Title: An In-depth Look at the Kansas Proposed Additional Compensation Plan Introduction: The Kansas Proposed Additional Compensation Plan aims to enhance the current compensation structure for various public sector employees within the state. This comprehensive plan seeks to address issues of wage disparity, labor market competitiveness, and employee retention, ensuring a fair and competitive environment for Kansas workers. Please find below a detailed description of the plan, including key provisions and components of the proposed compensation structure. 1. Overview of the Kansas Proposed Additional Compensation Plan: The Kansas Proposed Additional Compensation Plan is an initiative to revise and augment the existing compensation framework for state employees. This plan recognizes the need for equitable remuneration and offers a fair means to attract and retain highly skilled individuals across different professions. 2. Key Provisions of the Kansas Proposed Additional Compensation Plan: a. Salary Adjustments: The plan includes provisions for regular salary adjustments based on a thorough evaluation of market conditions, occupational demand, and budget capacities. b. Merit-Based Pay Increases: Employees demonstrating exceptional performance will be eligible for merit-based pay increases to reward their contributions to the organization. c. Skill Enhancement Fund: A Skill Enhancement Fund will be established to enable training and skill-building opportunities for employees, which can contribute to their professional growth and potential for career advancement. d. Cost of Living Adjustments (COLA): The plan prioritizes addressing inflationary effects on employee living expenses through periodic COLA adjustments. 3. Different Types of Kansas Proposed Additional Compensation Plan: a. Education Sector Compensation Plan: This plan focuses on providing additional compensation for teachers and staff working in K-12 public schools, community colleges, and universities in Kansas. b. State Government Employee Compensation Plan: Aimed at state employees across multiple departments, this plan provides additional compensation measures for various positions such as administrative staff, law enforcement officers, healthcare professionals, and more. c. Public Safety Compensation Plan: Designed specifically for police officers, firefighters, emergency medical personnel, and other essential public safety professionals, this plan aims to address unique challenges faced by these individuals in their line of duty. d. Skilled Trade and Technical Worker Compensation Plan: Recognizing the importance of trades and technical occupations, this plan offers additional compensation and benefits for skilled workers in fields such as construction, maintenance, and manufacturing. Conclusion: The Kansas Proposed Additional Compensation Plan endeavors to create a more attractive work environment for public sector employees by introducing various enhancements to the existing compensation structure. Through equitable remuneration, skill development opportunities, and an emphasis on acknowledging outstanding performance, this plan aims to foster employee satisfaction, retention, and continued growth within the state of Kansas. The diverse types of compensation plans within this proposal address the specific needs of different sectors, further promoting a fair and competitive compensation system for all Kansas workers.

