Kansas Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Joint Trust With Income Payable To Trustors During Joint Lives?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a selection of legal document formats that you can download or print.

By using the website, you can access thousands of forms for business and personal use, categorized by type, regions, or keywords. You can find the latest versions of documents like the Kansas Joint Trust with Income Payable to Trustors During Joint Lives in just a few minutes.

If you have a monthly membership, Log In and download the Kansas Joint Trust with Income Payable to Trustors During Joint Lives from the US Legal Forms database. The Download button will be displayed on every document you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the purchase.

Choose the format and download the document to your device. Make changes. Fill out, edit, and print and sign the downloaded Kansas Joint Trust with Income Payable to Trustors During Joint Lives. Each template you add to your account never expires and is yours permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Kansas Joint Trust with Income Payable to Trustors During Joint Lives with US Legal Forms, possibly the most comprehensive library of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

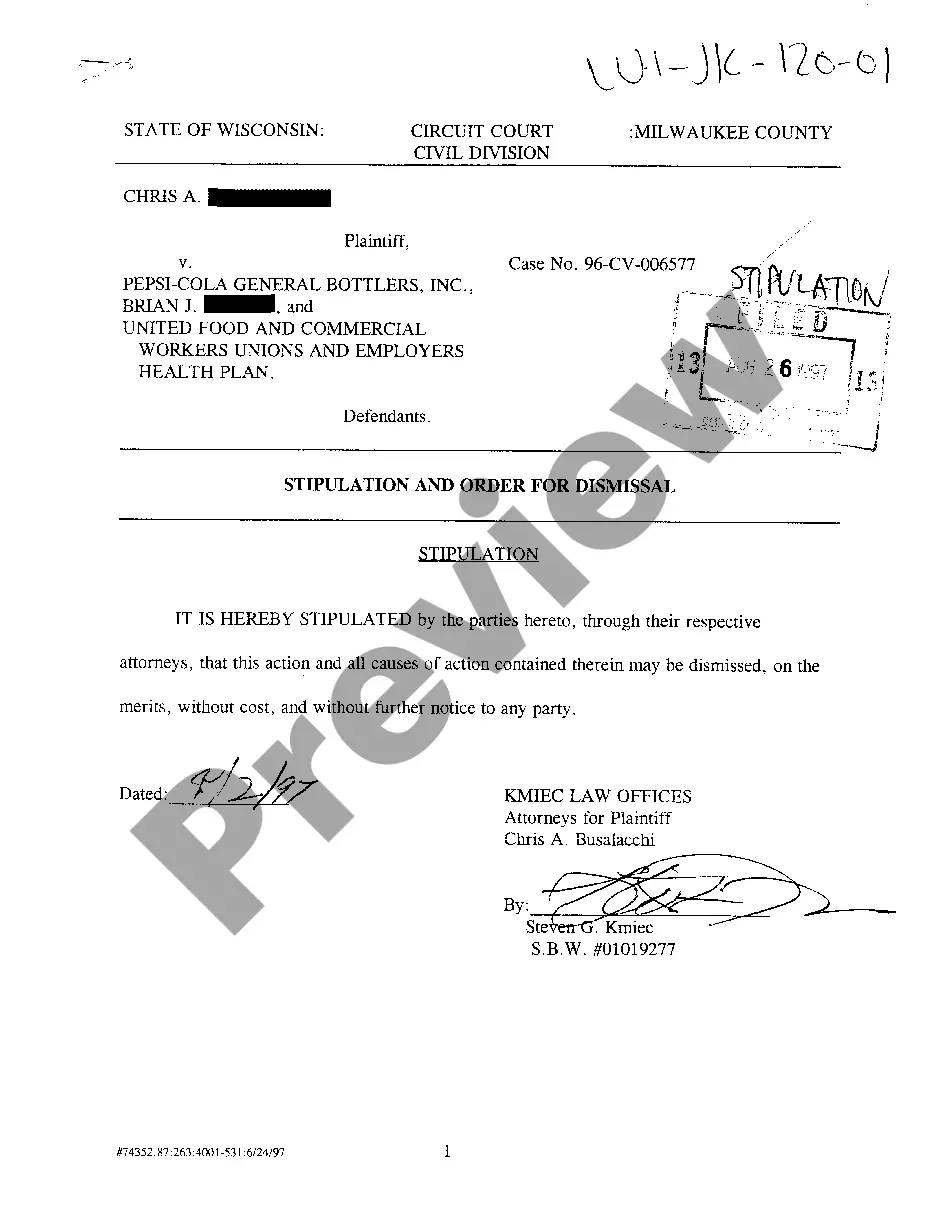

- Ensure you have chosen the correct document for your area/region. Click on the Preview button to review the form's content.

- Check the form description to confirm that you have selected the appropriate document.

- If the form does not meet your requirements, use the Search area at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking on the Get now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

Appointing co-trustees may seem like a good choice for many reasons. For example: Having two trustees can act as a safeguard, since there is a second person with access to records and responsibility for management and monitoring. In theory, having two trustees reduces the burden on each, since the work is shared.

Multiple GrantorsA trust can have more than one grantor. For instance, if more than one person funded the trust, they will each be treated as grantor in proportion to the value of the cash or property that they transferred to the trust.

Trustees have a duty to exercise reasonable care. Trustees have a duty to act jointly where more than one (and subject to the specific provisions of the Trust).

Joint And Several Liability.In the situation where there are multiple trustees, the trustees are jointly and severally liable for properly incurred liabilities - that is, all trustees are responsible for each others decisions in respect to the Trust.

A trust is basically a right to certain property, which is held by a fiduciary for the benefit of another individual. A trustee, on the other hand, is a party or parties designated as a holder of the property, charged with the duty of administering the trust at the appropriate time.

The trustee will hold the legal title and the beneficiary will hold the equitable title. This division is what makes a trust legally valid. Without the division, the trust will no longer be legally effective.

When there are multiple trustees appointed to manage a trust, they are called co-trustees. A trustee manages and administers a trust, including selling and distributing trust property, and filing taxes for trust income when necessary.

While there's no limit to how many trustees one trust can have, it might be beneficial to keep the number low. Here are a few reasons why: Potential disagreements among trustees. The more trustees you name, the greater the chance they'll have different ideas about how your trust should be managed.

So can a trustee also be a beneficiary? The short answer is yes, but the trustee will have to be exceedingly careful to never engage in any actions that would constitute a breach of trust, including placing their personal interests above those of the other beneficiaries.

The short answer is yes, a beneficiary can also be a trustee of the same trustbut it may not always be wise, and certain guidelines must be followed. Is it a good idea for a beneficiary to be a trustee? There are good reasons for naming a trust beneficiary as trustee. For one, it is convenient.