Kansas Memo on Company Relocation including Relocation Pay for Employees

Description

How to fill out Memo On Company Relocation Including Relocation Pay For Employees?

Are you presently in a position where you need documents for either business or personal purposes almost consistently.

There are numerous reliable document templates available online, but locating forms you can depend on is challenging.

US Legal Forms offers a vast array of form templates, such as the Kansas Memo on Company Relocation including Relocation Compensation for Employees, which can be tailored to satisfy federal and state requirements.

Once you find the right form, click Buy now.

Select the pricing plan you prefer, complete the required information to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kansas Memo on Company Relocation including Relocation Compensation for Employees template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

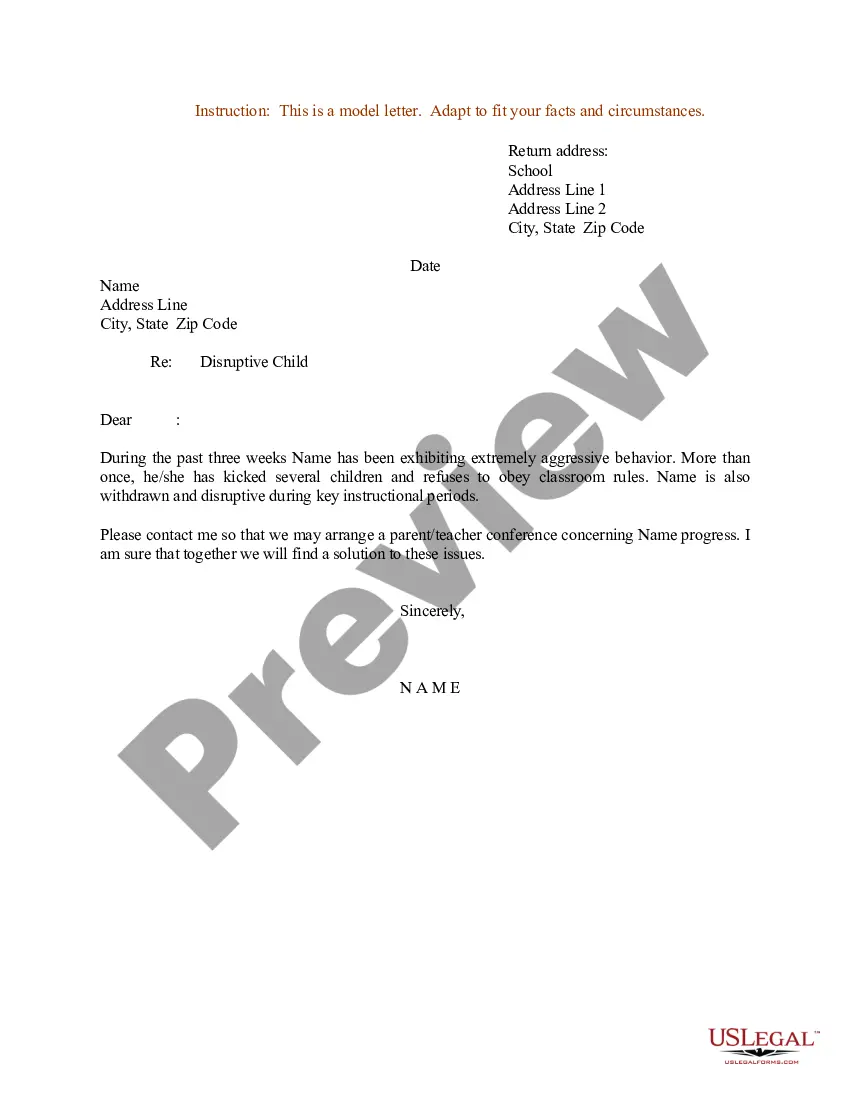

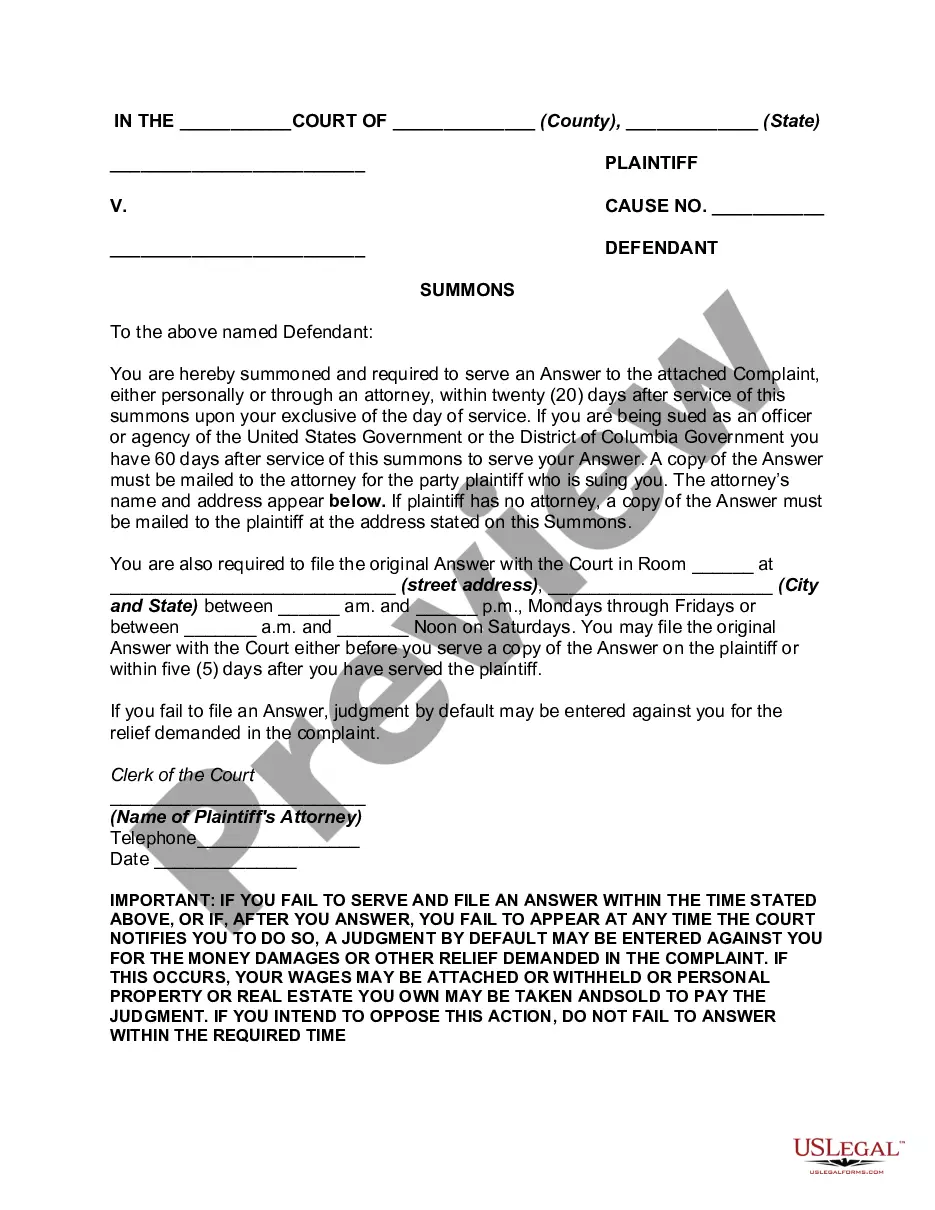

- Use the Preview button to review the form.

- Read the description to ensure you have selected the correct form.

- If the form is not what you're looking for, use the Search box to find the form that suits your needs.

Form popularity

FAQ

To announce an office relocation effectively, create a structured communication plan. Start with a company-wide meeting, followed by an email that includes all key details, such as the relocation date and benefits. Reference the Kansas Memo on Company Relocation including Relocation Pay for Employees to ensure employees are informed about their rights and benefits during this transition. It's important to show transparency and provide assurance to your team.

Announcing a business move should be clear and upbeat. Begin with an official announcement that outlines the new address and the date of the relocation. Remember to highlight any benefits from the move and refer to the Kansas Memo on Company Relocation including Relocation Pay for Employees to assure employees about any assistance available. Use this opportunity to maintain positive morale and confidence in the changes.

When emailing about an office move, start with an informative subject line that captures attention. In the email, provide essential details such as the date of the move, the new address, and the rationale behind the relocation. Be sure to mention the Kansas Memo on Company Relocation including Relocation Pay for Employees for any applicable benefits. Keep the message concise and provide a way for employees to reach out with their questions.

