The Kansas Agreement for Auditing Services between an Accounting Firm and a Municipality is a legally binding document that outlines the terms and conditions under which an accounting firm will provide auditing services to a municipality located in the state of Kansas. This agreement ensures that both parties are protected and have a clear understanding of their roles, responsibilities, and expectations. The agreement typically begins with an introductory section that identifies the accounting firm and the municipality involved in the agreement. It includes their legal names, addresses, and contact information. Next, the agreement defines the scope of the auditing services to be performed. This section outlines the specific tasks that the accounting firm will undertake during the audit process, such as reviewing financial records, evaluating internal controls, testing compliance with laws and regulations, and preparing financial statements. The agreement also outlines the timeline for the auditing services, including the start and end dates of the engagement. It may specify the frequency of the audits (e.g., annual, biennial) and any interim reporting requirements. Another important aspect covered in the agreement is the fee structure. It details how the accounting firm will be compensated for their services, whether it is on an hourly basis, a flat fee, or a combination thereof. It may also include provisions for reimbursement of expenses incurred during the auditing process. Furthermore, the agreement addresses any conflicts of interest. It ensures that the accounting firm is free from any conflicts that may compromise their independence or objectivity in performing the audit. It may also include clauses relating to confidentiality and data protection to safeguard sensitive information. In some cases, Kansas may have specific types of agreements for auditing services between accounting firms and municipalities, depending on the nature and complexity of the engagement. For example: 1. Financial Statement Audit Agreement: This type of agreement focuses on the examination of an entity's financial statements, including balance sheets, income statements, and cash flow statements to provide an opinion on their fairness and accuracy. 2. Compliance Audit Agreement: This agreement focuses on assessing whether a municipality has complied with applicable laws, regulations, and internal policies. It ensures that the municipality's operations are in accordance with legal requirements and funding conditions. 3. Performance Audit Agreement: This type of agreement involves evaluating the efficiency, effectiveness, and economy of a municipality's operations. It focuses on identifying areas for improvement and recommending strategies to enhance performance. In conclusion, the Kansas Agreement for Auditing Services between an Accounting Firm and a Municipality is a comprehensive document that governs the relationship between the accounting firm and the municipality during the auditing process. It covers aspects such as scope, timeline, fees, conflicts of interest, confidentiality, and specific types of audits, ensuring a transparent and mutually beneficial engagement.

Kansas Agreement for Auditing Services between Accounting Firm and Municipality

Description

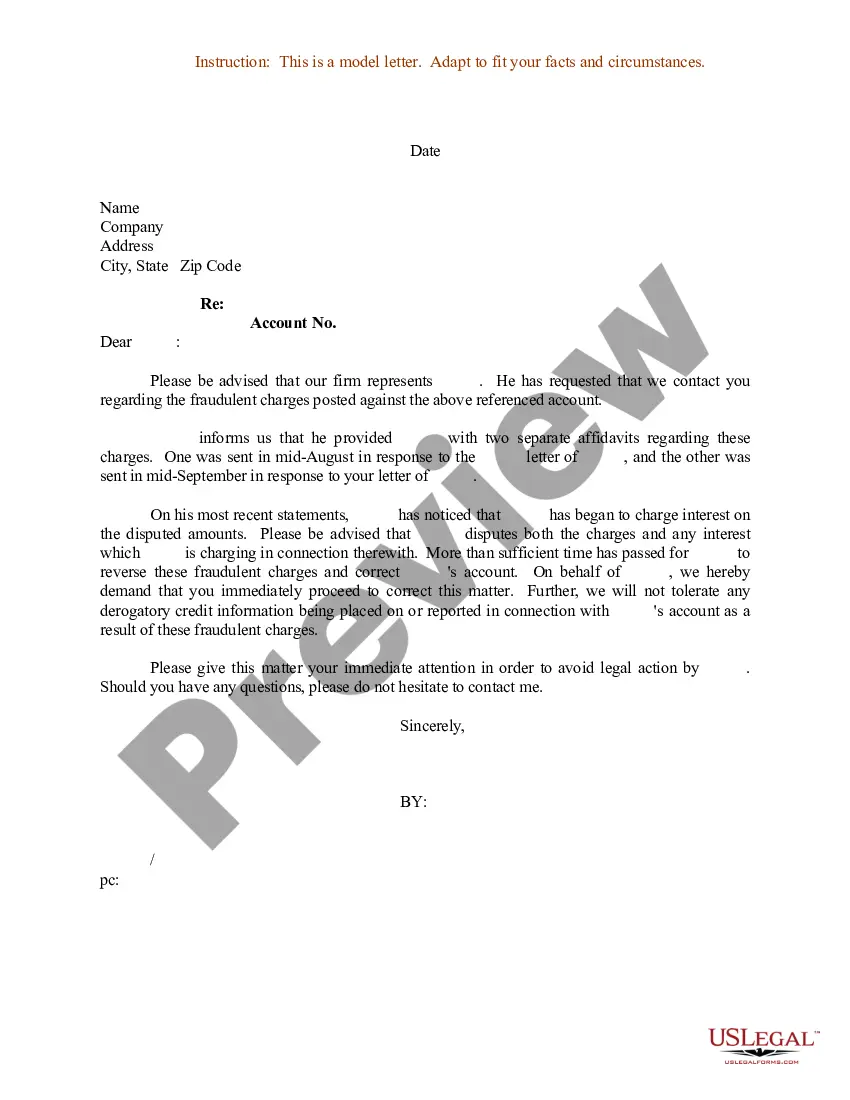

How to fill out Kansas Agreement For Auditing Services Between Accounting Firm And Municipality?

If you want to complete, acquire, or print out legitimate file layouts, use US Legal Forms, the greatest assortment of legitimate types, which can be found on-line. Utilize the site`s basic and practical search to find the papers you will need. Numerous layouts for business and person purposes are sorted by types and says, or key phrases. Use US Legal Forms to find the Kansas Agreement for Auditing Services between Accounting Firm and Municipality within a couple of mouse clicks.

If you are presently a US Legal Forms client, log in in your accounts and click the Down load key to find the Kansas Agreement for Auditing Services between Accounting Firm and Municipality. You can also access types you in the past acquired in the My Forms tab of the accounts.

If you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for your correct city/country.

- Step 2. Utilize the Preview option to look through the form`s content material. Do not neglect to read through the explanation.

- Step 3. If you are not happy with the develop, utilize the Research area near the top of the display screen to find other versions in the legitimate develop web template.

- Step 4. After you have identified the form you will need, click on the Get now key. Choose the pricing plan you prefer and add your references to register for the accounts.

- Step 5. Approach the purchase. You can utilize your Мisa or Ьastercard or PayPal accounts to perform the purchase.

- Step 6. Pick the file format in the legitimate develop and acquire it on the system.

- Step 7. Comprehensive, revise and print out or sign the Kansas Agreement for Auditing Services between Accounting Firm and Municipality.

Every legitimate file web template you buy is yours for a long time. You have acces to each and every develop you acquired with your acccount. Click on the My Forms section and choose a develop to print out or acquire once more.

Remain competitive and acquire, and print out the Kansas Agreement for Auditing Services between Accounting Firm and Municipality with US Legal Forms. There are millions of professional and condition-particular types you can use to your business or person needs.