Kansas Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

Selecting the finest legal document template can be challenging. Obviously, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website.

The service offers a multitude of templates, including the Kansas Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, which can be used for both business and personal purposes. All forms are verified by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the Kansas Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner. Use your account to search through the legal documents you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the documents you need.

Select the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Kansas Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner. US Legal Forms is the largest collection of legal forms, where you can find a variety of document templates. Leverage the service to download expertly crafted forms that meet state requirements.

- Firstly, make sure you have selected the correct form for your city/state.

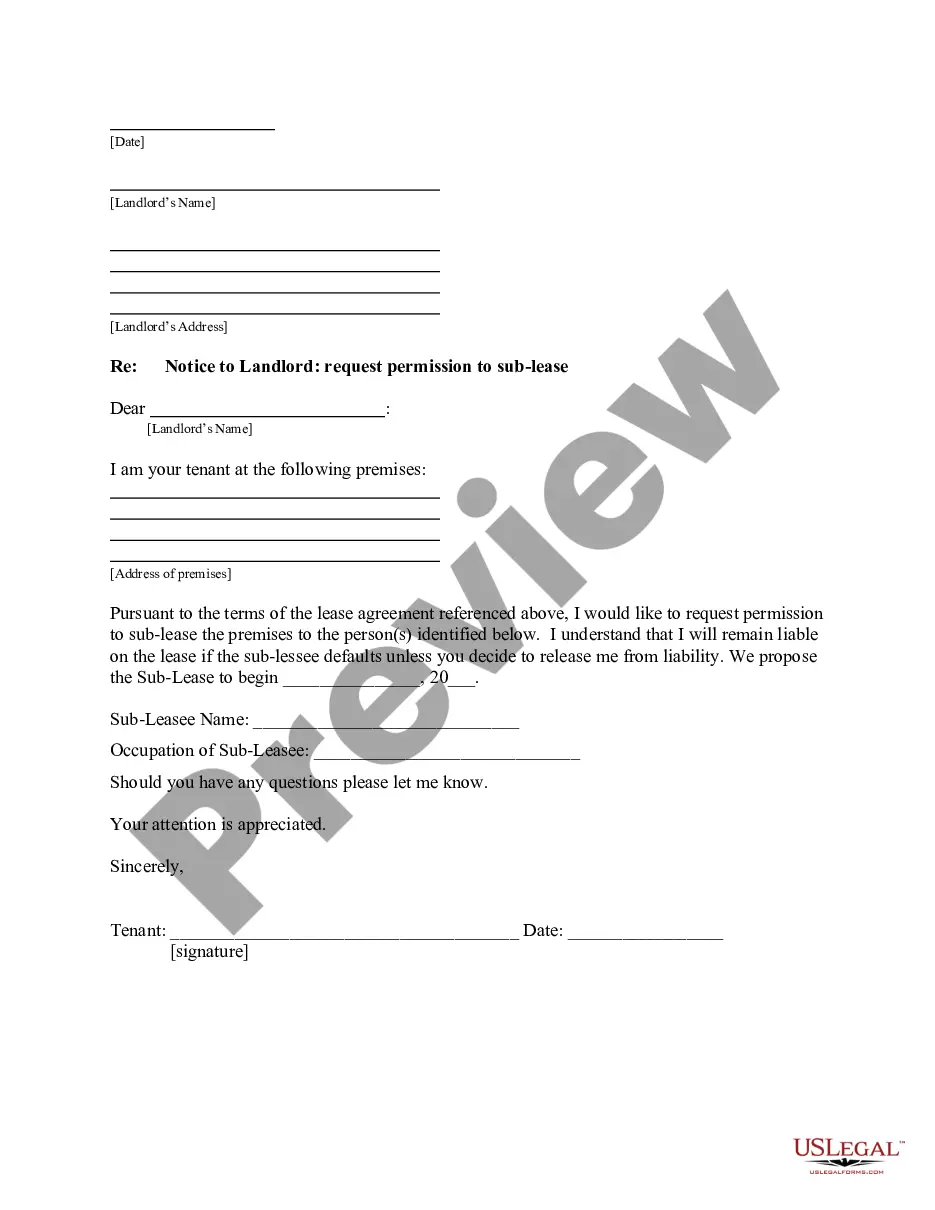

- You can review the form using the Preview option and read the form description to confirm it suits your needs.

- If the form does not fulfill your requirements, use the Search field to locate the appropriate form.

- Once you are certain that the form is correct, click the Get now button to acquire the form.

- Choose the pricing plan you prefer and enter the necessary details.

- Create your account and complete the payment for the order using your PayPal account or credit card.

Form popularity

FAQ

The Supreme Court held as under: Section 42(c) of the Partnership Act can appropriately be applied to a' partnership where there are more than two partners. If one of them dies, the firm is dissolved; but if there is a contract to the contrary, the surviving partners will continue the firm.

In a landmark judgment, in Mohd Laiquiddin v Kamala Devi Misra (deceased) by LRs,(1) the Supreme Court has ruled that on the death of a partner of a firm comprised of only two partners, the firm is dissolved automatically; this is notwithstanding any clause to the contrary in the partnership deed.

Death of the partner If there are only two partners, and one of the partner dies, the partnership firm will automatically dissolve. If there are more than two partners, other partners may continue to run the firm.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

The death of a partner or the unauthorized transfer of ownership of his share in the partnership in case there is a limitation to this effect results in the dissolution thereof. In other words, any change in the composition of the partnership, unless so allowed, will result in the dissolution thereof.

On the retirement or death of a partner, the existing partnership deed comes to an end, and in its place, a new partnership deed needs to be framed whereby, the remaining partners continue to do their business on changed terms and conditions.

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

Business partnership agreement. A properly arranged and funded agreement is a legally binding contract that spells out exactly what is to happen if one of the business's owners dies. It generally calls for the survivors to buy the deceased owner's share in the business from his or her heirs.

Keeping it successful is even harder, and coping with the death of a partner may be the hardest situation of all. When that happens, your deceased partner's share in the business usually passes to a surviving spouse, either by terms of a will or simply by default as the primary heir.