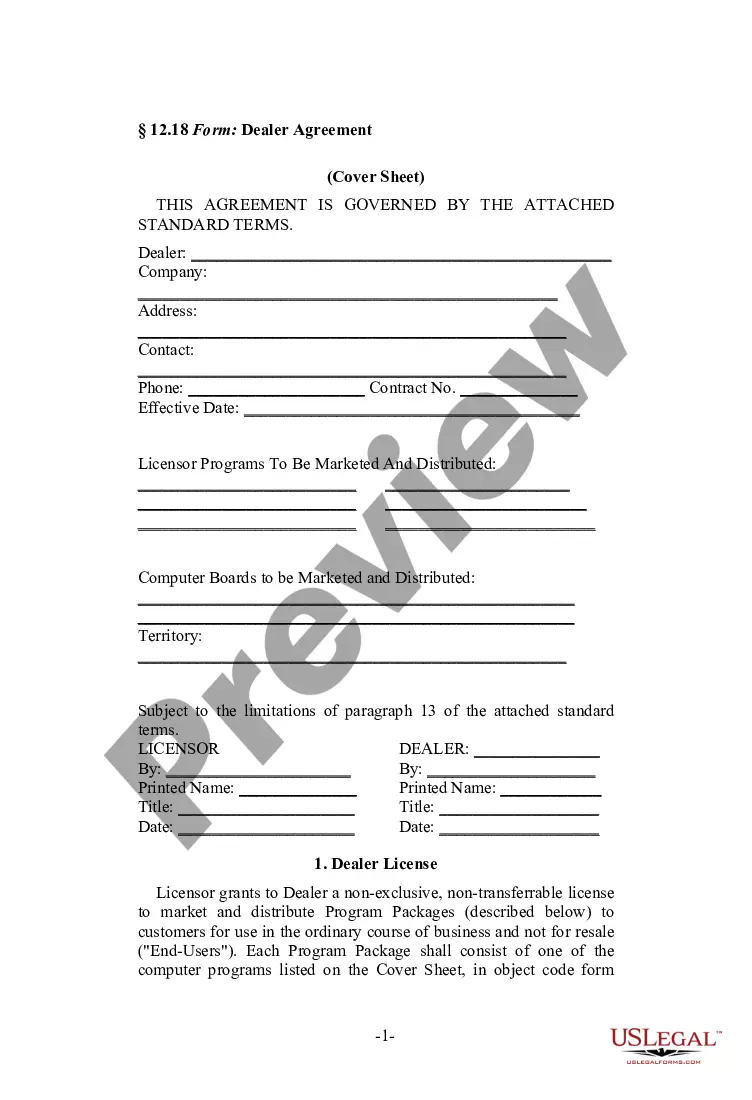

Kansas Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software

Description

How to fill out Agreement Between Licensor And Dealer For Sale Of Computers, Internet Services, Or Software?

Finding the correct legal document template can be quite a challenge.

Certainly, there are numerous templates available online, but how can you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Kansas Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software, which can be utilized for both business and personal purposes.

You can review the form by using the Preview button and read the form description to ensure it is right for you.

- All the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to get the Kansas Agreement between Licensor and Dealer for Sale of Computers, Internet Services, or Software.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your region/state.

Form popularity

FAQ

Sales of digital products are exempt from the sales tax in Kansas.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

Kansas generally does not require sales tax on Software-as-a-Service.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax.

Kansas Opinion SaaS is Non-Taxable - Avalara. Returns for small business Free automated sales tax filing for small businesses for up to 60 days. No credit card required.

Kansas: Shipping and handling charges are generally taxable in Kansas whether included in the sale price, separately stated, or billed separately. However, freight and postage are taxable only when included as part of a sale between a retailer and a customer.

Digital goods may be specifically defined Other states have gone further and passed legislation to specifically define digital goods and describe how they are taxed. These states are: Colorado, Idaho, Kentucky, Nebraska, New Jersey, South Dakota, Tennessee, Vermont, Washington, and Wisconsin.

California: SaaS is not a taxable service. However, software or information that is delivered electronically is exempt. The ability to access software from a remote network or location is exempt. Under California sales and use tax law, there must be a transfer of TPP, in order to have a taxable event.

Sales of digital products are exempt from the sales tax in Kansas.