Kansas Form Letters — Notice of Default: A Comprehensive Guide In the state of Kansas, when loan borrowers default on their payment obligations, lenders often resort to serving them with a Notice of Default to initiate the foreclosure process. This legal document serves as an official notification to the borrower that they have breached the terms of the loan agreement and must take immediate action to rectify the situation, failing which the lender may proceed with foreclosure proceedings. Kansas Form Letters — Notice of Default, encompassing various types, play a crucial role in this process. 1. Standard Notice of Default: The Standard Notice of Default is the most common type used by lenders in Kansas. This form letter clearly states the borrower's name, property address, loan amount, and the specific default conditions that have been violated. It informs the borrower about the time frame within which they need to cure the default, typically 30 days, to avoid further legal actions. 2. Early Default Notice: An Early Default Notice is sent when a borrower misses their initial payment or fails to comply with the loan payment terms from the inception of the loan. This notice aims to alert the borrower about their payment discrepancies right from the beginning, emphasizing the importance of prompt rectification and the potential consequences of continued non-compliance. 3. Acceleration Notice: An Acceleration Notice is utilized when the lender intends to call the entire loan amount due immediately. This type of Notice of Default is issued when the borrower fails to meet the conditions specified in the previous Notice of Default letter or has defaulted on multiple occasions. The Acceleration Notice forewarns the borrower that if the past due amount is not settled within a designated period, the lender has the right to demand full payment. 4. Notice of Default and Opportunity to Cure: The Notice of Default and Opportunity to Cure serves as a prominent document in Kansas foreclosure proceedings. This form letter highlights the specific default conditions, provides a clear outline of the steps required to rectify the default, and the timeframe within which the borrower can do, so before foreclosure is pursued. Should the borrower succeed in curing the default within the stipulated period, the lender will halt the foreclosure process. 5. Notice of Default and Intent to Sell: In cases where the borrower fails to cure the default within the provided time frame, the lender sends a Notice of Default and Intent to Sell. This legal document serves as a final warning before the initiation of foreclosure proceedings. It informs the borrower that unless the default is cured or an alternative arrangement is agreed upon, their property will be sold at public auction or through other means to recover the outstanding loan amount. Kansas Form Letters — Notice of Default hold vital importance for lenders and borrowers alike in the foreclosure process. These legal documents ensure compliance with Kansas state laws governing mortgage defaults and give borrowers opportunities to rectify their defaults before their property faces potential foreclosure sale.

Kansas Form Letters - Notice of Default

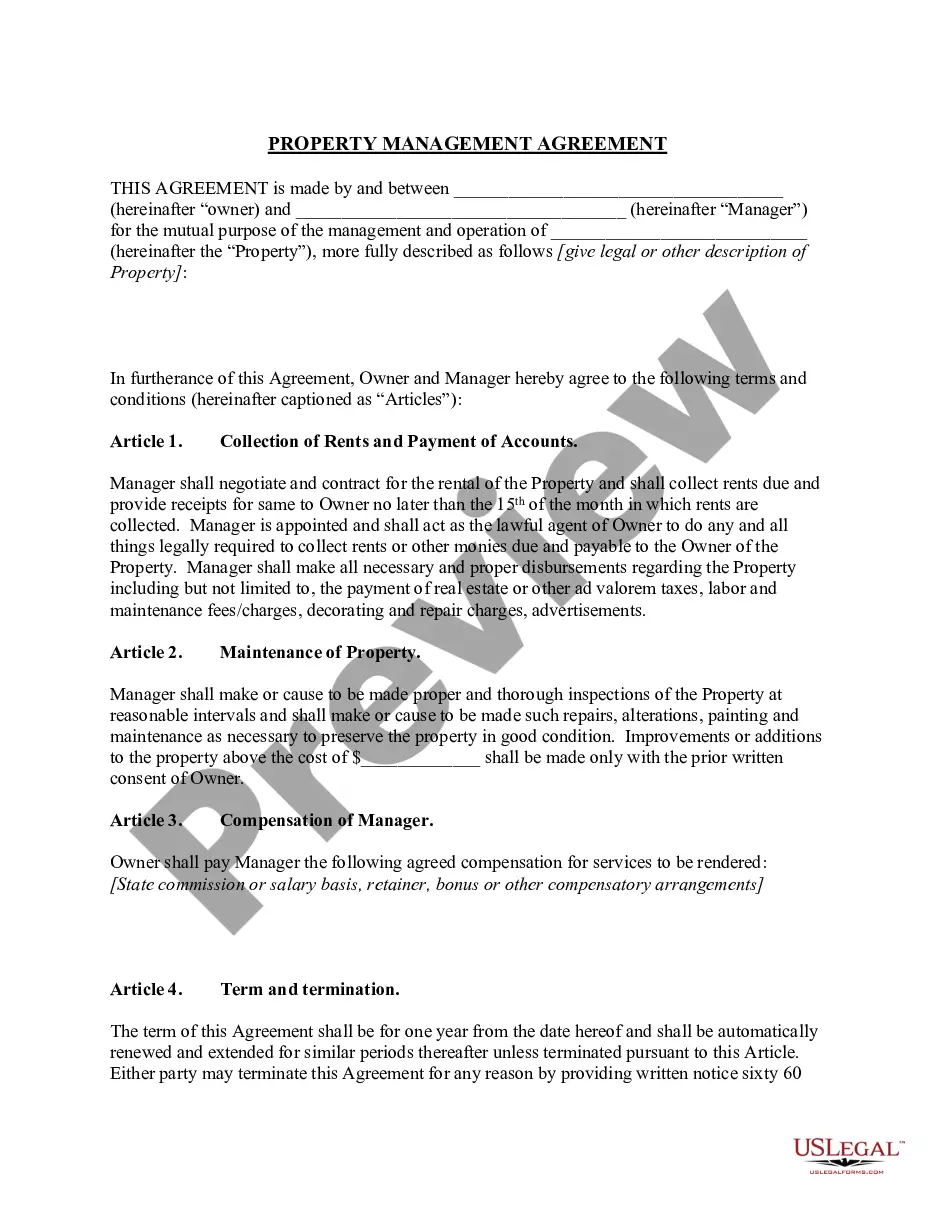

Description

How to fill out Kansas Form Letters - Notice Of Default?

You can commit hrs online trying to find the legal file web template that suits the state and federal requirements you want. US Legal Forms gives thousands of legal forms which can be evaluated by professionals. You can actually acquire or print the Kansas Form Letters - Notice of Default from my services.

If you have a US Legal Forms accounts, you are able to log in and then click the Acquire switch. Afterward, you are able to total, modify, print, or sign the Kansas Form Letters - Notice of Default. Every single legal file web template you get is yours permanently. To have an additional duplicate of the bought kind, go to the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms site the very first time, adhere to the basic directions beneath:

- First, make sure that you have chosen the best file web template to the area/metropolis of your choice. Look at the kind outline to ensure you have selected the right kind. If available, use the Review switch to check with the file web template too.

- If you wish to discover an additional model of the kind, use the Research area to get the web template that meets your requirements and requirements.

- When you have discovered the web template you need, just click Buy now to continue.

- Pick the rates strategy you need, type in your accreditations, and register for a free account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal accounts to purchase the legal kind.

- Pick the format of the file and acquire it to the device.

- Make changes to the file if possible. You can total, modify and sign and print Kansas Form Letters - Notice of Default.

Acquire and print thousands of file web templates using the US Legal Forms Internet site, which provides the greatest assortment of legal forms. Use expert and express-certain web templates to take on your organization or personal needs.