Kansas Department Time Report for Payroll

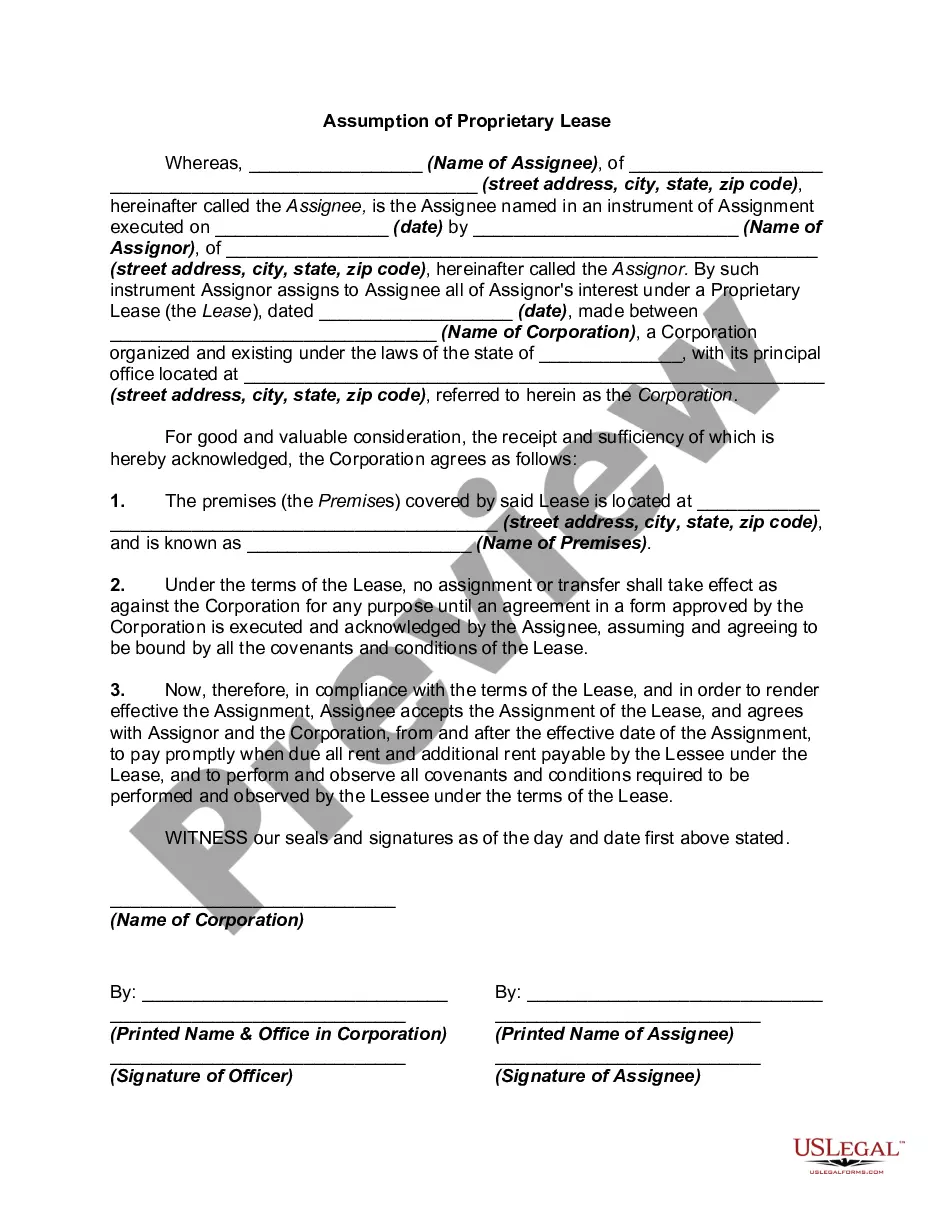

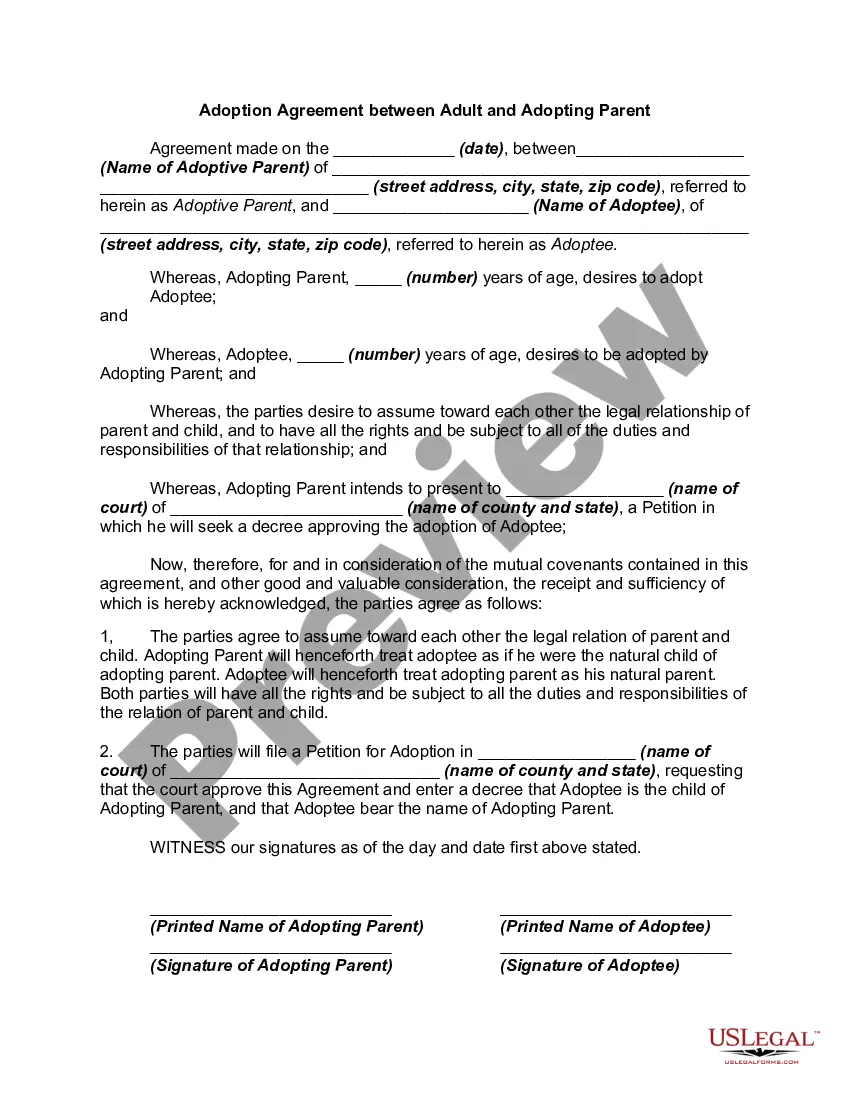

Description

How to fill out Department Time Report For Payroll?

Are you in a position where you frequently require documents for either organizational or personal purposes? There are many legitimate document templates accessible online, yet locating reliable ones is challenging.

US Legal Forms provides thousands of document templates, including the Kansas Department Time Report for Payroll, that are designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterward, you can download the Kansas Department Time Report for Payroll template.

Choose a convenient file format and download your copy.

You can find all the document templates you have acquired in the My documents section. You can obtain an additional copy of the Kansas Department Time Report for Payroll anytime, if needed. Click the desired form to download or print the document template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct city/region.

