Kansas Breakdown of Savings for Budget and Emergency Fund

Description

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

Are you presently in a situation where you require documentation for potential business or personal use almost daily.

There are numerous legal document templates accessible online, but locating reliable ones is not straightforward.

US Legal Forms offers thousands of form templates, such as the Kansas Breakdown of Savings for Budget and Emergency Fund, which are designed to meet state and federal regulations.

Once you find the correct form, click on Purchase now.

Select the payment plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Kansas Breakdown of Savings for Budget and Emergency Fund template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

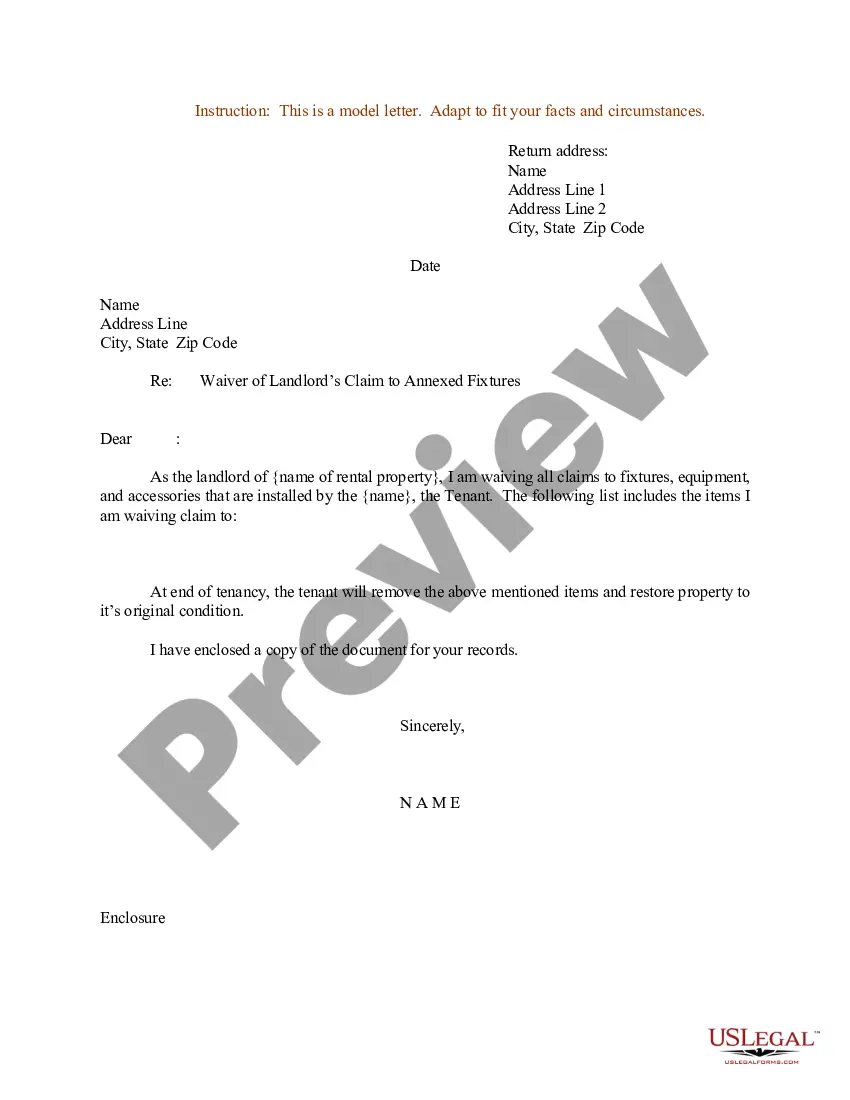

- Use the Preview button to review the document.

- Read the description to confirm you have selected the right form.

- If the form isn’t what you are looking for, utilize the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

An emergency fund is a cash reserve that's specifically set aside for unplanned expenses or financial emergencies. Some common examples include car repairs, home repairs, medical bills, or a loss of income.

Assess your emergency savings needs While $5,000 is certainly an impressive amount of money to have in the bank, it may not be enough to constitute a true emergency fund. Let's imagine you typically spend $2,500 a month on rent, transportation, food, medication, utilities, and other necessities.

The 50/30/20 budget divides your after-tax income into three separate categories: 50% for needs, 30% for wants and 20% for savings/financial goals. This approach is best for younger, average-income earners who have paid off their high-interest debt.

Calculate a Target Amount I generally recommend three months of net pay set aside for emergencies, she said. If you get two paychecks a month, and they are each $3,000 that's $6,000. I would multiply that by three, so you're looking at about nearly $20,000 in emergency savings.

Most experts recommend keeping three to six months' worth of expenses in an emergency fund, but some situations warrant more. Some experts recommend a smaller emergency fund while you're paying off debt. If your job is secure and you don't have a lot of expenses, you may be able to save less.

It's all about your personal expenses Those include things like rent or mortgage payments, utilities, healthcare expenses, and food. If your monthly essentials come to $2,500 a month, and you're comfortable with a four-month emergency fund, then you should be set with a $10,000 savings account balance.

It does work. That $1,000 emergency fund will be enough to have your back while you hustle to pay off your debt as quick as you can. The Baby Steps work, so stick with themno matter how uncomfortable it might make you feel. Lean into that awkward feeling and let that spur you on to pay off your debt even faster.

Creating a budgetStep 1: Calculate your net income. The foundation of an effective budget is your net income.Step 2: Track your spending.Step 3: Set realistic goals.Step 4: Make a plan.Step 5: Adjust your spending to stay on budget.Step 6: Review your budget regularly.

The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

Budget could be of three types a balanced budget, surplus budget, and deficit budget.