Informing employees about an office relocation requires a clear communication strategy. Begin by holding a meeting to explain the reasons for the move and the expected benefits. Follow up with a detailed email that includes the relocation timeline and references to the Kansas Memo on Company Relocation including Relocation Pay for Employees to outline any support available to staff. Encouraging open dialogue will help address any concerns.

A relocation notice should begin with a clear statement about the office move and its effective date. Include specific details about the new location and how it might impact employees, such as changes to their daily commute. Mention the Kansas Memo on Company Relocation including Relocation Pay for Employees to clarify any financial assistance available. Keep the tone professional yet empathetic, as this is an important change for staff.

To write a letter of relocation for an employee, start by clearly stating the purpose of the letter. Include details about the new location, relocation pay, and any support the company offers during this transition. Be sure to reference the Kansas Memo on Company Relocation including Relocation Pay for Employees for guidance on employee benefits. Make the letter personal and ensure it conveys understanding and support.

A relocation allowance provides employees with financial support to cover moving costs when relocating for a job. Typically, the employer outlines how the funds can be used, expanding upon the guidance in the Kansas Memo on Company Relocation including Relocation Pay for Employees. This assistance can ease the stress of moving and help ensure a smoother transition into your new role.

Yes, in specific instances, you can claim relocation expenses on your taxes. It is vital to know the current tax laws, as they can change. Utilize the guidelines from the Kansas Memo on Company Relocation including Relocation Pay for Employees to understand what qualifies as deductible expenses and ensure you fill out the correct forms with the IRS.

To claim your relocation allowance, start by gathering all the necessary documents, such as receipts and forms as stipulated by your company’s policy. Then, follow the procedure outlined in your employee handbook or consult your HR department for assistance. Referencing the Kansas Memo on Company Relocation including Relocation Pay for Employees can support your case and clarify your entitlements.

When requesting a relocation allowance from HR, prepare a clear and concise explanation of your situation. Include details about your upcoming move, as well as any relevant information from the Kansas Memo on Company Relocation including Relocation Pay for Employees. This demonstrates your understanding and reinforces your request.