Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders is a legal process that outlines the steps involved in dissolving a corporation in the state of Kansas. This resolution serves as the official document that authorizes the dissolution and provides guidelines for the distribution of assets, settlement of liabilities, and the overall winding up of the corporation's affairs. Here is a detailed description of what this resolution entails: 1. Purpose and Background: The Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders is drafted with the objective of initiating the orderly dissolution of a corporation. Whether due to financial difficulties, a change in business strategy, or other reasons, the directors have determined that it is in the best interest of the corporation and its stockholders to dissolve the entity. 2. Authority and Approval: The resolution acknowledges that the corporation's board of directors has the authority to initiate the dissolution process. It states the legal basis for such authority, which may be derived from statutes, the corporation's bylaws, or the articles of incorporation, among others. The resolution should also indicate the level of approval required from the directors to proceed with the dissolution. 3. Proposing Dissolution to Stockholders: The resolution addresses the requirement to obtain the approval of the corporation's stockholders. It outlines the procedure to submit the proposed dissolution to the stockholders for their consideration and approval. This may involve sending a notice that includes the proposition, along with a detailed explanation of the reasons for dissolution and the implications for the stockholders. 4. Stockholder Meeting: The resolution specifies the date, time, and location of the stockholder meeting where the proposition will be discussed. It also highlights the need to provide adequate notice to all stockholders according to Kansas state laws and the corporation's bylaws. The resolution may include provisions for both physical and virtual meetings to accommodate a diverse group of stockholders. 5. Dissolution Approval Threshold: The resolution defines the minimum approval threshold required from the stockholders for the dissolution proposition to be accepted. This threshold could be a majority vote, a two-thirds majority, or any other percentage stipulated by the corporation's governing documents or applicable laws. 6. Distribution of Assets and Liabilities: The resolution outlines the steps to be taken regarding the distribution of the corporation's assets and settlement of liabilities. It may include provisions for conducting a thorough inventory of the assets, paying off debts, and properly allocating any remaining assets among the stockholders. 7. Winding Up of Affairs: The resolution details the responsibilities of the directors, officers, and other individuals involved in the dissolution process regarding the winding up of the corporation's affairs. It may outline tasks such as the termination of contracts, resolution of legal matters, notification of regulatory authorities, and proper filing of required documents with the Secretary of State. 8. Appointment of Legal Counsel and Other Advisors: The resolution empowers the board of directors to engage legal counsel and other advisors to navigate the complexities of the dissolution process. It highlights the importance of seeking professional guidance to ensure compliance with all legal and regulatory requirements. Different Types of Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders: While the fundamental elements of a Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders tend to be consistent, the specific terms and provisions may vary depending on the circumstances. Some scenarios that could lead to different types of resolutions include: 1. Solvent Dissolution: When a corporation is solvent, meaning it can pay off all its debts and liabilities and distribute the remaining assets to its stockholders, the resolution will focus on the orderly liquidation and distribution process. 2. Insolvent Dissolution: In the event that a corporation is insolvent, meaning it cannot pay off all its debts and liabilities, the resolution will likely involve provisions for creditors' claims and guidance on how to handle potential disputes. 3. Merger or Acquisition: If the dissolution is a result of a merger or acquisition, the resolution may include specific terms addressing the transfer of assets and liabilities to the acquiring entity, as well as the rights and benefits of the stockholders in the new entity. 4. Voluntary Dissolution: This type of resolution is initiated by the board of directors based on internal decisions rather than external factors. It may require additional justifications and explanations for the stockholders' consideration. In conclusion, the Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders is a crucial legal document that ensures a structured and lawful dissolution process. It outlines the authority of the directors, proposes the dissolution to stockholders, establishes approval thresholds, addresses asset distribution and liability settlement, and covers various other aspects related to the winding up of the corporation. The different types of resolutions may vary based on factors such as solvency, merger/acquisition, or voluntary dissolution.

Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders

Description

How to fill out Kansas Resolution Of Directors To Dissolve Corporation With Submission Of Proposition To Stockholders?

If you have to full, download, or printing legal papers templates, use US Legal Forms, the biggest collection of legal types, that can be found on the Internet. Make use of the site`s simple and easy hassle-free search to obtain the papers you want. A variety of templates for business and specific functions are categorized by groups and states, or search phrases. Use US Legal Forms to obtain the Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders with a handful of click throughs.

In case you are already a US Legal Forms consumer, log in to the accounts and click on the Obtain switch to have the Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders. You can even entry types you formerly saved from the My Forms tab of the accounts.

