Kansas Complex Will - Max. Credit Shelter Marital Trust to Children

Description

How to fill out Complex Will - Max. Credit Shelter Marital Trust To Children?

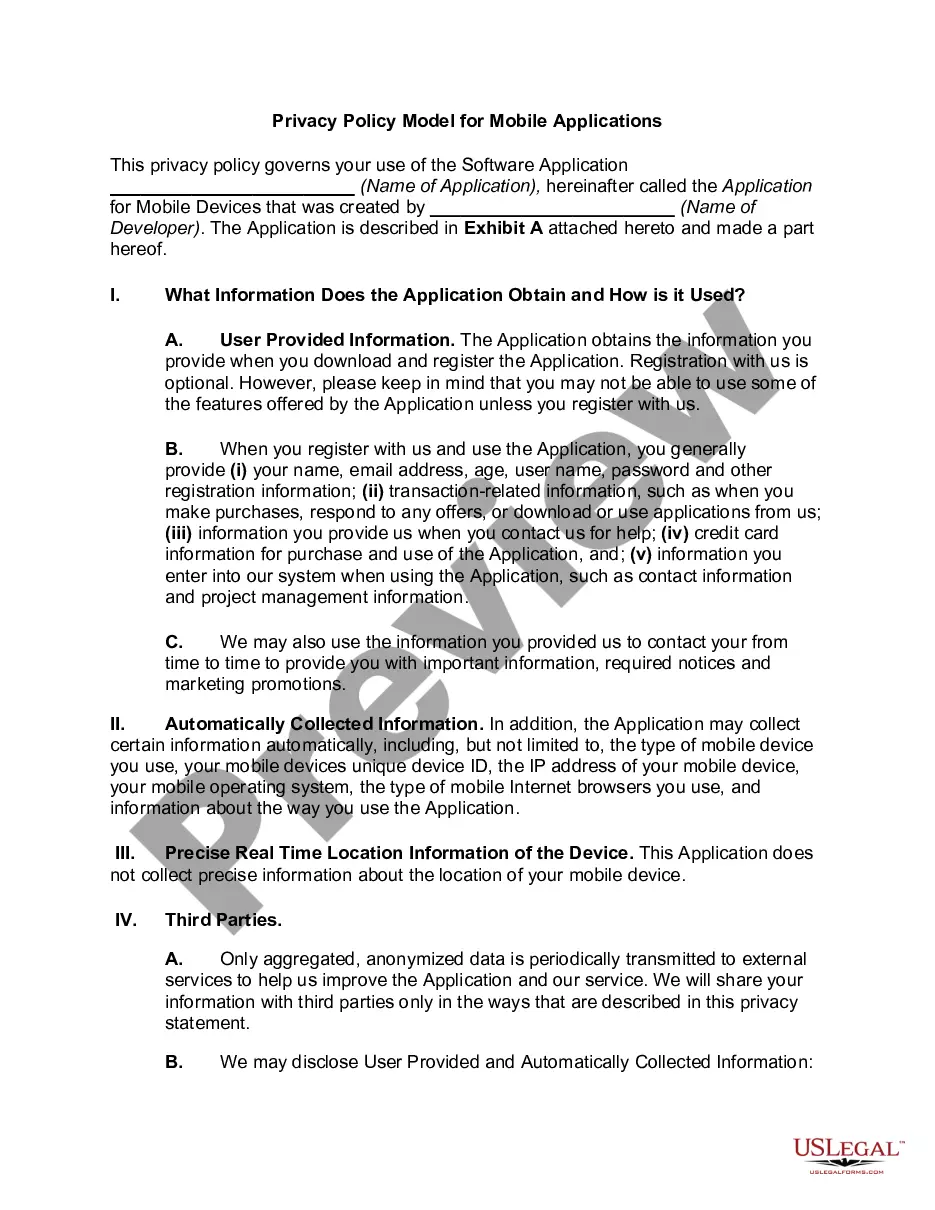

Are you presently inside a position that you will need paperwork for sometimes business or specific functions almost every day? There are tons of legitimate record themes accessible on the Internet, but finding ones you can depend on is not easy. US Legal Forms offers a huge number of form themes, like the Kansas Complex Will - Max. Credit Shelter Marital Trust to Children, that happen to be written to satisfy federal and state needs.

Should you be currently familiar with US Legal Forms internet site and have your account, basically log in. Afterward, you are able to down load the Kansas Complex Will - Max. Credit Shelter Marital Trust to Children template.

