This form is an outline of issues that the due diligence team should consider when determining the feasibility of the proposed transaction.

Kansas Outline of Considerations for Transactions Involving Foreign Investors

Description

How to fill out Outline Of Considerations For Transactions Involving Foreign Investors?

Are you in a situation where you need documentation for either business or personal reasons almost all the time.

There are numerous official document templates available online, but locating forms you can trust isn't straightforward.

US Legal Forms provides thousands of form templates, such as the Kansas Outline of Considerations for Transactions Involving Foreign Investors, which are created to satisfy state and federal requirements.

Once you find the correct form, click Acquire now.

Choose the pricing plan you desire, complete the required information to create your account, and pay for the transaction using your PayPal or credit card. Select a suitable document format and download your copy. You can find all the document templates you have purchased in the My documents section. You can download a duplicate of the Kansas Outline of Considerations for Transactions Involving Foreign Investors anytime if needed. Just access the required form to obtain or print the document template. Use US Legal Forms, the most extensive collection of official forms, to save time and prevent mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms site and have an account, just Log In.

- Then, you can download the Kansas Outline of Considerations for Transactions Involving Foreign Investors template.

- If you don't have an account and want to start using US Legal Forms, follow these instructions.

- Find the form you need and make sure it corresponds to the right area/county.

