Kansas Independent Contractor Agreement for Accountant and Bookkeeper

Description

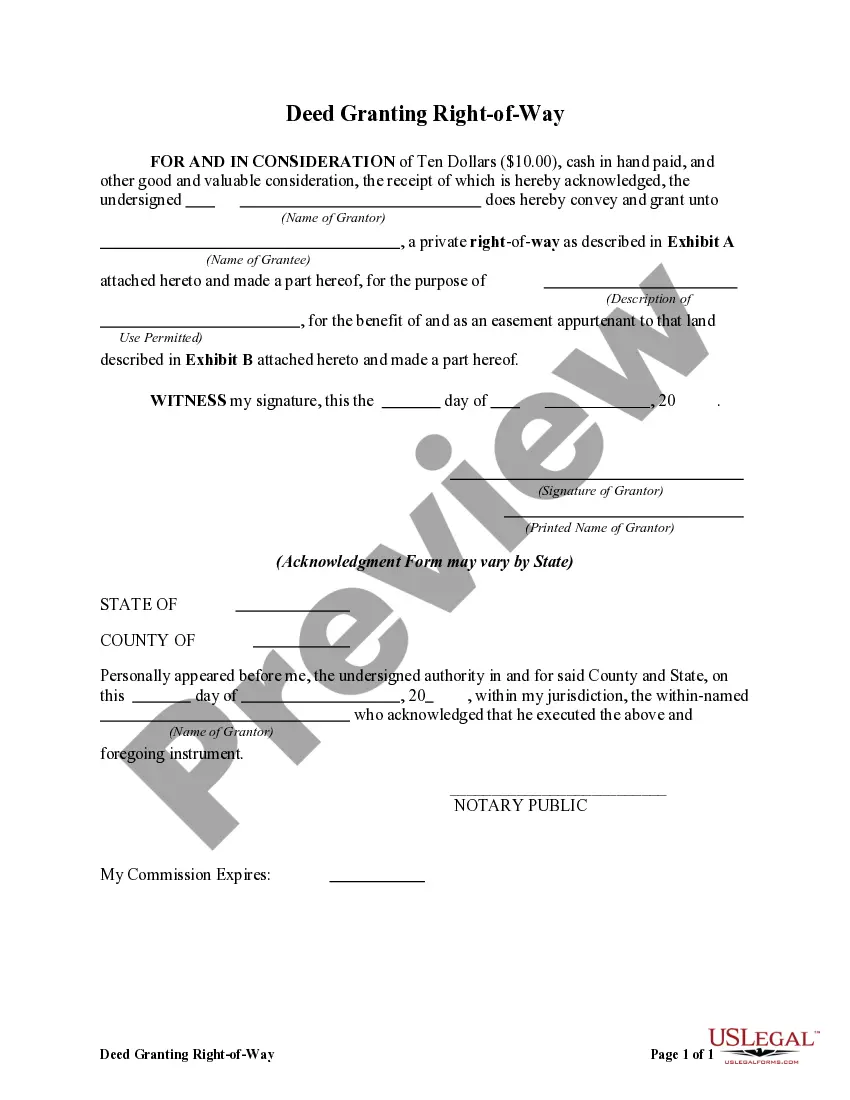

How to fill out Independent Contractor Agreement For Accountant And Bookkeeper?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

While using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Kansas Independent Contractor Agreement for Accountant and Bookkeeper in just a few minutes.

If you have a subscription, Log In and download the Kansas Independent Contractor Agreement for Accountant and Bookkeeper from the US Legal Forms library. The Download button will be visible for every form you view. You can access all previously downloaded forms under the My documents section of your account.

Every template added to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, just go to the My documents area and click on the form you need.

Access the Kansas Independent Contractor Agreement for Accountant and Bookkeeper through US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct form for your city/region. Click the Review button to check the form's details. Examine the form summary to ensure you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the page to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the payment plan you want and provide your information to create an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the document onto your device.

- Make edits. Complete, modify, print, and sign the downloaded Kansas Independent Contractor Agreement for Accountant and Bookkeeper.

Form popularity

FAQ

Yes, if you are an independent contractor, not a corporation, and were paid more than $600, the company that paid you should issue you a 1099-MISC that you report on your tax return. In QuickBooks, your vendor profile should indicate that you are 1099 eligible.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

So if you're paying unlicensed California accountants or bookkeepers as independent contractors, you're probably going to have to rehire them as employees regardless of whether or not your firm is located in California.

How to Become an Independent BookkeeperGet Your Degree. No one's going to trust you with their money if you haven't studied accounting and bookkeeping.Gain Practical Experience.Add Some Credentials.Handle Your Legal Issues.Start Marketing Yourself.

The reportable types of payments need to be made in the course of your trade or business. Here are some examples of payments you need to report on the 1099-NEC: Professional service fees to architects, designers, accountants, software engineers, attorneys, and law firms.

Bookkeepers and accountants are independent contractors when they: Are hired (temporary or potentially for a long period of time) to accomplish a specific result and are not subject to direction or control over the methods or means to accomplish it.

If the accountant is part of a corporation, you do not need to file a 1099. However, if the accountant is not part of a corporation, you might need to file a 1099. This includes accountants that are classified as a partnership or are independent contractors.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

Small to mid-size businesses might employ their own bookkeepers. But in recent years, many have started offering bookkeeping services on a self-employed basis. This is good for businesses, as it means they can get all the benefits of a bookkeeper without having to employ a full-time member of staff.