Kansas Exemption Statement — Texas is a legal document that allows certain individuals or entities in the state of Kansas to be exempt from specific taxes or regulations in Texas. This statement serves as proof for Kansas residents or organizations to claim exemptions in various areas. One type of Kansas Exemption Statement — Texas is the Sales Tax Exemption Statement. This statement is issued to Kansas residents or businesses that regularly make purchases in Texas and are exempt from paying sales tax on those purchases. This exemption applies to tangible personal property, such as goods or equipment, that are bought for resale, lease, or incorporated into products for sale. Another type of Kansas Exemption Statement — Texas is the Vehicle Registration Fee Exemption Statement. This statement is provided to Kansas residents who own a vehicle registered in Kansas but temporarily reside in Texas. It exempts them from paying vehicle registration fees, ensuring they are not required to register their vehicle in Texas while maintaining their Kansas registration. The Property Tax Exemption Statement is yet another type of Kansas Exemption Statement — Texas. This statement is granted to Kansas property owners who own properties in Texas but claim exemption from property taxes. It is typically applicable to properties owned by non-profit organizations or religious entities, which are exempt from paying property taxes in Kansas. The Income Tax Exemption Statement is also available as a type of Kansas Exemption Statement — Texas. This statement is issued to Kansas residents who derive income from Texas but are exempt from paying Texas state income taxes due to their Kansas residency. Overall, the Kansas Exemption Statement — Texas is a crucial document that allows Kansas residents and organizations to claim exemptions from various taxes in Texas. Whether it is sales tax, vehicle registration fees, property tax, or income tax, these statements provide legal proof of exemption, ensuring compliance with tax regulations in both states.

Kansas Exemption Statement

Description

How to fill out Kansas Exemption Statement?

