Kansas Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits In the state of Kansas, the employment of executives comes with attractive compensation packages that often include a combination of salary, cash equivalent to stock dividends, and retirement benefits. These comprehensive packages are designed to attract and retain top talent, ensuring the financial stability and success of both the executives and the organizations they serve. Let's delve into the different types of Kansas Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits. 1. Base Salary: Kansas employers offer competitive base salaries to executives as the foundation of their compensation packages. The base salary reflects an executive's qualifications, experience, and specific job responsibilities. It serves as a regular income source and is subject to annual reviews and adjustments based on performance evaluations and market trends. 2. Cash Equivalent to Stock Dividends: In addition to salary, executives often receive cash equivalents to stock dividends. This component provides them with the opportunity to benefit from the success of the company and its stock performance. As the value of the stocks increases and dividends are paid out, executives receive cash payments equivalent to the dividends, further enhancing their income potential. 3. Retirement Benefits: Kansas employment of executives emphasizes long-term financial security through robust retirement benefits. Executives often have access to various retirement savings plans, including 401(k), 403(b), or pension schemes. Employers may offer matching contributions, allowing executives to grow their retirement funds faster. These plans assist executives in building a nest egg, ensuring financial stability after their professional careers. 4. Executive Bonus Programs: Kansas organizations may implement executive bonus programs to incentivize executives to achieve specific performance targets. Executives who exceed their goals are eligible for substantial cash bonuses, often tied to the organization's financial performance or their individual achievements. Such programs provide executives with additional income opportunities and motivate them to drive the success of the company. 5. Stock Options and Equity Grants: To align the interests of executives with long-term company growth, Kansas employers frequently grant stock options or equity awards. These equity-based compensation plans give executives the right to purchase company stocks at a predetermined price or receive shares directly. As the company thrives, these grants gain value, bolstering the executive's overall wealth. 6. Deferred Compensation: Some Kansas employers provide executives with deferred compensation plans, allowing them to delay a portion of their salary and bonuses to a specified future date. Deferred compensation can be invested in various vehicles such as stocks, bonds, or mutual funds, further enhancing the potential for growth. This option enables executives to defer income tax and receive distributions during retirement when their tax liabilities might be lower. It is important to note that each organization may structure its compensation packages differently, tailoring them to meet the needs and goals of executives while complying with state and federal regulations. Kansas Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits encompasses a variety of components ensuring competitive compensation and post-retirement financial security for top executives in the state of Kansas.