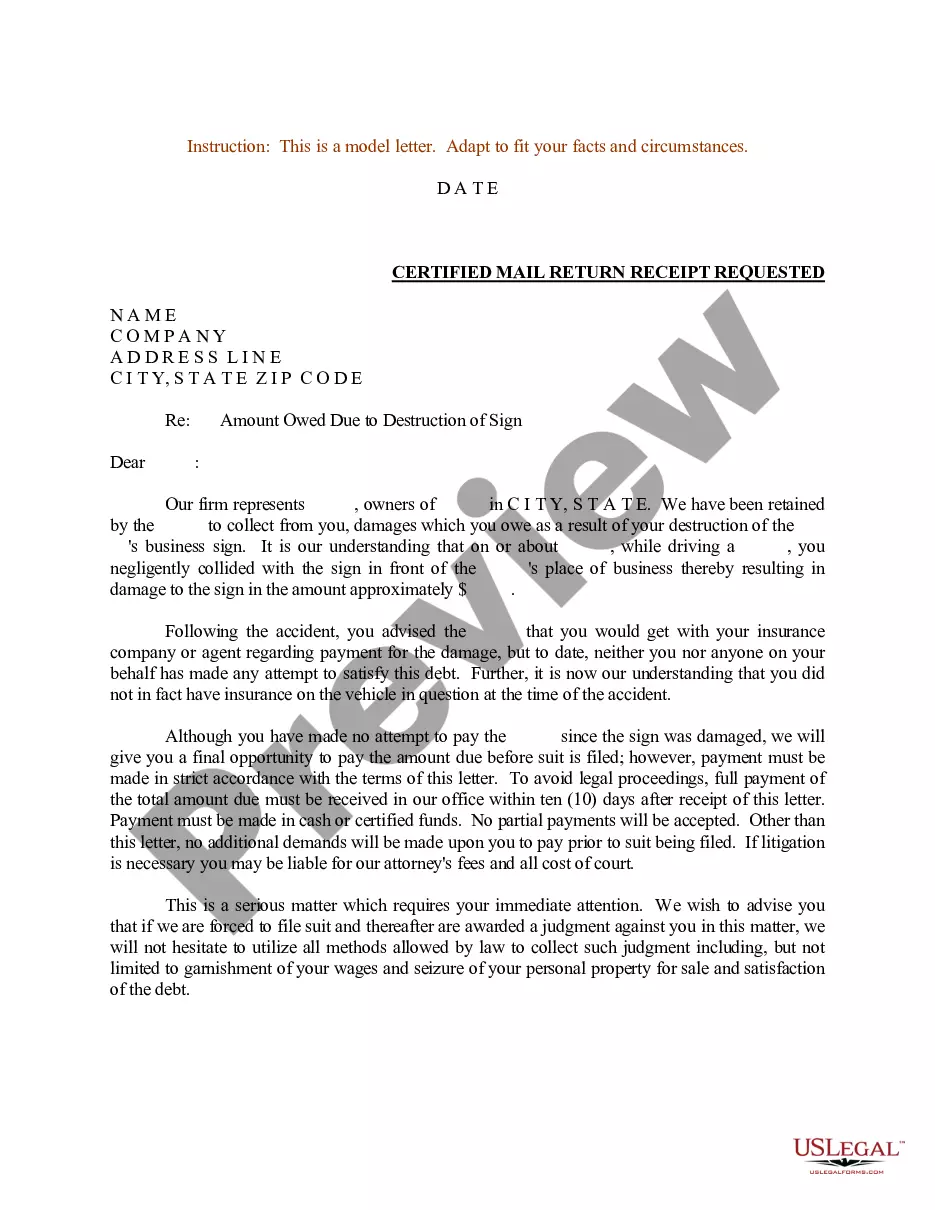

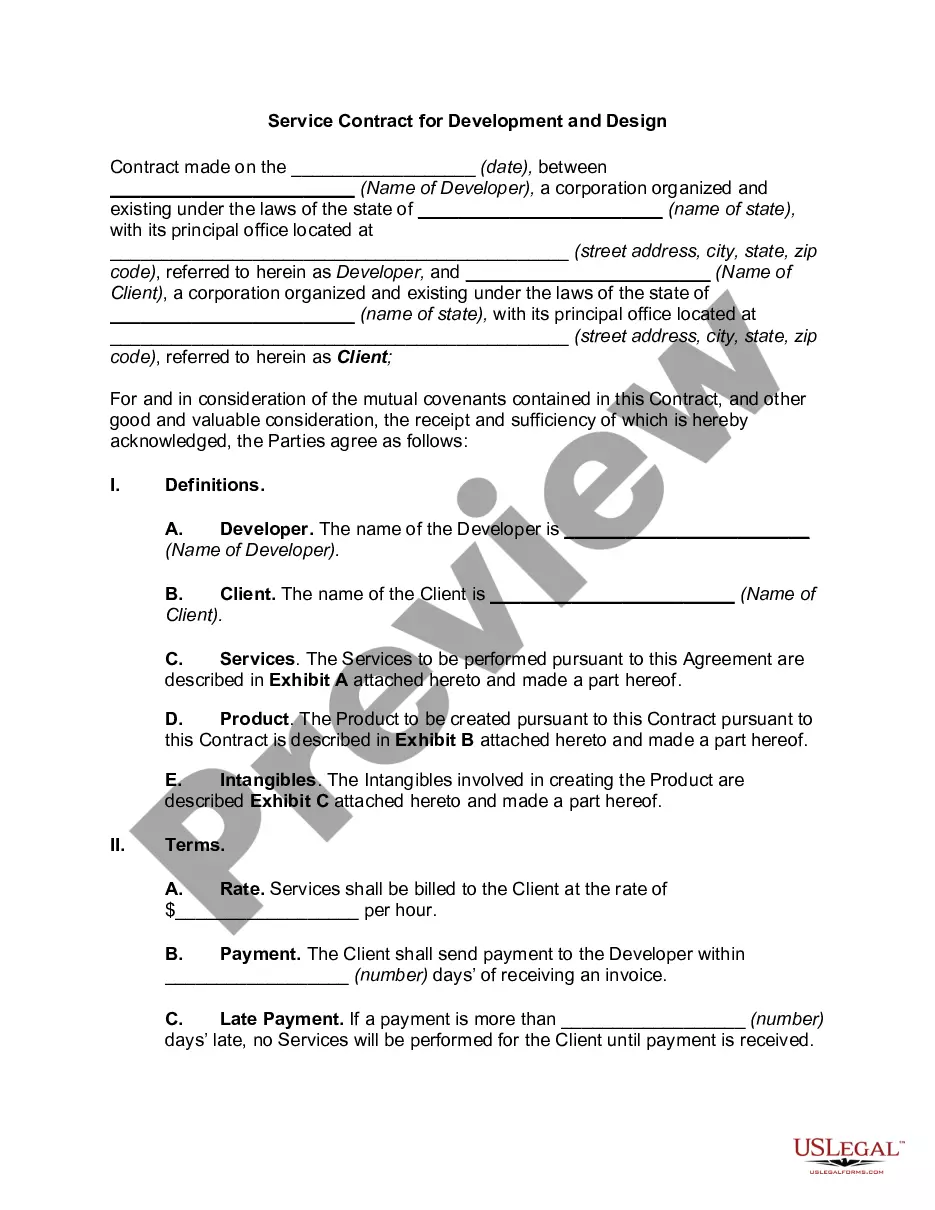

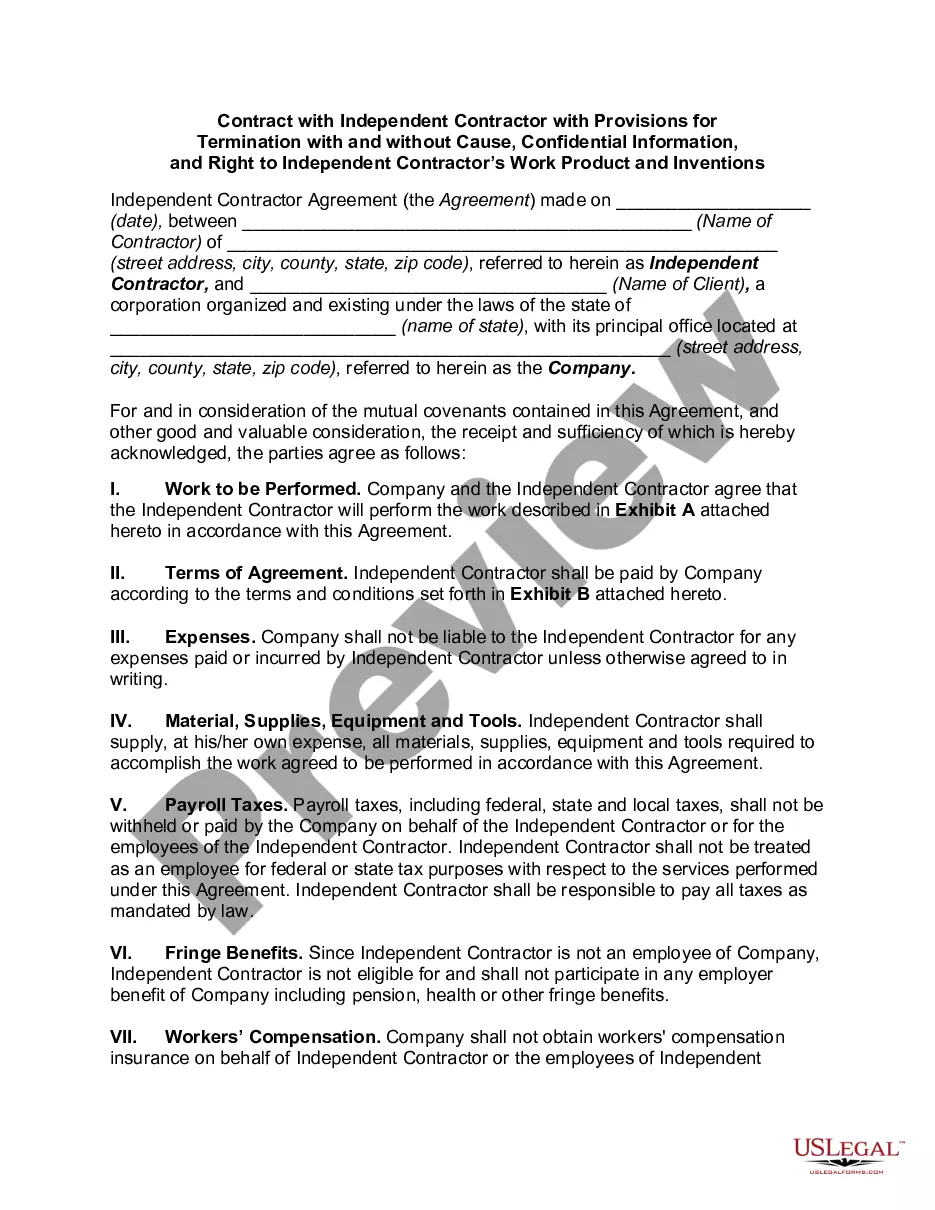

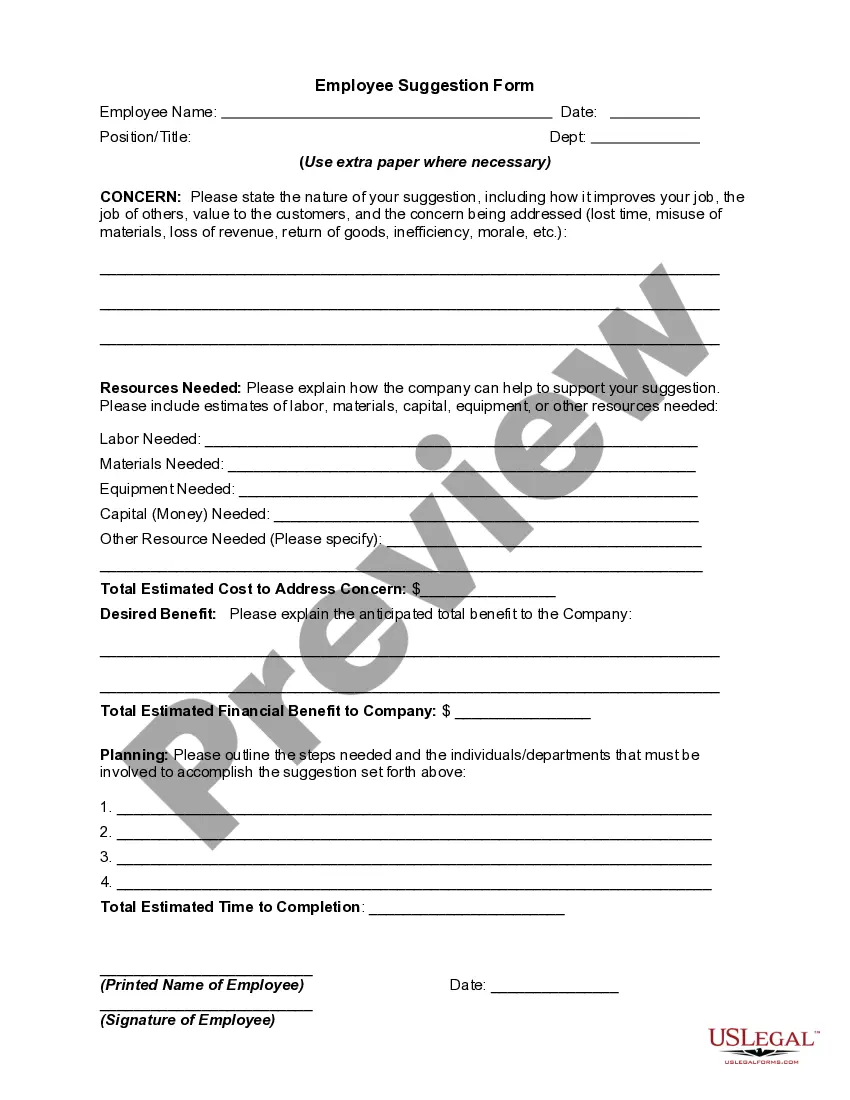

- Utilize the Review feature to evaluate the document.

- Check the details to confirm you have selected the appropriate form.

- If the form does not match what you are looking for, use the Search bar to find a template that fits your needs and criteria.

- Once you have the correct document, click Get now.

- Select the pricing plan you prefer, provide the necessary information to create your account, and submit the payment using your PayPal or credit card.

Form popularity

FAQ

