A Kansas Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement is a legal document that outlines the terms and conditions of a sale transaction involving a manufacturing facility in Kansas. This agreement is typically used when one party wishes to sell their manufacturing facility, and another party wishes to purchase it. It serves as a legally binding contract that protects the rights and interests of both the seller and the buyer. The contract outlines various important aspects of the sale, including the purchase price, payment terms, and any conditions or contingencies that must be met for the sale to proceed. It also includes provisions related to the transfer of assets, allocation of liabilities, and any warranties or representations made by the seller regarding the facility. There are different types of Kansas Contracts for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement that may be used depending on the specific circumstances of the transaction. Some of these types include: 1. Kansas Asset Purchase Agreement: This type of contract focuses on the purchase of specific assets of the manufacturing facility rather than the entire facility itself. It may include provisions for the transfer of machinery, equipment, inventory, intellectual property rights, and other assets. 2. Kansas Stock Purchase Agreement: In this type of contract, the buyer purchases the manufacturing facility by acquiring all or a majority of the seller's shares or ownership interest in the company that owns the facility. This agreement may involve additional considerations related to corporate governance and shareholder rights. 3. Kansas Sale of Business Agreement: This agreement goes beyond the sale of the manufacturing facility itself and includes the transfer of the entire business operation. It encompasses not only the physical assets, but also customer contracts, employee agreements, licenses, permits, and other business-related aspects. 4. Kansas Lease with Option to Buy Agreement: This type of agreement allows the buyer to lease the manufacturing facility for a specified period with an option to purchase it at a later date. It provides flexibility for the buyer to assess the facility's suitability before committing to its full purchase. In conclusion, a Kansas Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement is a crucial legal document that governs the sale of a manufacturing facility in Kansas. It ensures that both parties understand and agree to the terms and conditions of the sale, protecting their respective interests. The specific type of contract used may vary depending on the nature of the transaction, such as an asset purchase agreement, stock purchase agreement, sale of business agreement, or lease with an option to buy agreement.

Kansas Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement

Description

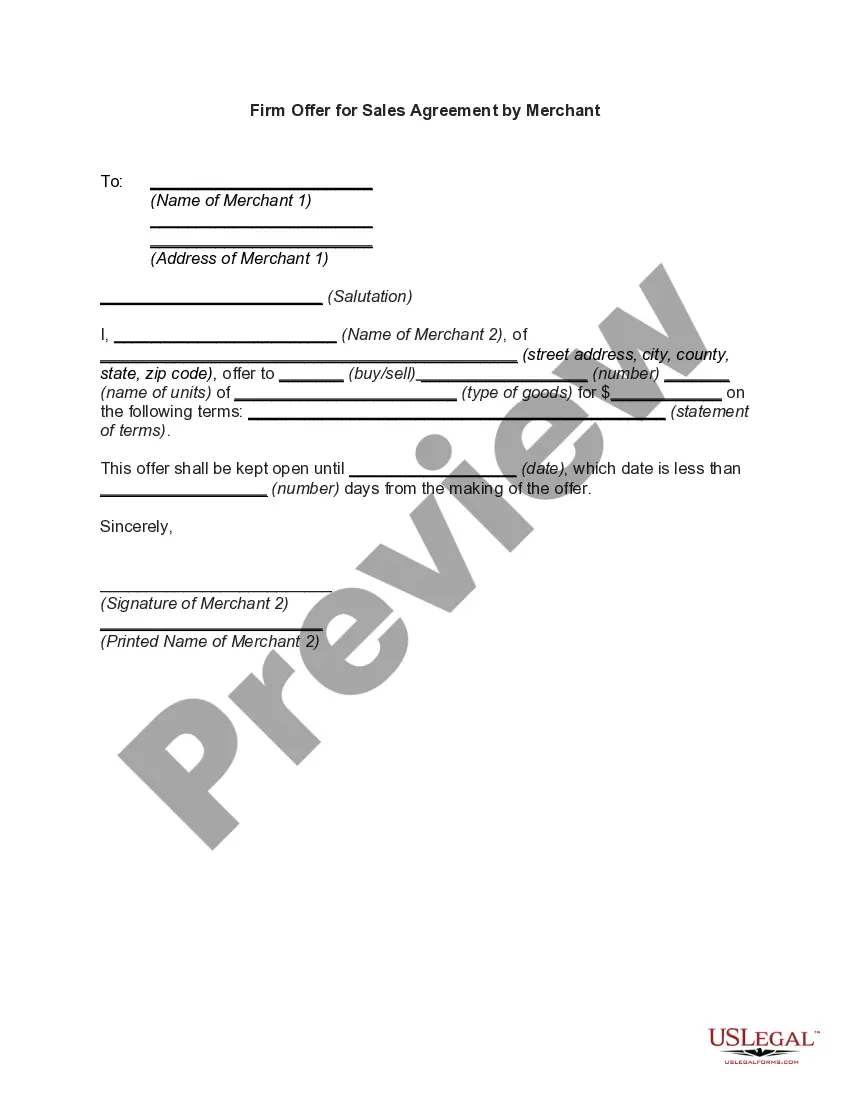

How to fill out Kansas Contract For Sale Of Manufacturing Facility Pursuant To Asset Purchase Agreement?

US Legal Forms - one of many biggest libraries of legal types in the United States - delivers a variety of legal record web templates you may obtain or printing. Utilizing the website, you may get a large number of types for organization and person reasons, categorized by groups, says, or key phrases.You can find the most up-to-date versions of types like the Kansas Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement within minutes.

If you already have a monthly subscription, log in and obtain Kansas Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement from the US Legal Forms collection. The Obtain switch will appear on each and every develop you see. You get access to all previously downloaded types in the My Forms tab of your profile.

If you wish to use US Legal Forms the first time, allow me to share simple guidelines to help you began:

- Make sure you have chosen the proper develop to your metropolis/state. Click on the Preview switch to check the form`s content. See the develop description to ensure that you have selected the right develop.

- In case the develop doesn`t satisfy your specifications, use the Lookup industry at the top of the display to find the one that does.

- Should you be pleased with the form, verify your decision by clicking on the Purchase now switch. Then, opt for the prices plan you like and supply your accreditations to sign up for the profile.

- Method the purchase. Utilize your Visa or Mastercard or PayPal profile to finish the purchase.

- Pick the structure and obtain the form in your system.

- Make adjustments. Fill up, revise and printing and indicator the downloaded Kansas Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement.

Every single web template you included with your bank account does not have an expiry particular date and it is your own for a long time. So, if you would like obtain or printing an additional duplicate, just check out the My Forms segment and then click around the develop you will need.

Get access to the Kansas Contract for Sale of Manufacturing Facility Pursuant to Asset Purchase Agreement with US Legal Forms, the most comprehensive collection of legal record web templates. Use a large number of expert and express-specific web templates that satisfy your company or person demands and specifications.

Form popularity

FAQ

A contract must be signed by both parties involved in the purchase and sale of a property to be legally enforceable. All parties signing must be of legal age and must enter into the contract voluntarily, not by force, to be enforceable.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

What is a Definitive Agreement? A definitive agreement may be known by other names such as a purchase and sale agreement, a stock purchase agreement or an asset purchase agreement. Regardless of its name, it is the final agreement that spells out details agreed upon by buyer and seller.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

Definition. An agreement between private parties creating mutual obligations enforceable by law. The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

An asset purchase agreement is a legal contract to buy the assets of a business. It can also be used to purchase specific assets from a business, especially if they are significant in value.

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.