Kansas Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment

Description

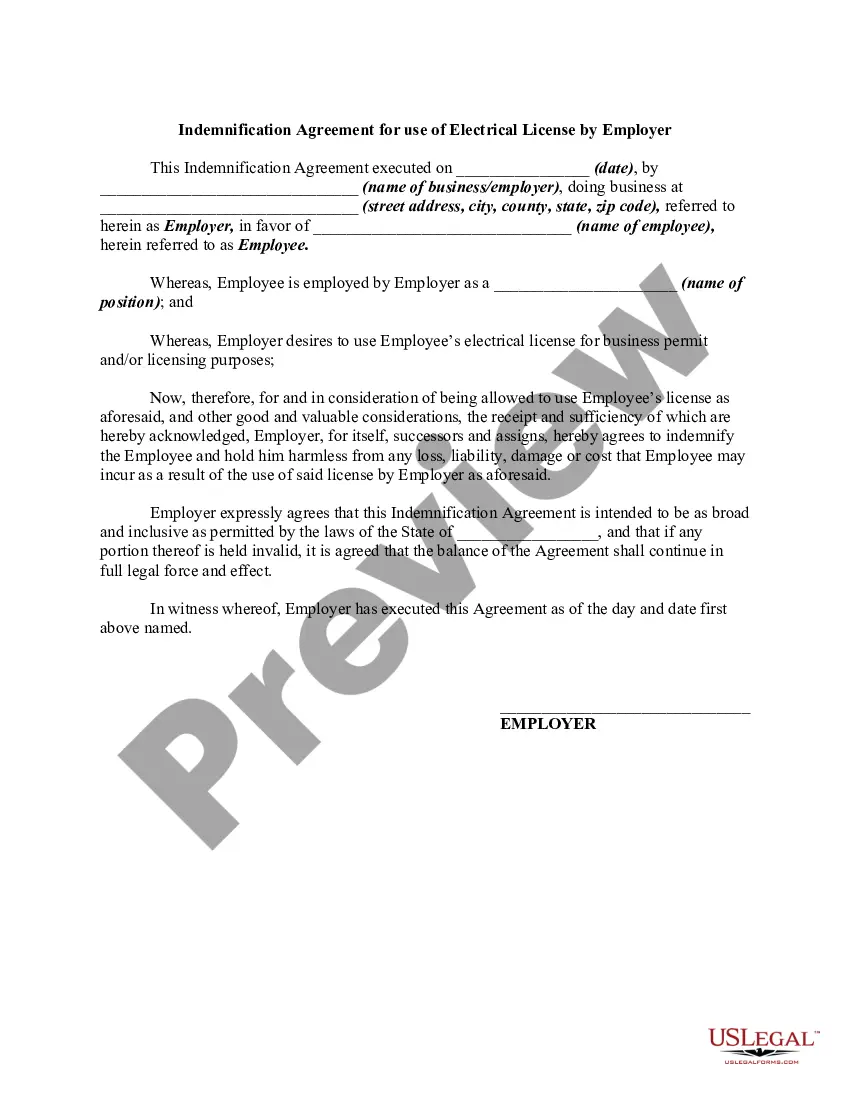

How to fill out Agreement To Dissolve And Wind Up Partnership With Settlement And Lump-sum Payment?

You may spend hours online looking for the legal document format that meets your state and federal requirements.

US Legal Forms offers a vast selection of legal forms that have been evaluated by professionals.

You can download or print the Kansas Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment from their platform.

If available, use the Review button to check the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- Afterward, you can complete, modify, print, or sign the Kansas Agreement to Dissolve and Wind up Partnership with Settlement and Lump-sum Payment.

- Each legal document format you acquire is yours permanently.

- To access another copy of any purchased form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for your location/city of choice.

- Review the form outline to confirm that you have selected the right form.

Form popularity

FAQ

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Liquidation is also referred to as dissolution and the terms are used interchangeably, but technically they describe different actions and their meaning is not the same. In other words, liquidation is seen as a last legal resort for a stressed company, while dissolution is the first step in closing a business.

An agreement can spell out the order in which liabilities are to be paid, but if it does not, UPA Section 40(a) and RUPA Section 807(1) rank them in this order: (1) to creditors other than partners, (2) to partners for liabilities other than for capital and profits, (3) to partners for capital contributions, and

Simply put, a dissolution is a (typically) voluntary legal closure of a business while a liquidation involves the selling of a company's assets in order to pay creditors.

To dissolve an LLC in Kansas, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Kansas LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

Settlement of accounts on dissolution Losses including deficiencies of capital shall be first paid out from the profits, next from the capital, and if necessary, by the personal contribution of partners in their profit-sharing ratio. 2.

It can take up to 90 days from the date you file the statement of dissolution for your partnership to be dissolved.

Effect of DissolutionA partnership continues after dissolution only for the purpose of winding up its business. The partnership is terminated when the winding up of its business is completed.

Winding up is the process where the liquidator is appointed to settle and distribute the company's assets among the creditors and other relevant stakeholders. Dissolution takes place after the winding process is completed.

To dissolve your Kansas LLC, file the Limited Liability Company Certificate of Cancellation with the Kansas Secretary of State. Submit one original for filing. After processing, it will be mailed to the LLC.