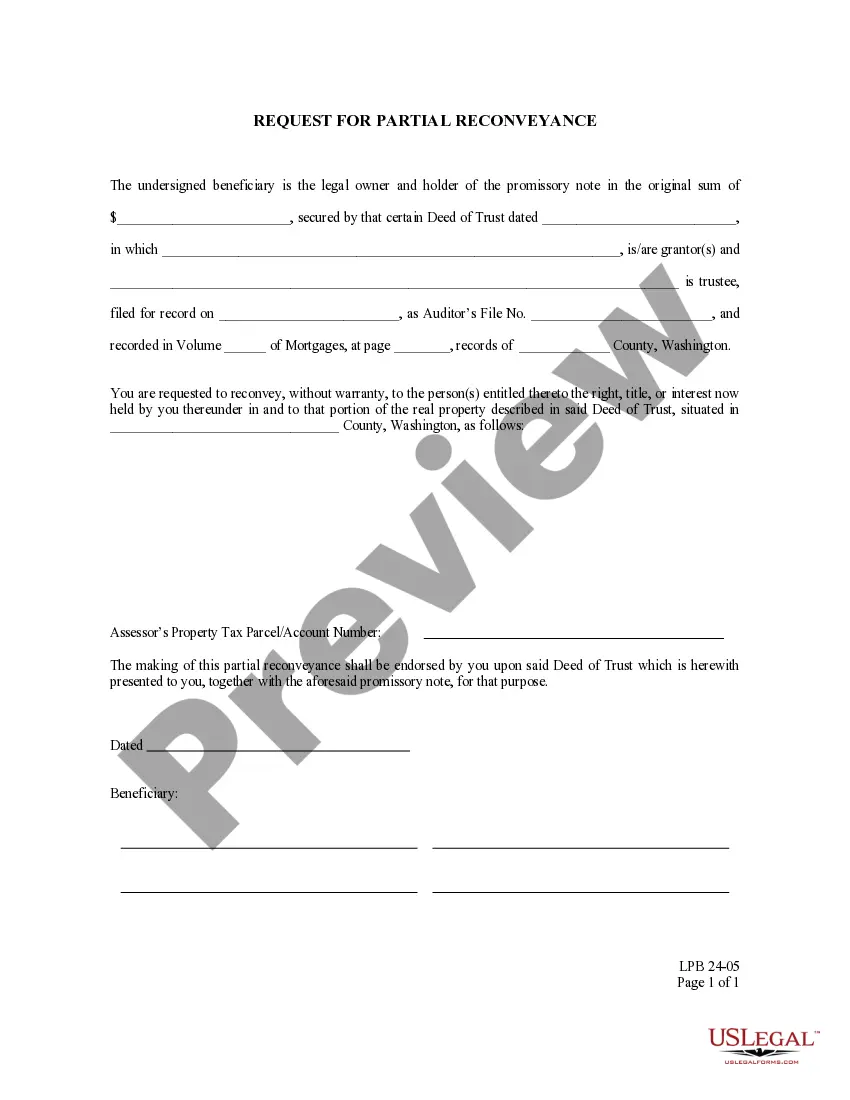

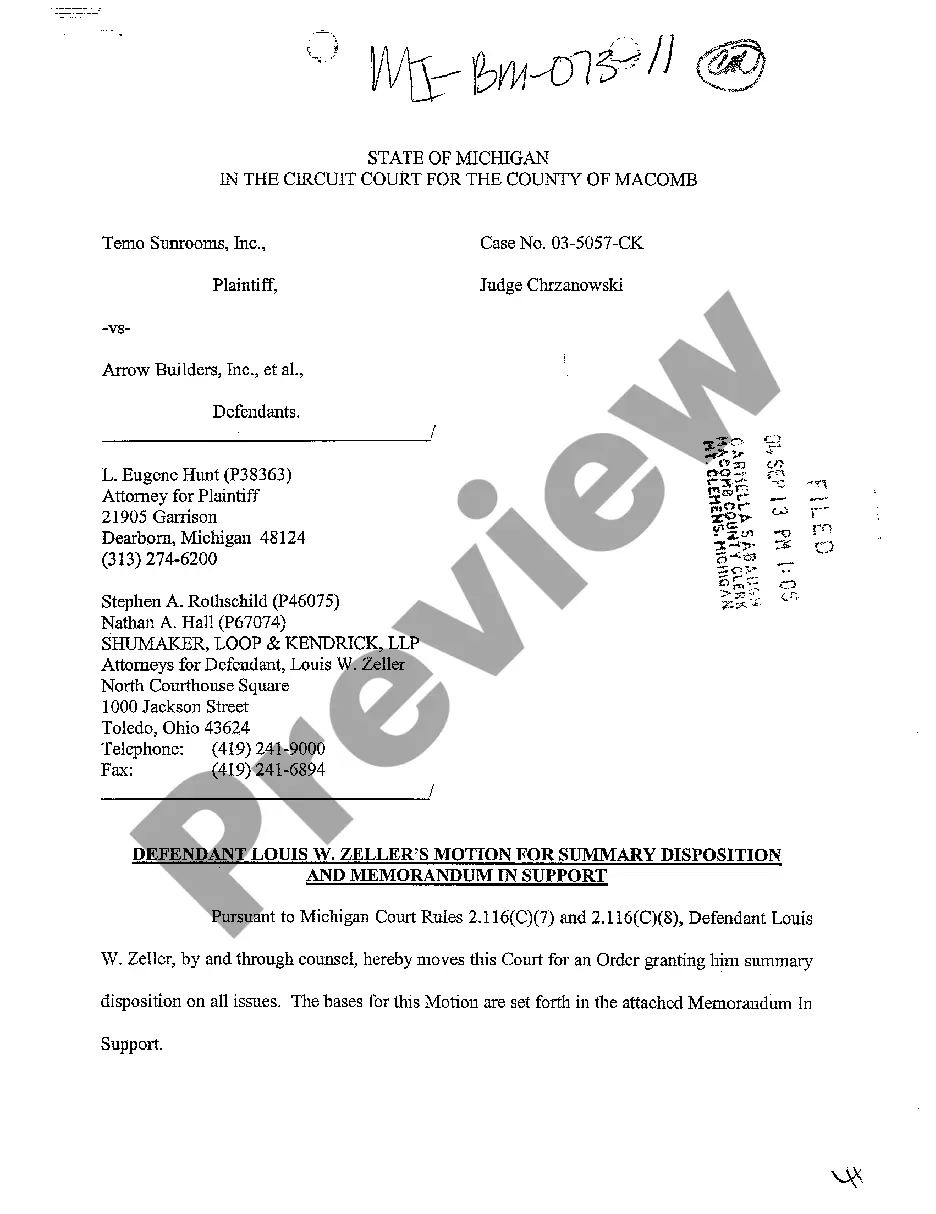

Kansas Proposed Additional Compensation Plan with copy of plan

Description

How to fill out Kansas Proposed Additional Compensation Plan With Copy Of Plan?

If you want to complete, acquire, or print out legitimate file web templates, use US Legal Forms, the largest collection of legitimate forms, that can be found on the Internet. Make use of the site`s basic and practical lookup to obtain the documents you need. Various web templates for business and person uses are sorted by classes and claims, or key phrases. Use US Legal Forms to obtain the Kansas Proposed Additional Compensation Plan with copy of plan in just a handful of clicks.

If you are currently a US Legal Forms client, log in in your bank account and click the Obtain switch to find the Kansas Proposed Additional Compensation Plan with copy of plan. Also you can accessibility forms you previously downloaded within the My Forms tab of your bank account.

If you use US Legal Forms for the first time, follow the instructions under:

- Step 1. Be sure you have selected the form for that proper city/country.

- Step 2. Make use of the Review option to look over the form`s articles. Never neglect to read the information.

- Step 3. If you are unhappy using the develop, use the Look for field at the top of the screen to discover other types of your legitimate develop design.

- Step 4. When you have located the form you need, go through the Acquire now switch. Opt for the costs prepare you prefer and add your qualifications to sign up for the bank account.

- Step 5. Method the transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the transaction.

- Step 6. Find the formatting of your legitimate develop and acquire it in your gadget.

- Step 7. Full, edit and print out or indication the Kansas Proposed Additional Compensation Plan with copy of plan.

Every legitimate file design you purchase is yours for a long time. You may have acces to each develop you downloaded in your acccount. Click on the My Forms area and pick a develop to print out or acquire again.

Contend and acquire, and print out the Kansas Proposed Additional Compensation Plan with copy of plan with US Legal Forms. There are thousands of skilled and express-distinct forms you can utilize to your business or person needs.

