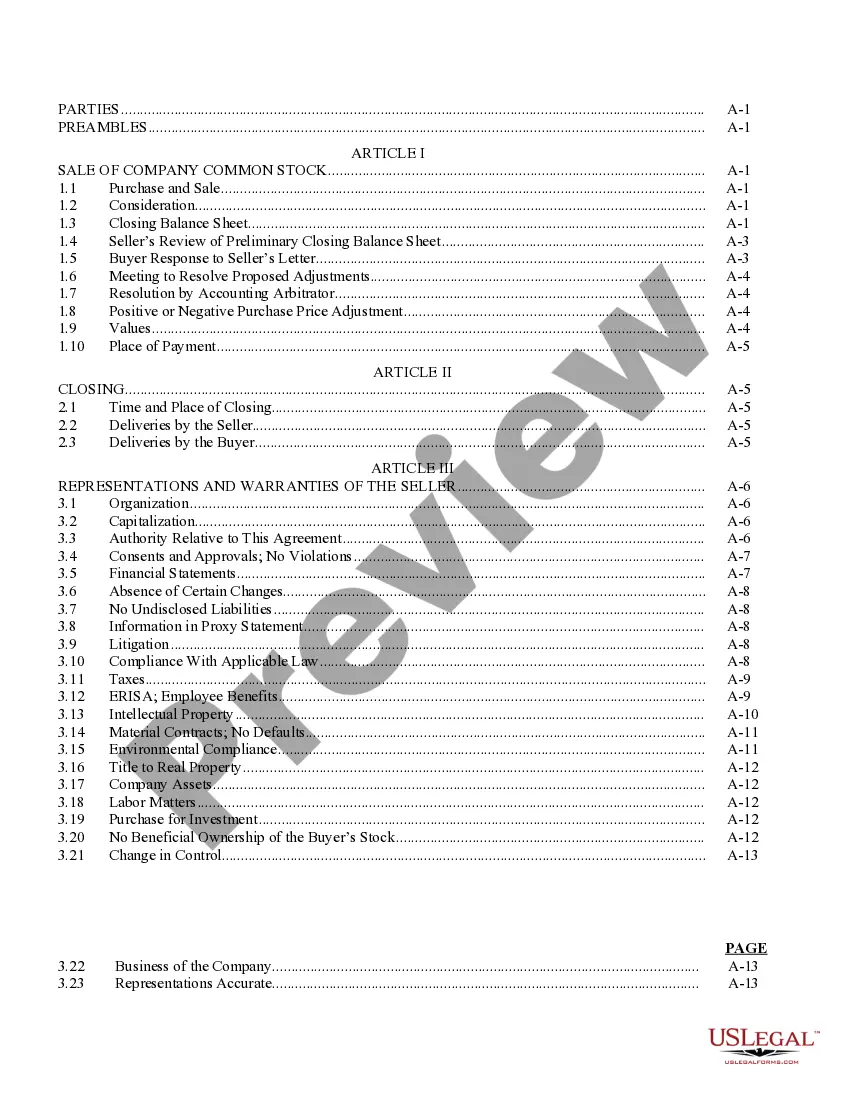

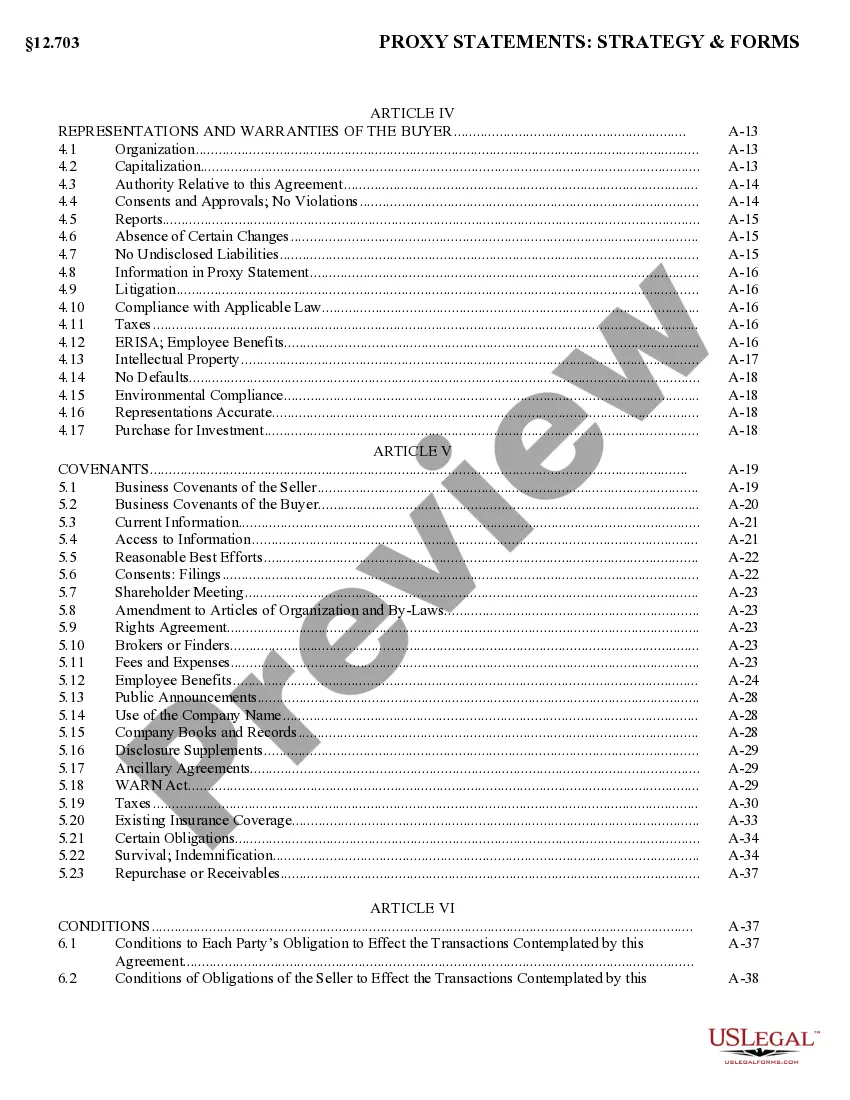

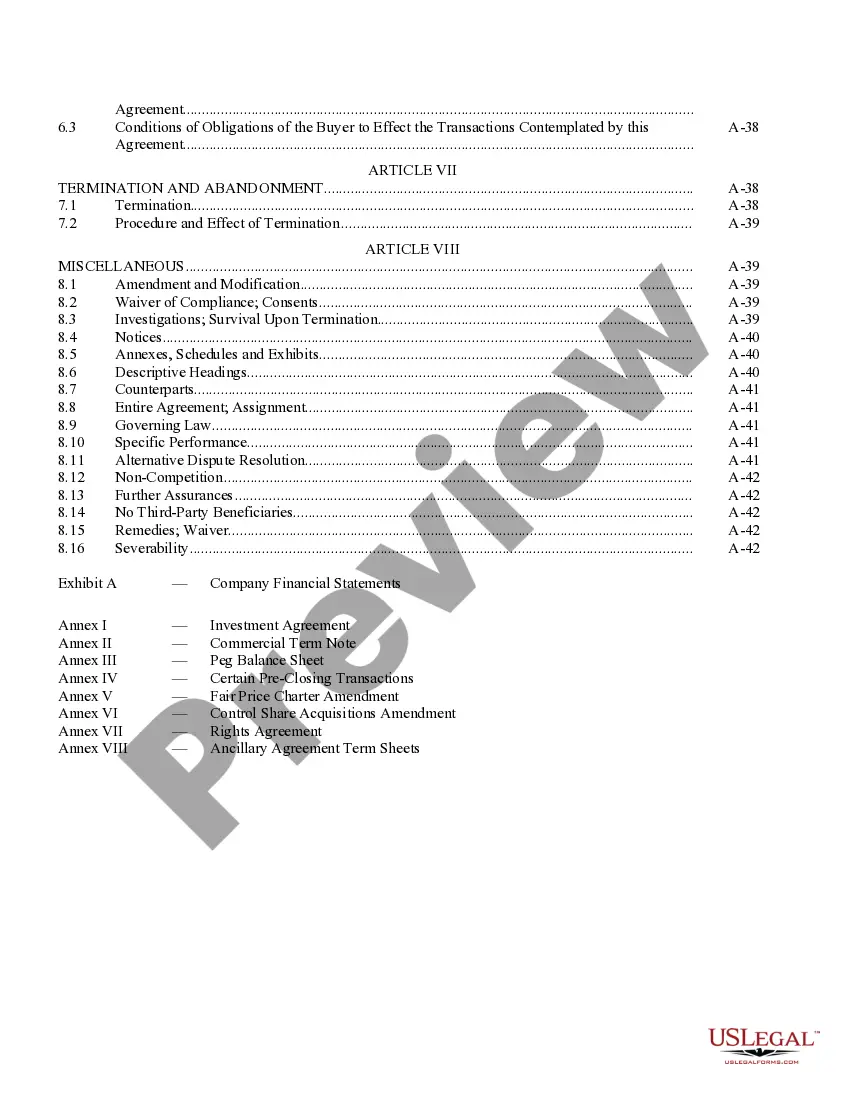

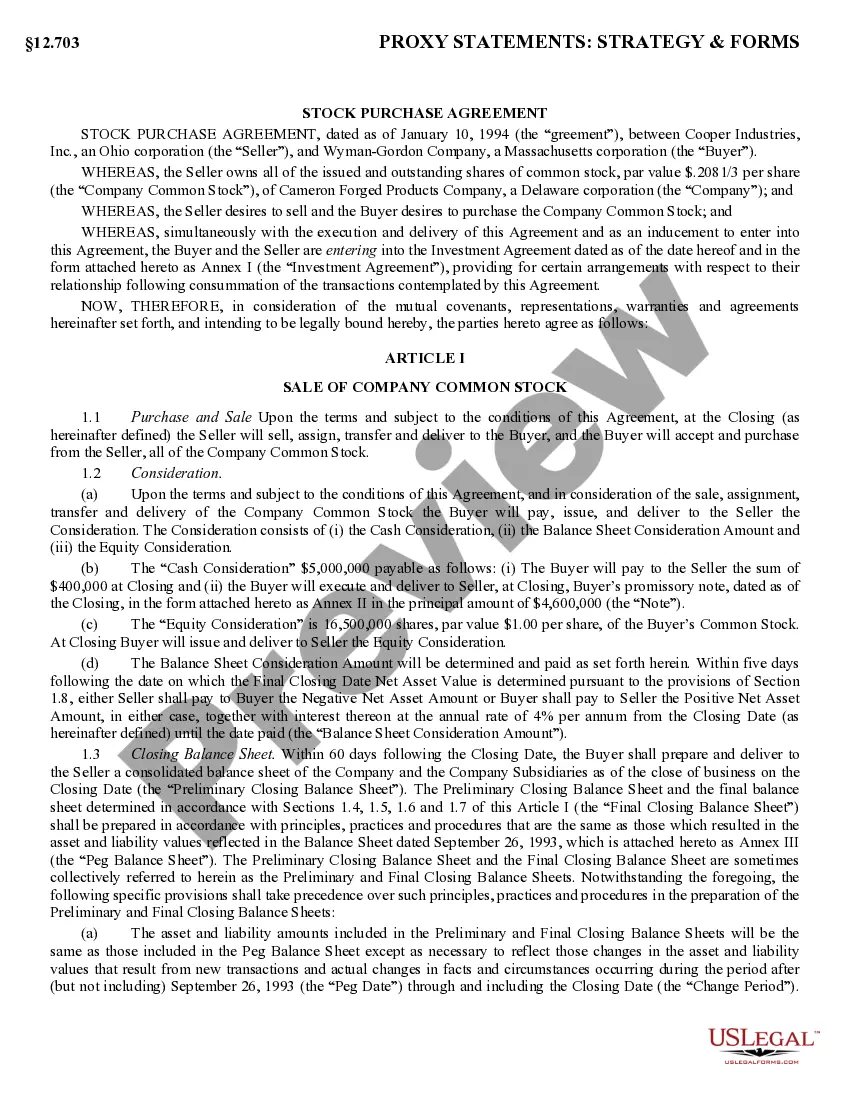

Kansas Sample Stock Purchase Agreement General Form is a legal document commonly used across the United States to facilitate the purchase of stocks in a corporation. It outlines the terms and conditions governing the transaction and protects the rights and obligations of both the buyer and the seller. This agreement is applicable in Kansas but can also be adopted in other states with minor modifications to align with local laws. The Kansas Sample Stock Purchase Agreement General Form typically includes the following key provisions: 1. Parties: Clearly identifies the buyer and the seller involved in the stock purchase agreement, including their legal names, addresses, and contact information. 2. Purchase Price: Specifies the agreed-upon purchase price for the stocks being sold. This may be a fixed amount or subject to adjustments based on factors such as working capital or indebtedness of the corporation. 3. Closing: Defines the date, time, and location of the closing, i.e., when the ownership of the stocks transfers from the seller to the buyer. It may also address the delivery of stock certificates and other closing documents. 