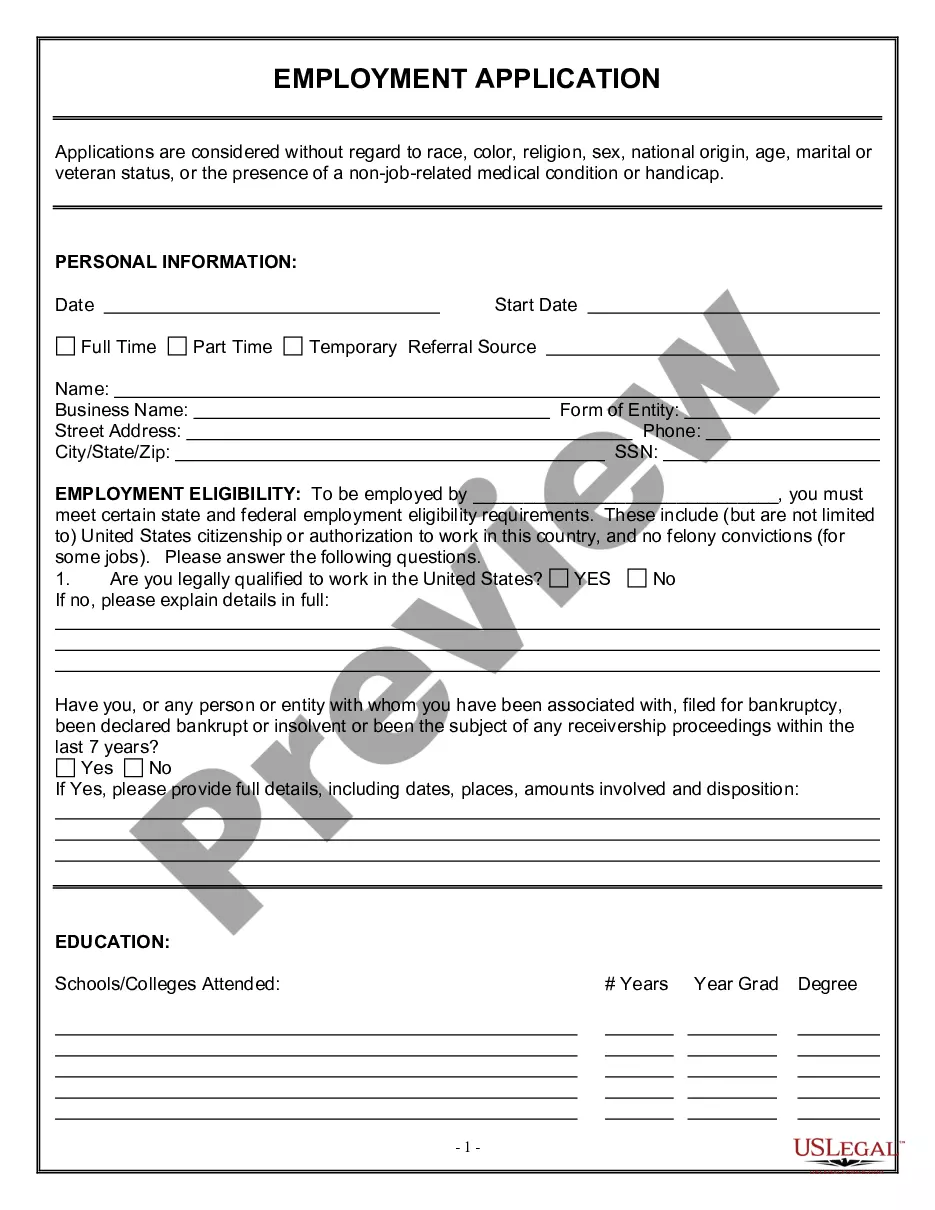

If you do not come with an account and would like to begin to use US Legal Forms, adopt these measures:

- Find the form you want and ensure it is to the appropriate city/county.

- Make use of the Review switch to examine the shape.

- Look at the description to actually have selected the appropriate form.

- In case the form is not what you`re searching for, use the Search area to get the form that fits your needs and needs.

- When you obtain the appropriate form, simply click Get now.

- Pick the rates plan you need, fill in the specified information to create your account, and buy an order using your PayPal or bank card.

- Pick a convenient paper structure and down load your copy.

Get all of the record themes you may have bought in the My Forms menus. You can get a additional copy of Kansas Complex Will - Max. Credit Shelter Marital Trust to Children anytime, if needed. Just click the needed form to down load or print the record template.

Use US Legal Forms, probably the most substantial collection of legitimate forms, in order to save some time and steer clear of errors. The support offers professionally created legitimate record themes which you can use for a selection of functions. Produce your account on US Legal Forms and initiate creating your lifestyle easier.

