Kansas Payroll Deduction — Special Services is a program offered by the state of Kansas that allows employees to opt for specific payroll deduction services. This initiative aims to help individuals manage their finances, contribute to savings programs, and support charitable causes conveniently. The Kansas Payroll Deduction — Special Services program encompasses various types of special service options. One type of Kansas Payroll Deduction — Special Service is the Health Insurance Deduction. Through this service, employees can have their health insurance premiums deducted from their paychecks automatically. This ensures that they have continuous coverage without the hassle of making monthly payments manually. Another type of special service is the Retirement Savings Deduction. With this option, employees can have a portion of their earnings withheld and redirected to their retirement savings accounts. The Kansas Payroll Deduction — Special Services program facilitates contributions to retirement plans such as a 401(k) or IRA, helping employees build a secure future. Moreover, the program also incorporates the Charitable Donation Deduction. Employees can choose to contribute to charitable organizations through payroll deductions. This provides a convenient and structured way for individuals to support causes they care about, while also potentially reducing their taxable income. Additionally, Kansas Payroll Deduction — Special Services may comprise Education Savings Deductions, allowing employees to allocate funds towards savings plans for educational expenses like college tuition or vocational training programs. This enables individuals to steadily build savings for their or their dependents' educational pursuits. The Kansas Payroll Deduction — Special Services initiative caters to employees across various industries and sectors. It aids in optimizing personal financial management, simplifying contributions, and ensuring timely payments towards health insurance, retirement savings, charitable donations, and education savings. By participating in this program, employees can align their financial goals with ease and convenience. In summary, Kansas Payroll Deduction — Special Services offers employees a range of options to automate deductions from their paychecks for essential expenses such as health insurance and retirement savings, as well as charitable donations and education savings. This program is designed to promote financial well-being and convenience for individuals in Kansas by enabling them to allocate funds towards important areas of their lives directly from their earnings.

Kansas Payroll Deduction - Special Services

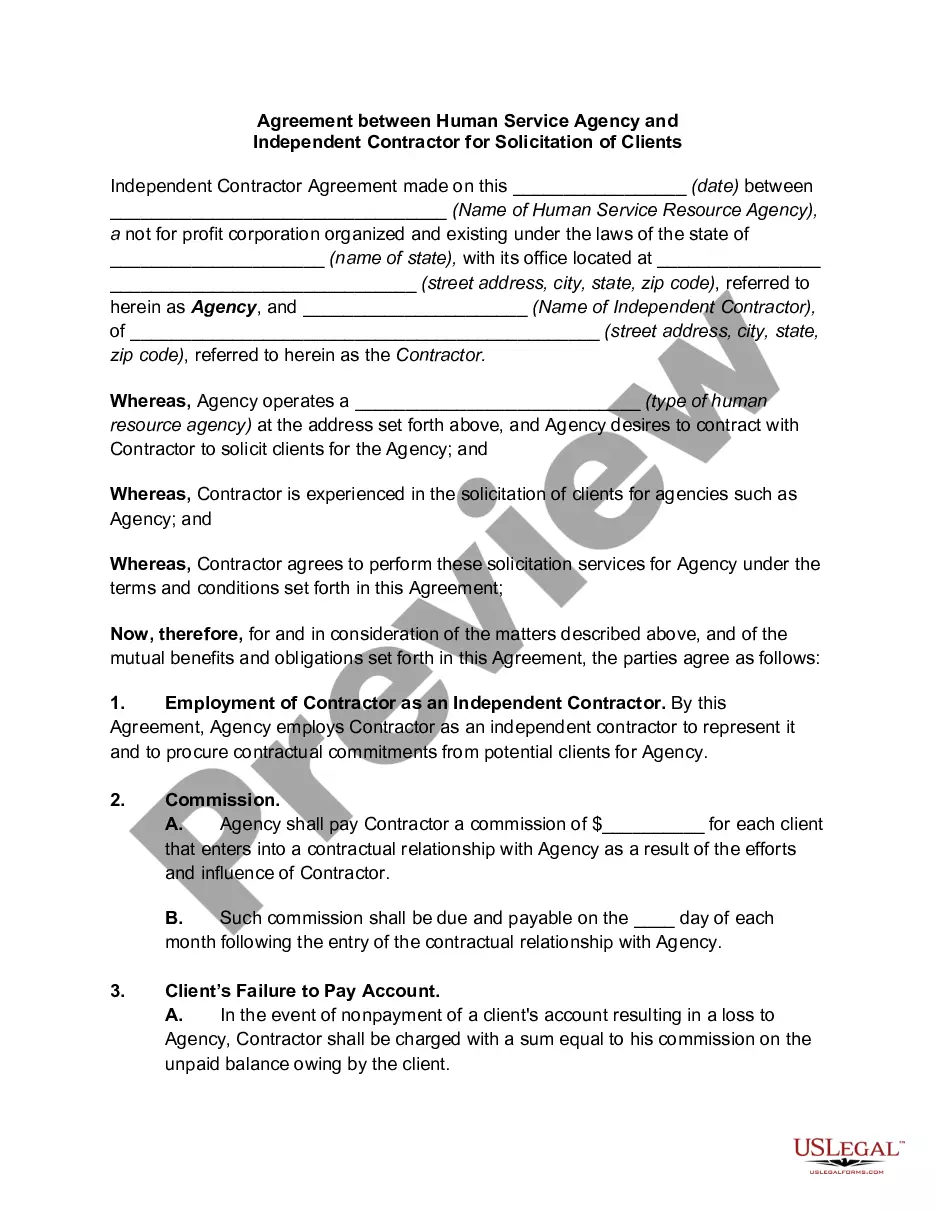

Description

How to fill out Kansas Payroll Deduction - Special Services?

You may devote time on the web attempting to find the authorized document web template that meets the federal and state needs you need. US Legal Forms offers a large number of authorized types that happen to be evaluated by pros. You can actually down load or printing the Kansas Payroll Deduction - Special Services from the support.

If you already possess a US Legal Forms bank account, you can log in and click the Down load option. Afterward, you can complete, edit, printing, or signal the Kansas Payroll Deduction - Special Services. Every authorized document web template you acquire is the one you have for a long time. To acquire an additional version for any acquired kind, visit the My Forms tab and click the related option.

If you are using the US Legal Forms internet site initially, follow the easy directions under:

- Very first, make sure that you have selected the best document web template to the area/town of your choosing. Read the kind description to ensure you have selected the appropriate kind. If accessible, use the Preview option to search from the document web template as well.

- If you would like get an additional variation from the kind, use the Search discipline to discover the web template that meets your requirements and needs.

- Upon having located the web template you would like, simply click Acquire now to carry on.

- Pick the rates plan you would like, type your qualifications, and register for your account on US Legal Forms.

- Comprehensive the deal. You should use your charge card or PayPal bank account to fund the authorized kind.

- Pick the formatting from the document and down load it to the system.

- Make modifications to the document if possible. You may complete, edit and signal and printing Kansas Payroll Deduction - Special Services.

Down load and printing a large number of document layouts while using US Legal Forms Internet site, that provides the most important collection of authorized types. Use expert and express-certain layouts to take on your business or individual requires.