Kansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself

Description

How to fill out Kansas Notice Of Violation Of Fair Debt Act - Creditor Misrepresented Himself?

If you wish to total, acquire, or printing legitimate file themes, use US Legal Forms, the biggest assortment of legitimate varieties, which can be found online. Utilize the site`s easy and practical lookup to get the documents you need. Different themes for company and personal purposes are categorized by groups and says, or key phrases. Use US Legal Forms to get the Kansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself within a few mouse clicks.

When you are currently a US Legal Forms buyer, log in to the profile and click on the Obtain key to have the Kansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself. You may also accessibility varieties you in the past saved from the My Forms tab of the profile.

If you are using US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape to the appropriate metropolis/land.

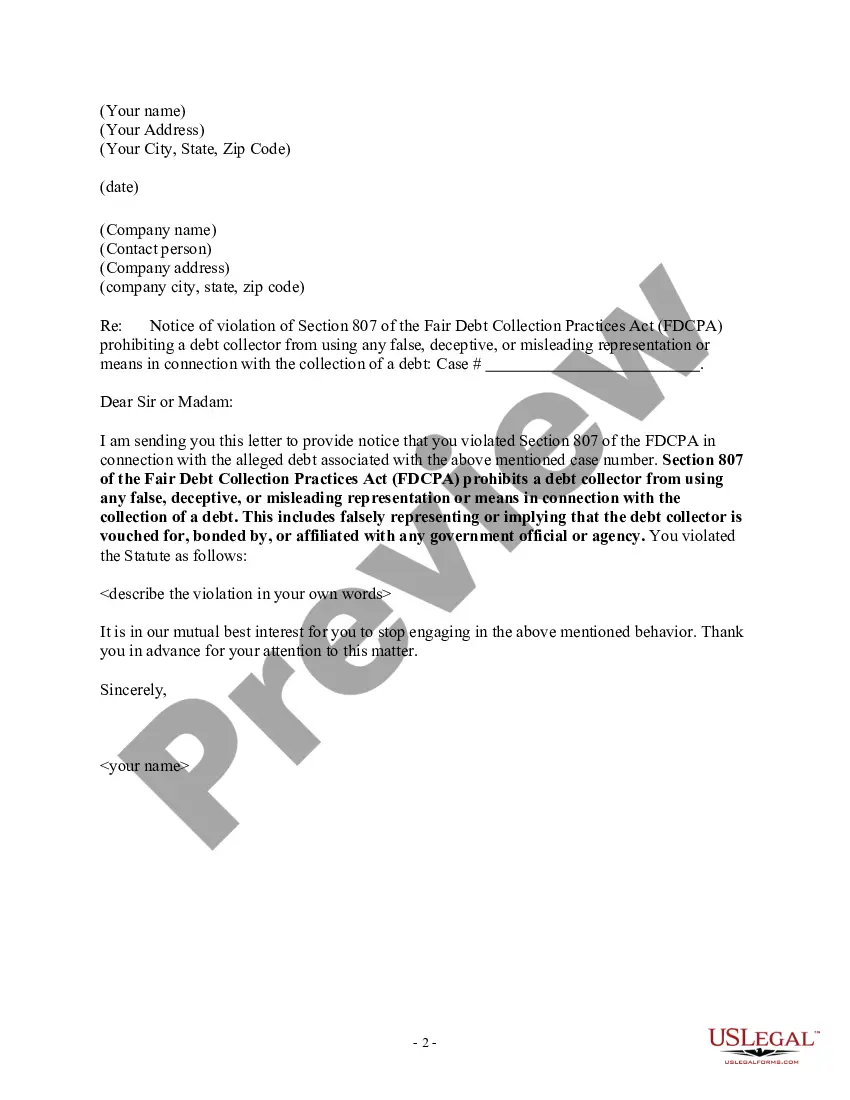

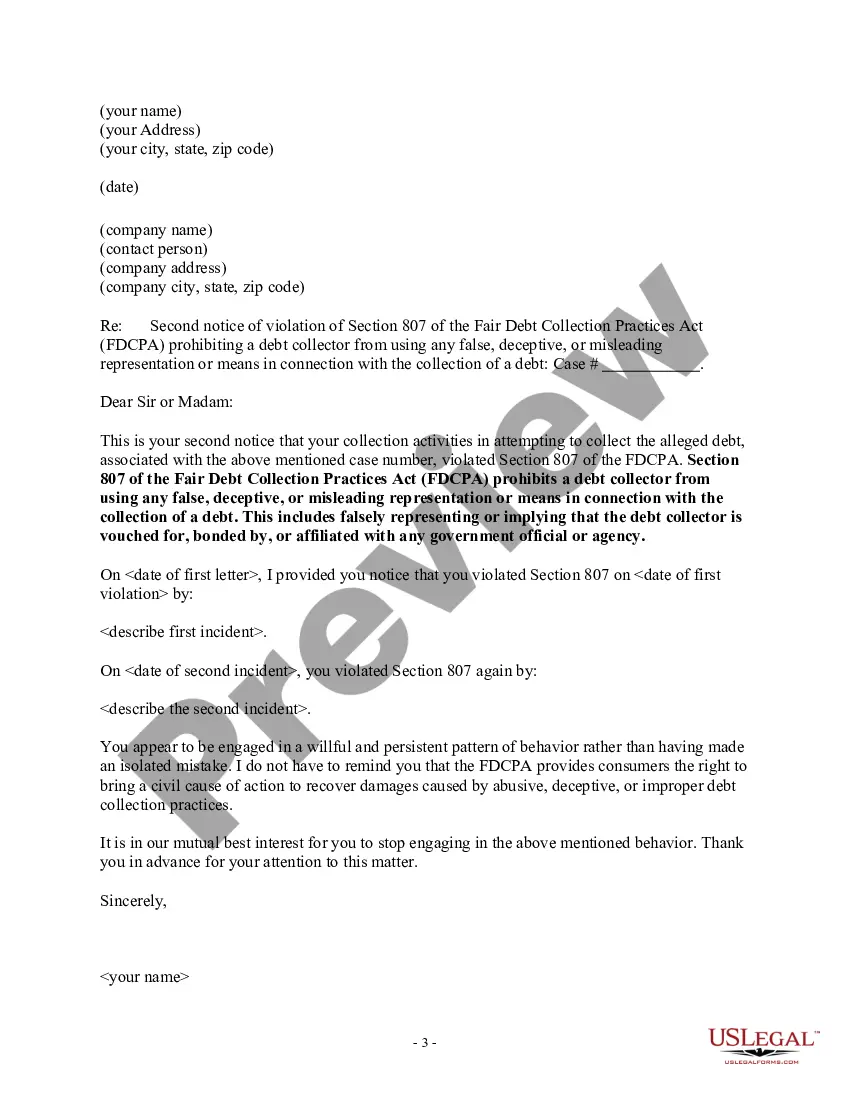

- Step 2. Use the Preview solution to examine the form`s articles. Don`t forget about to read the description.

- Step 3. When you are not happy with all the develop, use the Lookup industry near the top of the display screen to discover other variations of your legitimate develop design.

- Step 4. Once you have located the shape you need, select the Get now key. Choose the prices strategy you favor and include your references to sign up to have an profile.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal profile to finish the financial transaction.

- Step 6. Pick the formatting of your legitimate develop and acquire it in your device.

- Step 7. Comprehensive, modify and printing or sign the Kansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself.

Each and every legitimate file design you acquire is your own eternally. You might have acces to every single develop you saved inside your acccount. Click the My Forms area and pick a develop to printing or acquire yet again.

Be competitive and acquire, and printing the Kansas Notice of Violation of Fair Debt Act - Creditor Misrepresented Himself with US Legal Forms. There are many specialist and express-particular varieties you may use for your company or personal demands.

Form popularity

FAQ

The statute of limitations in Kansas is as follows: Mortgage debt: 5 years. Medical debt: 5 years. Credit card debt: 3 years.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Unfair practices are prohibitedDeposit or threaten to deposit a postdated check before your intended payment date. Take or threaten to take property if it's not allowed. Collect more than you owe on a debt, which may include fees and interest.

(1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof. (2) The false representation of -- (A) the character, amount, or legal status of any debt; or.