Kansas Assignment of Contract as Security for Loan

Description

How to fill out Assignment Of Contract As Security For Loan?

Are you in a circumstance where you require documents for potentially corporate or personal reasons almost every day.

There are many legitimate document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast selection of form templates, including the Kansas Assignment of Contract as Security for Loan, which can be tailored to meet state and federal requirements.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and prevent errors.

The service offers properly designed legal document templates that can be utilized for various purposes. Set up a free account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Kansas Assignment of Contract as Security for Loan template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is suited for the correct city/state.

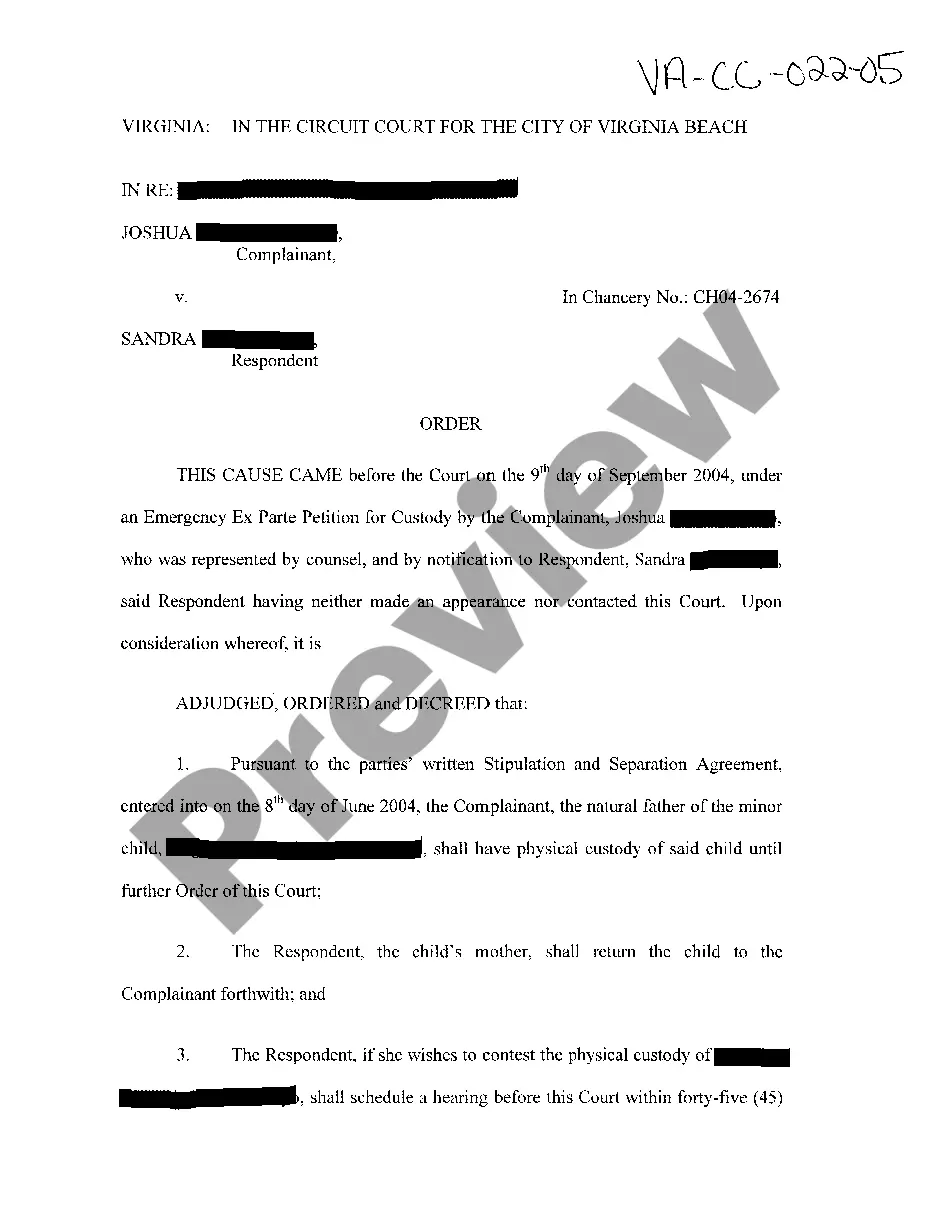

- Utilize the Preview button to review the document.

- Examine the description to confirm you have selected the right form.

- If the form isn’t what you desire, use the Search field to find a form that fulfills your needs.

- Once you find the right form, click on Get now.

- Select the pricing plan you prefer, complete the required information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Kansas Assignment of Contract as Security for Loan at any time, if necessary. Simply select the desired form to download or print the format.

Form popularity

FAQ

A security agreement refers to a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Terms and conditions are determined at the time the security agreement is drafted.

Collateral is defined as something pledged as security for repayment of a loan, to be forfeited in the event of a default.

Assignment is a legal term whereby an individual, the assignor, transfers rights, property, or other benefits to another known as the assignee. This concept is used in both contract and property law. The term can refer to either the act of transfer or the rights/property/benefits being transferred.

An "assignment" is the document that is the legal record of this transfer from one mortgagee to another. In a typical transaction, when the mortgagee sells the debt to another bank, an assignment is recorded, and the promissory note is endorsed (signed over) to the new bank.

Loan agreements are binding contracts between two or more parties to formalize a loan process. There are many types of loan agreements, ranging from simple promissory notes between friends and family members to more detailed contracts like mortgages, auto loans, credit card and short- or long-term payday advance loans.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

Loans from banks or other institutional lenders are always made using a number of documents, two of which are a promissory and security agreement. In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

When a lender reassigns a loan to another lender, this doesn't really change any of the fundamental factors that affect your credit score. For example, you do not take on more debt in loans, acquire new loans or take any other actions that might impact your credit score when your loan is reassigned.

Security agreements and financing statements are often confused with one another. The primary difference is that the financing statement largely serves as notice that a creditor possesses security interest in the debtor's assets or property. The financing statement is not a contract.