The Kansas Agreement is a legally binding document that attests to the accuracy and finality of a statement of account. It is used in various financial and business contexts to ensure that the parties involved agree that the statement of account presented is true, correct, and settled. This agreement provides reassurance and clarity regarding the financial standing between the parties. The purpose of the Kansas Agreement is to eliminate any disputes or discrepancies related to the statement of account. By signing this agreement, both parties confirm their mutual understanding that the statement of account accurately reflects all relevant transactions, balances, and payments up to a specific date. Key elements included in a Kansas Agreement that Statement of Account is True, Correct and Settled are: 1. Identification of the parties involved: The agreement clearly mentions the names and contact information of the parties who are settling the account. 2. Statement of account details: The agreement provides a comprehensive summary of the statement of account, including the period covered, balances, credits, debits, and any outstanding amounts. 3. Confirmation of accuracy: Both parties explicitly state that they have reviewed the statement of account and believe it to be accurate and complete. 4. Settlement clause: The agreement confirms that the account is settled, meaning that no further payments or adjustments are required, and both parties have no outstanding obligations to each other. 5. Legal implications: The agreement may include clauses specifying legal consequences for fraudulent or inaccurate information provided in the statement of account. Different types of Kansas Agreements that Statement of Account is True, Correct and Settled could vary based on the specific industry or nature of the financial relationship. For example: 1. Kansas Agreement for Vendor-Client: This agreement is used by vendors to assert that the statement of account provided to their clients is accurate, correct, and settled, ensuring there are no disputes regarding outstanding payments or discrepancies. 2. Kansas Agreement for Lender-Borrower: Borrowers may enter into this agreement with lenders, acknowledging that the statement of account provided by the lender is an accurate representation of outstanding balances, repayments, and any accrued interest. 3. Kansas Agreement for Business Partners: Business partners may sign this agreement to confirm the accuracy and finality of their joint statement of account, ensuring transparency and trust between them. In conclusion, the Kansas Agreement that Statement of Account is True, Correct and Settled is a significant legal document that establishes the accuracy and finality of financial statements. This agreement ensures clarity and prevents disputes related to outstanding balances, payments, and financial obligations. Various industries and financial relationships may utilize different types of Kansas Agreements tailored to their specific needs.

