The Kansas Fair Credit Act Disclosure Notice is an important legal document that outlines the rights and responsibilities of both consumers and creditors in credit transactions within the state of Kansas. This notice is designed to ensure transparency and fairness in lending practices and protect consumers from deceptive or unscrupulous lending practices. The Kansas Fair Credit Act Disclosure Notice provides a comprehensive overview of the terms and conditions of credit agreements, including information about interest rates, fees, and repayment terms. It also highlights the rights and remedies available to consumers in case of any violations or disputes. Key keywords related to the Kansas Fair Credit Act Disclosure Notice include "Kansas Fair Credit Act," "disclosure notice," "rights of consumers," "creditor responsibilities," "interest rates," "fees," "repayment terms," and "dispute resolution." There are different types of Kansas Fair Credit Act Disclosure Notices that may be applicable depending on the nature of the credit transaction. Some of these variations include: 1. Kansas Fair Credit Act Auto Loan Disclosure Notice: This specific notice is used for credit agreements related to purchasing vehicles, whether new or used. It includes details such as the loan amount, interest rate, term length, and any specific terms related to the auto loan. 2. Kansas Fair Credit Act Mortgage Disclosure Notice: This notice is specifically used for home mortgage loans. It includes important details about the loan, such as the loan amount, interest rate, repayment term, and any specific terms or conditions related to the mortgage. 3. Kansas Fair Credit Act Credit Card Agreement Disclosure Notice: This notice is utilized for credit card agreements. It outlines the terms and conditions of credit card usage, such as the annual percentage rate (APR), grace period, late payment fees, and any other charges or penalties. It is essential for both consumers and creditors to understand and comply with the Kansas Fair Credit Act Disclosure Notice to ensure fair and transparent lending practices. Consumers should carefully review the notice before entering into any credit agreement, while creditors must provide accurate and complete information in accordance with the law to protect consumers' rights.

