The Kansas Stop Annuity Request refers to a legal process in the state of Kansas that allows individuals to request the termination or cessation of annuity payments. Annuities are financial products typically offered by insurance companies and provide a steady stream of income to the annuitant over a specified period of time, often stretching into retirement years. The Kansas Stop Annuity Request can be initiated by annuitants who wish to halt the periodic disbursement of payments due to various reasons such as financial hardship, changes in personal circumstances, or investment requirements. This process helps annuitants regain control over their finances and make necessary adjustments to their financial plans. There are different types of Kansas Stop Annuity Requests that individuals may file based on their specific situations: 1. Kansas Stop Annuity Request for Financial Hardship: Individuals facing severe financial hardship or unexpected expenses may request a stoppage of annuity payments. This type of request enables annuitants to redirect funds towards urgent needs or to resolve financial crises. 2. Kansas Stop Annuity Request for Life Events: Major life events such as marriage, divorce, birth of a child, or the death of a loved one can significantly impact an individual's financial situation. In such cases, annuitants may file a stop request to modify their annuity payments to align with the changes in their circumstances. 3. Kansas Stop Annuity Request for Investment Opportunities: Sometimes, individuals may find lucrative investment opportunities that require immediate capital. By halting annuity payments temporarily, annuitants can access the accumulated funds and invest them in potentially more profitable ventures. 4. Kansas Stop Annuity Request for Annuity Conversion: Annuitants looking to convert their existing annuity contract into another form, such as a lump-sum payment or a different annuity product, can file a stop request to initiate the conversion process. 5. Kansas Stop Annuity Request for Contract Modifications: If an annuity holder wishes to modify certain terms of their annuity contract, such as the payment frequency, duration, or beneficiaries, they can utilize the Kansas Stop Annuity Request to initiate the necessary modifications. When filing a Kansas Stop Annuity Request, it is crucial for individuals to provide relevant documentation supporting their reasons for the stoppage and follow the legal procedures mandated by the State of Kansas. Consulting with a financial advisor or an attorney specializing in annuity laws can provide valuable guidance throughout the process. Keywords: Kansas Stop Annuity Request, annuity payments, termination, cessation, financial hardship, personal circumstances, investment requirements, financial plans, life events, marriage, divorce, birth of a child, death, investment opportunities, annuity conversion, lump-sum payment, contract modification, annuity contract, payment frequency, duration, beneficiaries, legal procedures, financial advisor, attorney, annuity laws.