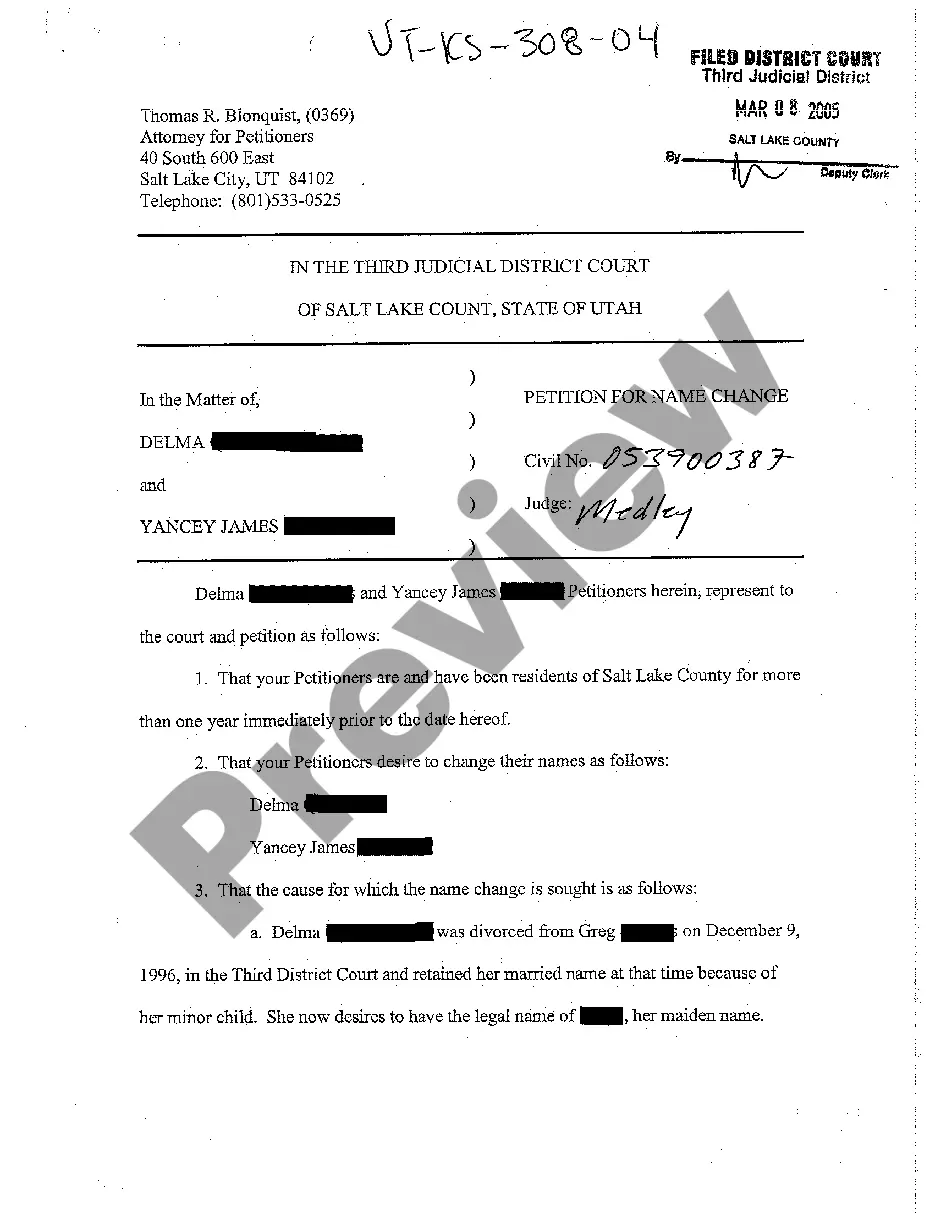

Kansas Agreement that Statement of Account is True, Correct and Settled

Description

How to fill out Kansas Agreement That Statement Of Account Is True, Correct And Settled?

If you have to full, down load, or printing authorized record web templates, use US Legal Forms, the largest selection of authorized kinds, which can be found on the Internet. Utilize the site`s simple and convenient search to find the documents you require. Different web templates for organization and person functions are categorized by groups and claims, or search phrases. Use US Legal Forms to find the Kansas Agreement that Statement of Account is True, Correct and Settled with a handful of mouse clicks.

Should you be presently a US Legal Forms consumer, log in in your profile and then click the Download option to obtain the Kansas Agreement that Statement of Account is True, Correct and Settled. Also you can accessibility kinds you in the past acquired within the My Forms tab of your respective profile.

If you work with US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have chosen the shape for your appropriate area/nation.

- Step 2. Use the Preview choice to examine the form`s content material. Do not overlook to read through the outline.

- Step 3. Should you be not happy using the type, use the Look for industry on top of the screen to get other variations in the authorized type format.

- Step 4. After you have located the shape you require, go through the Get now option. Select the rates prepare you prefer and add your credentials to sign up for an profile.

- Step 5. Method the financial transaction. You can use your charge card or PayPal profile to perform the financial transaction.

- Step 6. Select the format in the authorized type and down load it in your device.

- Step 7. Full, modify and printing or signal the Kansas Agreement that Statement of Account is True, Correct and Settled.

Every authorized record format you purchase is the one you have permanently. You have acces to each type you acquired within your acccount. Click on the My Forms segment and pick a type to printing or down load once more.

Contend and down load, and printing the Kansas Agreement that Statement of Account is True, Correct and Settled with US Legal Forms. There are millions of skilled and state-certain kinds you can use for your personal organization or person needs.