Kansas Notice to Seller - Confirmation of Sale to Merchant

Description

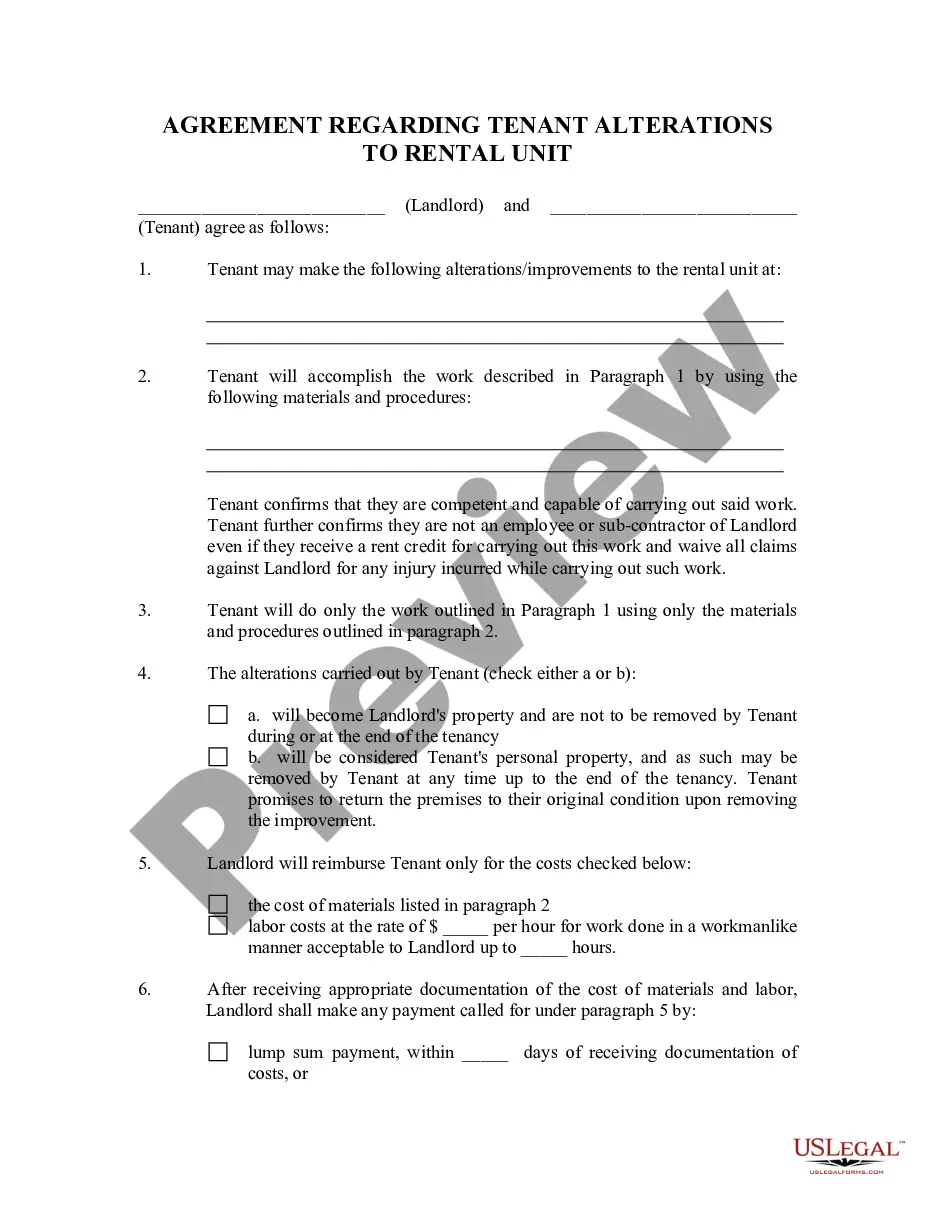

How to fill out Notice To Seller - Confirmation Of Sale To Merchant?

If you have to complete, download, or print out legal file web templates, use US Legal Forms, the greatest assortment of legal types, that can be found online. Make use of the site`s basic and convenient look for to discover the files you require. Various web templates for organization and individual reasons are sorted by groups and states, or key phrases. Use US Legal Forms to discover the Kansas Notice to Seller - Confirmation of Sale to Merchant within a few mouse clicks.

When you are already a US Legal Forms client, log in to your account and click the Down load switch to find the Kansas Notice to Seller - Confirmation of Sale to Merchant. Also you can accessibility types you previously downloaded in the My Forms tab of your own account.

If you use US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have selected the form for that appropriate city/nation.

- Step 2. Take advantage of the Review solution to examine the form`s content. Don`t overlook to read through the outline.

- Step 3. When you are unsatisfied with the type, utilize the Search area on top of the display to discover other models of the legal type web template.

- Step 4. Upon having found the form you require, select the Acquire now switch. Opt for the prices strategy you favor and add your qualifications to register for an account.

- Step 5. Method the deal. You can utilize your credit card or PayPal account to finish the deal.

- Step 6. Find the formatting of the legal type and download it on the device.

- Step 7. Comprehensive, change and print out or signal the Kansas Notice to Seller - Confirmation of Sale to Merchant.

Every legal file web template you get is your own for a long time. You might have acces to every single type you downloaded within your acccount. Select the My Forms segment and decide on a type to print out or download once more.