To obtain a W2 from the state of Kansas, contact your employer directly, as they are responsible for issuing W2 forms annually. If your employer is using a payroll service, they may provide access to your W2 electronically. Ensure that the information aligns with the Kansas Department Time Report for Payroll to ensure accuracy in your tax filings.

Failure to pay wages for work done counts, in law, as an unauthorised deduction from wages. If the matter cannot be resolved, you are entitled to make a claim to an employment tribunal. Failure to pay wages in full and on time is also a fundamental breach of the employment contract.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

Employee Onboarding Documents You Must Keep:Form W-4 for federal income tax withholding.Form I-9 to identify individuals authorized to work in the US.Job application form.Register with state employment agencies.Drug testing records.Payroll records.Employee handbook signature page.More items...?20-Jun-2019

New employees: Employers must report all employees who reside or work in the State of Kansas to whom the employer anticipates paying earnings. Employees should be reported even if they work only one day and are terminated (prior to the employer fulfilling the new hire reporting requirement).

One payroll report many business owners need to file quarterly is Form 941, Employer's Quarterly Federal Tax Return. Use Form 941 to report employee wages and payroll taxes each quarter.

Complaint forms can be obtained at the Kansas Human Rights Commission's website at or by calling our complaint intake unit at 1-888-793-6874 or (785) 296-3206.

Contact the Kansas Department of LaborKansas City (913) 596-3500.Topeka (785) 575-1460.Wichita (316) 383-9947.Toll-Free (800) 292-6333.

Steps to Hiring your First Employee in KansasStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.12-Oct-2021

Kansas Department of Labor's Workers Compensation DivisionKansas Department of Labor's Workers Compensation Division. Contact at (785) 296-4000 or kdol.wc@ks.gov.Note: The links below are to other federal or state agencies.