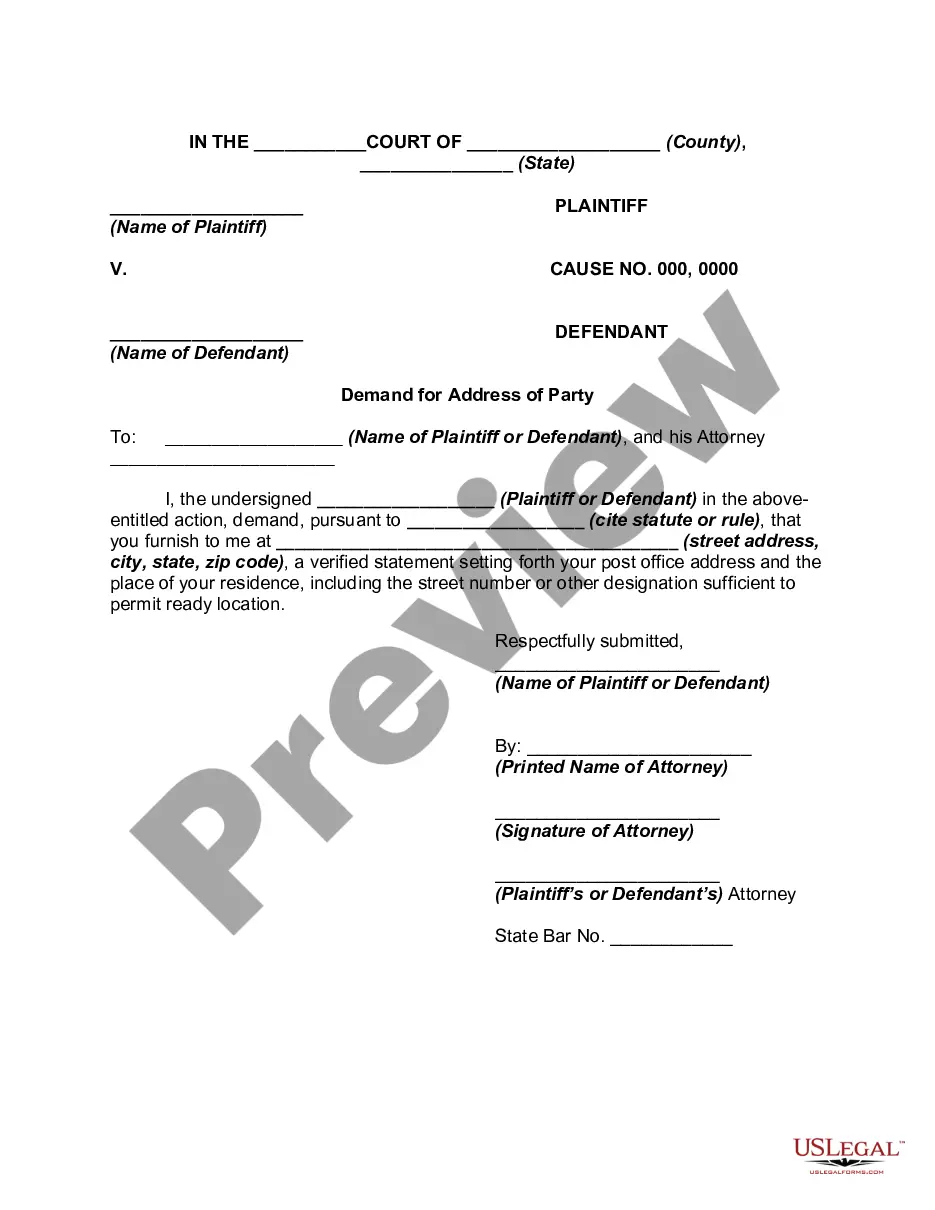

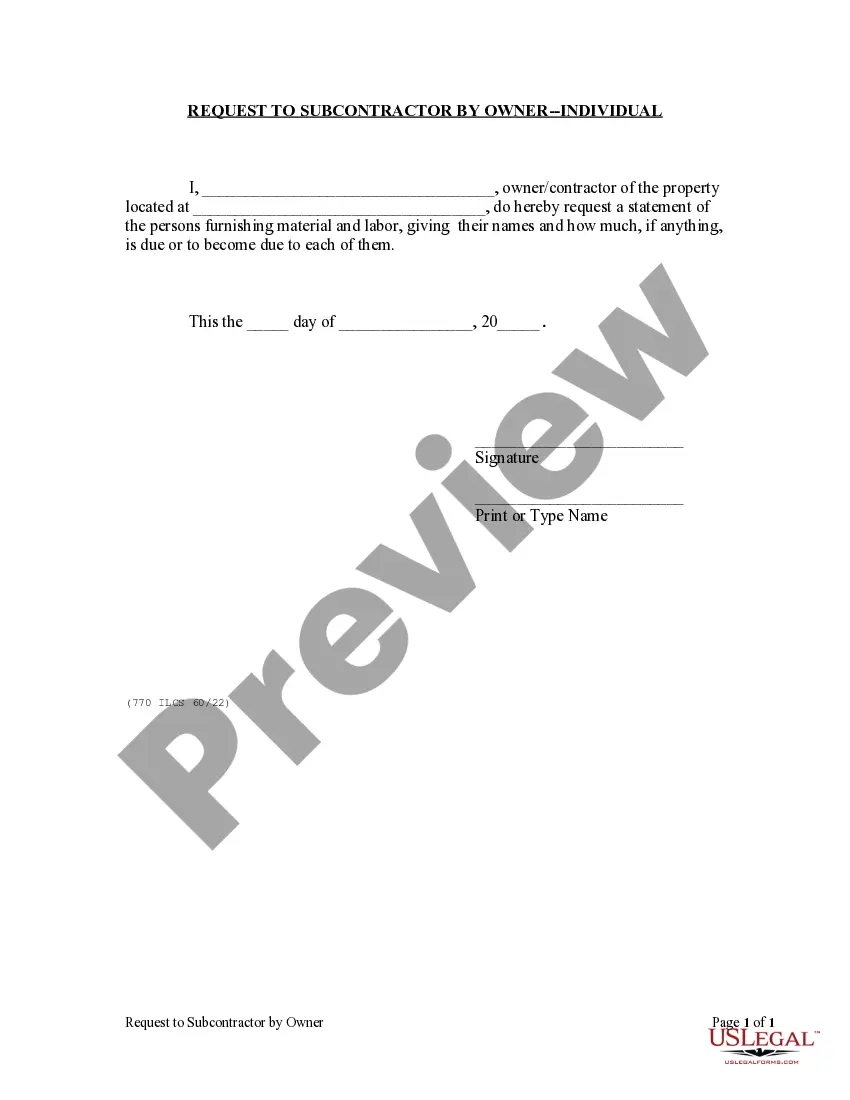

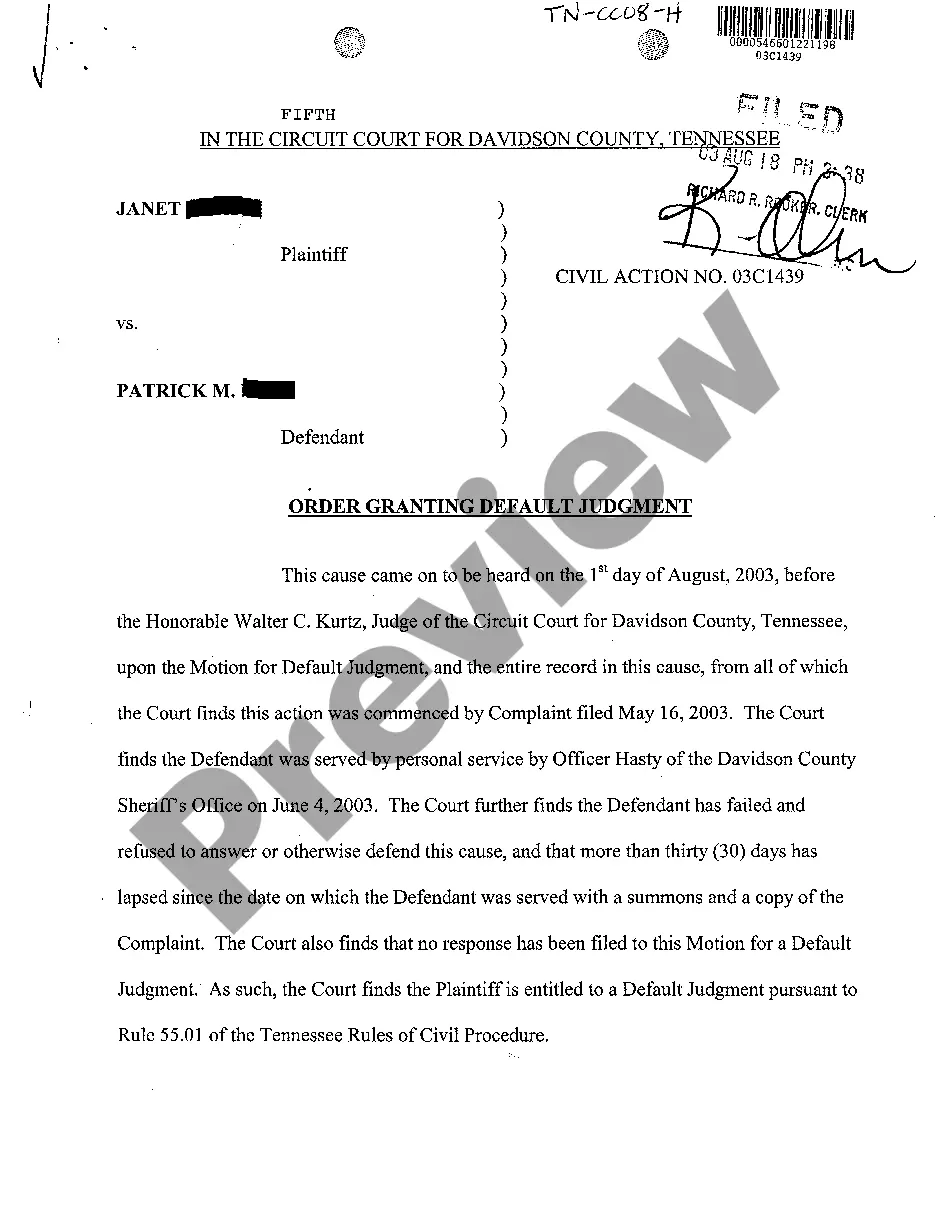

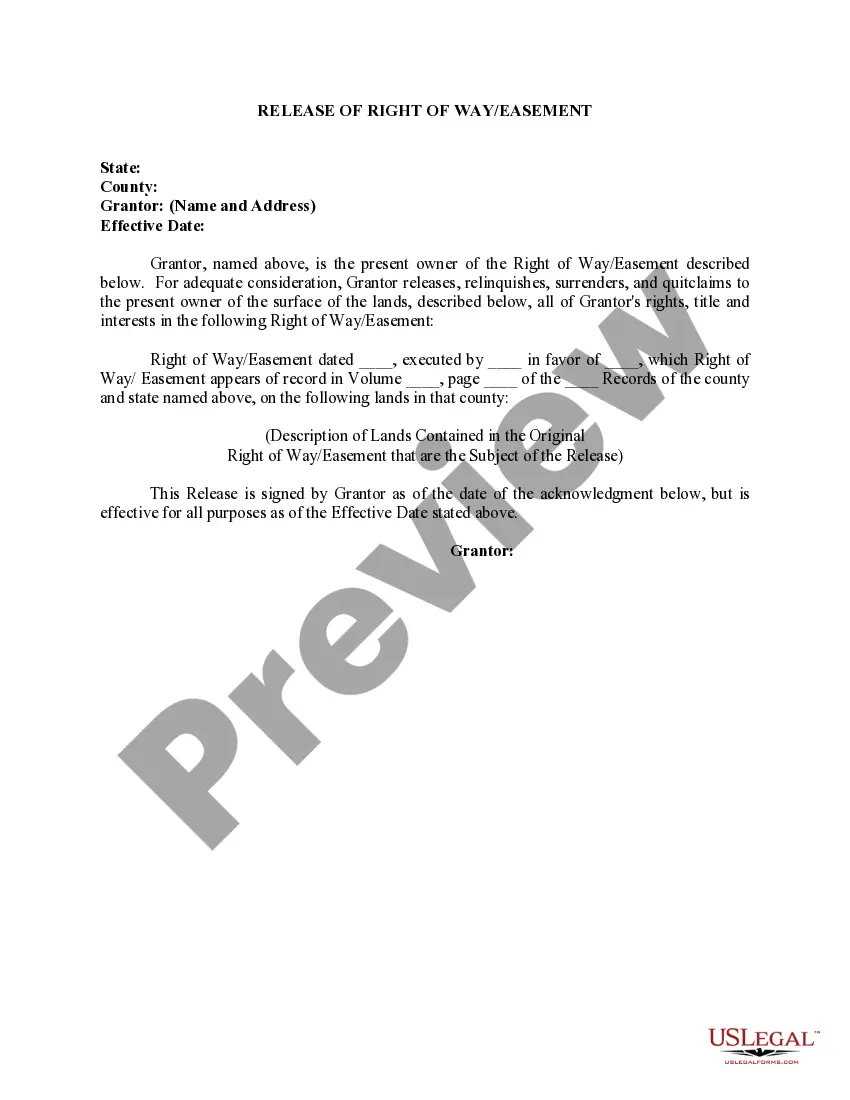

Are you inside a place in which you need to have paperwork for sometimes business or person reasons just about every time? There are plenty of authorized record layouts available online, but getting versions you can depend on is not easy. US Legal Forms offers 1000s of form layouts, such as the Kansas Exemption Statement - Texas, that are created to satisfy state and federal needs.

If you are already knowledgeable about US Legal Forms site and possess an account, merely log in. After that, you may download the Kansas Exemption Statement - Texas format.

Unless you provide an accounts and would like to start using US Legal Forms, adopt these measures:

- Find the form you want and make sure it is for that right metropolis/area.

- Utilize the Review switch to analyze the form.

- Look at the outline to ensure that you have chosen the appropriate form.

- In the event the form is not what you are seeking, make use of the Search discipline to find the form that meets your needs and needs.

