Kansas Utilization by a REIT of partnership structures in financing five development projects

Description

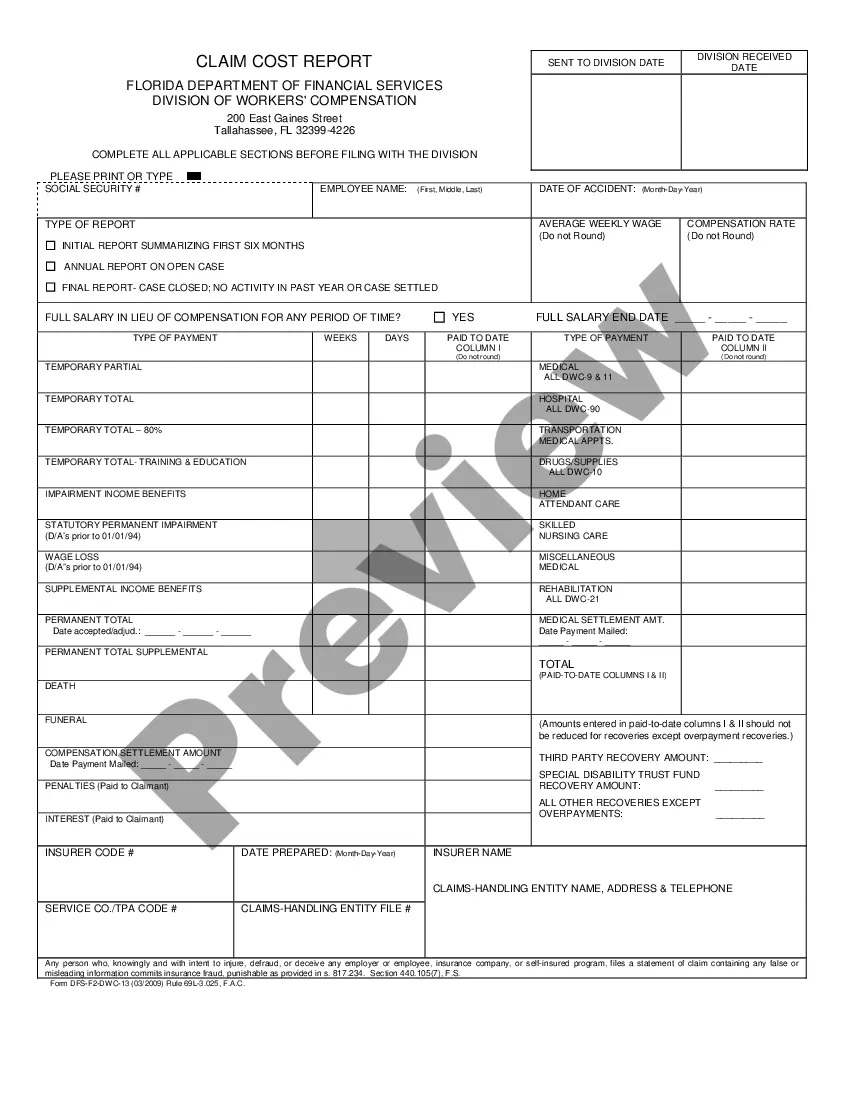

How to fill out Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

Are you within a place the place you need to have documents for both business or specific reasons almost every day time? There are a variety of authorized papers web templates available on the Internet, but locating types you can rely isn`t simple. US Legal Forms provides a huge number of form web templates, just like the Kansas Utilization by a REIT of partnership structures in financing five development projects, which can be composed to satisfy federal and state demands.

In case you are already acquainted with US Legal Forms internet site and have a merchant account, simply log in. Following that, you may down load the Kansas Utilization by a REIT of partnership structures in financing five development projects template.

If you do not offer an account and would like to begin to use US Legal Forms, follow these steps:

- Get the form you will need and ensure it is for the proper town/area.

- Make use of the Preview option to examine the shape.

- Read the outline to actually have chosen the right form.

- In case the form isn`t what you are searching for, take advantage of the Research field to discover the form that meets your needs and demands.

- Once you get the proper form, click on Acquire now.

- Pick the prices prepare you need, submit the specified details to generate your bank account, and purchase an order with your PayPal or bank card.

- Choose a convenient file formatting and down load your version.

Get all the papers web templates you may have bought in the My Forms food list. You can get a further version of Kansas Utilization by a REIT of partnership structures in financing five development projects whenever, if needed. Just click on the necessary form to down load or print the papers template.

Use US Legal Forms, by far the most considerable assortment of authorized varieties, to save some time and steer clear of faults. The services provides professionally made authorized papers web templates which can be used for a range of reasons. Create a merchant account on US Legal Forms and start creating your lifestyle easier.

Form popularity

FAQ

What is the Minimum Investment Amount for Private REITs? Typically $1,000 - $25,000; private REITs that are designed for institutional or accredited investors generally require a much higher minimum investment.

Are REITs Good Investments? Investing in REITs is a great way to diversify your portfolio outside of traditional stocks and bonds and can be attractive for their strong dividends and long-term capital appreciation.

REIT stands for "Real Estate Investment Trust". A REIT is organized as a partnership, corporation, trust, or association that invests directly in real estate through the purchase of properties or by buying up mortgages. REITs issue shares that trade stock exchange and are bought and sold like ordinary stocks.

REITs, or real estate investment trusts, were created by Congress in 1960 to give all individuals the opportunity to benefit from investing in income-producing real estate. REITs allow anyone to own or finance properties the same way they invest in other industries, through the purchase of stock.

REITs generate income for investors either through interest payments on the property's underlying mortgage or rental income once the development is completed.