Remain competitive and download, and print out the Kansas Notice to Seller - Confirmation of Sale to Merchant with US Legal Forms. There are millions of expert and condition-particular types you may use to your organization or individual requirements.

Form popularity

FAQ

The term "nexus" is used in tax law to describe a situation in which a business has a tax presence in a particular state. A nexus is basically a connection between the taxing authority and an entity that must collect or pay the tax.

Kansas Sales Tax on Car Purchases:Kansas collects a 7.3% to 8.775% state sales tax rate on the purchase of all vehicles. There are also local taxes up to 1%, which will vary depending on region. In addition to taxes, car purchases in Kansas may be subject to other fees like registration, title, and plate fees.

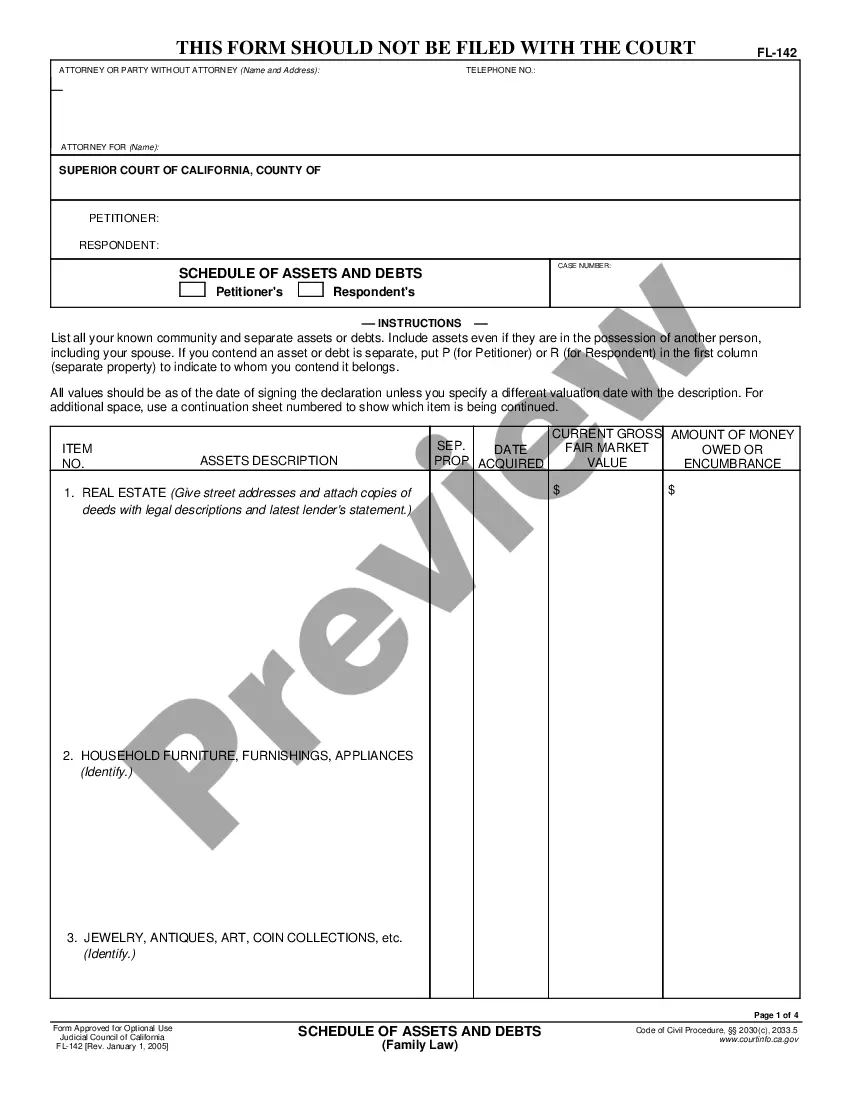

Details to Include in a Bill of SaleThe vehicle's make, model, year, and VIN (Vehicle Identification Number) Purchase price of the vehicle. Date of the sale. Signatures of both the buyer and seller and the date the document was signed.

In the state of Kansas, an antique vehicle is the only vehicle type that can be titled with just a bill of sale. To qualify as an antique vehicle, your automobile is required to be more than 35 years old and without any major alterations so that it is as close to its original form as possible.

Generally, a business has nexus in Kansas when it has a physical presence there, such as a retail store, warehouse, inventory, or the regular presence of traveling salespeople or representatives. However, out-of-state sellers can also establish nexus in the ways described below.

How Do I Write a Kansas Bill of Sale?Their names (printed)The date of the bill of sale.Certain information about the item being sold.The amount the item was sold for.The signatures of the involved parties.In some instances, the bill of sale may also need to be notarized.

After this process is complete, you need to fill out form TR-216 with information on the buyer, the seller, and the vehicle being sold and send it to the address on the form with a $10 fee. This is the Seller's Notification of Sale.

You might have nexus in a state if you sell goods to a customer in that state. Sales tax is a pass-through tax. Businesses in specific localities or states must collect sales tax from customers at the point of sale.

A Kansas bill of sale is a written record that documents the change in legal ownership of an item. In addition to being required to transfer the ownership of an item through a state agency, a Kansas bill of sale is an important part of personal record keeping.

Summary: Kansas has passed an economic nexus law, effective July 1, 2021, requiring that all out-of-state sellers and marketplace facilitators register for the collection and remittance of sales and compensating use tax if they have over $100,000 in gross sales during the previous or current calendar year.