Kansas Employee Payroll Record

Description

How to fill out Employee Payroll Record?

Have you ever found yourself in a situation where you require documentation for potential business or personal purposes nearly every day.

There is a plethora of legal document templates accessible online, but discovering reliable ones can be a challenge.

US Legal Forms provides thousands of document templates, such as the Kansas Employee Payroll Record, crafted to comply with state and federal requirements.

Once you locate the desired document, click on Buy now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for your order using a PayPal account or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Kansas Employee Payroll Record template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the appropriate city/county.

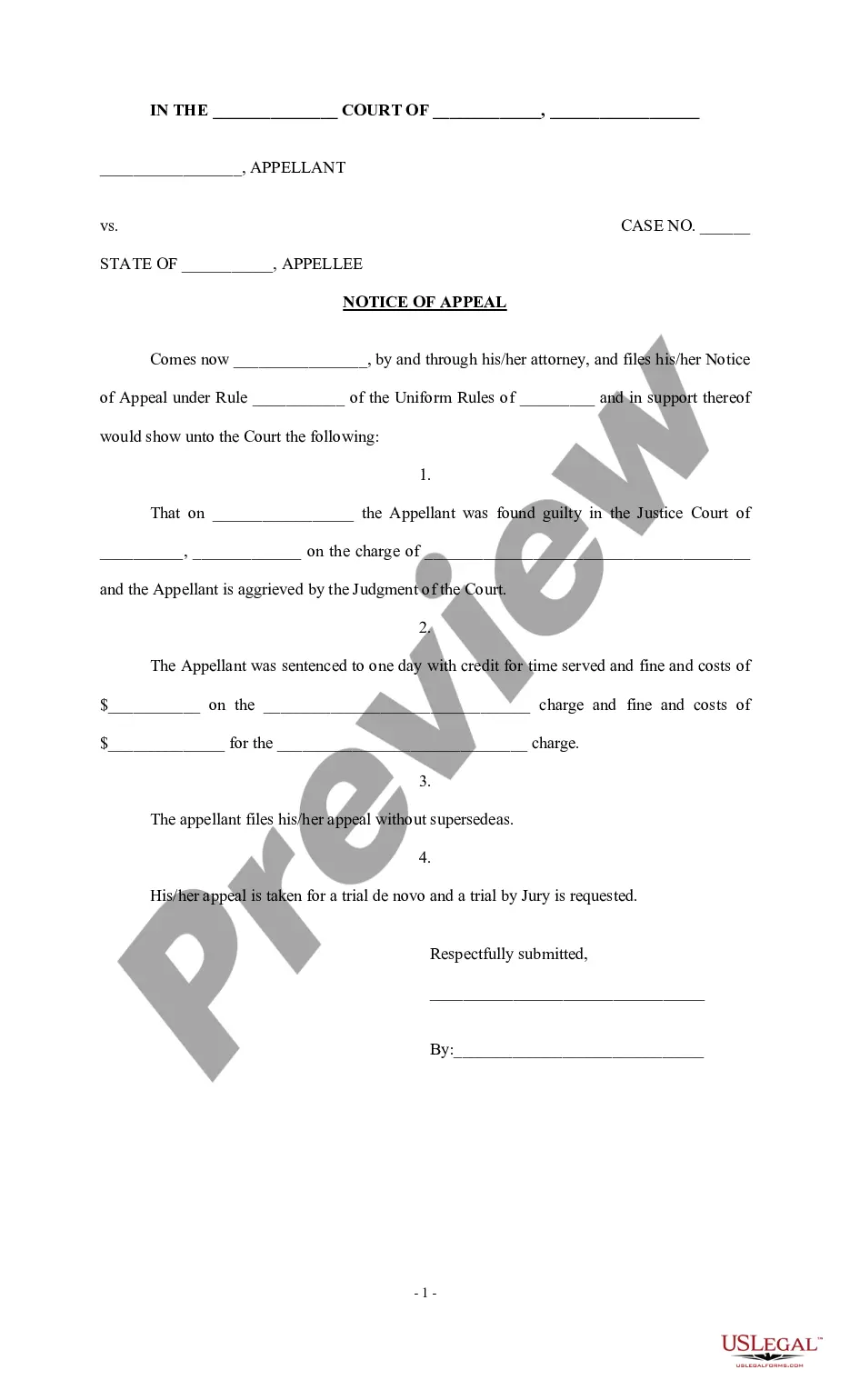

- Utilize the Review option to examine the form.

- Check the description to confirm that you have chosen the correct document.

- If the document is not what you are looking for, use the Lookup field to find the form that best suits your needs.

Form popularity

FAQ

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services.

For instance, employers in Kansas, Indiana, Texas, Missouri and South Carolina can require employees to accept direct deposit, but the employer must provide another payroll payment method such as payroll card, cash or check to employees who do not have a bank account.

They could determine the size and delivery of your paycheck, for example.5 forms to complete when starting a new job. You might be wondering why you need to be prepared for your new-hire paperwork.I-9 documents.W-4 form.Direct deposit form.Benefits enrollment.Company-specific paperwork.

Withholding Tax KW-5 Deposit Reports can be made using the Kansas Department of Revenue Customer Service Center. After connecting to your Withholding account, simply click the Make an EFT Payment link to complete your filing and payment.

Your employer is not required to put anything on your pay stub. However, if you request it, your employer must provide you with an itemized statement of deductions for each pay period.

Kansas Paychecks: What you need to know Sec. 44-313). An employer must pay its employees their wages at least once a month on regular paydays designated in advance. Payment must be made within 15 days of the end of the pay period (KS Stat.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

Generally, you can pay employees weekly, biweekly, semimonthly, or monthly. How will you pay employees? Many employers pay employees using direct deposit, but you can also pay employees with paper checks or pay cards. To pay employees the right amount, you need to know how much to deduct from employee wages.

The New Hire Reporting form (K-CNS 436) is fillable and can be submitted via mail or fax to (888) 219-7798. Login to the KansasEmployer.gov site. Choose the Select button that corresponds to the "Enter new hire information" option. Enter the hiring company's FEIN and Kansas Serial Number.

The vast majority of companies and employees use direct deposit. But cash and paper checks are also options. Make sure that you are paying your employees at least the Kansas minimum wage, which is the same as the federal minimum wage, $7.25 per hour. You can pay your federal and Kansas state taxes online.