Title: Exploring the Kansas Checklist for Proving Entertainment Expenses: Key Types and Requirements Introduction: When it comes to recording entertainment expenses, businesses in Kansas must adhere to specific guidelines outlined in the Kansas Checklist for Proving Entertainment Expenses. This comprehensive checklist serves as a reference point to ensure compliance with the Kansas Department of Revenue regulations. In this article, we will delve into the various types of Kansas Checklist for Proving Entertainment Expenses, highlighting their unique requirements and providing relevant information for businesses operating in the state. 1. General Entertainment Expenses: Under the Kansas Checklist for Proving Entertainment Expenses, businesses must maintain detailed records of all incurred entertainment expenses. This includes expenses related to meals, tickets for shows or events, hospitality, fees for performers, and other related costs. Businesses should meticulously document each expense, including date, location, purpose, individuals involved, and business-related discussions or activities conducted during the entertainment event. 2. Employee Reimbursements: For businesses reimbursing employees for entertainment expenses incurred on behalf of the company, adherence to specific regulations is crucial. The Kansas Checklist outlines that reimbursements should be substantiated with appropriate documentation, such as receipts, providing the necessary proof of the expense. 3. Client and Customer Entertainment: Kansas businesses often engage in entertainment activities aimed at building and nurturing relationships with clients or customers. Expenses incurred for such purposes must be thoroughly documented, indicating the business purpose and relationship to the individual entertained. The Checklist emphasizes that records should clearly identify the business entity entertained, the nature of the engagement, and the individuals present, including their respective titles and affiliations. 4. Expenses Related to Business Meetings: In certain instances, entertainment expenses incurred during business meetings can be deductible. However, it is important to differentiate between actual business meetings and those that include entertainment components. The Kansas Checklist stresses the need for accurate record-keeping to segregate entertainment expenses from purely business-related costs, ensuring compliance with applicable tax regulations. 5. Substantiation Requirements: The Kansas Checklist for Proving Entertainment Expenses emphasizes the importance of substantiating each expense, irrespective of the amount. Detailed records must be maintained, and receipts should contain essential information, such as the date, amount, description, and business purpose of the expense. Simply recording credit card statements or cancelled checks is generally insufficient without proper documentation supporting the entertainment expense. Conclusion: Navigating the Kansas Checklist for Proving Entertainment Expenses is crucial for businesses operating in the state. By adhering to the guidelines, businesses can ensure compliance with tax regulations, mitigate risks, and maximize legitimate expense deductions. The checklist covers various types of entertainment expenses, including general expenses, employee reimbursements, client and customer entertainment, business meetings, and highlights the importance of maintaining proper substantiation records. Familiarity with these requirements is crucial to avoid penalties and unwanted audits while efficiently managing entertainment expenses within the permissible boundaries of Kansas tax laws.

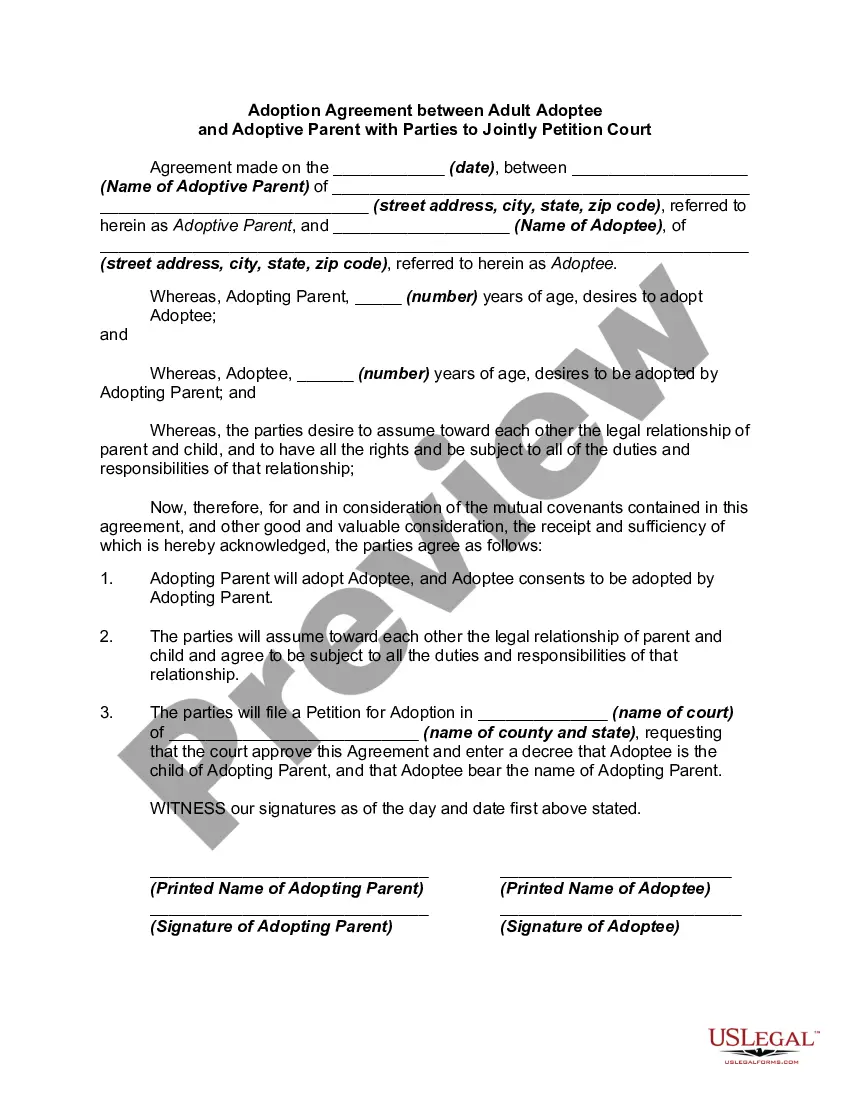

Kansas Checklist for Proving Entertainment Expenses

Description

How to fill out Kansas Checklist For Proving Entertainment Expenses?

If you want to comprehensive, download, or print lawful record themes, use US Legal Forms, the largest collection of lawful types, which can be found on-line. Make use of the site`s easy and hassle-free search to discover the papers you require. Various themes for enterprise and specific uses are categorized by categories and says, or key phrases. Use US Legal Forms to discover the Kansas Checklist for Proving Entertainment Expenses with a number of mouse clicks.

If you are previously a US Legal Forms consumer, log in to your account and then click the Download button to find the Kansas Checklist for Proving Entertainment Expenses. You may also accessibility types you earlier saved from the My Forms tab of the account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have selected the form for that appropriate town/nation.

- Step 2. Use the Preview option to look through the form`s content material. Never overlook to read through the description.

- Step 3. If you are not happy together with the form, make use of the Search area towards the top of the display screen to discover other variations from the lawful form format.

- Step 4. After you have found the form you require, select the Acquire now button. Select the costs program you prefer and include your accreditations to sign up for the account.

- Step 5. Procedure the purchase. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Find the structure from the lawful form and download it on the product.

- Step 7. Full, edit and print or signal the Kansas Checklist for Proving Entertainment Expenses.

Each lawful record format you purchase is your own property eternally. You possess acces to every single form you saved inside your acccount. Click on the My Forms area and pick a form to print or download once more.

Remain competitive and download, and print the Kansas Checklist for Proving Entertainment Expenses with US Legal Forms. There are millions of specialist and condition-distinct types you may use to your enterprise or specific requires.