Kansas Liquidation of Partnership is a critical process that occurs when a partnership decides to dissolve and terminate its operations. During this process, the partnership's assets are liquidated, debts are settled, and the remaining assets are distributed among the partners. It is essential for partners to understand the authority, rights, and obligations that they have during this liquidation process. In a Kansas Liquidation of Partnership, there are two main types: voluntary liquidation and involuntary liquidation. Voluntary liquidation occurs when the partners mutually agree to dissolve the partnership, whereas involuntary liquidation is initiated by external factors such as bankruptcy or court order. During the liquidation process, partners have certain authorities. They can actively participate in the decision-making process regarding the sale of assets, settling debts, and other related matters. Partners should be proactive in ensuring that the liquidation process is conducted efficiently and in accordance with the applicable laws and regulations. Partners also possess specific rights during the liquidation of a Kansas partnership. They have the right to receive a fair and equitable distribution of the remaining assets after settling all the debts and liabilities. It is crucial for partners to review the partnership agreement or Kansas partnership laws to understand their specific rights during the liquidation process. Additionally, partners may have the right to appoint a liquidator or take legal action in case any irregularities or misconduct occur during the liquidation process. However, along with rights, partners also bear certain obligations during the liquidation of a Kansas partnership. They have a fundamental obligation to act in good faith and in the best interest of the partnership and its creditors. Partners should diligently cooperate with the liquidator, provide all necessary information, and assist in the valuation and sale of assets. Furthermore, partners should fulfill their obligation to pay any outstanding debts or liabilities owed by the partnership. In summary, the liquidation of a Kansas partnership involves voluntary or involuntary dissolution, asset liquidation, debt settlement, and distribution of remaining assets. Partners have the authority to participate in decision-making, rights to equitable distribution, and obligations to act in the best interest of the partnership. Understanding these aspects is crucial for partners involved in a Kansas Liquidation of Partnership, as it ensures a fair and efficient winding up of the partnership's affairs.