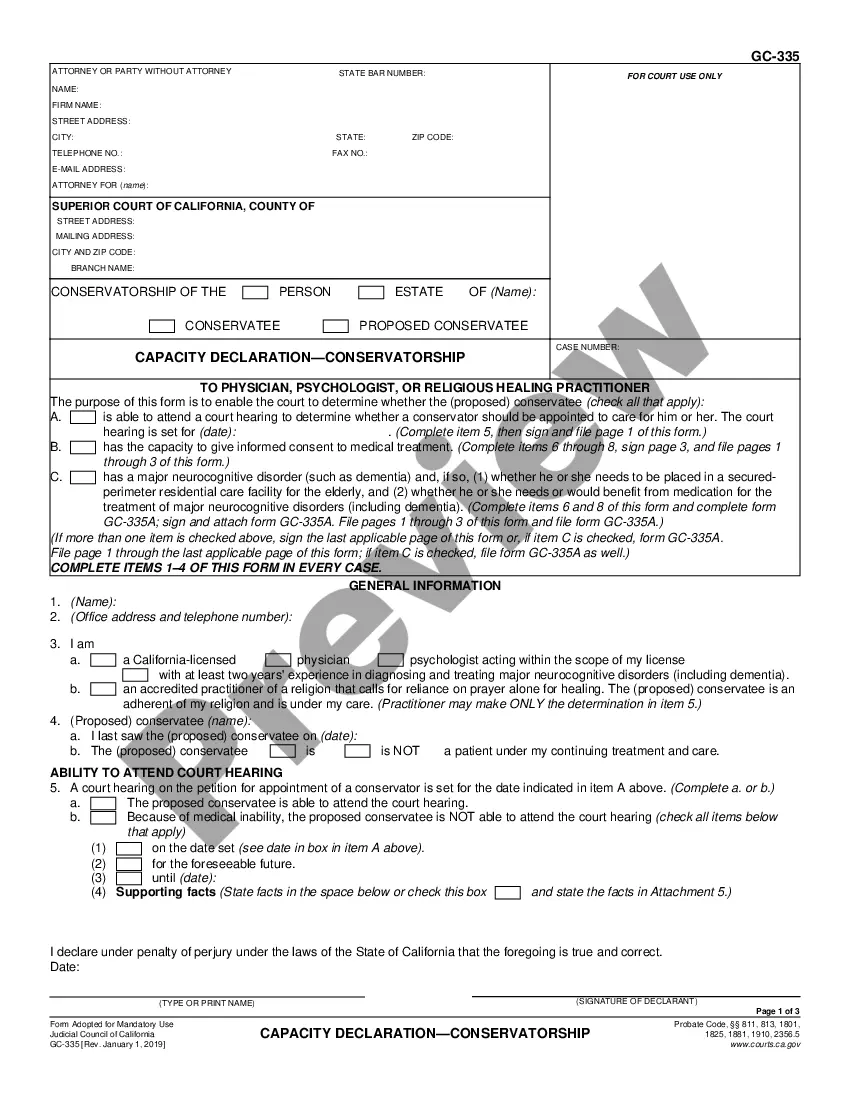

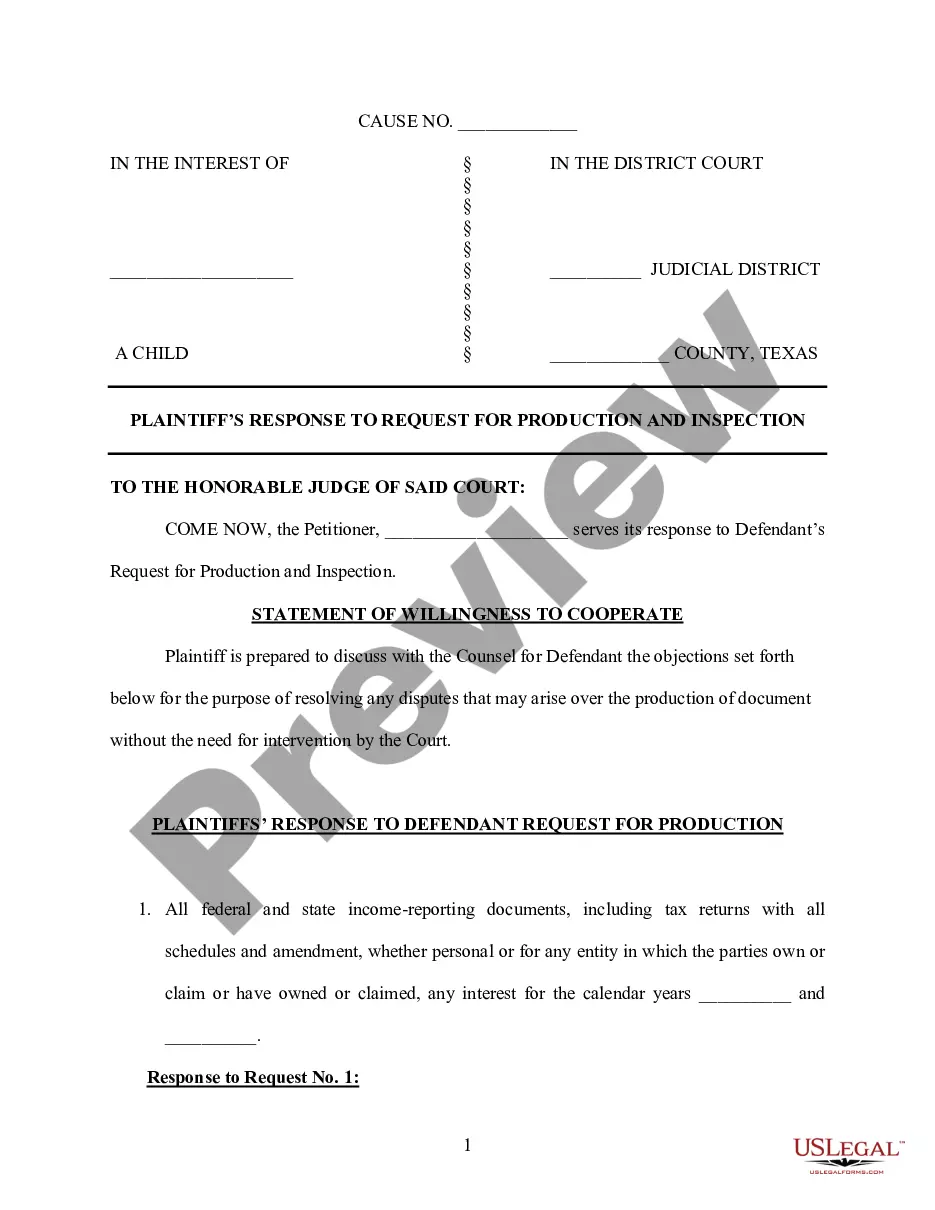

- Use the Preview button to review the form.

- Check the outline to ensure that you've selected the correct form.

- If the form isn't what you are looking for, use the Search field to locate the form that meets your needs.

Form popularity

FAQ

The Kansas Common Interest Community Act governs communities with shared interests, such as condos and homeowner associations. This act establishes the rights and responsibilities of the community members. Familiarizing yourself with the Kansas Outline of Considerations for Transactions Involving Foreign Investors includes understanding such regulations, which can facilitate smoother transactions.

States such as Texas and North Dakota have enacted laws that restrict foreign ownership of agricultural land. Understanding these restrictions is essential for anyone considering investments in real estate. The Kansas Outline of Considerations for Transactions Involving Foreign Investors can help navigate these complexities.

Yes, foreigners can own land in the USA in most cases. However, regulations can vary from state to state, and it's important to be aware of local laws. When exploring the Kansas Outline of Considerations for Transactions Involving Foreign Investors, this knowledge can be especially useful for potential foreign investors.

Some states impose restrictions on foreign ownership of land. For instance, states like Arizona and New Mexico have particular rules that limit the extent to which foreigners can own land. Understanding these regulations is crucial, especially when considering the Kansas Outline of Considerations for Transactions Involving Foreign Investors.

Registering a foreign business in the US typically involves choosing a state to register in, filing the appropriate documents with that state’s Secretary of State, and obtaining any necessary licenses or permits. It's important to understand the specific requirements for each state, including Kansas, as outlined in the Kansas Outline of Considerations for Transactions Involving Foreign Investors. Utilizing resources like USLegalForms can streamline this process for you.

To register as a foreign entity in Kansas, you need to complete an application form and submit it along with the necessary fees to the KS SOS office. This process may also require you to provide a certificate of good standing from your home state. This step is integral to complying with the Kansas Outline of Considerations for Transactions Involving Foreign Investors, ensuring you operate legally within the state.

The Kansas Secretary of State (KS SOS) office processes a variety of business filings, including registration of foreign entities, amendments, and renewals. They utilize both online systems and traditional paper filings to accommodate different business needs. Understanding this process is vital when following the Kansas Outline of Considerations for Transactions Involving Foreign Investors, ensuring that your documentation meets state requirements.

A foreign entity is generally defined as a business that is incorporated or organized outside the state of Kansas. This includes corporations, limited liability companies (LLCs), and other business forms established under the laws of another jurisdiction. When navigating the Kansas Outline of Considerations for Transactions Involving Foreign Investors, it is essential to identify your business classification clearly.

Yes, Kansas does require nonresident withholding for certain payments made to foreign entities. This requirement is crucial for ensuring that state taxes are appropriately collected on income generated within Kansas. It’s an essential point in the Kansas Outline of Considerations for Transactions Involving Foreign Investors, helping you adhere to tax obligations efficiently.

To register as a foreign entity in Kansas, you must file an application with the Kansas Secretary of State's office. This involves providing details about your business, including its incorporation state and a registered agent in Kansas. This registration process is a key component of the Kansas Outline of Considerations for Transactions Involving Foreign Investors, ensuring compliance with state laws while facilitating a smooth business operation.