A Kansas Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor is a legal document that outlines the terms and conditions regarding the transfer of a deceased partner's interest in a partnership to the surviving partner(s). This particular type of agreement is specific to partnerships formed in the state of Kansas. Keywords: Kansas partnership, buy-sell agreement, fixing value, requiring sale, estate of deceased partner, survivor This type of agreement serves as a mechanism to protect the continuity of a partnership in the event of the death of one of the partners. It establishes a process for the valuation of the deceased partner's interest and requires the estate of the deceased partner to sell that interest to the surviving partner. The Kansas Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor typically includes the following key provisions: 1. Valuation method: The agreement specifies the method to be used for determining the value of the deceased partner's interest. Common methods include the book value, fair market value, or a predetermined fixed value. 2. Timing of valuation: The agreement stipulates when the valuation process should occur, such as upon the death of a partner or at regular intervals. 3. Buyout terms: The agreement details how the buyout process will take place. It may include terms for the payment of the purchase price, such as a lump sum payment or installment payments over a specified period. 4. Right of first refusal: The surviving partner(s) is typically given the right of first refusal to purchase the deceased partner's interest. If the surviving partner is unable or unwilling to purchase the interest, it can be offered to other partners or third parties. 5. Funding mechanisms: The agreement may provide options for funding the buyout, such as life insurance policies on the partners or establishing a sinking fund. Different types of Kansas Partnership Buy-Sell Agreements Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor may include variations in the valuation method, the timing of valuation, or additional provisions specific to the particular partnership. Some possible variations of Kansas Partnership Buy-Sell Agreements Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor include: 1. Fixed Value Agreement: This type of agreement establishes a predetermined fixed value for the deceased partner's interest, which eliminates the need for valuation upon death. 2. Fair Market Value Agreement: In this agreement, the fair market value of the deceased partner's interest is determined at the time of their death. The surviving partner(s) or the partnership itself may have the option to purchase the interest at this value. 3. Cross-Purchase Agreement: With a cross-purchase agreement, each partner within the partnership agrees to purchase the interest of the deceased partner. This can provide a greater sense of security for the surviving partner(s). In conclusion, a Kansas Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor is a crucial legal document that ensures the smooth transition of a deceased partner's interest to the surviving partner(s). By specifying the valuation method, buyout terms, and funding mechanisms, this agreement safeguards the continuity and stability of the partnership in the face of unexpected events.

Kansas Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor

Description

How to fill out Kansas Partnership Buy-Sell Agreement Fixing Value And Requiring Sale By Estate Of Deceased Partner To Survivor?

If you want to total, download, or print out authorized file web templates, use US Legal Forms, the largest collection of authorized varieties, that can be found on the web. Use the site`s easy and hassle-free research to find the paperwork you require. Numerous web templates for company and specific functions are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Kansas Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor in just a number of click throughs.

In case you are presently a US Legal Forms consumer, log in in your bank account and click the Down load button to have the Kansas Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor. Also you can entry varieties you in the past downloaded in the My Forms tab of the bank account.

If you work with US Legal Forms initially, refer to the instructions beneath:

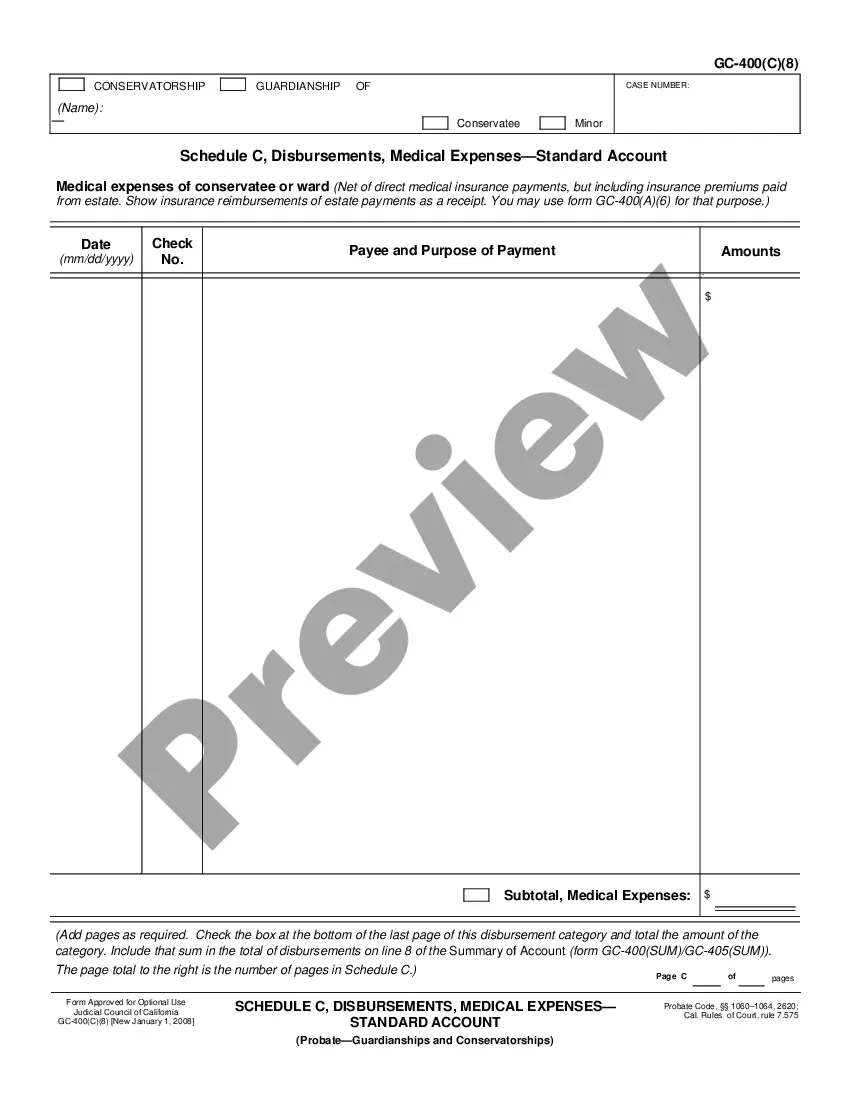

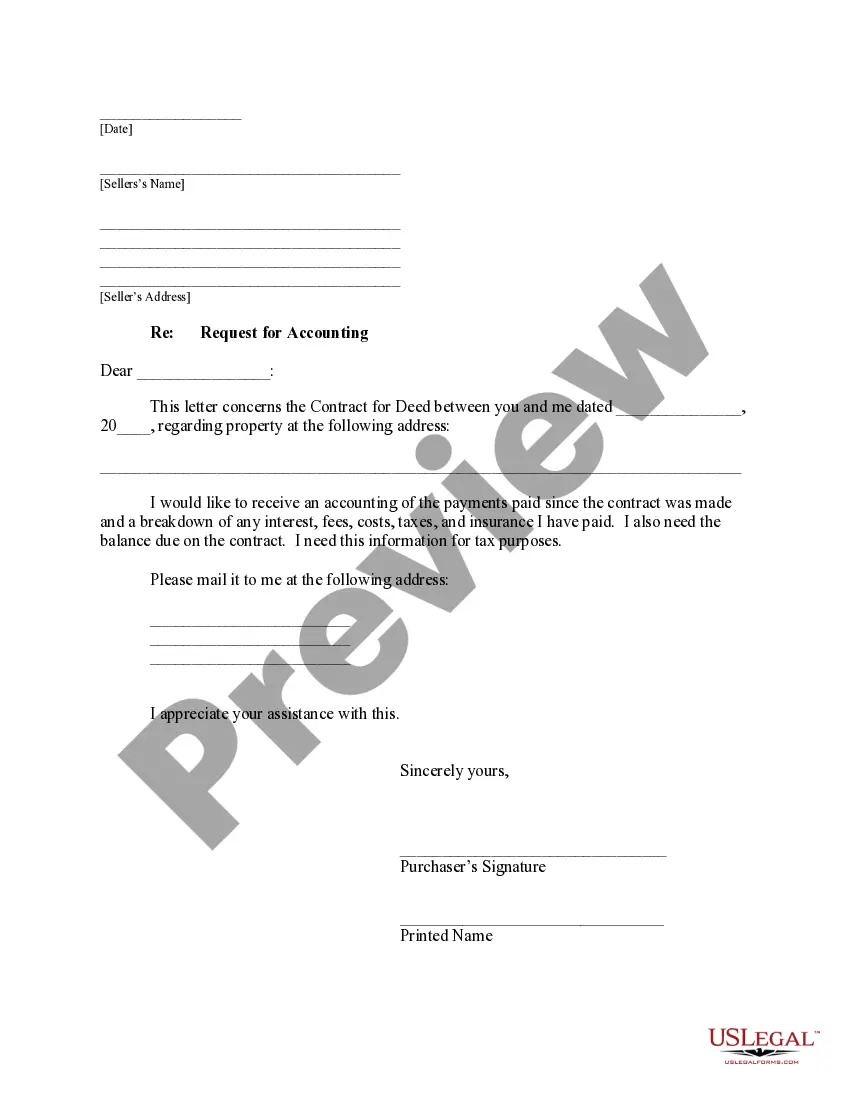

- Step 1. Be sure you have chosen the form for that correct town/nation.

- Step 2. Use the Review choice to check out the form`s information. Do not forget to see the information.

- Step 3. In case you are unhappy using the type, take advantage of the Look for industry towards the top of the screen to get other variations of your authorized type format.

- Step 4. Once you have located the form you require, click the Buy now button. Opt for the pricing prepare you favor and put your qualifications to register to have an bank account.

- Step 5. Method the purchase. You can utilize your bank card or PayPal bank account to perform the purchase.

- Step 6. Pick the file format of your authorized type and download it in your system.

- Step 7. Comprehensive, change and print out or indicator the Kansas Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor.

Every single authorized file format you get is your own property eternally. You have acces to each type you downloaded within your acccount. Select the My Forms segment and select a type to print out or download once more.

Remain competitive and download, and print out the Kansas Partnership Buy-Sell Agreement Fixing Value and Requiring Sale by Estate of Deceased Partner to Survivor with US Legal Forms. There are millions of expert and express-distinct varieties you may use for your company or specific requirements.

Form popularity

FAQ

Buyout agreement (also known as a buy-sell agreement) refers to a contract that gives rights to at least one party of the contract to buy the share, assets, or rights of another party given a specific event. These agreements can arise in a variety of contexts as stand-alone contracts or parts of larger agreements.

The key elements of a buy-sell agreement include:Element 1. Identify the parties.Element 2. Triggered buyout event.Element 3. Buy-sell structure.Element 4. Company valuation.Element 5. Funding resources.Element 6. Taxation considerations.

Right to access books and accounts: Each partner can inspect and copy books of accounts of the business. This right is applicable equally to active and dormant partners. Right to share profits: Partners generally describe in their deed the proportion in which they will share profits of the firm.

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

A retiring partner may be free from any liability to any third party for the acts of the firm by an agreement made by the outgoing partner with a third-party done before his retirement and such agreement being implied during the dealing.

Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

This is one of the few ways that the parties can feel comfortable that the valuation will be unbiased and take into consideration the company's current condition. The valuation provision of a buy-sell agreement covers how a shareholder's interest will be priced.

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

A purchase and sale agreement is different from a purchase agreement in one particular way. Rather than complete the transaction, a purchase and sale agreement will facilitate it while providing clear guidance regarding party responsibility. By signing the contract, you do not agree to buy or sell the house.