- When you get the right form, click on Acquire now.

- Select the rates prepare you would like, fill out the desired information and facts to produce your money, and purchase the order making use of your PayPal or Visa or Mastercard.

- Choose a convenient paper format and download your version.

Get all of the record layouts you possess bought in the My Forms food selection. You can aquire a more version of Kansas Exemption Statement - Texas anytime, if required. Just go through the necessary form to download or print out the record format.

Use US Legal Forms, by far the most extensive collection of authorized forms, in order to save some time and avoid faults. The support offers professionally manufactured authorized record layouts which can be used for a selection of reasons. Produce an account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

You will need to: Sign-in or register with the Kansas Department of Revenue Customer Service Center. Select one of the below exemption certificate types. Complete and submit an exemption certificate application.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

Common Texas sales tax exemptions include those for necessities of life, including most food and health-related items. In addition, goods for resale, such as wholesale items, are exempt from sales tax, as well as newspapers, containers, previously taxed items, and certain goods used for manufacturing.

Applications for property tax exemptions are filed with the appraisal district in which the property is located. The general deadline for filing an exemption application is before May 1. Appraisal district chief appraisers are solely responsible for determining whether or not property qualifies for an exemption.

You must apply with your county appraisal district to get a homestead exemption. Applying is free and only needs to be filed once. You can find forms on your appraisal district website or you can use the Texas Comptroller forms. General Exemption Form 50-114.

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax. NOTE: if you claim EXEMPT you must complete a new W-4 annually in February.

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.