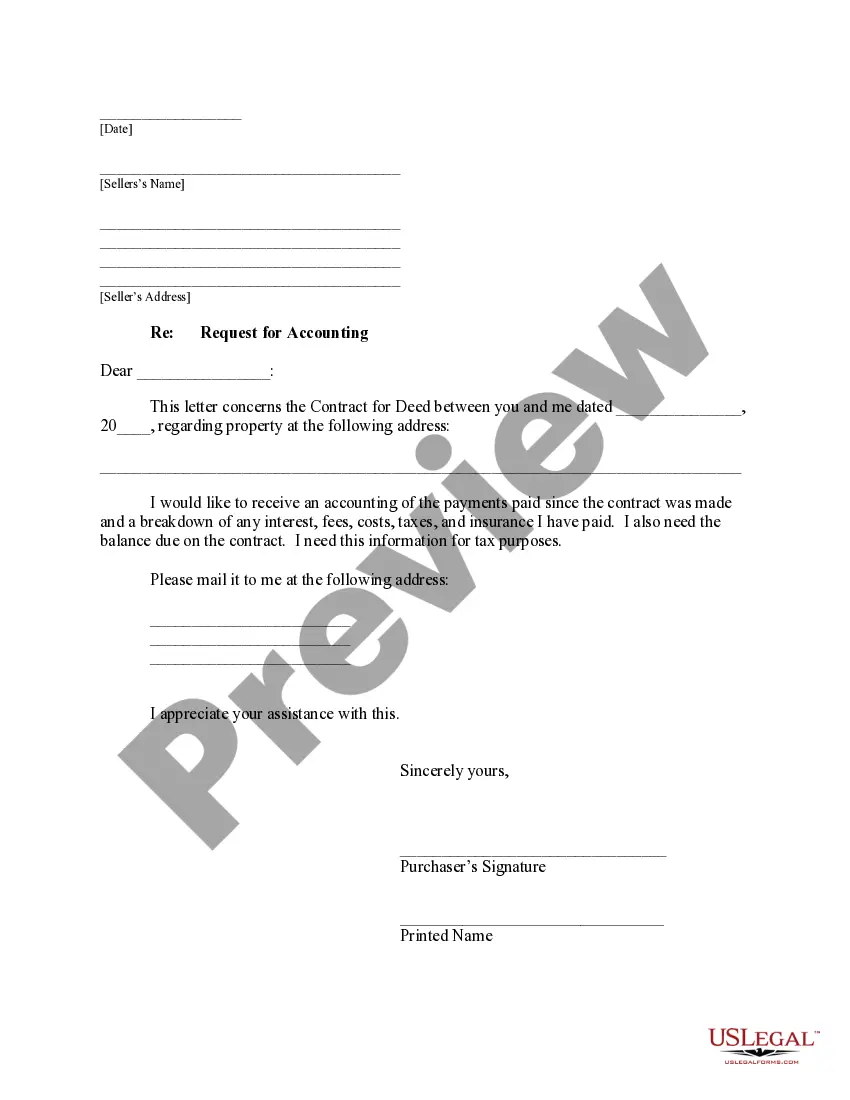

How to fill out Kansas Partnership Agreement Re Land?

Discovering the right authorized document template can be a have a problem. Naturally, there are plenty of layouts available online, but how would you get the authorized kind you want? Utilize the US Legal Forms internet site. The support offers a large number of layouts, such as the Kansas Partnership Agreement Re Land, that you can use for business and personal requirements. Each of the varieties are inspected by specialists and meet up with federal and state specifications.

If you are already signed up, log in to the profile and click the Acquire button to have the Kansas Partnership Agreement Re Land. Utilize your profile to appear from the authorized varieties you possess acquired in the past. Proceed to the My Forms tab of your respective profile and obtain an additional version of the document you want.

If you are a whole new end user of US Legal Forms, here are basic guidelines so that you can adhere to:

- First, ensure you have selected the proper kind to your city/area. You can look over the shape making use of the Preview button and look at the shape description to ensure this is the best for you.

- When the kind will not meet up with your requirements, use the Seach discipline to get the correct kind.

- Once you are certain the shape would work, go through the Purchase now button to have the kind.

- Opt for the rates plan you desire and type in the essential information. Build your profile and purchase the transaction using your PayPal profile or charge card.

- Select the document structure and down load the authorized document template to the gadget.

- Comprehensive, edit and print and signal the acquired Kansas Partnership Agreement Re Land.

US Legal Forms may be the largest catalogue of authorized varieties that you will find different document layouts. Utilize the company to down load appropriately-produced paperwork that adhere to status specifications.

Form popularity

FAQ

A partnership must have two or more owners who share in the profits and losses of a business. Partnerships can form automatically without the submission of formation documents. All partnerships should have a written partnership agreement that spells out the rules and regulations of the business.

A deed of partnership, also known as a partnership agreement or a shareholders' agreement, is just another way of planning for the future of your venture. It removes the sort of doubt that can often cause a sense of aggrievement in business.

Because a partnership is not a legal person, it cannot acquire or hold a registered interest in real property. In order to acquire and hold real property, the partnership requires an individual or corporation to become a registered owner.

Once the decision to form a Kansas partnership has been made, the partners must work with state agencies to properly create the business.Step 1: Select a business name.Step 2: Register the business name.Step 3: Complete required paperwork.Step 4: Determine if you need an EIN, additional licenses or tax IDs.More items...

A partnership has no separate legal personality and it cannot therefore own property and it will be owned by the individual property owning partners. The Land Registry will allow up to four property owning partners to be named at the Land Registry as legal owners.

In community property states, including California, spouses and registered domestic partners take title as community property unless they elect otherwise. Each spouse has a half-interest in the property, and equal control over the property's management and use. To sell the property, both spouses must act together.

However, where it is the penultimate partner who dies or withdraws, courts have held that the buyout provision does not apply because a partnership cannot exist with only one partner. Furthermore, courts have reasoned that, insofar as a partnership cannot continue with a single partner, the dissociation of a partner

Such partnerships have no ownership restrictions, meaning that the owners can be people, corporations, LLCs, or any other kind of business.

Because a partnership is not a legal person, it cannot acquire or hold a registered interest in real property. In order to acquire and hold real property, the partnership requires an individual or corporation to become a registered owner.

The following states have adopted the RUPA: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Delaware, District of Columbia, Florida, Hawaii, Idaho, Illinois, Iowa, Kansas, Kentucky, Maine, Maryland, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Dakota, Oklahoma, Oregon,