Form popularity

FAQ

How to design an employee compensation plan? Define the company's compensation philosophy. Research and analyze the job market. Decide whether you want to implement salaries or hourly wages. Defining employee salaries. Define employee hourly wages. Bonus tips: Calculating commissions. ... Select the benefits you'll offer. How to make an employee compensation plan (with templates) clockify.me ? blog ? business ? compensation-plan clockify.me ? blog ? business ? compensation-plan

For example, the employer may offer health insurance, dental insurance, life insurance, short- and long-term disability insurance and vision insurance. Employee retirement plans, like 401(k) plans, are another common form of indirect compensation. Equity-based programs are another compensation offering. How to Create a Desirable Compensation Plan businessnewsdaily.com ? 15831-create-com... businessnewsdaily.com ? 15831-create-com...

Process: Rolling out a compensation plan for the first time Step 1: Finalize your comp plan and proposal. Step 2: Get leadership approval. Step 3: Run all-hands meeting. Step 4: Share comp plan. Process: Rolling out a compensation plan for the first time - Almanac almanac.io ? docs ? process-rolling-out-a-compen... almanac.io ? docs ? process-rolling-out-a-compen...

How to create a compensation plan Determine your compensation philosophy. Outline job architecture by defining roles and levels. Create guidelines for performance evaluations. Define direct compensation (salary, bonus, and equity) Add in benefits. Implement a pay equity process. Conduct post-hoc reviews. Compensation Plan: Compensation Planning & Examples - Carta carta.com ? blog ? compensation-plan carta.com ? blog ? compensation-plan

How to create a compensation plan Determine your compensation philosophy. Outline job architecture by defining roles and levels. Create guidelines for performance evaluations. Define direct compensation (salary, bonus, and equity) Add in benefits. Implement a pay equity process. Conduct post-hoc reviews. Compensation Plan: Compensation Planning & Examples - Carta carta.com ? blog ? compensation-plan carta.com ? blog ? compensation-plan