Form popularity

FAQ

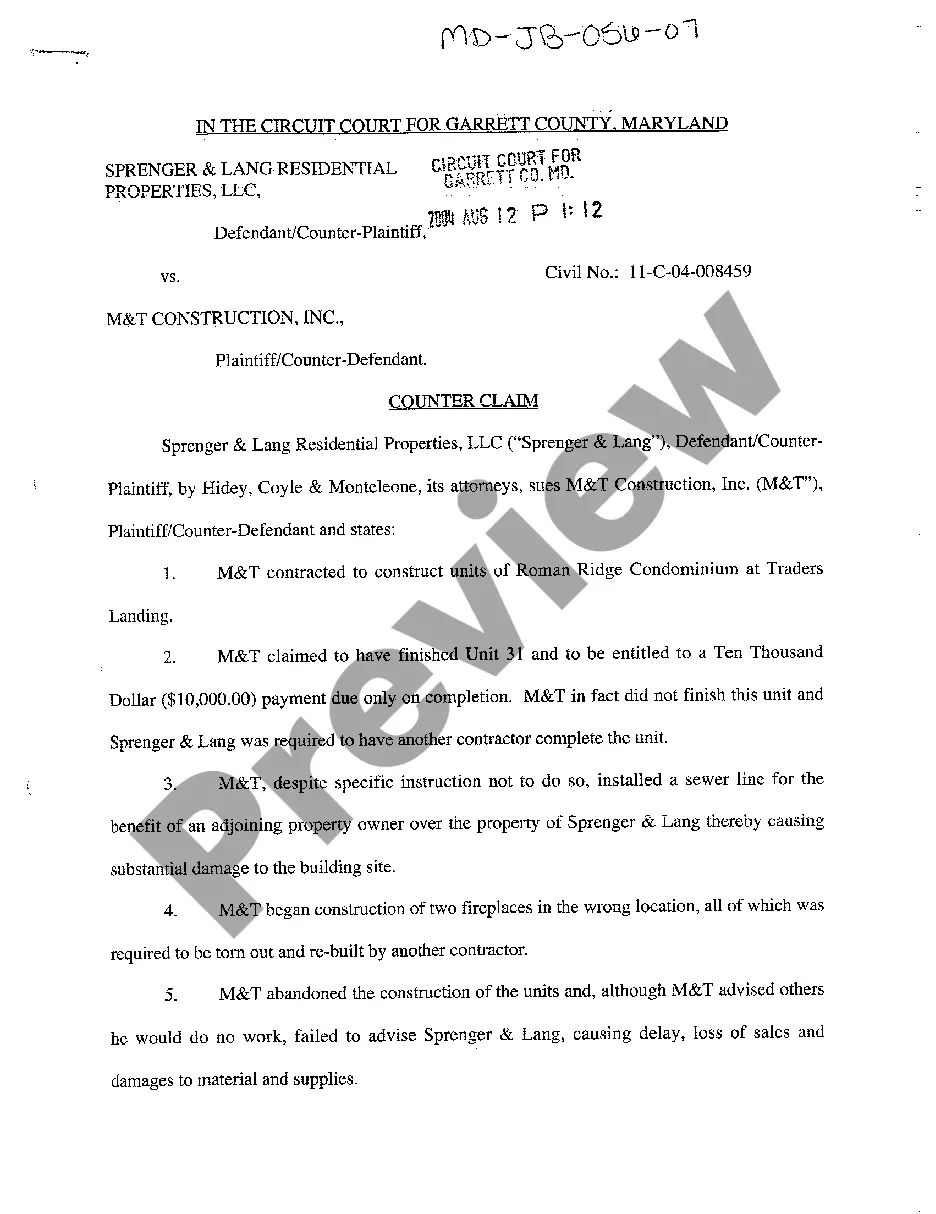

The 5&5 Power allows the surviving spouse to request the greater of $5,000.00 and 5% of the trust principal every year to be used in any manner of the surviving spouse's choosing. The beauty of the Disclaimer Trust is that it is flexible.

Credit Shelter Trust vs Marital Trust - Is a Marital Trust the Same as a Credit Shelter Trust? No. A Marital Trust is a type of Credit Shelter Trust. You and your spouse can use a Marital Trust to pass assets to a surviving spouse, children or grandchildren.

A credit shelter trust (CST) is a trust created after the death of the first spouse in a married couple. Assets placed in the trust are generally held apart from the estate of the surviving spouse, so they may pass tax-free to the remaining beneficiaries at the death of the surviving spouse.

Also called an "A" trust, a marital trust goes into effect when the first spouse dies. Assets are moved into the trust upon death and the income that these assets generate go to the surviving spouse?under some arrangements, the surviving spouse can also receive principal payments.

A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

Five by Five Power ? The ability for the beneficiary to take the greater of $5000 or 5% of the trust each calendar year; a 5% version of the Lifetime General Power. Some access translates to 5% of the income being taxable to the beneficiary, and 5% being included in the power holder's estate.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.