Kansas Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits

Description

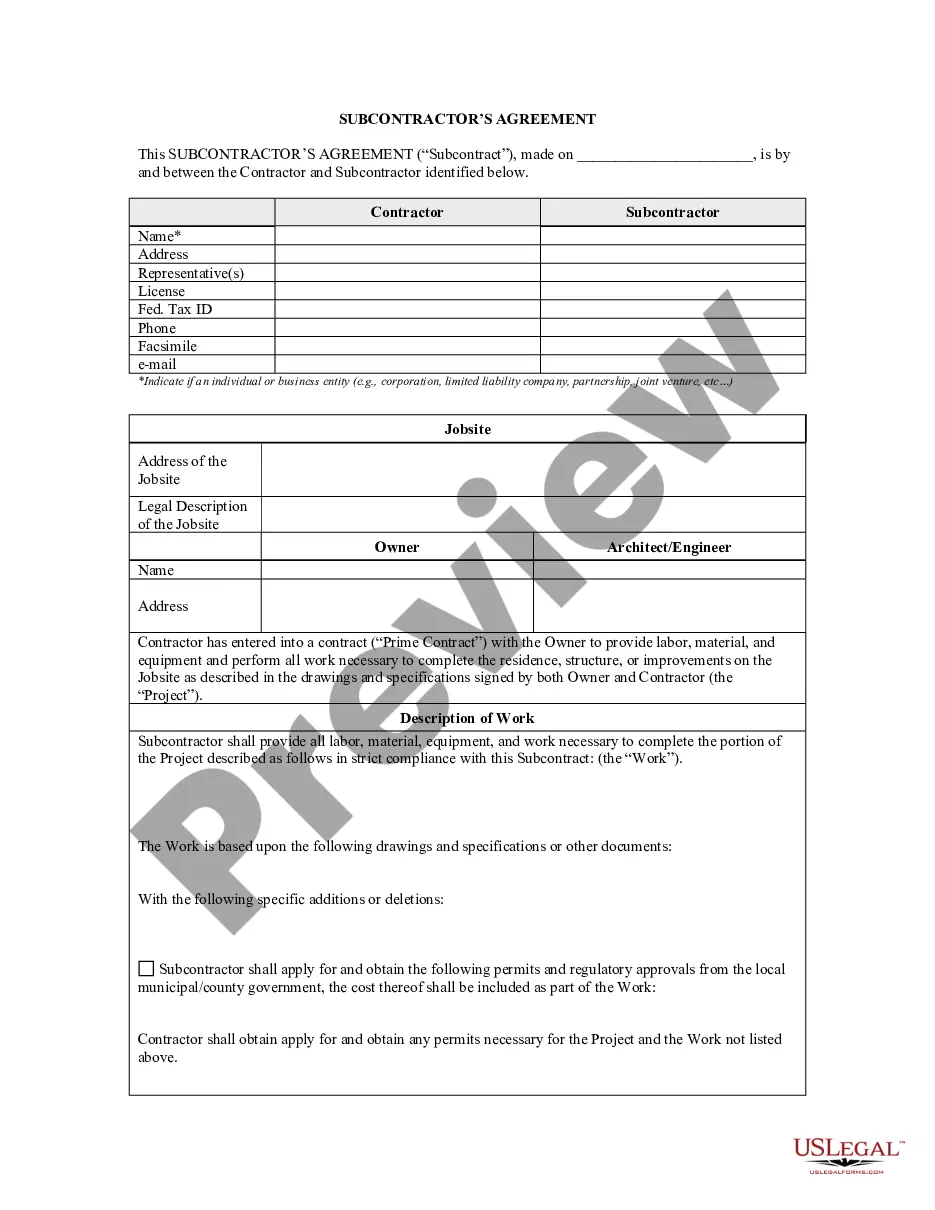

How to fill out Kansas Employment Of Executive With Salary Plus Cash Equivalent To Stock Dividends And Retirement Benefits?

Choosing the best legitimate record template can be a have a problem. Of course, there are a lot of web templates available online, but how can you get the legitimate type you require? Use the US Legal Forms web site. The support provides thousands of web templates, for example the Kansas Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits, which can be used for business and personal demands. All of the kinds are checked by pros and satisfy state and federal needs.

Should you be presently authorized, log in for your bank account and click the Down load key to obtain the Kansas Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits. Make use of bank account to search with the legitimate kinds you might have acquired earlier. Check out the My Forms tab of your bank account and get an additional version of your record you require.

Should you be a fresh customer of US Legal Forms, allow me to share easy guidelines for you to stick to:

- Very first, be sure you have selected the appropriate type for the area/state. You may look over the shape making use of the Review key and study the shape explanation to guarantee it is the right one for you.

- In case the type does not satisfy your preferences, take advantage of the Seach area to find the appropriate type.

- When you are certain that the shape is suitable, go through the Get now key to obtain the type.

- Pick the pricing program you would like and enter in the necessary details. Design your bank account and purchase your order with your PayPal bank account or credit card.

- Choose the file formatting and download the legitimate record template for your system.

- Comprehensive, edit and print and indication the received Kansas Employment of Executive with Salary plus Cash Equivalent to Stock Dividends and Retirement Benefits.

US Legal Forms is definitely the greatest collection of legitimate kinds in which you will find a variety of record web templates. Use the service to download expertly-made papers that stick to state needs.