Kansas Fair Credit Act Disclosure Notice

Description

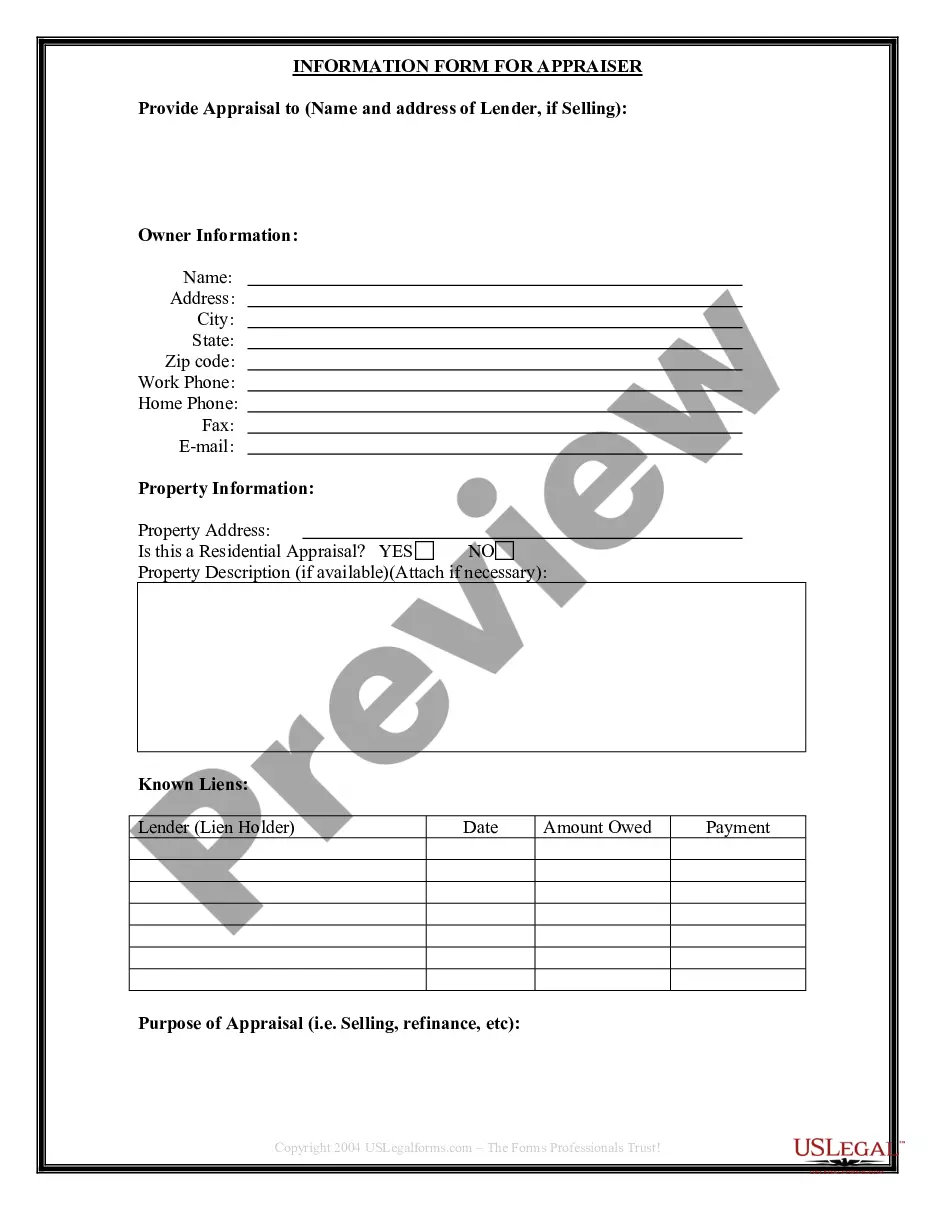

How to fill out Kansas Fair Credit Act Disclosure Notice?

If you want to total, obtain, or print out lawful record layouts, use US Legal Forms, the most important assortment of lawful varieties, that can be found on the web. Make use of the site`s simple and easy handy look for to get the documents you want. A variety of layouts for company and personal uses are categorized by classes and claims, or key phrases. Use US Legal Forms to get the Kansas Fair Credit Act Disclosure Notice in just a few clicks.

Should you be presently a US Legal Forms buyer, log in for your account and click the Down load switch to obtain the Kansas Fair Credit Act Disclosure Notice. You may also accessibility varieties you earlier downloaded within the My Forms tab of your account.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for your proper city/country.

- Step 2. Take advantage of the Review method to examine the form`s content. Never forget about to learn the outline.

- Step 3. Should you be unsatisfied using the type, take advantage of the Look for area near the top of the display screen to find other versions of the lawful type design.

- Step 4. After you have found the shape you want, click on the Get now switch. Select the rates plan you like and add your credentials to sign up on an account.

- Step 5. Procedure the transaction. You can use your bank card or PayPal account to finish the transaction.

- Step 6. Choose the format of the lawful type and obtain it on your own device.

- Step 7. Comprehensive, edit and print out or indication the Kansas Fair Credit Act Disclosure Notice.

Every lawful record design you get is yours eternally. You may have acces to each type you downloaded within your acccount. Click on the My Forms segment and decide on a type to print out or obtain again.

Remain competitive and obtain, and print out the Kansas Fair Credit Act Disclosure Notice with US Legal Forms. There are millions of specialist and express-certain varieties you can use to your company or personal requires.

Form popularity

FAQ

The Fair Credit Reporting Act (FCRA) is a federal law that requires you to make a disclosure to employees or applicants informing them that you will obtain a consumer report about them for employment consideration purposes.

A creditor must disclose a consumer's credit score and information relating to a credit score on a risk-based pricing notice when the score of the consumer to whom the creditor extends credit or whose extension of credit is under review is used in setting the material terms of credit.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

2022 You have the right to know what is in your file. report; 2022 you are the victim of identity theft and place a fraud alert in your file; 2022 your file contains inaccurate information as a result of fraud; 2022 you are on public assistance; 2022 you are unemployed but expect to apply for employment within 60 days.

Under the FCRA, an employer may not run a background check on a prospective employee without first providing "a clear and conspicuous disclosure . . . in a document that consists solely of that disclosure, that a consumer report may be obtained for employment purposes." For efficiency, many employers include all

A Credit Score Disclosure alerts a consumer of their FICO scores, defines what a FICO is, informs how FICO scores affect their access to consumer credit and provides contact information for the bureaus.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

2022 You have the right to know what is in your file. report; 2022 you are the victim of identity theft and place a fraud alert in your file; 2022 your file contains inaccurate information as a result of fraud; 2022 you are on public assistance; 2022 you are unemployed but expect to apply for employment within 60 days.

On July 21, 2010, Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). Section 1100F of the Dodd-Frank Act amended the FCRA to require disclosure of credit scores and information relating to credit scores for both risk-based pricing and FCRA adverse action notices.

The Fair Credit Reporting Act describes the kind of data that the bureaus are allowed to collect. That includes the person's bill payment history, past loans, and current debts.