Kansas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

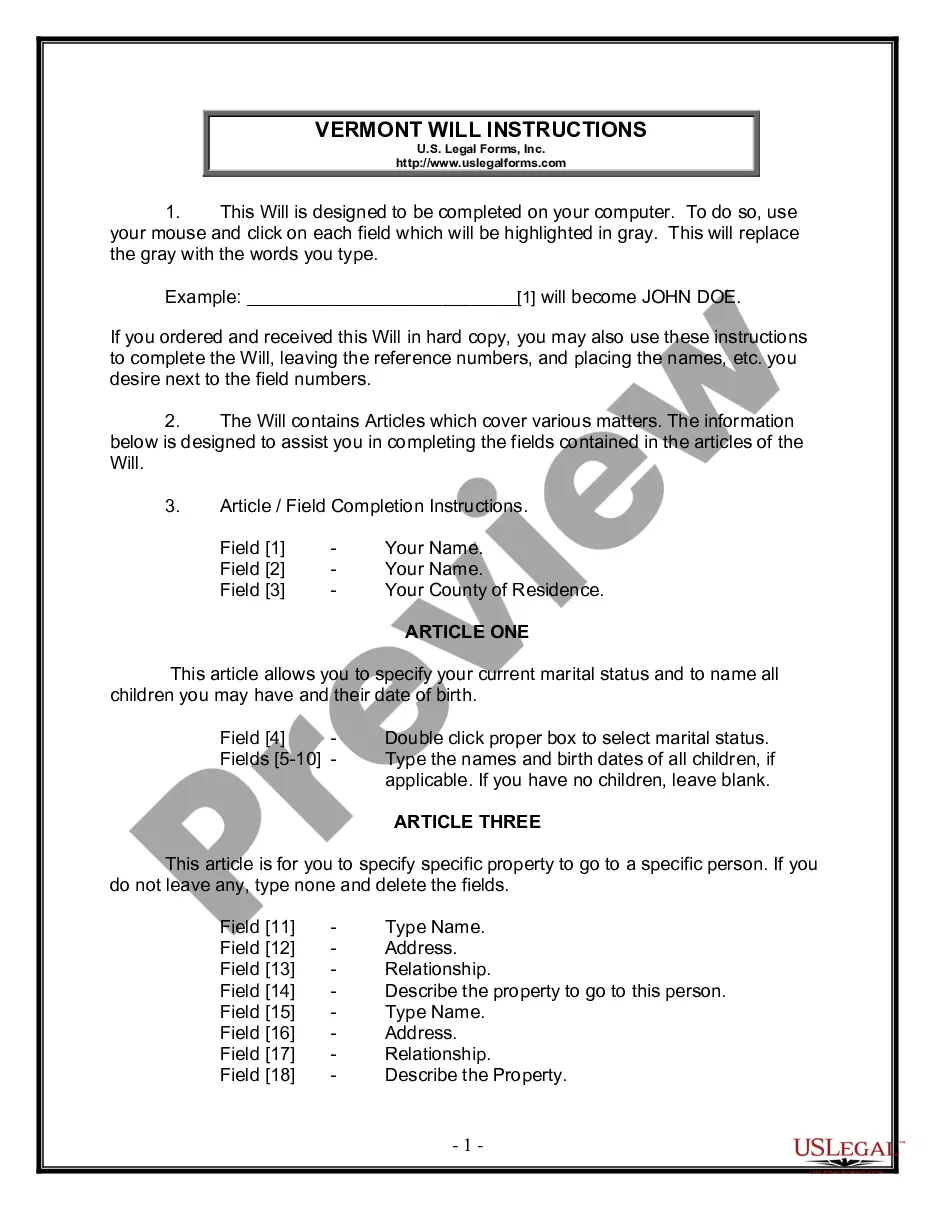

How to fill out Kansas Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

You are able to invest several hours on the Internet searching for the lawful document format that fits the state and federal demands you need. US Legal Forms supplies a huge number of lawful types that are analyzed by specialists. It is possible to download or print out the Kansas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation from my services.

If you already possess a US Legal Forms accounts, it is possible to log in and then click the Download button. Following that, it is possible to total, edit, print out, or sign the Kansas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation. Each and every lawful document format you get is your own property for a long time. To get yet another copy of any purchased kind, check out the My Forms tab and then click the related button.

If you use the US Legal Forms internet site the first time, follow the basic instructions listed below:

- Very first, ensure that you have selected the right document format to the region/town that you pick. Look at the kind outline to make sure you have selected the correct kind. If accessible, take advantage of the Review button to search with the document format at the same time.

- If you would like find yet another variation of your kind, take advantage of the Lookup area to discover the format that fits your needs and demands.

- After you have located the format you desire, just click Buy now to move forward.

- Find the prices plan you desire, type in your references, and register for your account on US Legal Forms.

- Full the deal. You may use your charge card or PayPal accounts to purchase the lawful kind.

- Find the file format of your document and download it for your system.

- Make alterations for your document if needed. You are able to total, edit and sign and print out Kansas Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Download and print out a huge number of document web templates making use of the US Legal Forms web site, that offers the most important variety of lawful types. Use expert and condition-particular web templates to deal with your small business or individual needs.

Form popularity

FAQ

Liquidate means a formal closing down by a liquidator when there are still assets and liabilities to be dealt with. Dissolving a company is where the business is struck off the register at Companies House because it is now inactive.

If the partnership decides to liquidate, the assets of the partnership are sold, liabilities are paid off, and any remaining cash is distributed to the partners according to their capital account balances.

: the process of liquidating the assets of a partnership or corporation in order to pay creditors and make distributions to partners or shareholders upon dissolution.

Winding Up involves ending all business affairs and includes the closure of the company (including liquidation or dissolution), whilst Liquidation is specifically about selling off company assets in order to pay creditors and then closing the company.

The company itself can issue a petition for a winding up order if it resolves to do so on the grounds that it is insolvent, or by a creditor because the company is unable to pay its debts. Once the court has made a winding-up order, the company is in liquidation, and a liquidator will be appointed.

If a company goes into a liquidation process, its assets, i.e. property and stock, are "liquidated" - turned into cash for payment to the company's creditors, in order of priority. This results in your company being removed from the register at Companies House as it ceases to exist.

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

Liquidation is the process of converting a company's assets into cash, and using those funds to repay, as much as possible, the company's debts. Liquidation results in the company being shut down.

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.