4. Representations and Warranties: Outlines the statements made by the seller regarding the corporation's financial condition, assets, liabilities, contracts, and other key aspects. These representations and warranties ensure that the buyer has an accurate understanding of the corporation's state before making the purchase. 5. Indemnification: Establishes the obligations of the parties to indemnify and hold each other harmless from any losses, damages, or liabilities arising out of a breach of the agreement or any misrepresentation of facts. 6. Governing Law and Jurisdiction: Determines the state laws that will govern the interpretation and enforcement of the agreement and the appropriate jurisdiction for any legal actions that may arise. Regarding different types of Kansas Sample Stock Purchase Agreement general forms, there might be variations based on the nature of the corporation, such as whether it is a closely held corporation, publicly traded company, or a non-profit organization. However, the core provisions mentioned above are typically relevant across all types of stock purchase agreements. It is crucial to consult a qualified attorney or legal professional to ensure that the Stock Purchase Agreement meets the specific requirements of the state, incorporates relevant federal laws, and provides adequate protection for both the buyer and the seller.

Kansas Sample Stock Purchase Agreement general form to be used across the United States

Description

How to fill out Kansas Sample Stock Purchase Agreement General Form To Be Used Across The United States?

Have you been in a place the place you require files for sometimes enterprise or specific purposes virtually every day time? There are tons of lawful document themes available on the net, but locating kinds you can trust is not effortless. US Legal Forms delivers a large number of form themes, much like the Kansas Sample Stock Purchase Agreement general form to be used across the United States, which are written in order to meet state and federal demands.

Should you be previously knowledgeable about US Legal Forms web site and get a merchant account, merely log in. After that, you are able to down load the Kansas Sample Stock Purchase Agreement general form to be used across the United States web template.

If you do not come with an bank account and would like to begin using US Legal Forms, abide by these steps:

- Get the form you need and ensure it is to the proper metropolis/area.

- Use the Preview key to examine the shape.

- See the information to actually have selected the right form.

- If the form is not what you`re seeking, take advantage of the Search industry to get the form that meets your needs and demands.

- When you get the proper form, click on Get now.

- Select the costs program you would like, complete the necessary info to produce your account, and purchase your order utilizing your PayPal or Visa or Mastercard.

- Pick a hassle-free file file format and down load your version.

Locate all the document themes you have purchased in the My Forms menus. You can obtain a additional version of Kansas Sample Stock Purchase Agreement general form to be used across the United States any time, if required. Just go through the required form to down load or print out the document web template.

Use US Legal Forms, by far the most considerable selection of lawful varieties, in order to save time as well as prevent mistakes. The service delivers appropriately created lawful document themes that you can use for a selection of purposes. Produce a merchant account on US Legal Forms and commence making your life easier.