Kansas Stop Annuity Request

Description

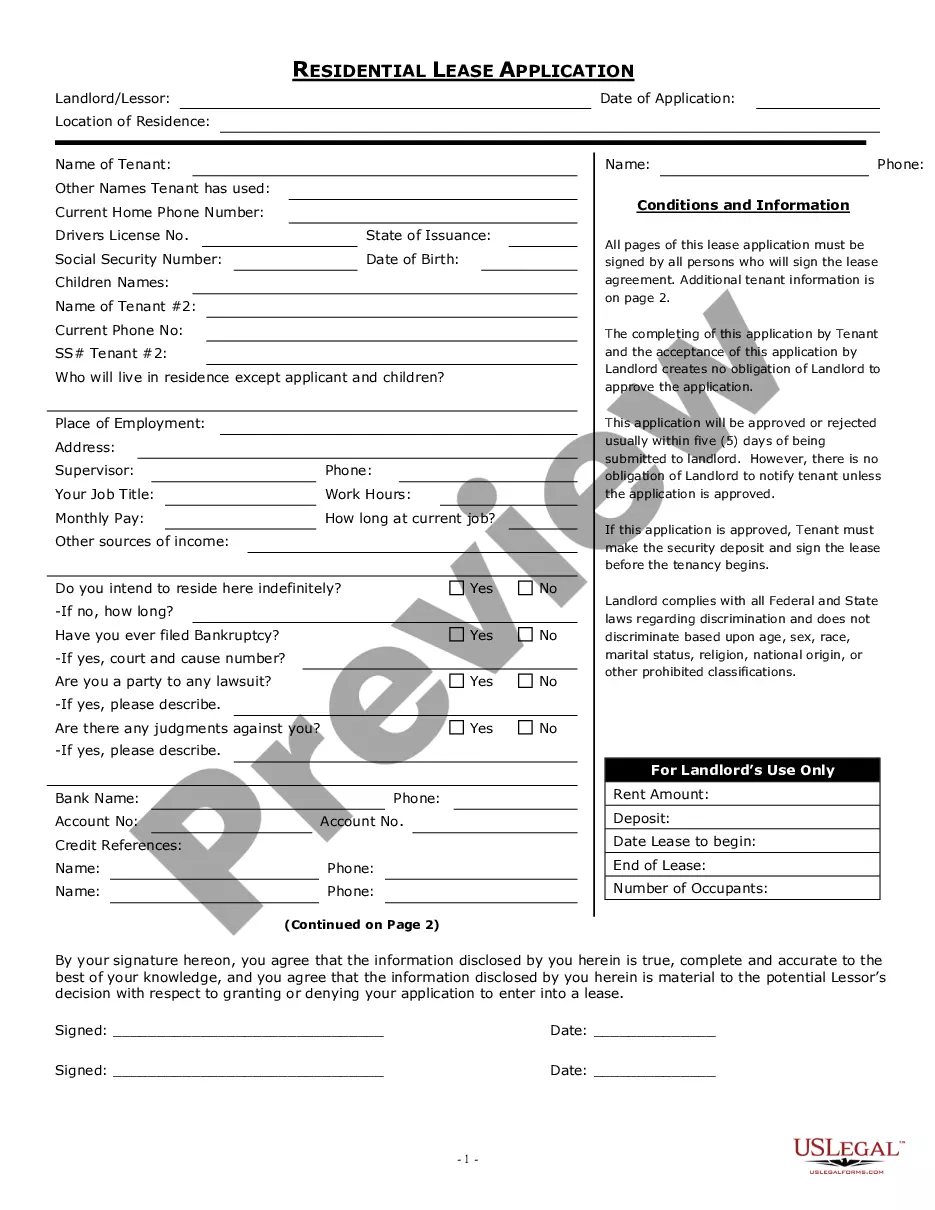

How to fill out Kansas Stop Annuity Request?

Discovering the right legal record web template might be a have a problem. Obviously, there are a variety of web templates available online, but how would you find the legal form you will need? Take advantage of the US Legal Forms website. The service offers a huge number of web templates, like the Kansas Stop Annuity Request, which you can use for enterprise and private needs. Every one of the types are checked out by pros and satisfy federal and state requirements.

In case you are currently authorized, log in for your accounts and click on the Acquire option to get the Kansas Stop Annuity Request. Use your accounts to look with the legal types you may have ordered formerly. Proceed to the My Forms tab of your respective accounts and obtain an additional backup from the record you will need.

In case you are a fresh user of US Legal Forms, here are straightforward instructions that you can adhere to:

- Initially, ensure you have selected the correct form to your town/state. You may look over the form making use of the Preview option and study the form outline to ensure this is the best for you.

- In case the form is not going to satisfy your requirements, take advantage of the Seach field to get the right form.

- When you are certain the form is acceptable, click the Get now option to get the form.

- Opt for the rates prepare you desire and type in the necessary info. Design your accounts and buy the order utilizing your PayPal accounts or bank card.

- Opt for the file structure and obtain the legal record web template for your gadget.

- Comprehensive, modify and printing and sign the attained Kansas Stop Annuity Request.

US Legal Forms is the largest local library of legal types where you can find a variety of record web templates. Take advantage of the service to obtain expertly-produced papers that adhere to express requirements.

Form popularity

FAQ

KPERS retiree benefits are safe and guaranteed by Kansas law. A retiree will receive his or her benefit for life, no matter the economic condition. Members who leave employment and withdraw their contributions before retirement will receive the full amount they have contributed, plus interest.

If the employee chooses KPERS, do a regular enrollment on the EWP. To opt out of KPERS, employees use a State Officer Retirement Plan Election form (KPERS-3S).

If you are a PERS member terminating employment and wish to withdraw your funds, download the form from the PERS website or contact PERS at (888) 320-7377 to request the form. For members of the Optional Retirement Plan (ORP) contact your carrier directly.

You may roll over the payment to either an IRA (an individual retirement account or individual retirement annuity) or an employer plan (a tax-qualified section 401(a) plan, section 403(b) plan, or governmental section 457(b) de ferred compensation plan) that will accept the rollover.

After five years of service you are guaranteed a retirement benefit, even if you leave employment. This is called vesting your benefit. If you leave employment before you're vested with five years of service, you'll need to withdraw your account balance.

While you may have the ability to access some of your investments, such as a 401(k), this isn't possible for the funds in your CalPERS pension account. There is only one instance where you can access your CalPERS pension contributions when you leave CalPERS employment.

Complete an Application for Withdrawal of Contributions. You can download one from our forms page, get one from your designated agent or call our office at 1-888-275-5737 to receive one by mail. Once we receive your completed application, please allow four weeks for payment.

If you contribute under the employee/employer contribution plan, you may withdraw your employee contributions if you terminate all employment for which a contribution is required or if you are employed in a position ineligible for membership for at least 90 days.

You can retire at age 55 with 10 years of service. Correctional members may be eligible to retire earlier than regular KPERS members. To be eligible, you must work in a Group A or B position for at least three years immediately before retirement.

If you are no longer employed by a PERS-participating employer, you may choose to withdraw the member contributions and earnings that have accumulated in your Individual Account Program (IAP), as long as certain conditions have been met. Doing so completely cancels your membership in OPSRP/PERS.