Should you use US Legal Forms initially, follow the instructions listed below:

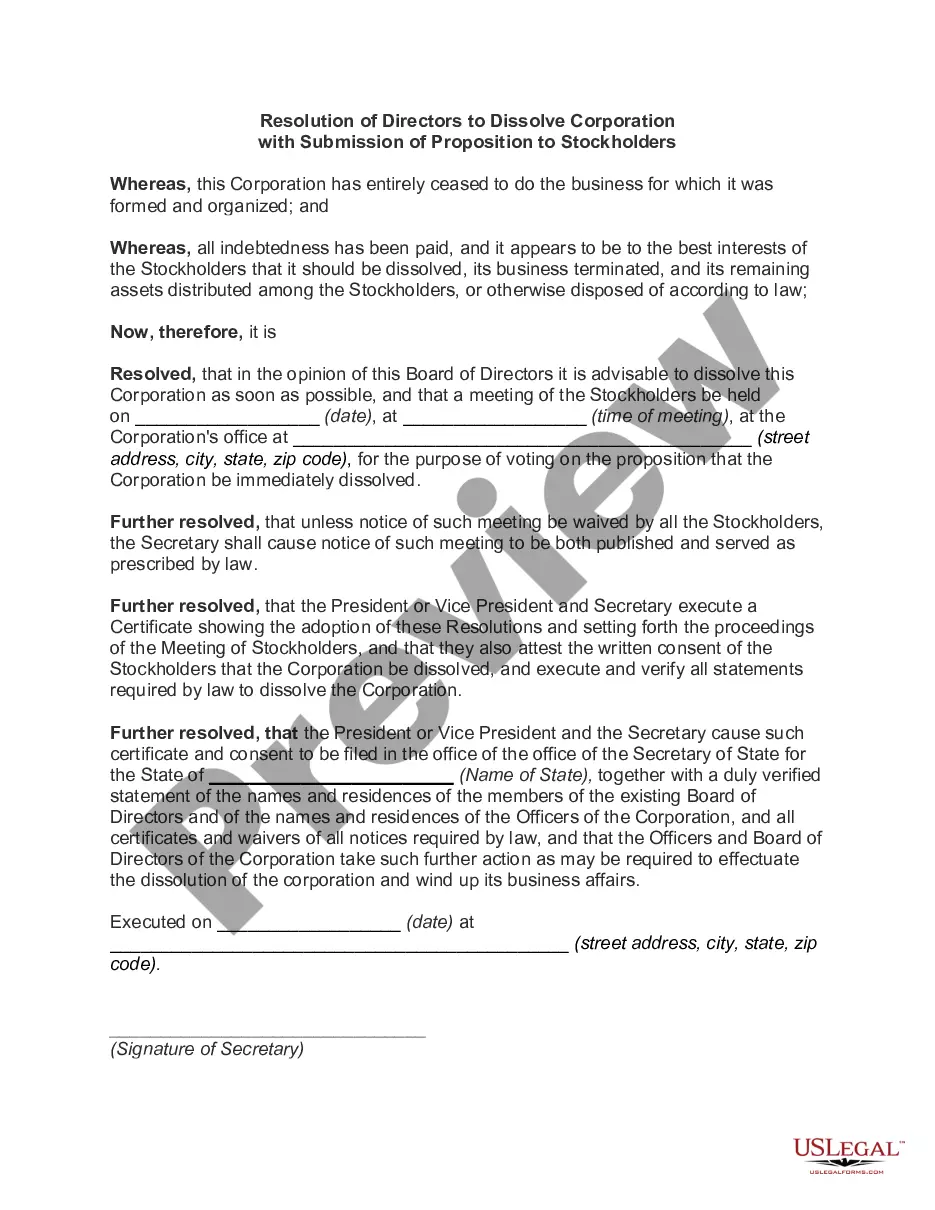

- Step 1. Ensure you have selected the shape for your correct area/region.

- Step 2. Take advantage of the Preview option to look over the form`s content. Do not forget about to read the explanation.

- Step 3. In case you are not satisfied with all the develop, utilize the Research discipline on top of the display to get other variations in the legal develop design.

- Step 4. Upon having located the shape you want, go through the Purchase now switch. Choose the costs plan you choose and add your accreditations to sign up to have an accounts.

- Step 5. Method the purchase. You should use your bank card or PayPal accounts to finish the purchase.

- Step 6. Find the structure in the legal develop and download it on the gadget.

- Step 7. Full, revise and printing or signal the Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders.

Each legal papers design you purchase is yours permanently. You might have acces to each develop you saved with your acccount. Select the My Forms portion and decide on a develop to printing or download yet again.

Remain competitive and download, and printing the Kansas Resolution of Directors to Dissolve Corporation with Submission of Proposition to Stockholders with US Legal Forms. There are thousands of professional and express-particular types you can utilize for your business or specific demands.