Kansas Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee

Description

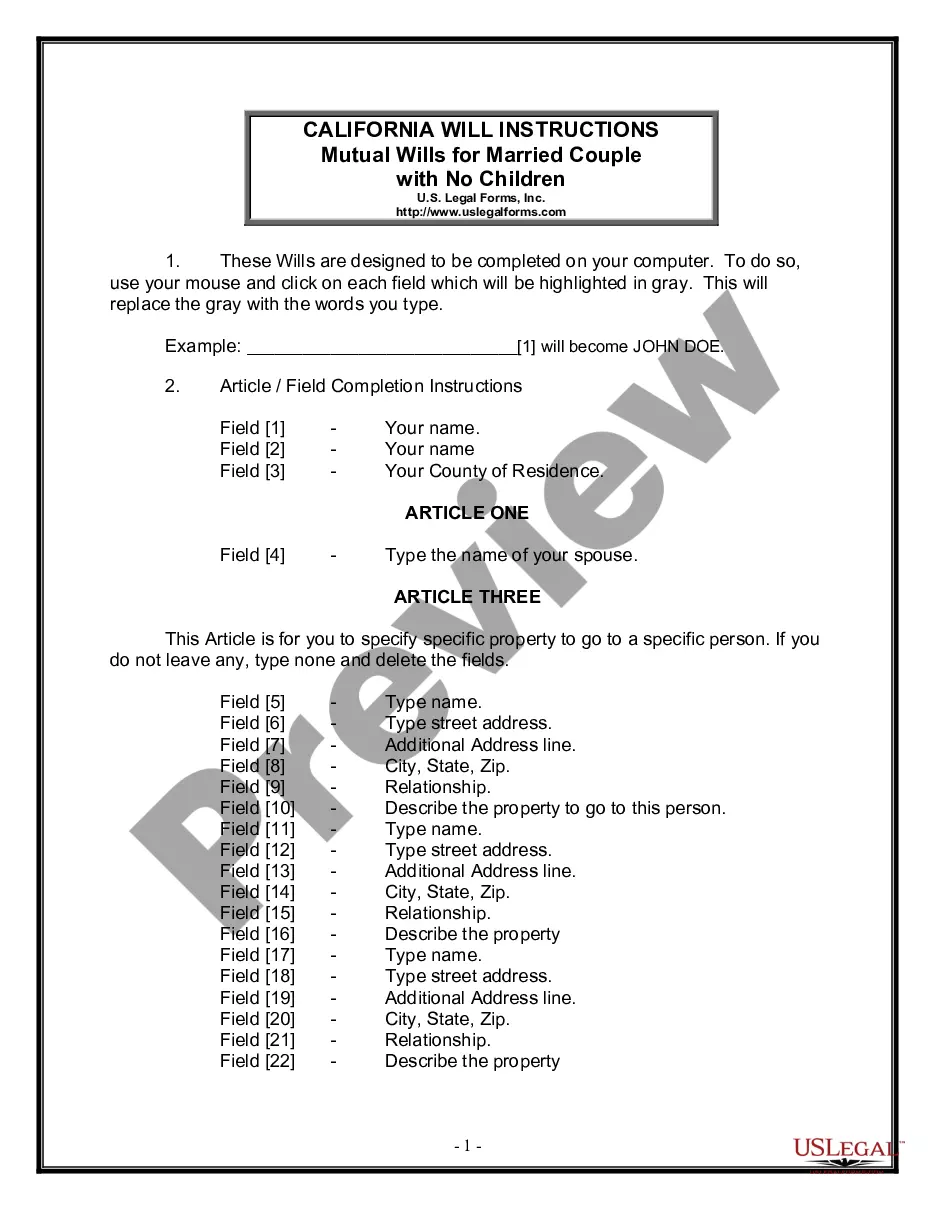

How to fill out Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee?

Have you been inside a placement that you need files for possibly enterprise or person reasons just about every time? There are a variety of lawful record themes available on the net, but locating versions you can depend on isn`t simple. US Legal Forms offers thousands of kind themes, much like the Kansas Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee, which can be created in order to meet state and federal specifications.

If you are previously familiar with US Legal Forms web site and get a merchant account, simply log in. Following that, you can down load the Kansas Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee template.

Unless you offer an profile and would like to begin to use US Legal Forms, abide by these steps:

- Obtain the kind you will need and ensure it is for your correct area/area.

- Make use of the Review key to review the form.

- See the information to ensure that you have chosen the proper kind.

- In case the kind isn`t what you`re trying to find, utilize the Research industry to get the kind that fits your needs and specifications.

- If you find the correct kind, simply click Get now.

- Select the pricing strategy you would like, fill out the necessary information and facts to make your money, and purchase the transaction using your PayPal or bank card.

- Select a handy data file formatting and down load your backup.

Discover all the record themes you possess bought in the My Forms menu. You may get a further backup of Kansas Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee at any time, if possible. Just click on the required kind to down load or printing the record template.

Use US Legal Forms, the most comprehensive assortment of lawful forms, to conserve time as well as prevent blunders. The service offers expertly produced lawful record themes which you can use for a selection of reasons. Produce a merchant account on US Legal Forms and start making your lifestyle easier.